HELOCs can be a powerful financial tool, but they often come with hidden costs.

At HELOC360, we’ve seen many homeowners caught off guard by unexpected HELOC penalties.

This post will expose the most common hidden fees and rate hikes that could drain your wallet. We’ll also share practical tips to help you avoid these costly surprises and make the most of your home equity line of credit.

The Early Termination Fee Trap: Understanding Hidden HELOC Costs

What Are Early Termination Fees?

Early Termination Fees represent penalties that lenders impose when borrowers close their HELOC early. If you decide to close out your HELOC loan early, some lenders will charge a fee for doing so. This also varies by lender.

The Financial Impact on Borrowers

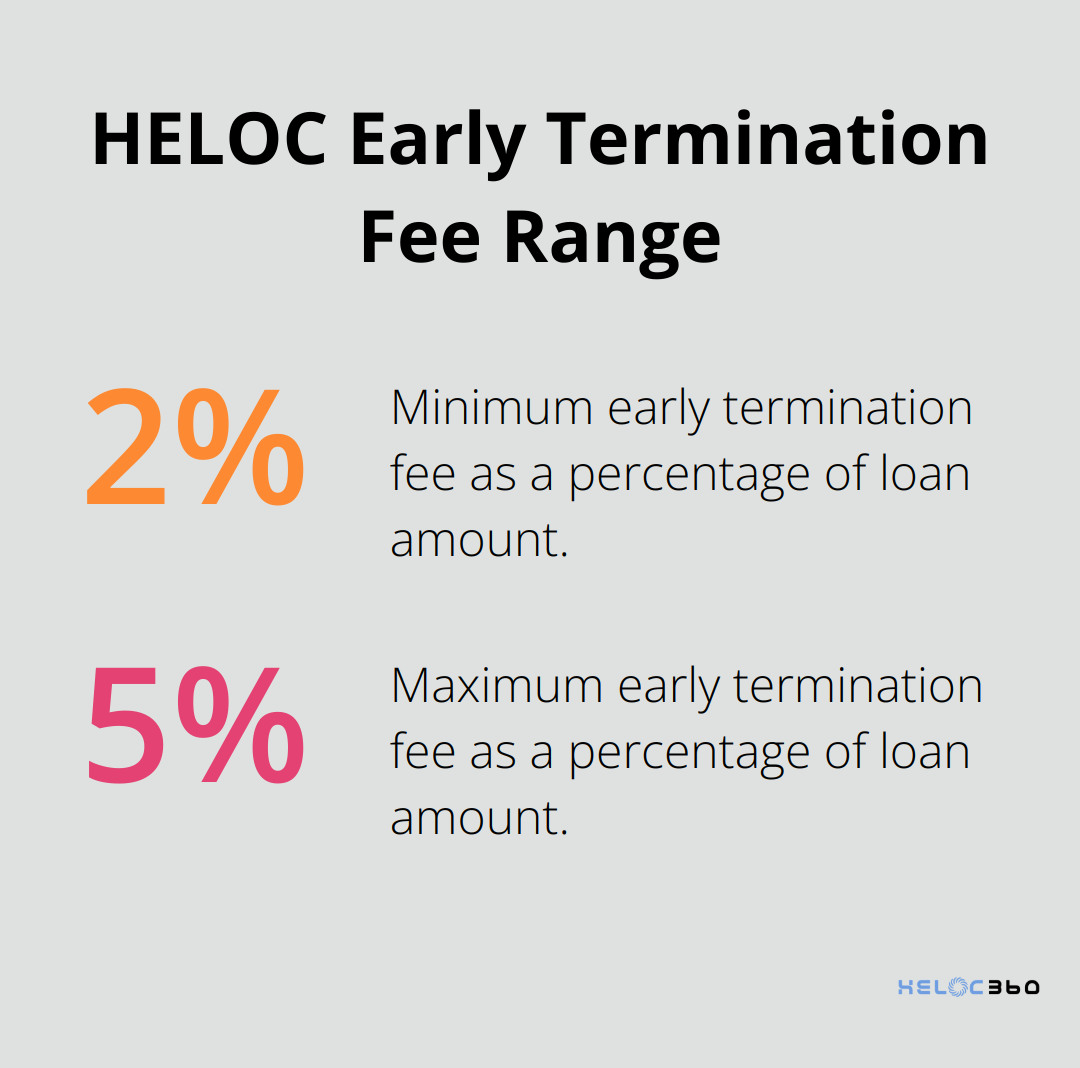

These fees can significantly affect your finances. In general, you can expect the fee to range from 2 percent to 5 percent of your loan. In some cases, the fee the lender charges may be based on other factors. It’s essential to factor in these potential expenses when planning your HELOC strategy.

