Estate planning is a complex process that requires careful consideration of various financial tools. One often overlooked aspect is how Home Equity Lines of Credit (HELOCs) can play a role in your estate strategy.

At HELOC360, we’ve seen firsthand how incorporating HELOCs into estate plans can significantly impact wealth transfer and asset management. This guide will explore the intricacies of HELOC estate planning, helping you make informed decisions about your financial legacy.

What Are HELOCs and How Do They Affect Your Estate?

The Basics of HELOCs

Home Equity Lines of Credit (HELOCs) are powerful financial tools that can significantly impact your estate planning strategy. These credit lines allow homeowners to borrow against their home’s equity, providing a flexible source of funds for various purposes.

A HELOC functions similarly to a credit card, but with your home as collateral. Lenders approve you for a maximum credit limit based on your home’s value and your outstanding mortgage balance. During the draw period (typically 5-10 years), you can borrow as needed and only pay interest on the amount used. After this, the repayment period begins, where you pay back both principal and interest.

HELOCs and Estate Value

Including a HELOC in your estate plan can profoundly affect your estate’s value. A HELOC can provide liquidity, allowing you to access funds without selling assets. This proves particularly useful for covering unexpected expenses or making strategic investments. However, it’s important to understand that a HELOC also represents a debt against your estate. If not managed properly, it could reduce the overall value of assets passed to your heirs.

Benefits and Risks

The strategic use of HELOCs in estate planning offers several advantages. For instance, you might use a HELOC to fund home improvements, potentially increasing your property’s value and, by extension, your estate’s worth. Additionally, a HELOC can provide a buffer against market volatility, allowing you to avoid selling investments at inopportune times.

However, the risks are equally important to consider. Interest rates on HELOCs are typically variable, which means your payments could increase over time. The national average HELOC interest rate is 7.99% as of May 7, 2025. There’s also the risk of overextending yourself financially, potentially leaving your heirs with debt to manage. Moreover, since your home serves as collateral, you face the risk of foreclosure if you’re unable to meet the repayment terms.

Strategic Considerations

When incorporating a HELOC into your estate plan, it’s essential to have a clear strategy. Consider how you’ll use the funds and how they align with your overall estate goals. For example, you might use a HELOC to equalize inheritances among heirs or to fund a trust for a specific purpose.

It’s also crucial to communicate your HELOC strategy with your heirs. They should understand how the HELOC fits into your overall estate plan and what responsibilities they might inherit. This transparency can help prevent misunderstandings and ensure your wishes are carried out effectively.

As we move forward, we’ll explore specific strategies for incorporating HELOCs into your estate planning, providing you with practical approaches to maximize the benefits while mitigating potential risks.

Maximizing Estate Value with HELOCs

Funding Trusts with HELOC Proceeds

Estate planning with HELOCs requires a strategic approach to balance potential benefits and risks. One powerful strategy involves the use of HELOC funds to establish or fund trusts. This approach can help transfer wealth to heirs while minimizing estate taxes. For example, HELOC funds can create an irrevocable life insurance trust (ILIT). The trust can then purchase a life insurance policy, potentially providing a significant tax-free benefit to beneficiaries upon death.

An ILIT is a useful estate planning tool because it avoids federal estate tax on assets passing that do not qualify for a charitable or marital deduction. However, it’s important to work with a qualified estate planning attorney to ensure the trust is structured correctly and complies with all relevant laws.

Equalizing Inheritances Among Heirs

HELOCs can serve as an effective tool for equalizing inheritances among heirs. For instance, if multiple children exist but only one wants to inherit the family home, a HELOC can provide liquid assets to the other heirs. This strategy allows the property to remain in the family while ensuring all heirs receive a fair share of the estate.

It’s possible to get a home equity loan on a home you’ve inherited jointly with other heirs. In fact, many lenders offer this option, which can be useful for equalizing inheritances among heirs.

