Are you considering a HELOC balance transfer? This financial move can be a game-changer for homeowners looking to optimize their home equity line of credit.

At HELOC360, we understand that navigating the world of HELOCs can be complex. That’s why we’ve created this comprehensive guide to help you determine if a HELOC balance transfer is the right choice for your financial situation.

What Is a HELOC Balance Transfer?

Definition and Mechanics

A HELOC balance transfer allows homeowners to move their existing HELOC debt to a new lender, often with more favorable terms. This process involves opening a new HELOC with a different financial institution and using it to pay off the balance of your current HELOC. If you have an outstanding balance and are approved for a new HELOC, you can move that balance over and again borrow funds for up to 10 years to cover home expenses.

Unique Characteristics

HELOC transfers differ from credit card balance transfers in that they deal with secured debt tied to your home’s equity. This distinction raises the stakes but also increases the potential rewards. While credit card transfers typically offer short-term promotional periods, HELOC transfers usually provide long-term benefits through lower interest rates or improved terms.

Potential Advantages

Transferring your HELOC can result in substantial savings. Interest rates on HELOCs (home equity lines of credit) have risen to 8 percent. This change in rates could translate to thousands of dollars in savings over the life of the loan for many borrowers.

Another benefit includes the possibility of a higher credit limit. As home values have increased in many areas, you might qualify for a larger line of credit with a new lender. This extra borrowing power can prove invaluable for funding major home improvements or other significant expenses.

Assessing Your Current HELOC

Before you decide on a transfer, review your existing HELOC terms thoroughly. Look for any prepayment penalties or early closure fees (these costs could negate the benefits of a transfer if not carefully considered). Examine your current interest rate and compare it to market rates. If your rate significantly exceeds current offerings, a transfer could prove particularly advantageous.

HELOCs tend to cost more than mortgages, with current interest rates around 8.28 percent. However, you must consider your long-term financial goals and how a transfer aligns with them. A transfer that saves money in the short term might not always represent the best choice if it extends your debt over a longer period.

Risks and Considerations

While a HELOC balance transfer can offer substantial benefits, it comes with risks. Your home serves as collateral, so you must approach this decision with careful consideration and expert guidance. The next section will explore key factors to weigh before proceeding with a HELOC balance transfer.

Is a HELOC Balance Transfer Worth It?

Evaluating Your Current HELOC Terms

To determine if a HELOC balance transfer makes sense, you must first examine your existing HELOC agreement. Check your current interest rate, which typically varies and links to the prime rate. As of March 2025, the average HELOC rate is forecasted to be 7.25%. A transfer might benefit you if your rate exceeds this significantly.

Next, review any prepayment penalties or early closure fees. These can sometimes offset potential transfer savings. For instance, a 2% prepayment penalty on a $100,000 balance equals $2,000-a cost you’ll need to factor into your calculations.

Comparing New Lender Offerings

Shop around and compare offers from multiple lenders. Look beyond just the interest rate. Focus on the annual percentage rate (APR), which includes fees and provides a more accurate picture of total borrowing costs.

Some lenders offer attractive introductory rates. However, understand what the rate will be after this period ends.

Also, consider the new credit limit offered. If your home value has increased, you might qualify for a higher limit, providing more financial flexibility. Exercise caution about over-borrowing against your home equity.

Assessing Your Financial Health

Your credit score significantly influences the terms you’ll receive. Most lenders require a minimum FICO score of 620 for HELOC approval, but you’ll need a higher score to qualify for the best rates. Check your credit report and score before applying. If your score has improved since opening your original HELOC, you might qualify for better terms now.

Consider your debt-to-income ratio (DTI) as well. Lenders typically prefer a DTI of 43% or lower. An improved financial situation might put you in a stronger position to negotiate better terms.

Aligning with Long-Term Financial Goals

Think about how a HELOC balance transfer fits into your broader financial strategy. A transfer might not make sense if you plan to sell your home soon, due to closing costs and potential prepayment penalties.

However, a HELOC transfer could be a smart move if you’re looking to fund long-term home improvements or consolidate high-interest debt. For example, transferring credit card debt with a high APR to a HELOC could result in substantial interest savings.

Weighing Risks and Benefits

While a HELOC balance transfer can offer significant benefits, it’s a major financial decision that requires careful consideration. Take time to thoroughly evaluate your options and seek professional advice if needed. The right choice can lead to substantial savings and improved financial health in the long run.

Now that you understand the factors to consider when evaluating a HELOC balance transfer, let’s explore the steps involved in completing this process.

