HELOCs are powerful financial tools, but many homeowners don’t use them to their full potential.

At HELOC360, we’ve seen firsthand how proper HELOC optimization can transform your finances.

This guide will show you practical strategies to maximize your HELOC’s benefits, from debt consolidation to wealth building.

What Exactly Is a HELOC?

Definition and Basics

A Home Equity Line of Credit (HELOC) is a financial tool that allows homeowners to borrow against the available equity in their home, using the house as collateral for the line of credit. Unlike a traditional loan, a HELOC functions more like a credit card, providing access to a revolving line of credit that you can use as needed.

How HELOCs Work

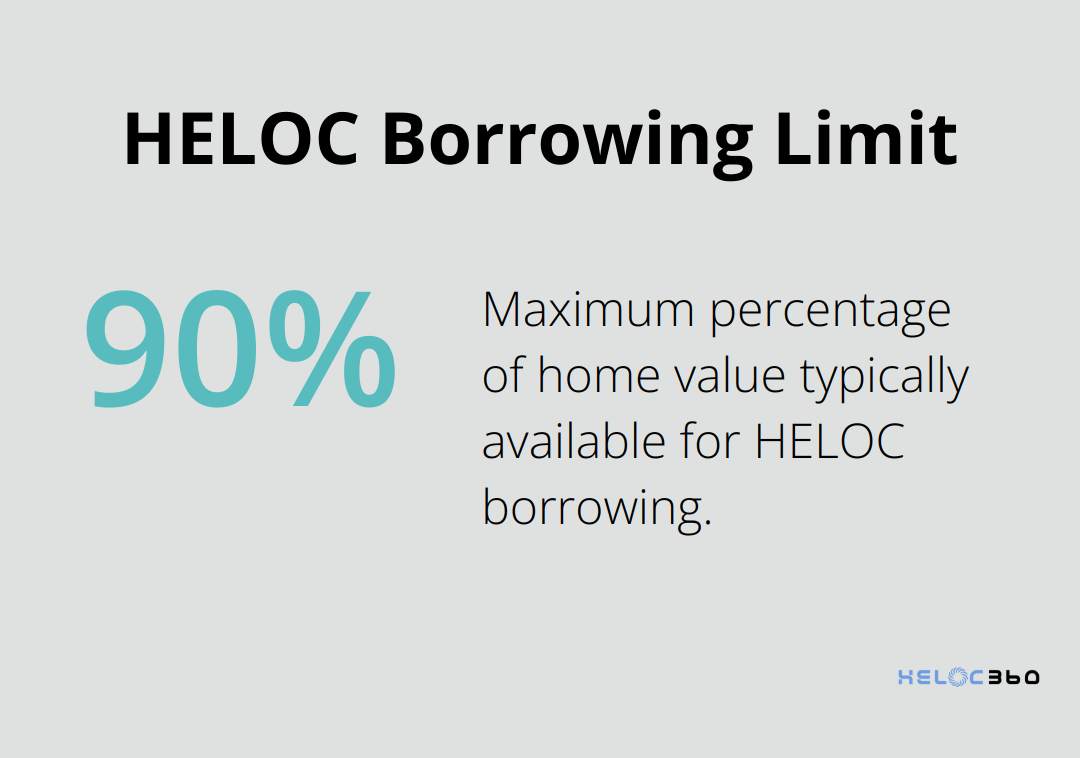

When you apply for a HELOC, the lender sets a credit limit based on your home’s value and your outstanding mortgage balance. You can typically borrow up to 80-90% of your home’s appraised value, minus what you still owe on your mortgage. For instance, if your home is worth $500,000 and you owe $200,000 on your mortgage, you might qualify for a HELOC of up to $250,000 (90% of $500,000 = $450,000, minus $200,000).

Key HELOC Features

HELOCs have unique features that distinguish them from other loan types:

- Draw Period: Most HELOCs have a draw period (usually 5-10 years) during which you can borrow funds as needed. You often only need to make interest payments on the amount you’ve borrowed during this time.

- Repayment Phase: After the draw period ends, you enter the repayment phase where you must pay back both principal and interest.