Common Scenarios That Trigger Fees

Several situations can lead to early HELOC termination:

- Home sales: Selling your property typically requires closing your HELOC.

- Mortgage refinancing: This process often involves terminating existing liens, including HELOCs.

- Project completion: Some borrowers close their HELOCs after finishing a major renovation or paying off a large expense, unaware of the penalty.

Strategies to Avoid Early Termination Fees

To sidestep these costly surprises:

- Review your HELOC agreement thoroughly before signing.

- Compare offers from multiple lenders (some don’t charge early termination fees).

- If you plan to sell or refinance soon, consider postponing your HELOC application.

- For existing HELOCs, try to keep the account open until the fee period expires, even with a zero balance.

The Importance of Transparency

Transparency in HELOC terms is paramount. Disclosures are a type of document in which lenders are obligated to be completely transparent about all the terms of the mortgage agreement. This approach helps you understand all potential fees before committing to a HELOC, reducing the risk of unexpected costs down the road.

As we move forward, it’s important to consider another hidden cost that can catch HELOC borrowers off guard: rate increase penalties. These can turn your affordable line of credit into an expensive burden overnight.

Are Variable HELOC Rates a Ticking Time Bomb?

The Volatility of Variable Interest Rates

HELOCs typically come with variable interest rates, which can lead to unexpected increases in your monthly payments. The average HELOC rate as of May 2025 is between 4.25% and 4.50%. However, this rate can change rapidly based on market conditions.

