Thinking about HELOC cancellation? You’re not alone. Many homeowners find themselves in situations where they need to end their Home Equity Line of Credit (HELOC) agreement.

At HELOC360, we understand the complexities involved in this process. This guide will walk you through the steps to cancel your HELOC without incurring unnecessary penalties, helping you make informed decisions about your financial future.

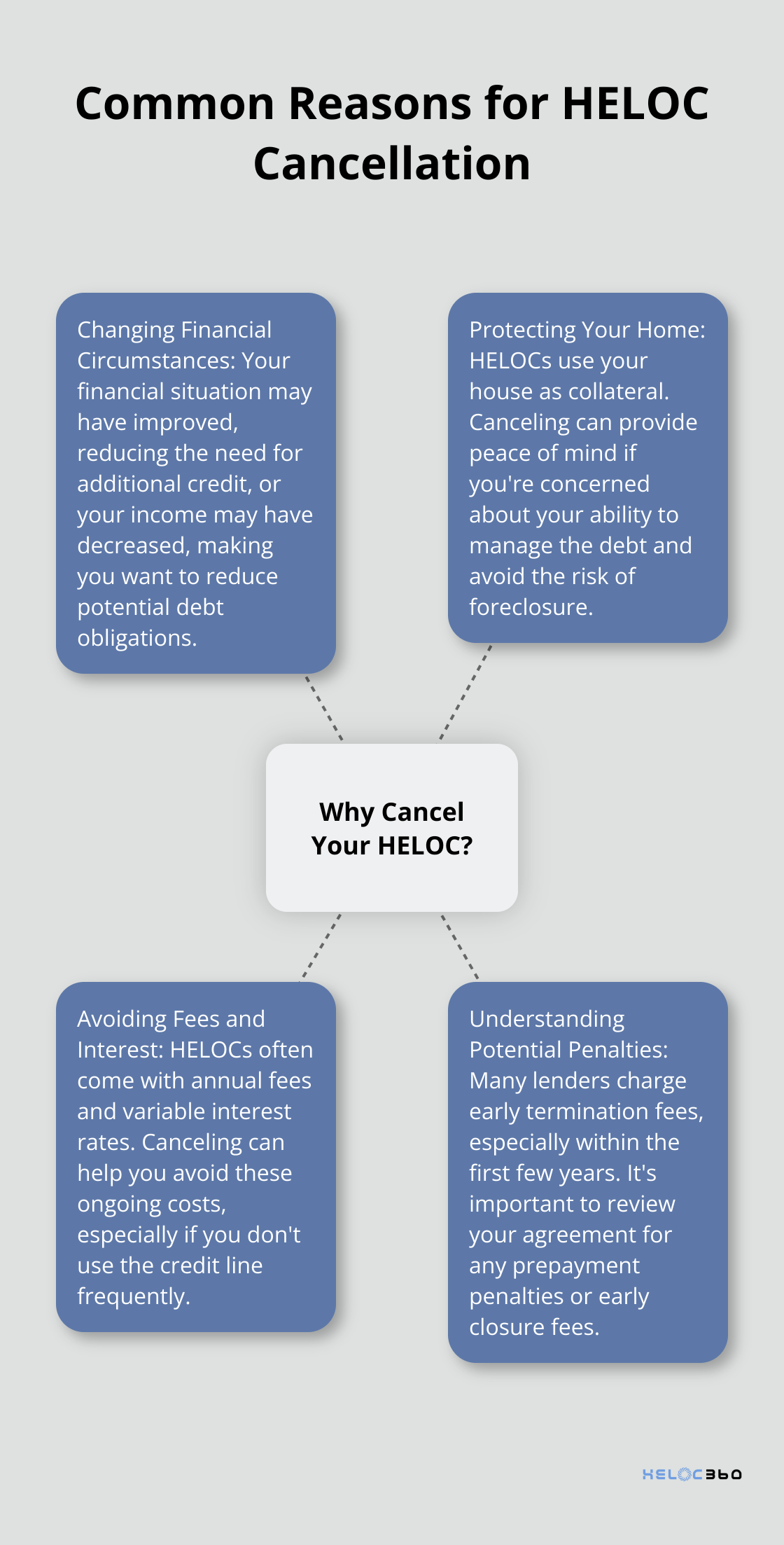

Why Cancel Your HELOC?

A Home Equity Line of Credit (HELOC) is a line of credit secured by your home that gives you a revolving credit line to use for large expenses. It functions like a credit card, with a revolving credit line you can draw from as needed. However, there are valid reasons why you might want to cancel your HELOC.

Changing Financial Circumstances

One common reason for canceling a HELOC is a shift in your financial situation. Perhaps you’ve come into an inheritance or received a significant bonus at work. In such cases, you might no longer need the additional credit line. Alternatively, if your income has decreased, you might want to reduce your potential debt obligations.

