- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Are you looking to leverage your investment property’s equity? An investment property equity line of credit might be the solution you’re seeking.

At HELOC360, we understand that property investors need flexible financing options to grow their portfolios and maximize returns. This powerful financial tool can provide you with the capital you need for renovations, new acquisitions, or other investment opportunities.

In this post, we’ll break down everything you need to know about investment property HELOCs, including their benefits and key considerations.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

What Is an Investment Property HELOC?

Definition and Basic Concept

An investment property Home Equity Line of Credit (HELOC) is a loan taken out against a piece of real estate that generates income or a profit through capital appreciation. This financial tool works similarly to a traditional HELOC but is specifically tailored for non-owner-occupied properties.

With an investment property HELOC, you can borrow against the equity in your rental property, typically up to 75-80% of the property’s value minus any existing mortgage balance. This line of credit provides access to funds as needed, and you pay interest only on the amount you borrow.

Key Features

- Flexible Funding: Use the funds for property improvements, purchasing additional properties, or covering unexpected expenses related to your investment portfolio.

- Draw Period: Most investment property HELOCs offer a draw period of 5-10 years, during which you can access funds as needed.

- Repayment Period: After the draw period ends, you enter a repayment phase (typically 10-20 years) where you must pay back both principal and interest.

Differences from Traditional HELOCs

Investment property HELOCs differ from those on primary residences in several ways:

- Higher Interest Rates: Due to the perceived increased risk associated with investment properties, mortgage rates for investment properties are generally 0.25% to 0.875% higher than traditional mortgage rates.

- Stricter Eligibility Requirements: Lenders often impose more stringent criteria for investment property HELOCs.

- Limited Availability: Not all lenders offer HELOCs on investment properties, which can make finding a suitable lender more challenging.

Eligibility Requirements

To qualify for an investment property HELOC, you must meet more stringent criteria than for a traditional HELOC. Common requirements include:

- Credit Score: A minimum credit score of 680 with a 15% down payment is typically required.

- Debt-to-Income Ratio (DTI): Your DTI should be 43% or lower, including the potential HELOC payment.

- Equity: You need significant equity in your investment property (usually at least 20-25% after accounting for the HELOC).

- Cash Reserves: Proof of cash reserves to cover 6-12 months of payments on all your properties is often required.

- Rental Income: A history of stable rental income from the property may be necessary.

These stringent requirements underscore the importance of thorough preparation when applying for an investment property HELOC. In the next section, we’ll explore the specific benefits of using this financial tool to grow your real estate portfolio.

Why Investment Property HELOCs Are Game-Changers

Investment property HELOCs stand out as powerful tools that can significantly boost your real estate portfolio. These financial instruments offer unique advantages that allow savvy investors to maximize their returns and expand their holdings.

Efficient Property Improvements

One of the most compelling benefits of an investment property HELOC is the ability to fund property improvements quickly and efficiently. Unlike traditional loans that provide a lump sum, HELOCs allow you to draw funds as needed, giving you greater control over your renovation budget.

Consider a kitchen remodel in your rental property. You can draw funds in stages as the project progresses. This approach helps you avoid overestimating costs and paying interest on unused funds. A 2024 study by the National Association of Home Builders revealed that kitchen remodels in rental properties can yield an average return on investment of 75%. With a HELOC, you can time your draws to coincide with different phases of the renovation, potentially saving thousands in interest charges.

Potential Tax Benefits

While tax laws can be complex (and subject to change), investment property HELOCs may offer certain tax advantages. For tax years 2018 through 2025, the deductibility of interest paid on a home equity loan or a home equity line of credit (HELOC) depends on how the funds are used.

It’s important to consult with a tax professional to understand the specific implications for your situation. However, many investors find that the potential tax benefits of HELOCs make them more attractive than other financing options. For instance, a $50,000 HELOC used for property improvements could potentially lead to thousands of dollars in tax savings over the life of the loan.

