Are you ready to take the plunge into the world of home equity? A HELOC application can be your ticket to accessing the value locked in your property.

At HELOC360, we’ve seen countless homeowners successfully navigate this process. This guide will walk you through the essential steps to ace your HELOC application and unlock the financial flexibility you’ve been seeking.

What Is a HELOC?

Definition and Basics

A Home Equity Line of Credit (HELOC) allows you to borrow exactly what you need, typically for lower rates than other forms of credit, and you only pay interest on what you use. It functions as a revolving credit line, similar to a credit card, but uses your home as collateral. This financial tool provides access to funds based on your home’s value and outstanding mortgage balance.

How HELOCs Operate

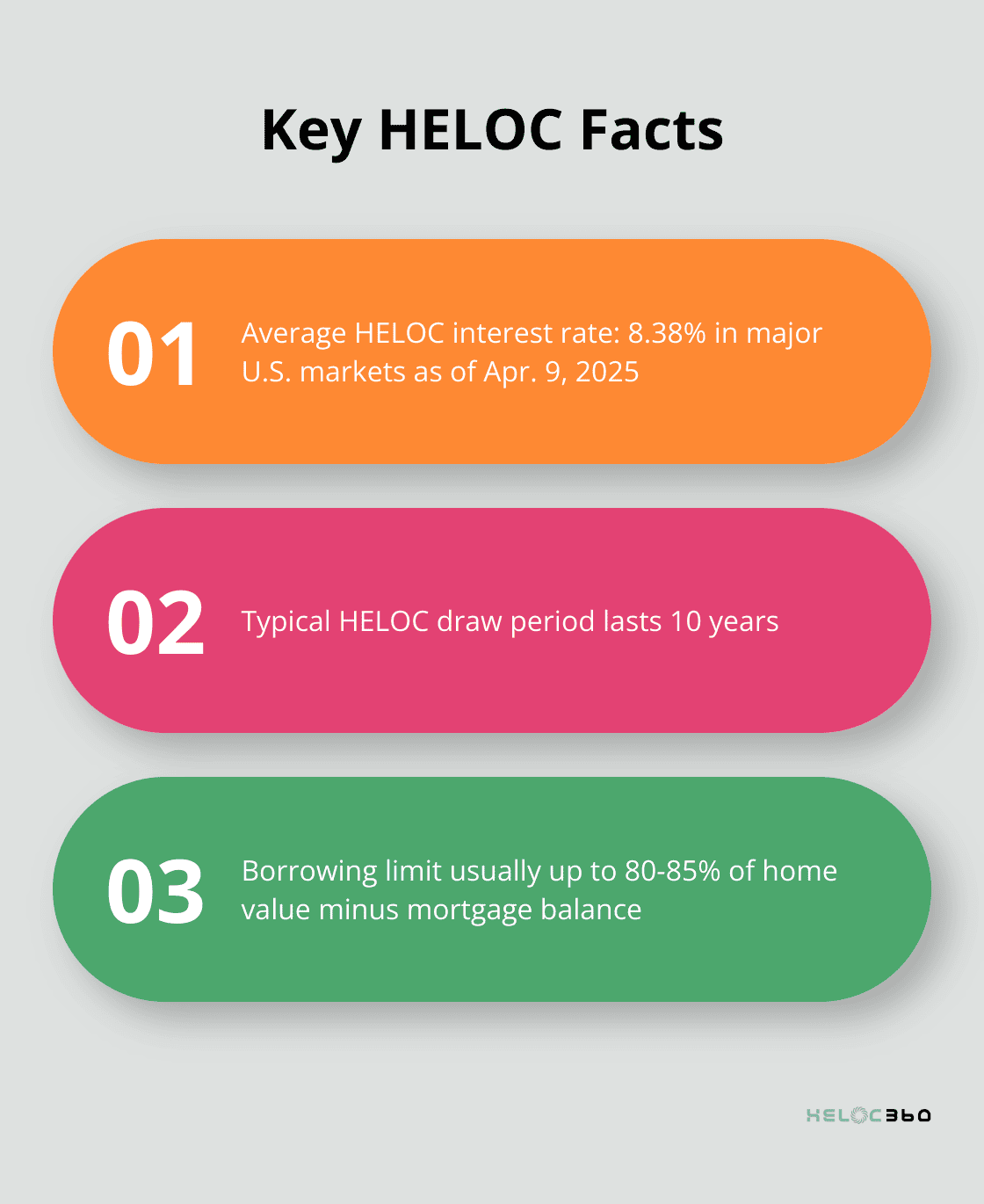

When you receive HELOC approval, the lender assigns a credit limit. You can withdraw funds from this line during the draw period, which typically lasts 10 years. During this time, you’ll likely only make interest payments. This structure offers flexibility for various financial needs.