The Real-World Impact of Rate Hikes

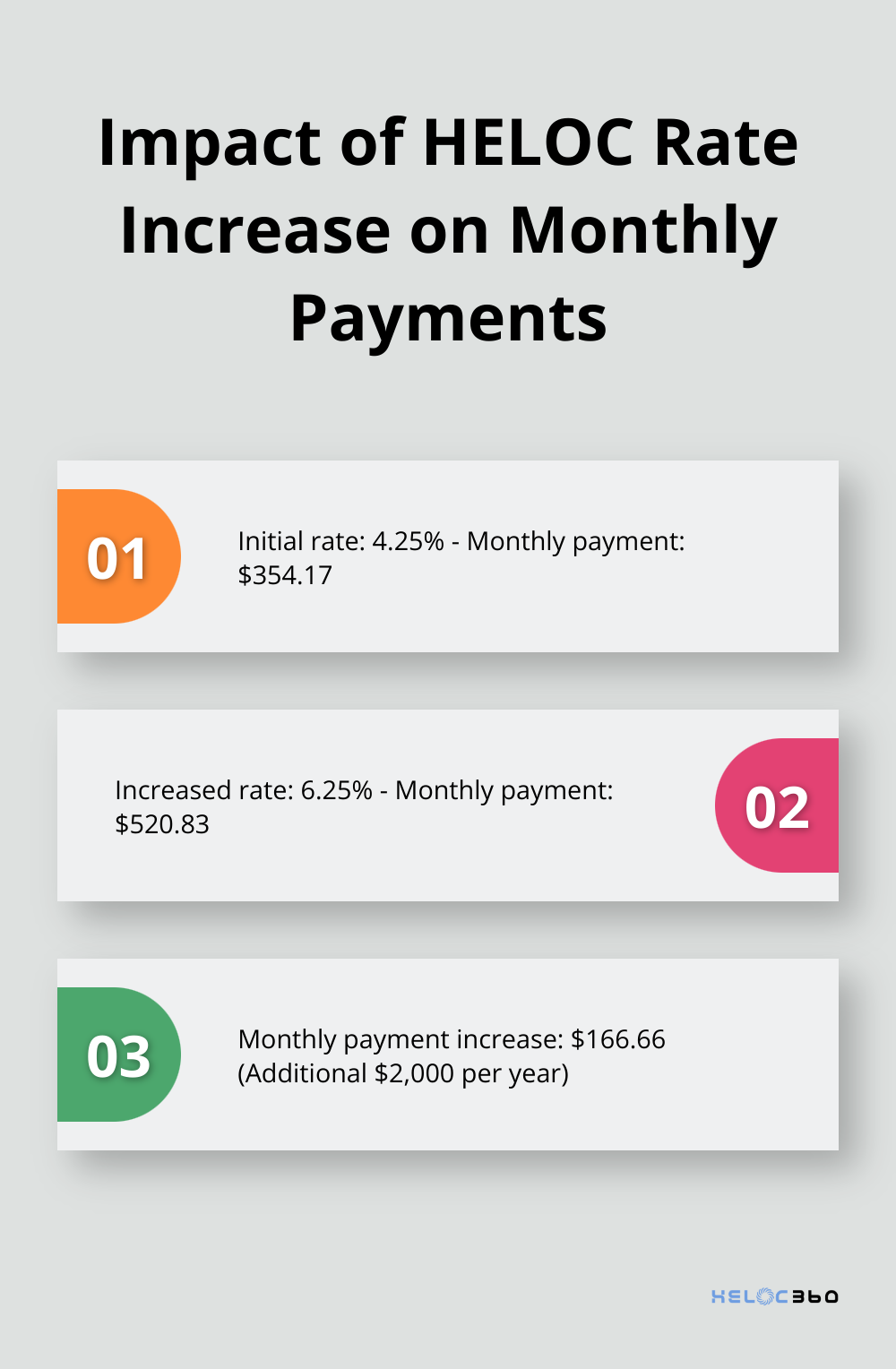

Let’s examine a concrete example. If you have a $100,000 HELOC balance with an initial rate of 4.25%, your monthly interest-only payment would be about $354.17. If the rate jumps to 6.25%, your payment would increase to $520.83. That’s an extra $166.66 per month (or $2,000 per year).

Current HELOC borrowers can expect their interest rate and payments to adjust within a month or two after a Fed rate change. This can quickly strain your budget if you’re not prepared.

Strategies to Protect Your Finances

To shield yourself from sudden rate hikes, consider these strategies:

- Choose a fixed-rate option: Some lenders offer the ability to convert part or all of your HELOC balance to a fixed rate. While this rate might be higher initially, it provides stability and protection against future increases.

- Create a budget buffer: Set aside extra funds each month to cushion against potential rate increases. This approach can help you avoid financial stress if rates rise unexpectedly.

- Pay more than the minimum: Paying down your principal faster reduces the balance subject to interest rate changes. This strategy can save you thousands over the life of your HELOC.

- Look for a rate cap: Some HELOCs come with rate caps that limit how much your rate can increase over the life of the loan. While these HELOCs might have slightly higher initial rates, they offer long-term protection against dramatic increases.

- Monitor economic indicators: Keep an eye on economic indicators and Federal Reserve announcements. This awareness can help you anticipate potential rate changes and adjust your financial strategy accordingly.

The Importance of Informed Decision-Making

Understanding the complexities of variable rates and their potential impact on your finances is essential. Shop for the best home equity line of credit interest rates by comparing offers from multiple HELOC lenders. The right tools and knowledge can empower you to make the most of your home equity while minimizing financial risks.

Variable rates can significantly impact your HELOC experience, but they’re not the only hidden cost to watch out for. Another often-overlooked expense is inactivity fees. Let’s explore how these charges can affect your HELOC strategy and what you can do to avoid them.

Are You Paying for an Unused HELOC?

The Hidden Cost of Inactivity Fees

Inactivity fees represent a lesser-known but potentially costly aspect of HELOCs. These charges can silently erode your finances if you don’t pay attention. Let’s explore why lenders impose these fees and how you can avoid them.

Lenders’ Rationale for Inactivity Fees

Lenders often implement inactivity fees to motivate borrowers to use their HELOCs. From the lender’s perspective, an unused HELOC represents a financial commitment without generating revenue. Many lenders will charge an inactivity fee if you don’t use your HELOC for a certain period, typically a year or more. These fees can add up over time and eat into your finances.

Strategies to Sidestep Unnecessary Charges

To avoid these fees, consider the following strategies:

- Make regular, small withdrawals: Withdraw small amounts from your HELOC periodically, even if you don’t need the funds immediately. You can deposit these funds into a high-yield savings account, effectively offsetting the cost of interest while avoiding inactivity fees.

- Negotiate with your lender: If you have a long-standing relationship with your lender and a good credit history, you might successfully negotiate the removal of inactivity fees. You may be able to negotiate closing costs, whether you’re buying a home or refinancing your mortgage.

- Compare lender options: Not all lenders charge inactivity fees. When selecting a HELOC provider, prioritize those that don’t impose these charges.

Responsible HELOC Usage

While avoiding inactivity fees is important, you must use your HELOC responsibly. Here are some tips for maintaining a healthy balance:

- Set reminders: Use digital tools to set regular reminders for HELOC withdrawals. This can help you stay active without overusing the credit line.

- Plan your usage: Align HELOC withdrawals with planned expenses or investments. This approach ensures you use the credit line purposefully rather than just to avoid fees.