Protecting Your Home

Another reason to cancel your HELOC is to safeguard your home. HELOCs use your house as collateral, which means if you default on payments, you risk foreclosure. If you’re concerned about your ability to manage the debt, canceling the HELOC can provide peace of mind.

Avoiding Fees and Interest

HELOCs often come with annual fees, which can add up over time. If you don’t use the credit line frequently, these fees might outweigh the benefits. Moreover, HELOCs typically have variable interest rates. If rates rise, you might want to cancel to avoid potentially higher payments in the future.

Understanding Potential Penalties

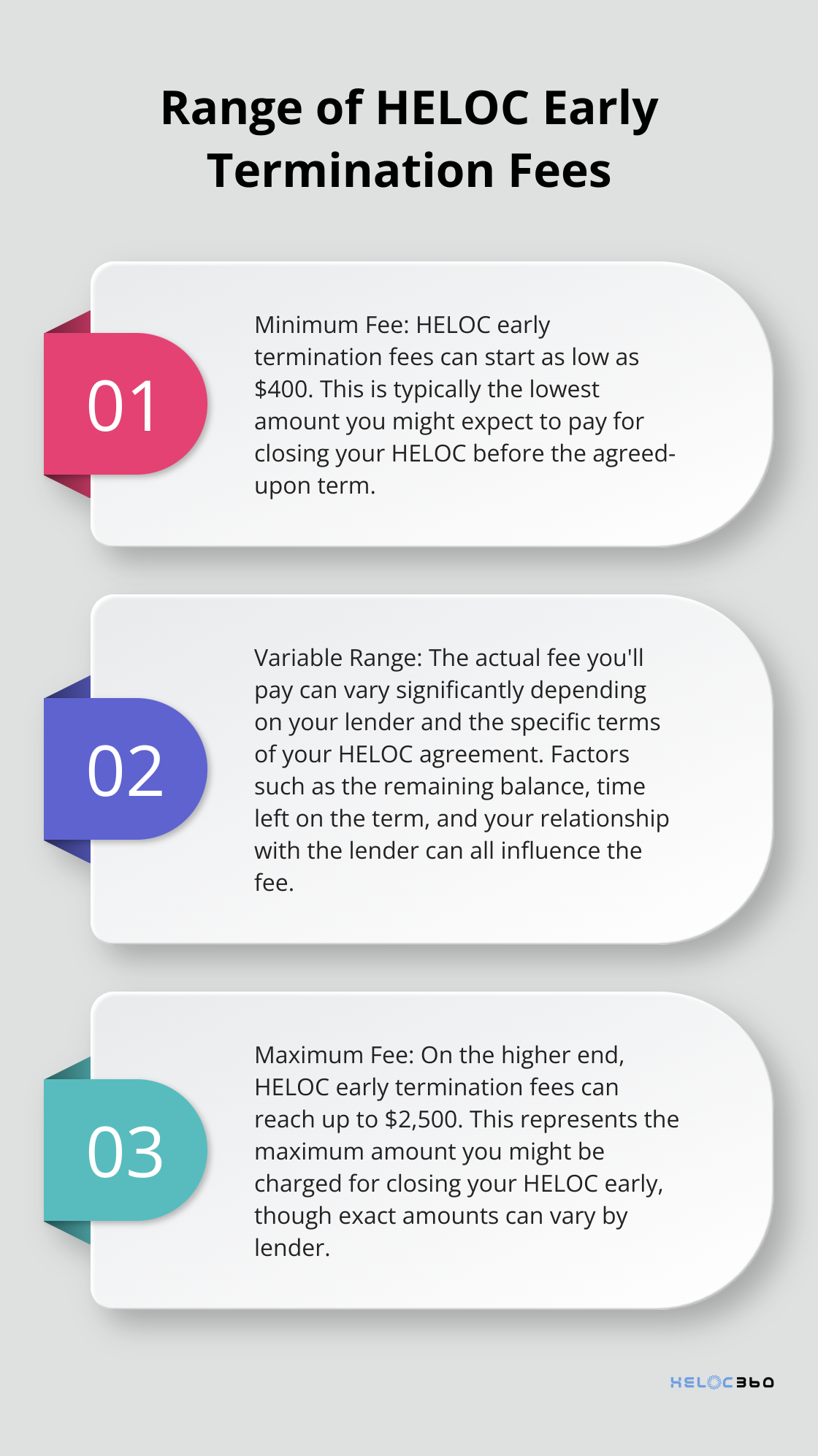

It’s important to note that canceling a HELOC isn’t always penalty-free. Many lenders charge early termination fees, especially if you close the account within the first few years.