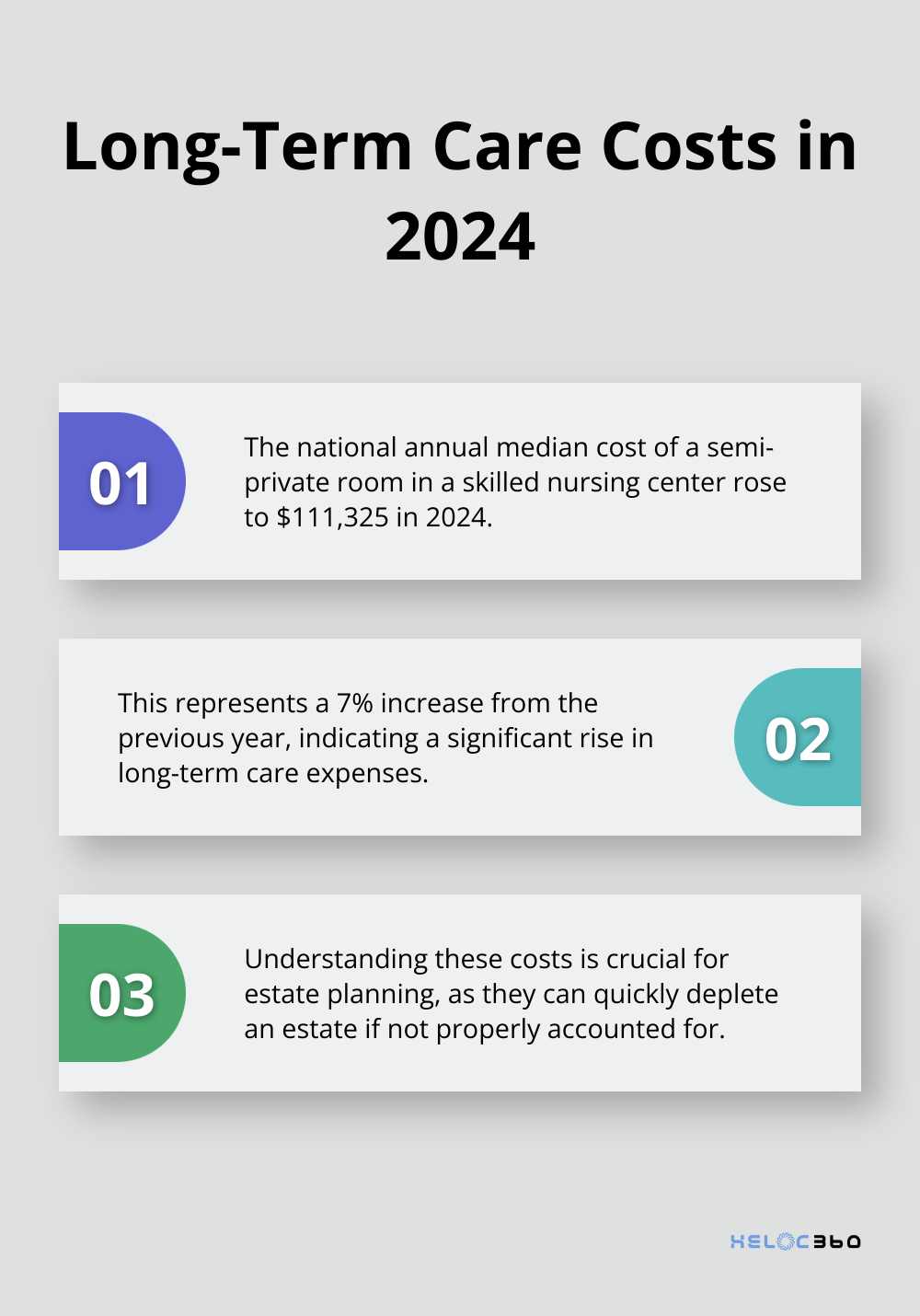

Funding Long-Term Care Expenses

Long-term care costs can quickly deplete an estate, leaving little for heirs. A HELOC can provide a financial buffer for these expenses. In 2024, the national annual median cost of a semi-private room in a skilled nursing center rose to $111,325, an increase of 7%. The use of a HELOC to cover these costs can potentially preserve other assets for heirs.