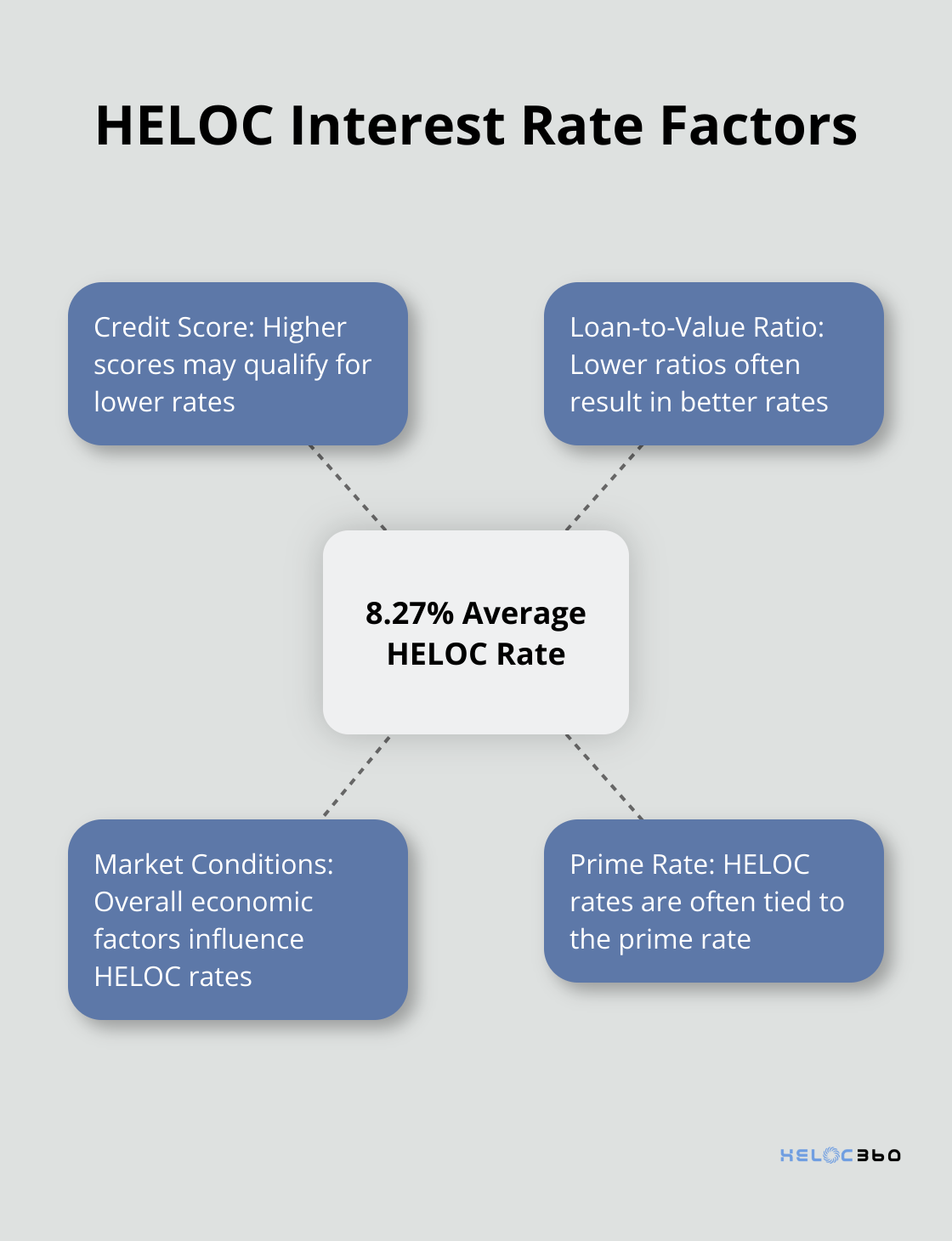

- Variable Interest Rates: HELOC interest rates typically fluctuate based on market conditions. This can be advantageous when rates are low but may lead to higher payments if rates increase. A variable-rate HELOC can be risky, especially if you have a high debt-to-income ratio.

HELOC vs. Other Loan Types

HELOCs differ significantly from other loan options:

- Home Equity Loans: Unlike a home equity loan, which provides a lump sum upfront, a HELOC offers flexibility to borrow only what you need, when you need it. This can result in lower overall interest costs if you don’t need the full amount immediately.

- Personal Loans and Credit Cards: HELOCs often come with lower interest rates because they’re secured by your home. However, this also means your home is at risk if you default on payments.

- Cash-Out Refinancing: This involves replacing your entire mortgage with a new, larger loan. In contrast, a HELOC is a separate line of credit that doesn’t affect your existing mortgage terms.