Your lender may charge you a fee for closing your HELOC early.

Some lenders also require you to repay any closing costs they initially covered when you opened the HELOC. This could include appraisal fees, title search costs, and other expenses.

Reviewing Your HELOC Agreement

Before you decide to cancel, carefully review your HELOC agreement. Look for any mention of prepayment penalties or early closure fees. If you’re unsure about any terms, ask your lender for clarification.

While canceling a HELOC is a significant financial decision, it’s not the only option available. Some homeowners choose to freeze their HELOC instead of canceling it outright, which might offer similar benefits without the potential penalties. To make the best decision for your unique situation, consider consulting with a financial advisor who can help you weigh the pros and cons based on your specific circumstances.

How to Cancel Your HELOC: A Step-by-Step Guide

Review Your HELOC Agreement

The first step in canceling your Home Equity Line of Credit (HELOC) is to examine your agreement thoroughly. This document contains critical information about cancellation procedures, potential fees, and your obligations. Focus on sections that detail early termination penalties.

Understanding these terms upfront will help you time your cancellation to minimize costs.

Contact Your Lender

After you review your agreement, reach out to your lender. This conversation is essential for understanding the exact steps you need to take. Ask about the documents you may need, the costs you can expect, and the steps you can take to prepare for a HELOC closing.

Some lenders have a dedicated HELOC cancellation form, while others require a written request. During this conversation, ask about the possibility of waiving any cancellation fees. While not guaranteed, some lenders might negotiate, especially if you have a long-standing relationship or face financial hardship.

Pay Off Your Outstanding Balance

Before you can officially close your HELOC, you must clear any remaining balance. Request an official payoff statement from your lender, which will include the principal, accrued interest, and any additional fees. Be aware that this amount may differ from your last statement due to daily interest accrual.

If you carry a significant balance, consider whether immediate payoff is the best financial move. In some cases, it might benefit you more to keep the HELOC open and pay it down over time, especially if closing it would incur substantial penalties.

Submit Your Formal Cancellation Request

After you settle your balance, submit a formal cancellation request according to your lender’s instructions. This typically involves sending a written notice or completing a specific form. Include key details such as:

- Your account number

- The date you want the cancellation to take effect

- A clear statement of your intent to close the account

You may not cancel by phone or in a face-to-face conversation with the lender. Mail or deliver your written notice before midnight of the third business day.

Canceling your HELOC is just one option among many. If you seek to adjust your home equity strategy, consider exploring alternatives that might better suit your current financial situation. The next section will discuss strategies to avoid penalties when canceling your HELOC, ensuring you make the most informed decision for your unique circumstances.

How to Avoid HELOC Cancellation Penalties

Time Your Cancellation Strategically

The timing of your HELOC cancellation can significantly impact the fees you’ll face. With home equity contracts, homeowners get cash up front in exchange for a repayment later. However, these contracts can be risky, so it’s important to understand the terms and potential penalties before canceling.

To avoid charges, wait until after the initial period, often three to five years. If you’re close to the end of your draw period, it might benefit you to hold off on cancellation for a few months to save hundreds or even thousands of dollars.

Negotiate With Your Lender

Don’t underestimate the power of negotiation. Lenders often have flexibility when it comes to fees, especially for long-standing customers. When you contact your lender about cancellation, ask if they’ll waive or reduce any penalties.

Prepare to make your case. If you’ve been a reliable customer with a good payment history, highlight this fact. You might also mention any financial hardships you’re facing. A study found that men have twice the success rate of women when it comes to getting annual fees waived.

