Home Equity Lines of Credit (HELOCs) can be an attractive financing option, but they often come with hidden costs that catch borrowers off guard.

At HELOC360, we’ve seen many homeowners surprised by unexpected HELOC fees that weren’t clearly disclosed upfront.

This post will shed light on these hidden charges, helping you make a more informed decision about whether a HELOC is right for your financial situation.

What Upfront HELOC Fees Should You Expect?

Application and Origination Fees: The First Hurdle

When you consider a Home Equity Line of Credit (HELOC), you must understand the upfront costs. These fees can significantly impact your loan’s overall expense.

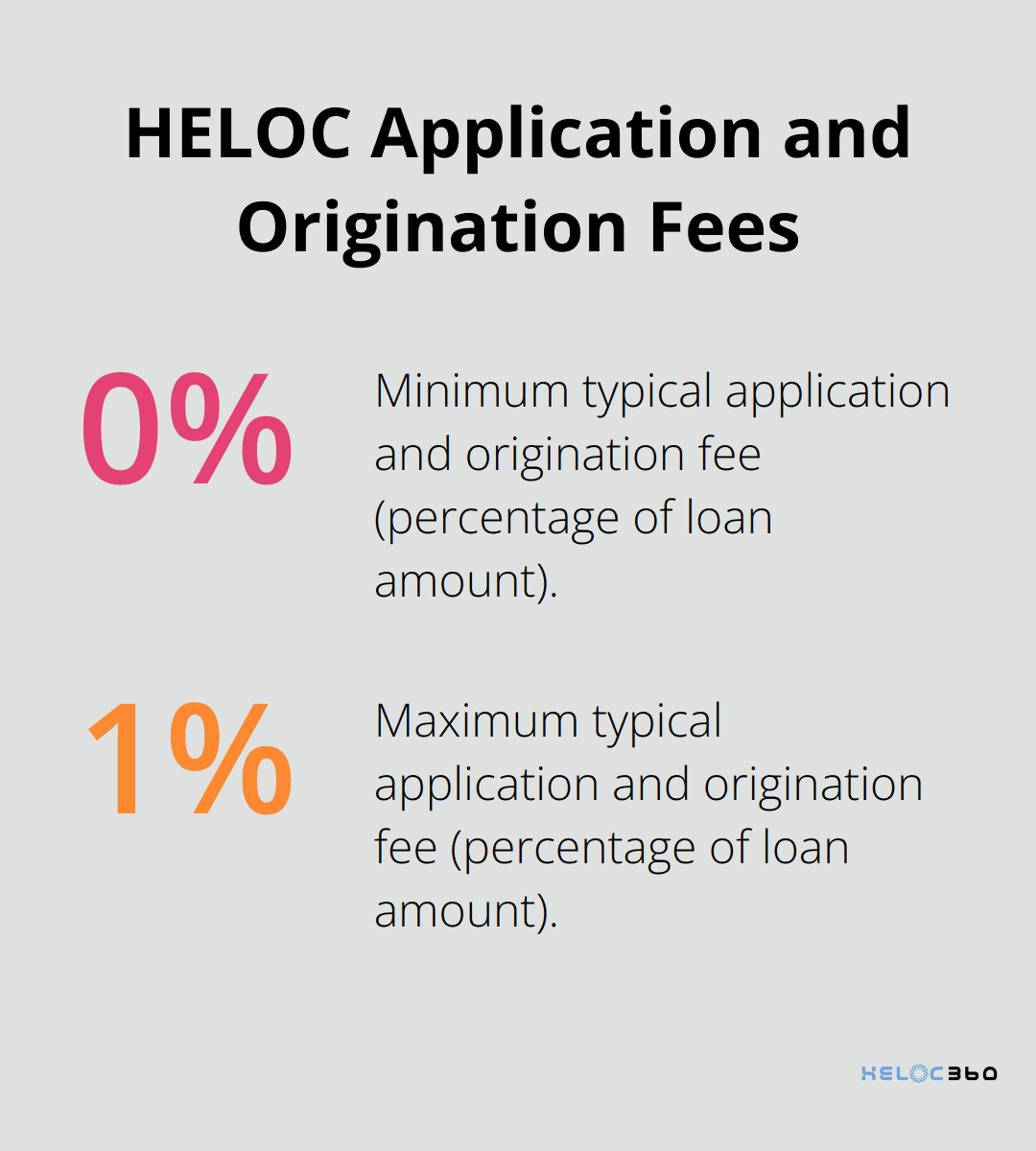

Many lenders charge application and origination fees typically ranging from 0.5% to 1% of the total loan amount. These cover the cost of processing and approving your HELOC application.

Some borrowers focus solely on interest rates, overlooking these initial fees. You should always ask your lender for a detailed breakdown of all upfront costs before proceeding.