While HELOCs offer unique benefits, they’re not suitable for everyone. You must carefully consider your financial situation and goals before deciding. If you’re exploring HELOC options, platforms like HELOC360 can provide tailored guidance and connect you with lenders that match your specific needs.

Now that we understand what a HELOC is and how it compares to other loan types, let’s explore strategies to optimize your HELOC for maximum benefit.

How to Maximize Your HELOC’s Potential

Smart Debt Consolidation

One of the most effective ways to optimize your HELOC involves strategic debt consolidation. According to a 2023 Federal Reserve report, revolving credit decreased at an annual rate of 3.2 percent, while nonrevolving credit increased at an annual rate of 2.8 percent. HELOC rates typically range from 6% to 8%, depending on your credit score and market conditions.

You can potentially save thousands in interest payments when you use your HELOC to pay off high-interest debts. For example, $20,000 in credit card debt at 20% APR results in about $4,000 in annual interest. Transfer this debt to a HELOC at 7% APR, and you could reduce your yearly interest to $1,400, saving $2,600.

A solid repayment plan proves essential. Some homeowners accumulate more debt after consolidation. To avoid this pitfall, create a budget that allocates a fixed amount towards HELOC repayment each month.

Value-Adding Home Improvements

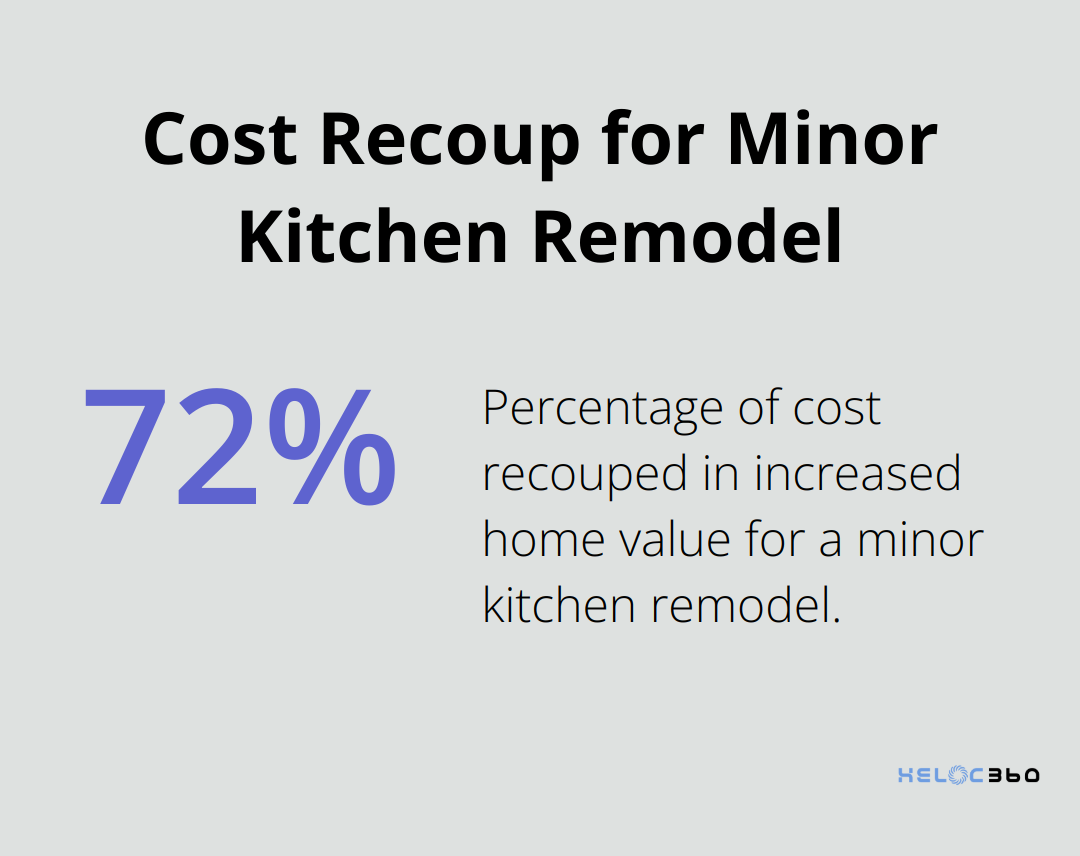

Another smart use of your HELOC focuses on home improvements that increase your property’s value. Remodeling Magazine’s 2023 Cost vs. Value Report indicates certain renovations offer high returns on investment. A minor kitchen remodel, for instance, can recoup about 72% of its cost in increased home value.