Advantages: Flexibility and Lower Rates

HELOCs stand out for their adaptability. You don’t need to use the entire credit line and can repay and reborrow as needed during the draw period. This feature makes HELOCs suitable for ongoing expenses or projects with uncertain costs.

HELOCs also often come with lower interest rates compared to other credit options. As of Apr. 9, 2025, the current home equity loan interest rate in five of the largest U.S. markets averages 8.38 percent.

Popular Uses for HELOC Funds

Homeowners utilize HELOCs for various purposes:

- Home Improvements: A 2024 study by the National Association of Home Builders found that 43% of HELOC borrowers use funds for renovations.

- Debt Consolidation: Combining high-interest debts into a lower-rate HELOC can save money.

- Education Expenses: Paying for college or other educational costs.

- Emergency Funds: Creating a financial safety net for unexpected expenses.

Understanding the Risks

While HELOCs offer benefits, they also come with potential risks:

- Collateral: Your home secures the loan, meaning you could lose it if you default on payments.

- Variable Rates: Most HELOCs have variable interest rates, which can increase over time (potentially affecting your monthly payments).

As you consider a HELOC, it’s important to weigh these factors carefully. The next section will guide you through the preparation steps for your HELOC application, ensuring you’re well-equipped to navigate the process successfully.

How to Prepare for Your HELOC Application

Review Your Credit Report

Start your preparation by obtaining a free copy of your credit report from AnnualCreditReport.com. This website, authorized by federal law, is the quickest way to get your credit reports from all three major credit bureaus. You can also request them by phone or mail. Examine your report for any errors or discrepancies. If you spot any inaccuracies, dispute them with the credit bureau immediately.

Check your credit score next. While FICO scores range from 300 to 850, most HELOC lenders prefer scores of 680 or higher. If your score falls below this threshold, take action to improve it. Paying down credit card balances can quickly impact your score positively. The credit utilization ratio (which measures how much of your available credit you use) is an important factor in your credit score.

Assess Your Home’s Equity

To calculate your home’s equity, determine its current market value and subtract your outstanding mortgage balance. Many lenders require at least 15-20% equity for HELOC approval. Online home value estimators provide a rough idea of your property’s worth, but they lack precision. For a more accurate valuation, hire a professional appraiser.

Lenders typically allow you to borrow up to 80-85% of your home’s value minus your mortgage balance. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you might borrow up to $55,000 (85% of $300,000 = $255,000, minus $200,000 mortgage balance).

Compile Your Financial Documents

Lenders want to see proof of your income, assets, and debts. Gather these documents:

- W-2 forms or 1099s from the past two years

- Federal tax returns for the past two years

- Recent pay stubs (usually for the last 30 days)

- Bank statements for the past two to three months

- Statements for investment accounts and retirement savings

- A list of all your debts (including credit cards, car loans, and student loans)

Having these documents ready will streamline the application process and showcase your financial responsibility to potential lenders.