Property Valuation: An Unavoidable Expense

Appraisal fees can vary depending on your property’s location and size. Some lenders might waive this fee, but it often results in a higher interest rate. Title search costs can add another $100 to $250 to your bill.

A recent study found that refinishing or installing hardwood floors yielded the largest return on investment according to the National Association of Realtors’ Remodeling Impact Report. You should factor these expenses into your decision-making process to avoid unexpected financial strain.

Legal Fees: The Often Overlooked Cost

Attorney and notary fees frequently slip under the radar but can add up quickly. You should expect to pay anywhere from $200 to $500 for these services. Some states require an attorney to be present at closing, which can drive costs even higher.

To minimize these expenses, you can ask your lender if they offer any discounts for using their preferred legal services. Some banks partner with local attorneys and can pass on savings to you.

The Impact of Upfront Fees on Your HELOC Decision

While these upfront fees might seem steep, they represent a one-time cost. You should weigh them against the potential benefits of accessing your home equity. If you plan to borrow a substantial amount or use your HELOC for a long-term project, these initial expenses may prove worthwhile in the long run.

As we move forward, it’s important to consider not just these upfront costs, but also the ongoing expenses associated with maintaining a HELOC. Let’s explore these recurring fees in the next section.

What Ongoing HELOC Expenses Should You Watch For?