When you plan renovations, prioritize projects that add long-term value rather than luxury upgrades. Energy-efficient improvements (such as installing solar panels or upgrading to energy-efficient windows) can not only increase your home’s value but also reduce your monthly utility costs.

Get multiple quotes from contractors and create a detailed budget before you start any project. Overspending on renovations happens easily, so a clear plan proves essential.

The HELOC Wealth-Building Strategy

An advanced technique for HELOC optimization involves the HELOC wealth-building strategy. This approach uses your HELOC to make strategic investments that yield higher returns than the HELOC’s interest rate.

HELOC investment strategies can include using the funds as a down payment for rental properties or as bridge financing when buying real estate. If the rental income exceeds the HELOC payments and property expenses, you effectively use your home equity to generate positive cash flow.

Another approach uses your HELOC to invest in dividend-paying stocks or index funds. If your investment returns consistently outpace your HELOC interest rate, you can potentially build wealth over time. However, this strategy carries significant risks and should only be considered by those with a high risk tolerance and deep understanding of investment markets.

These strategies don’t suit everyone. They require careful planning, discipline, and often professional guidance. Always consult with a financial advisor before you implement any advanced HELOC strategies.

The key to successful HELOC optimization lies in responsible usage. While HELOCs offer flexibility and potential for financial growth, they also put your home at risk if mismanaged. Always have a clear plan for how you’ll use and repay your HELOC funds.

Now that we’ve explored ways to maximize your HELOC’s potential, let’s examine the risks and costs associated with HELOCs and how to manage them effectively.

How to Manage HELOC Risks Effectively

Understanding Variable Interest Rates

Home Equity Lines of Credit (HELOCs) come with variable interest rates, which can lead to unpredictable monthly payments. The national average HELOC interest rate is 8.27% as of July 9, 2025, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

To protect yourself against rate fluctuations:

- Set aside a portion of your budget as a buffer for potential rate increases.

- Look for lenders who offer rate caps (many HELOCs have a lifetime cap of 18%).

- Consider locking in a portion of your balance at a fixed rate if your lender offers this option.

Avoiding Overspending Pitfalls

The easy access to funds through a HELOC can tempt you to overspend. About 15 percent of HELOC borrowers consider paying regular household bills a “good use” of home equity, which could be a potential pitfall.

To prevent overspending:

- Create a specific plan for your HELOC funds before you start borrowing.

- For home improvements, obtain detailed quotes from contractors and adhere to your budget.

- When consolidating debt, calculate the exact amount needed to pay off high-interest debts and resist borrowing more.

Strategies for Responsible HELOC Usage

Implement these practical tips to manage your HELOC responsibly:

- Pay more than the minimum: During the draw period, many HELOCs only require interest payments. Paying extra towards the principal can reduce your overall interest costs.

- Monitor your credit utilization: Keep your HELOC balance below 30% of your credit limit to maintain a healthy credit score. (Credit utilization accounts for 30% of your FICO score calculation.)

- Set up automatic payments: This practice ensures you never miss a payment, which could result in late fees or negative impacts on your credit score.

- Review your HELOC terms regularly: Lenders may change terms or fees, so stay informed about your HELOC’s current conditions.

- Try a fixed-rate option: Some HELOCs allow you to lock in a portion of your balance at a fixed rate, providing stability if you worry about rising interest rates.

Importance of Professional Guidance

Managing a HELOC can be complex. Seek advice from financial professionals who can provide personalized strategies based on your specific financial situation and goals. It is important to consult with your tax and financial advisors to optimize potential tax benefits and assist in structuring your liabilities.

Final Thoughts

HELOCs offer a powerful financial tool for homeowners, but their true potential lies in strategic optimization. You can transform your home equity into a catalyst for financial growth through smart debt consolidation, value-adding home improvements, and calculated wealth-building strategies. However, responsible management remains key to reaping these benefits while mitigating risks.

Your financial situation, goals, and risk tolerance should guide your approach to HELOC optimization. Variable interest rates demand vigilance, and the temptation to overspend requires discipline. You can navigate these challenges effectively when you pay more than the minimum, monitor your credit utilization, and stay informed about your HELOC terms.

As you start your HELOC journey, consider partnering with experts who can provide personalized guidance. HELOC360 offers solutions to help you unlock the full potential of your home equity. Their platform simplifies the process, connects you with suitable lenders, and equips you with the knowledge to make informed decisions about your HELOC (without making any unverified claims about the company).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.