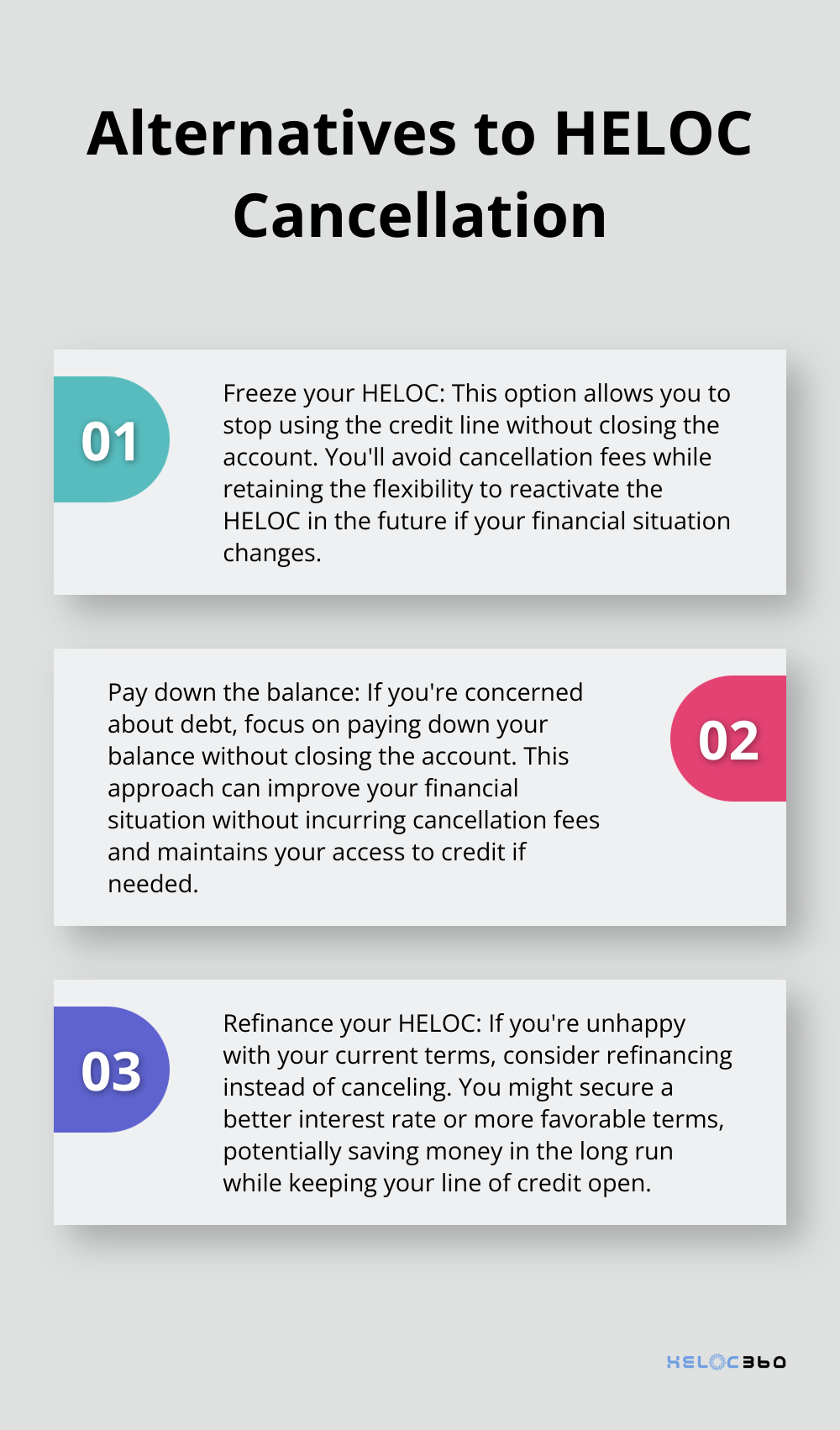

Explore Alternatives to Cancellation

Sometimes, outright cancellation isn’t the best option. Consider these alternatives:

- Freeze your HELOC: This option allows you to stop using the credit line without closing the account. You’ll avoid cancellation fees while retaining the flexibility to reactivate the HELOC in the future.

- Pay down the balance: If you worry about debt, focus on paying down your balance without closing the account. This approach can improve your financial situation without incurring cancellation fees.

- Refinance your HELOC: If you’re unhappy with your current terms, consider refinancing instead of canceling. You might secure a better interest rate or more favorable terms.

- Convert to a fixed-rate loan: Some lenders allow you to convert your variable-rate HELOC to a fixed-rate loan. FlexLine gives you the ability to turn a portion of your balance into a fixed-rate term, also called a partition, at any time during the draw period. This can provide more predictable payments without the need for cancellation.

Calculate the Full Cost of Cancellation

Before you decide, calculate the total cost of cancellation. This includes not just penalty fees, but also potential costs like:

- Repayment of closing costs the lender initially covered

- Fees for releasing the lien on your property

- Any balance transfer fees if you’re moving the debt elsewhere

Compare these costs against the long-term savings from cancellation. In some cases, paying a penalty now might still prove more cost-effective than keeping the HELOC open.

Final Thoughts

HELOC cancellation requires careful consideration and planning. You must review your agreement, communicate with your lender, pay off outstanding balances, and submit a formal request. The terms of your HELOC agreement will help you time your cancellation, negotiate with your lender, and explore alternatives that suit your financial situation.

We at HELOC360 understand the complexities of managing home equity. Our platform empowers homeowners with knowledge and connects them with suitable lenders. We provide full-circle solutions tailored to your goals (whether you consider HELOC cancellation or explore other options to leverage your home’s value).

HELOC360 simplifies the process and offers expert guidance for informed decisions about your financial future. You can unlock the full potential of your home equity and turn it into a gateway for new opportunities with our help.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.