Calculate Your Debt-to-Income Ratio

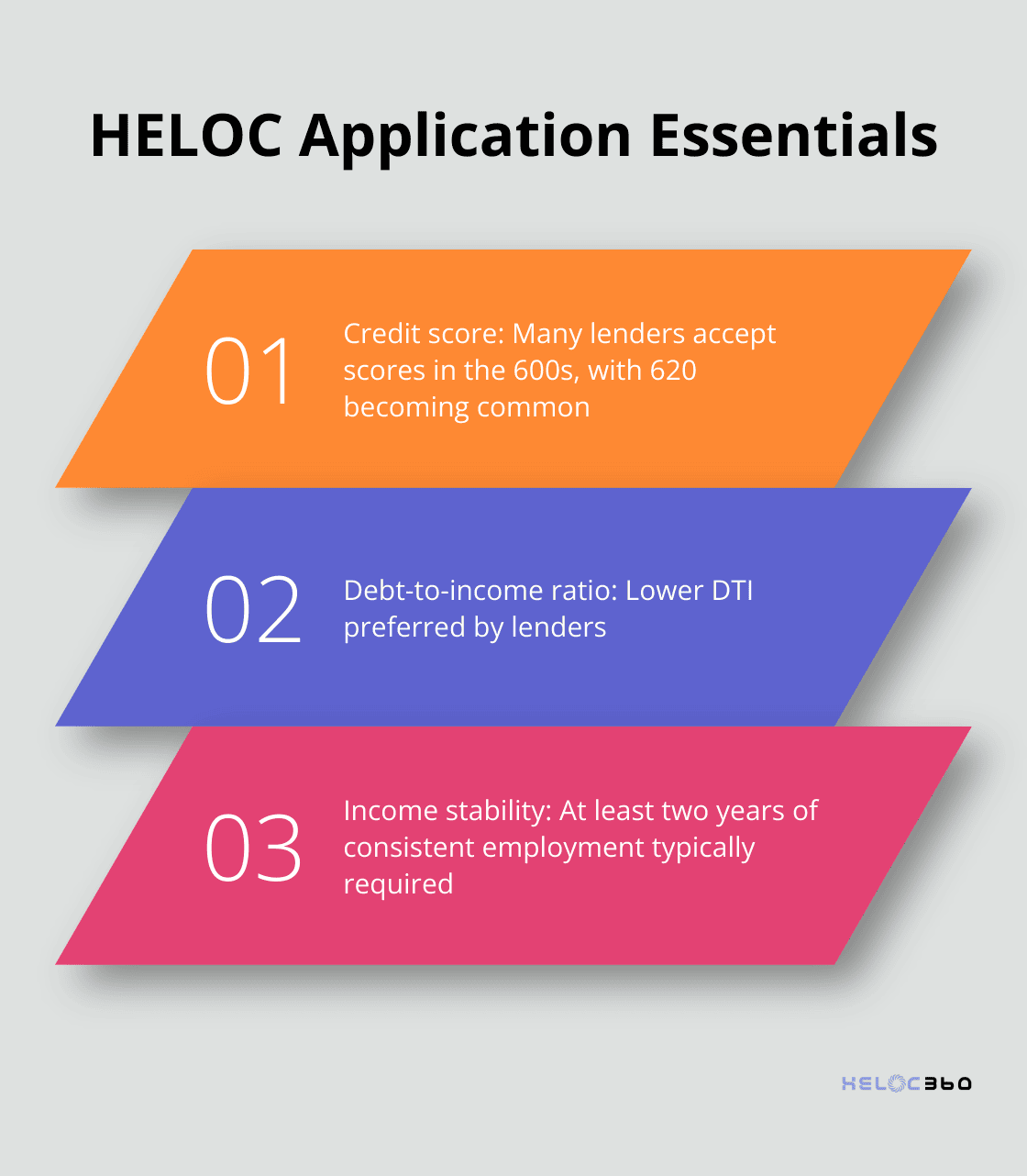

Your debt-to-income (DTI) ratio plays a significant role in your HELOC application. Calculate your DTI by entering your current income and payments. Most HELOC lenders prefer a lower DTI ratio. If your DTI exceeds the lender’s threshold, consider paying down some debts before applying.

These preparatory steps position you to submit a strong HELOC application. You’ll gain a clearer picture of your financial standing and address potential issues before they become roadblocks in the approval process. Now, let’s explore the key factors lenders consider when evaluating your HELOC application.

What HELOC Lenders Evaluate

Debt-to-Income Ratio: Your Financial Balance

HELOC lenders scrutinize your debt-to-income (DTI) ratio. This percentage shows how much of your monthly income goes to debt payments. Getting a HELOC with a high DTI can be challenging, but there are tips and alternatives to secure the funds you need. To calculate your DTI, add all monthly debt payments and divide by your gross monthly income.

A high DTI? Try to pay down some debts before applying. Even small reductions can make a difference.

Loan-to-Value Ratio: Your Home’s Worth

The loan-to-value (LTV) ratio compares your borrowing amount to your home’s current market value. To calculate LTV, divide your current loan balance by the current appraised value of your home. For example, if your loan balance is $140,000 and your home’s appraised value is $200,000, your LTV would be 70% ($140,000 ÷ $200,000 = .70).

To improve your LTV ratio, consider ways to increase your home’s value. Simple upgrades like fresh paint or landscaping can boost your home’s appraisal value.

Credit Score and Payment History: Your Financial Reputation

Your credit score and payment history provide lenders insight into your financial responsibility. Many lenders now allow you to tap your equity with a credit score in the 600s, with 620 becoming more common, especially for HELOCs. A higher score often translates to better rates and terms.

Your payment history carries significant weight. Late payments, especially on mortgages or other loans, can impact your approval chances. To improve your credit score, focus on timely payments and reduce credit card balances. These actions can quickly positively impact your score.

Income Stability: Your Repayment Ability

Lenders want to see a stable, reliable income that can support your HELOC payments. Most prefer at least two years of consistent employment in the same field. Self-employed applicants should prepare additional documentation, such as profit and loss statements or business tax returns.

It’s not just about the amount you earn, but also the stability and predictability of your income. For variable income (like commissions or bonuses), lenders typically average your earnings over the past two years.

Final Thoughts

The HELOC application process can challenge many homeowners. You can position yourself for success with proper preparation and knowledge. HELOC360 understands the complexities of this process and supports you at every stage.

Our platform simplifies your journey and provides expert guidance. We connect you with lenders that match your unique financial situation and goals. HELOC360 offers tailored solutions to help you maximize your home’s equity for various purposes.

Preparation plays a key role in your HELOC application. Take time to review your finances and improve your credit score if needed. HELOC360 stands as your trusted partner to help you navigate the complexities and unlock your home’s equity potential.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.