Strategic Portfolio Expansion

Perhaps the most exciting aspect of investment property HELOCs is the opportunity they provide for portfolio expansion. You can tap into the equity of your existing properties to generate the capital needed to acquire new assets without selling your current holdings.

This strategy proves particularly effective in hot real estate markets. For example, in Austin, Texas, the average home value is $514,193, down 3.8% over the past year. Investors who used HELOCs to purchase additional properties in these markets capitalized on this growth without liquidating their existing assets.

Moreover, the flexibility of HELOCs allows you to act quickly when opportunities arise. In competitive markets, the ability to make a cash offer backed by your HELOC can give you an edge over other buyers who rely on traditional financing.

Competitive Advantage in Real Estate Investing

The strategic use of HELOCs can provide a significant competitive advantage in the real estate market. You can leverage your existing equity to make quick, cash-like offers on new properties, often beating out competitors who rely on traditional financing methods.

This advantage becomes particularly valuable in fast-moving markets where properties sell quickly. The ability to access funds rapidly through a HELOC can mean the difference between securing a lucrative investment opportunity and missing out.

As you explore the benefits of investment property HELOCs, it’s essential to also consider the potential risks and challenges. The next section will address key considerations to keep in mind before obtaining an investment property HELOC.

Is an Investment Property HELOC Right for You?