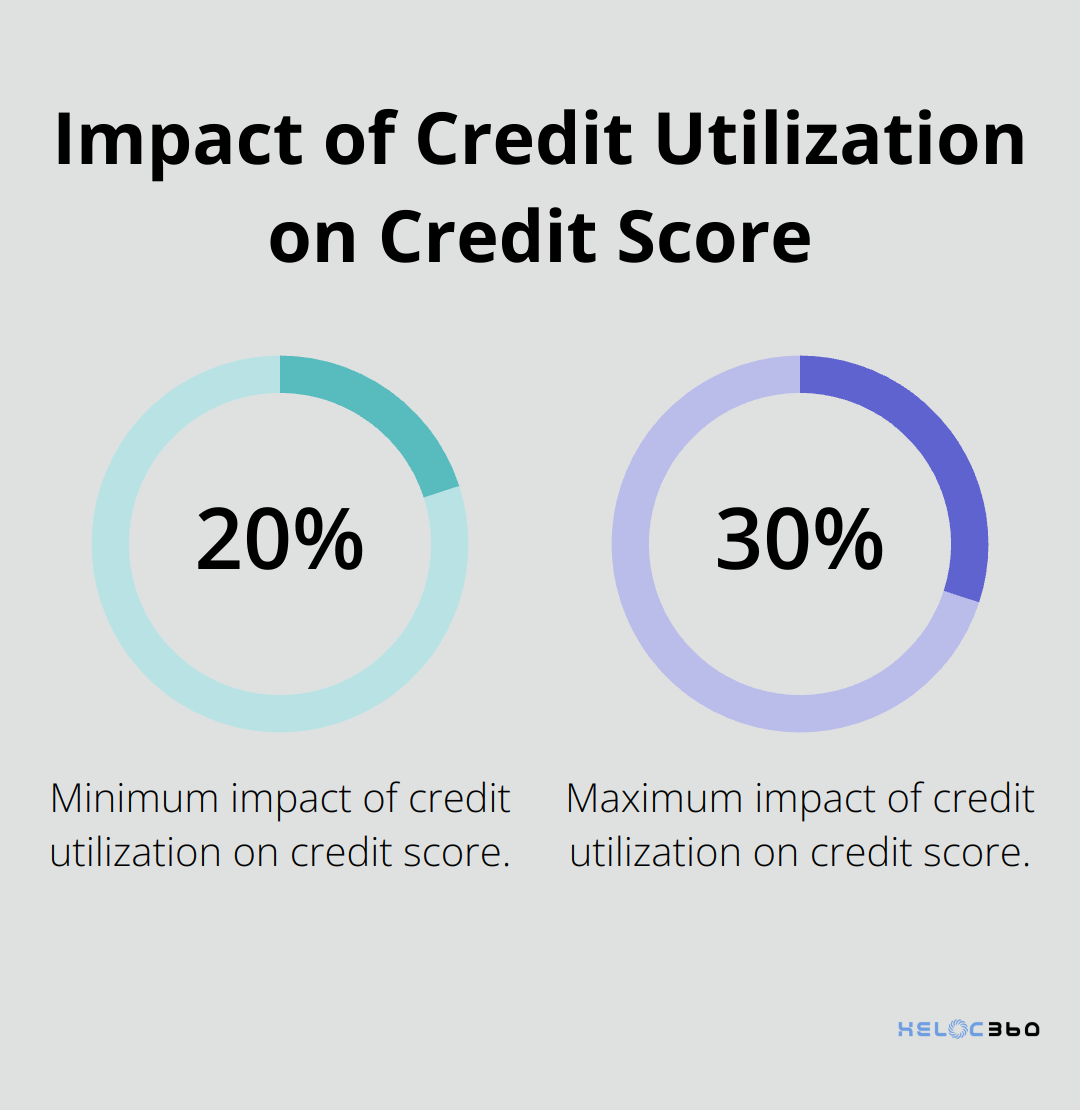

- Monitor your credit utilization: Keep your HELOC balance low to maintain a healthy credit score. Revolving credit utilization is an important scoring factor that could affect around 20% to 30% of your credit score depending on the scoring model.

- Explore alternatives: If you consistently don’t use your HELOC, you might want to explore other financial products that better suit your needs. A financial advisor can help you assess whether a HELOC is the right tool for your situation.

Final Thoughts

Hidden HELOC penalties can significantly impact your financial well-being. Early termination fees, rate increase penalties, and inactivity charges are just a few potential pitfalls that await unsuspecting borrowers. These costs can add up quickly, turning a seemingly smart financial move into a costly mistake.

The key to avoiding these surprises lies in thorough research and careful consideration of your HELOC agreement. Reading the fine print isn’t just a suggestion – it’s a necessity. Every clause, condition, and potential fee should undergo scrutiny before you sign on the dotted line.

HELOC360 understands the complexities of home equity lines of credit and the importance of making informed decisions. Our platform helps you navigate the HELOC landscape with confidence, providing tools and knowledge to avoid costly penalties. We connect you with lenders who offer transparent terms and competitive rates, ensuring you get the best possible deal for your unique situation (visit HELOC360 to learn more).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.