It’s important to consider the long-term implications of this strategy. If the HELOC isn’t repaid before death, it will need to be settled from the estate, potentially reducing the overall inheritance. Always consult with a financial advisor to determine if this approach aligns with your overall estate planning goals.

Risks and Considerations

While HELOCs offer powerful tools in estate planning, they come with risks. It’s essential to have a clear repayment strategy and to communicate plans with heirs. The benefits of HELOCs can be leveraged while minimizing potential drawbacks, ultimately maximizing the value of your estate for future generations.

HELOCs typically have variable interest rates, which means payments could increase over time. There’s also the risk of overextending financially, potentially leaving heirs with debt to manage. Moreover, since your home serves as collateral, the risk of foreclosure exists if repayment terms can’t be met.

As we move forward, we’ll explore the legal and tax implications of incorporating HELOCs into your estate plan, providing you with a comprehensive understanding of how these financial tools can impact your legacy.

Legal and Tax Implications of HELOCs After Death

HELOC Treatment Post-Death

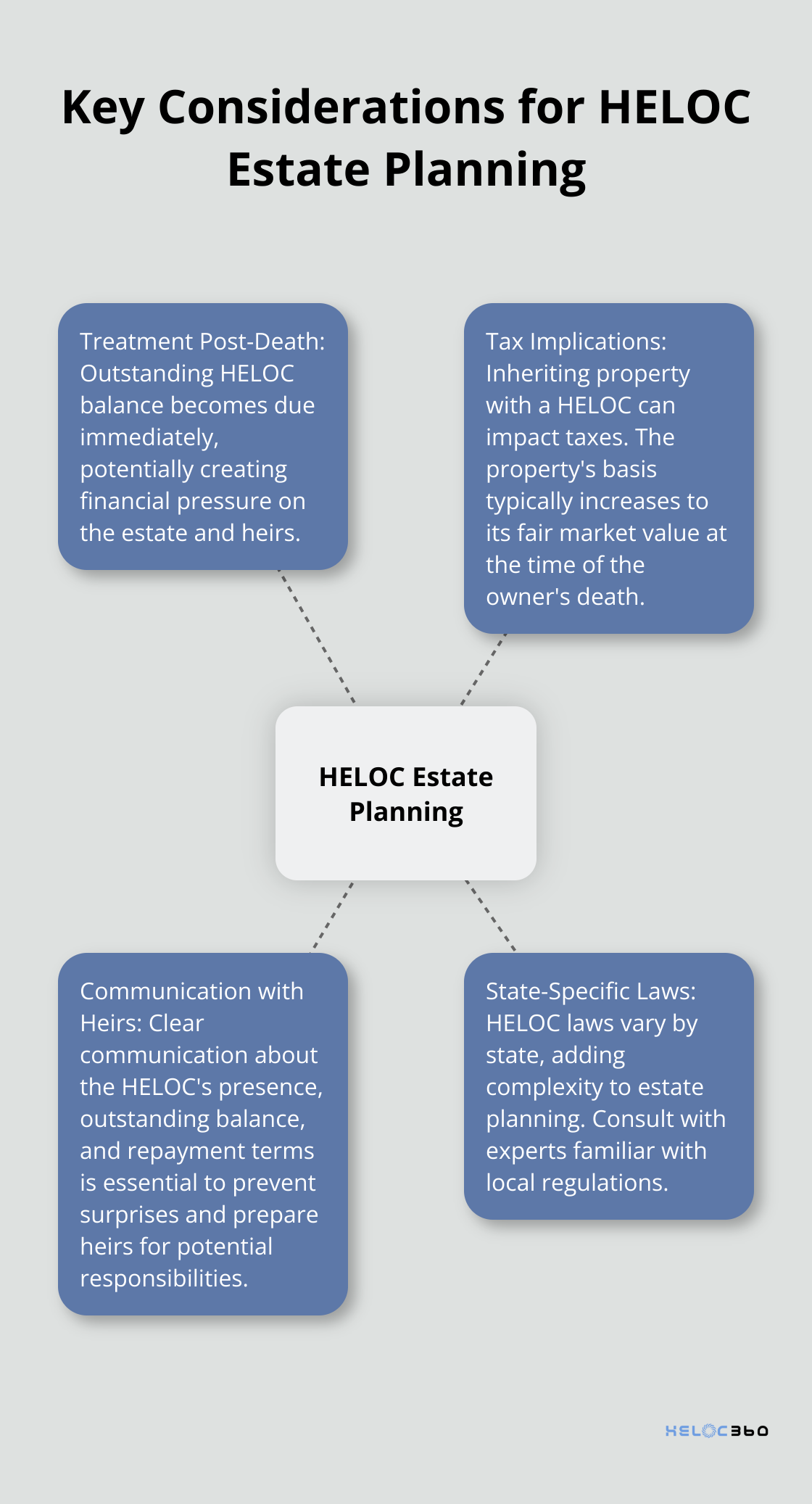

When a HELOC borrower dies, the outstanding balance becomes due immediately. This situation can create financial pressure on the estate and heirs. If the inherited property was not part of a living trust, it might need to go through probate. During probate, the court validates the will, and the executor may need to address the HELOC balance.

The executor may choose to pay off the HELOC balance if the estate has sufficient liquid assets. However, if the estate lacks liquidity, heirs might need to refinance the HELOC or sell the property to settle the debt. Some lenders may work with heirs to establish a new payment plan, but this outcome is not guaranteed.

Tax Considerations for Heirs

Inheriting a property with a HELOC can significantly impact taxes. The property’s basis typically increases to its fair market value at the time of the owner’s death, which can benefit capital gains tax purposes if the heirs decide to sell. However, any outstanding HELOC balance remains a liability against the estate.

State-Specific HELOC Laws

HELOC laws vary significantly from state to state, which adds complexity to estate planning. For example, California subjects HELOCs to the state’s one-action rule, which can limit a lender’s options for recovering the debt. Texas, on the other hand, has strict homestead laws that can affect how HELOCs are treated in estate settlements.