How to Execute a HELOC Balance Transfer

Research Lenders and Compare Offers

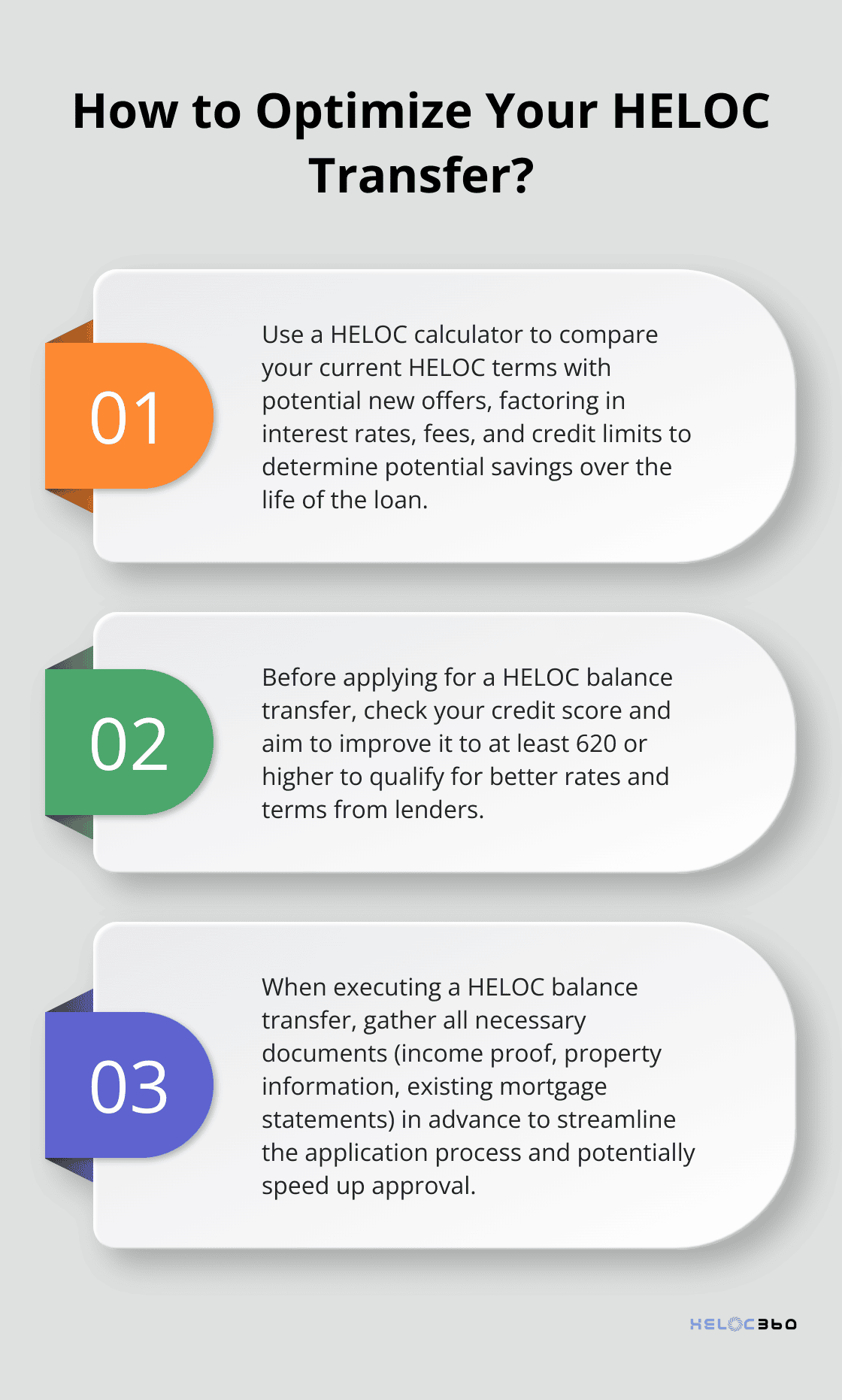

Start your HELOC balance transfer process by conducting thorough research on potential lenders. Look beyond interest rates and examine the Annual Percentage Rate (APR) for a more comprehensive view of borrowing costs. HELOC rates can vary significantly between lenders.

Pay attention to introductory rates and understand their duration. Some lenders offer attractive teaser rates that increase substantially after a short period. Investigate any fees associated with opening and maintaining the new HELOC (application fees, annual fees, or early closure penalties).

Don’t overlook credit unions in your search. They often offer competitive rates and more flexible terms compared to traditional banks.

Prepare Your Application

After you identify potential lenders, gather all necessary documentation. This typically includes:

- Proof of income (pay stubs, tax returns)

- Property information (recent appraisal, property tax statements)

- Existing mortgage statements

- Current HELOC agreement

Have these documents ready to speed up the application process significantly. Many lenders now offer online applications, which can further streamline the process.

Before you apply, check your credit score. Lender requirements vary, but typically you’ll need a credit score of 620 or higher. If your score has improved since you opened your original HELOC, you’re likely to get better terms now.

Finalize the Transfer

After approval, review the new HELOC agreement carefully. Pay special attention to the draw period length, repayment terms, and any clauses about rate adjustments or credit limit changes.

Once you’re satisfied with the terms, proceed with the balance transfer. Your new lender will typically handle this process, paying off your old HELOC directly. Follow up and ensure the old account is properly closed to avoid any potential issues or unexpected fees.

Consider Professional Guidance

The HELOC balance transfer process can be complex. Try to seek professional advice if you’re unsure about any aspect of the transfer. Financial advisors or mortgage professionals can provide valuable insights tailored to your specific situation.

Monitor Your New HELOC

After you complete the transfer, monitor your new HELOC regularly. Keep track of interest rate changes, your borrowing habits, and how the new terms align with your financial goals. This proactive approach will help you maximize the benefits of your HELOC balance transfer and adjust your strategy if needed.

Final Thoughts

A HELOC balance transfer offers homeowners a chance to optimize their home equity line of credit. This strategy can lead to lower interest rates, better terms, and increased borrowing power. However, it requires careful evaluation of your financial situation, long-term goals, and the specific terms offered by potential lenders.

Extensive research is necessary before proceeding with a HELOC balance transfer. You must compare offers from multiple lenders, focusing on interest rates, fees, and terms. Your credit score and overall financial health will significantly influence the terms you receive, so review and improve these aspects if possible before applying.

At HELOC360, we understand the complexities of HELOC balance transfers and help homeowners make informed decisions about their home equity. Our platform provides comprehensive guidance and connects you with lenders that match your specific needs and goals (simplifying the process and offering expert insights).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.