Understanding the Cost of Borrowing

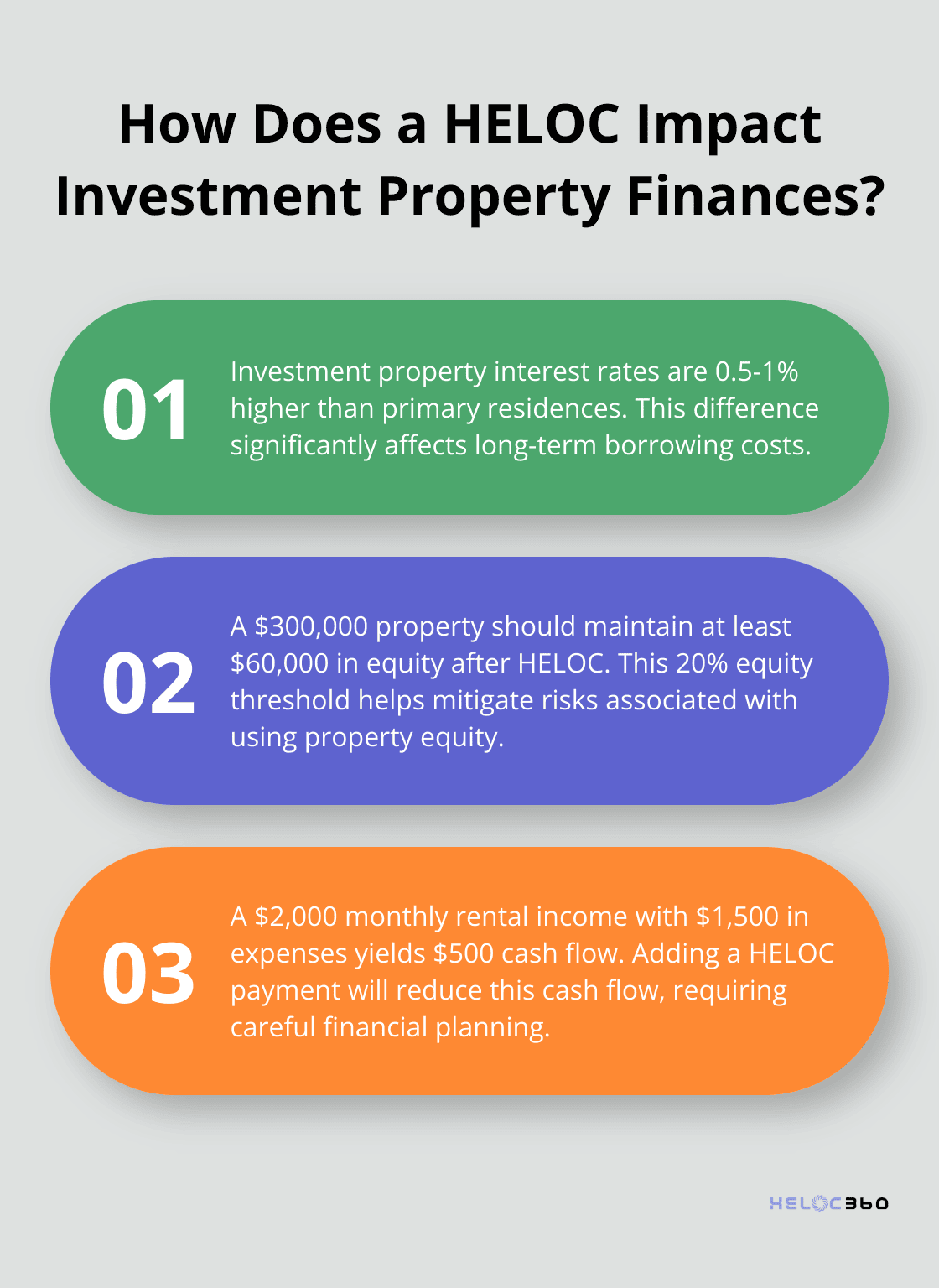

Interest rates on investment properties are typically higher than those for primary residences, generally a half to a full percentage point higher. This difference significantly impacts long-term costs.

Repayment terms vary widely. Some lenders offer interest-only payments during the draw period, which can improve cash flow but may lead to payment shock when the repayment period begins. Others require immediate principal and interest payments, which can strain your monthly budget but reduce overall interest costs.

Assessing Cash Flow Impact

A HELOC on your investment property will affect your cash flow. Consider this example: You have a rental property generating $2,000 in monthly income with $1,500 in expenses (including the mortgage). Your current cash flow is $500 per month.

If you take out a HELOC, it will add to your monthly expenses, reducing your cash flow. This reduction might prove worthwhile if the HELOC funds increase the property’s value or income potential, but it’s an important calculation to make beforehand.

Mitigating Risks of Equity Use

Using your property’s equity involves inherent risks. Your home is on the line, home values can change, interest rates can rise with some loans, and payments could skyrocket.

To mitigate this risk, try to maintain at least 20% equity in your property after taking out the HELOC. On a $300,000 property, this means limiting your total borrowing (including the first mortgage and HELOC) to $240,000.

Additionally, create a clear plan for using the funds. Invest in property improvements that increase rental income or property value to offset the risk. For instance, adding a second bathroom to a single-bathroom rental could increase monthly rent by $200-$300, potentially covering the HELOC payment and then some.

Weighing Benefits Against Risks

An investment property HELOC can provide significant advantages, but it’s not suitable for everyone. HELOCs offer flexibility but may carry higher interest rates than conventional mortgages. Carefully assess your financial situation, investment goals, and risk tolerance before making a decision. If you’re unsure, consult with a financial advisor or real estate professional to gain valuable insights tailored to your unique circumstances.

Consider the potential benefits, such as the ability to fund strategic improvements or expand your real estate portfolio, against the risks of increased debt and potential market fluctuations. Your decision should align with your long-term investment strategy and financial objectives.

Final Thoughts

Investment property equity lines of credit offer a powerful tool for real estate investors to leverage their existing assets. These financial instruments provide flexibility, potential tax benefits, and opportunities for portfolio expansion that can enhance investment strategies. However, investors must approach these HELOCs with careful consideration due to higher interest rates, stricter eligibility requirements, and potential cash flow impacts.

HELOC360 offers support throughout the process of obtaining an investment property equity line of credit. Our platform simplifies the complexities of HELOCs, provides expert guidance, and connects you with suitable lenders. We aim to empower you to make informed decisions about leveraging your property’s equity, helping you unlock new opportunities in real estate investing.

Investment property HELOCs can transform your portfolio, but they’re not one-size-fits-all solutions. HELOC360 gives you access to the knowledge and resources needed to navigate this financial tool effectively. Take the next step in your real estate investment journey with confidence, backed by the expertise of HELOC360.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.