Proactive Planning for HELOC Estates

Clients who address these legal and tax implications in their estate plans position themselves better to protect their heirs from unexpected financial burdens. You should review your HELOC terms and estate plan regularly, especially when major life changes occur or when state laws update.

HELOCs can serve as powerful financial tools, but their impact on your estate requires careful consideration and expert guidance. You should consult with estate planning attorneys and tax professionals who know HELOC regulations well. These experts can help ensure your estate plan effectively manages these complexities.

The Role of Communication in HELOC Estate Planning

Clear communication with heirs about the presence of a HELOC and its potential impact on the estate proves essential. You should inform your heirs about the outstanding balance, repayment terms, and any plans you have for addressing the HELOC in your estate. This transparency can help prevent surprises and allow heirs to prepare for potential financial responsibilities.

A will is a legal document that provides guidance for the distribution of assets and possessions in the event of someone’s death. Including information about HELOCs in your will can be an important part of your estate planning strategy.

Final Thoughts

HELOCs offer opportunities and challenges in estate planning. These financial tools provide liquidity, fund trusts, equalize inheritances, and cover long-term care expenses, but also carry risks such as variable interest rates and potential debt for heirs. Professional advice proves essential when integrating HELOCs into your estate plan due to complex legal and tax implications that vary by state.

Clear communication with heirs about your HELOC strategy prevents surprises and helps them prepare for potential responsibilities. You should inform them about outstanding balances, repayment terms, and your plans for addressing the HELOC in your estate. Regular review and adjustment of your estate plan ensure it evolves with changing life circumstances and laws.

HELOC360 offers comprehensive solutions tailored to individual financial goals for homeowners looking to leverage their home equity effectively. Our expert guidance can help you make informed decisions about incorporating HELOCs into your estate planning strategy (HELOC estate). We connect homeowners with suitable lenders to enhance their financial legacy for future generations.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.