Annual Fees: The Price of Convenience

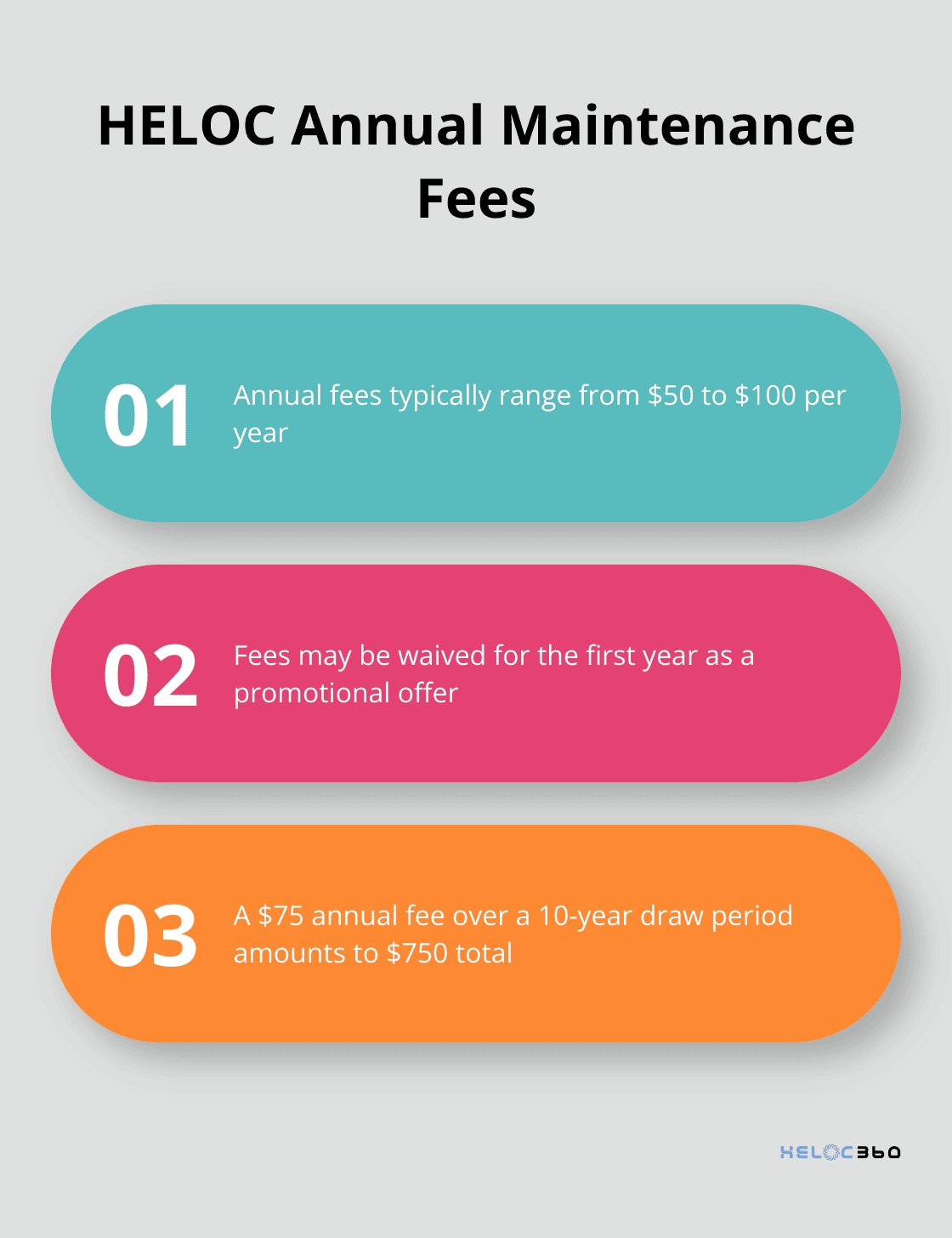

Many lenders charge annual maintenance fees for keeping your HELOC open. These fees typically range from $50 to $100 per year. While this might seem small, it adds up over the life of your HELOC. For example, a $75 annual fee over a 10-year draw period amounts to $750 – a significant sum that reduces your available credit.

Some lenders waive this fee for the first year as a promotional offer. However, you should always ask about the long-term fee structure. Many borrowers express surprise when annual fees kick in after the promotional period ends.

The Cost of Inactivity

Inactivity or non-usage fees present another expense that can surprise HELOC borrowers. Lenders may charge a termination fee equal to 5% of your line of credit if you close your HELOC before 3 years or 3% if you close it before 5 years.

To avoid these fees, you must understand your lender’s policy on inactivity. Some borrowers choose to make small, regular draws on their HELOC to keep it active. However, this strategy only makes sense if the interest on these small draws costs less than the inactivity fee.

Minimum Draw Requirements: A Hidden Obligation

Some HELOCs come with minimum draw requirements. This means you must borrow a certain amount each time you access your line of credit. The minimum loan amount can be as low as $10,000, while the maximum can go up to $500,000.

If you plan to use your HELOC for smaller expenses, these requirements can force you to borrow more than you need, potentially increasing your interest costs. Always ask about minimum draw amounts when shopping for a HELOC.

A study by the Federal Reserve Bank of Philadelphia found that 30% of HELOC borrowers don’t fully understand the terms of their credit line. This lack of awareness can lead to unexpected costs and financial strain.

To minimize these ongoing expenses, you should consider negotiating with your lender. Some institutions may waive certain fees, especially for customers with strong credit profiles or those who maintain other accounts with the bank.

The true cost of a HELOC extends beyond the interest rate. Understanding and planning for these ongoing expenses will help you make a more informed decision about whether a HELOC aligns with your financial goals. As we move forward, let’s explore the closing and cancellation costs associated with HELOCs, which can also catch borrowers off guard if not properly anticipated.

What Happens When You Close Your HELOC Early?

Early Termination Fees: The Hidden Cost of Flexibility

Many homeowners don’t realize that closing a Home Equity Line of Credit (HELOC) before its term ends can lead to unexpected costs. Early termination fees are a common surprise for HELOC borrowers. If you want to cancel your HELOC, you should notify the lender in writing within the first three days after the account was opened. The lender must then cancel the loan and return the fees you paid.

Prepayment Penalties: The Double-Edged Sword

Some lenders charge prepayment penalties if you pay off your HELOC balance early. A HELOC early prepayment penalty is a fee charged if borrowers settle their debt before the agreed-upon term ends. It’s important to understand how to avoid these penalties.

Reconveyance Fees: The Final Hurdle

When you close your HELOC, you’ll likely encounter reconveyance fees. These costs cover the administrative work of removing the lien on your property. Home equity loan closing costs typically range from 2% to 5% of the loan amount, but some lenders may reduce or waive them altogether.

Strategies to Minimize Closing Costs

You can minimize these closing costs by timing your HELOC closure strategically. If you’re close to the end of your draw period, it might be worth waiting to avoid early termination fees. Additionally, some lenders offer to cover reconveyance fees as part of a refinancing deal (which could save you money if you’re planning to refinance your mortgage).

You must read your agreement carefully and ask your lender for clarification on any fees you don’t understand. This knowledge will help you make the best decision for your financial situation and avoid costly surprises down the road.

Final Thoughts

Home Equity Lines of Credit offer powerful financial tools, but they include a complex web of HELOC fees that can surprise unwary borrowers. These costs extend far beyond interest rates, encompassing upfront charges, ongoing expenses, and potential penalties for early closure. We at HELOC360 emphasize the importance of thoroughly reading and understanding all terms and conditions before signing any agreement.

You should consider negotiating with your lender to minimize unexpected costs. Some institutions might waive certain fees, especially for customers with strong credit profiles. Planning your HELOC usage strategically will help you avoid inactivity fees and maximize the benefits of your credit line.

For personalized guidance on navigating HELOC complexities and finding the right solution for your needs, visit HELOC360. Our platform will help you unlock the full potential of your home equity while avoiding common pitfalls and hidden costs (including those often-overlooked HELOC fees).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.