Homeowners with a Home Equity Line of Credit (HELOC) often face a crucial decision as their draw period nears its end: Should they renew their HELOC?

At HELOC360, we understand that this choice can significantly impact your financial future. HELOC renewal offers both opportunities and potential pitfalls, depending on your unique circumstances.

In this post, we’ll explore the pros and cons of HELOC renewal to help you make an informed decision.

What Happens During HELOC Renewal?

The Renewal Process Explained

Home Equity Line of Credit (HELOC) renewal occurs when your draw period ends. This process requires your active participation and understanding to make the right financial decision.

HELOC renewal extends your line of credit beyond its initial term. HELOCs typically have a draw period of 5 to 10 years. At the end of this period, you have three main options: renew the HELOC, refinance, or start repaying the borrowed amount.

During renewal, your lender will reassess your financial situation. They’ll examine your credit score, income, and the current value of your home. This evaluation forms the basis for the new terms they may offer for your HELOC.

New Terms and Conditions

The terms of your renewed HELOC may differ from your original agreement. Interest rates stand out as a key factor that could change.

Your credit limit might also change. An increase in your home’s value could make you eligible for a higher limit. On the flip side, a worsened financial situation might lead your lender to reduce your available credit.

Renewal vs. Refinancing

Renewal and refinancing, while seemingly similar, are distinct processes. Renewal extends your existing HELOC, often with minimal changes to your agreement. Refinancing can be far less complex than cash-out refinancing and may have lower costs.

Preparing for Renewal

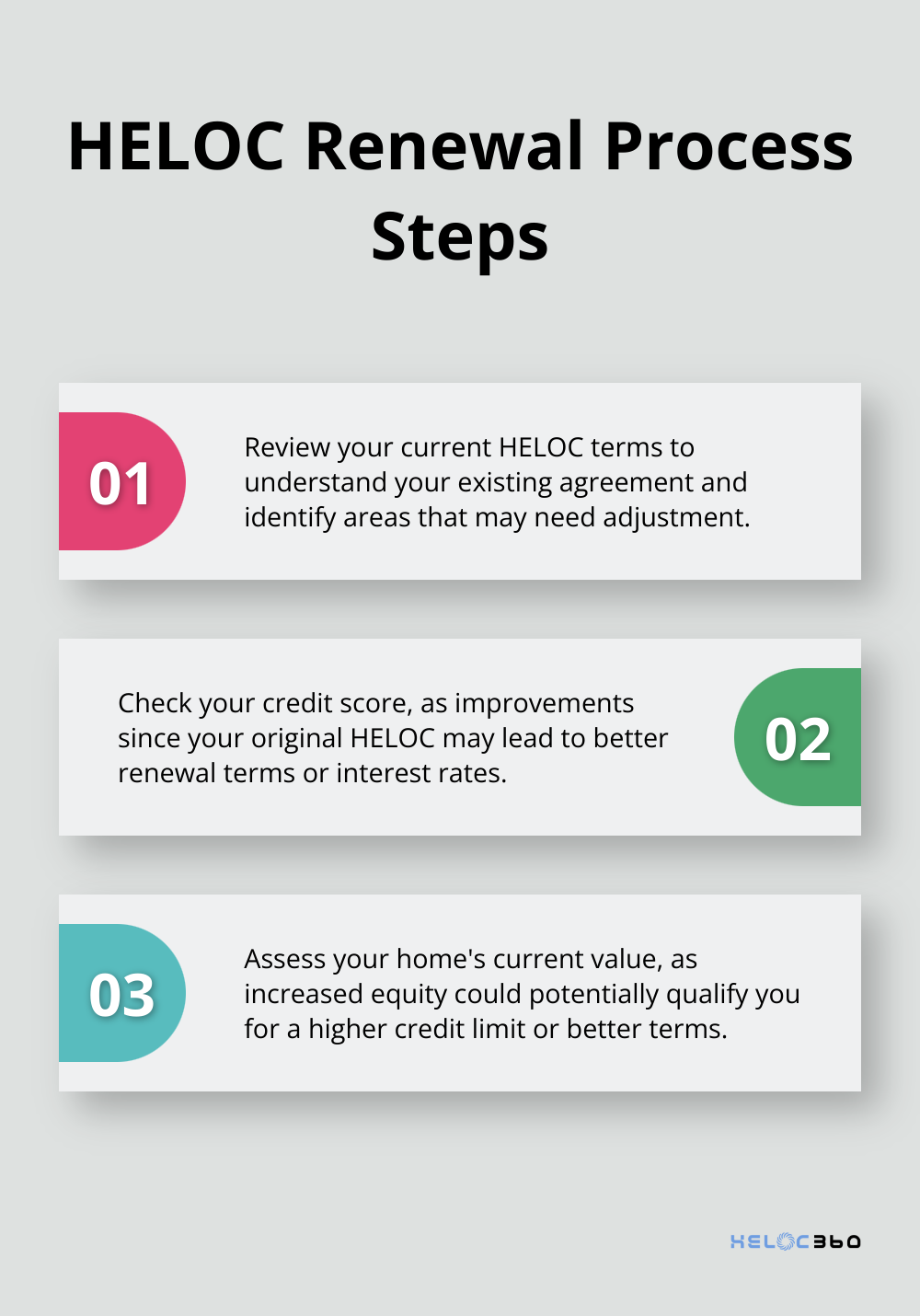

To prepare for HELOC renewal, take these steps:

- Review your current HELOC terms

- Check your credit score

- Assess your home’s current value

- Evaluate your financial goals

This preparation will help you negotiate better terms or decide if refinancing might be a better option.

The Impact of Market Conditions

Market conditions play a significant role in HELOC renewal. Interest rates, housing market trends, and overall economic conditions can all affect the terms you’re offered. Stay informed about these factors to make the best decision for your financial future.

As you consider your options for HELOC renewal, remember that each situation is unique. What works for one homeowner might not be the best choice for another. The next section will explore the advantages of renewing your HELOC, helping you weigh your options more effectively.

Why Renew Your HELOC?

Continued Financial Flexibility

Renewing your Home Equity Line of Credit (HELOC) offers several advantages, making it an attractive option for many homeowners. One of the primary reasons to renew your HELOC is the continued access to a flexible credit line. This ongoing availability of funds can serve as a financial lifesaver in various situations. If you plan a major home renovation or need to cover unexpected expenses, a renewed HELOC eliminates the need to search for new financing options.

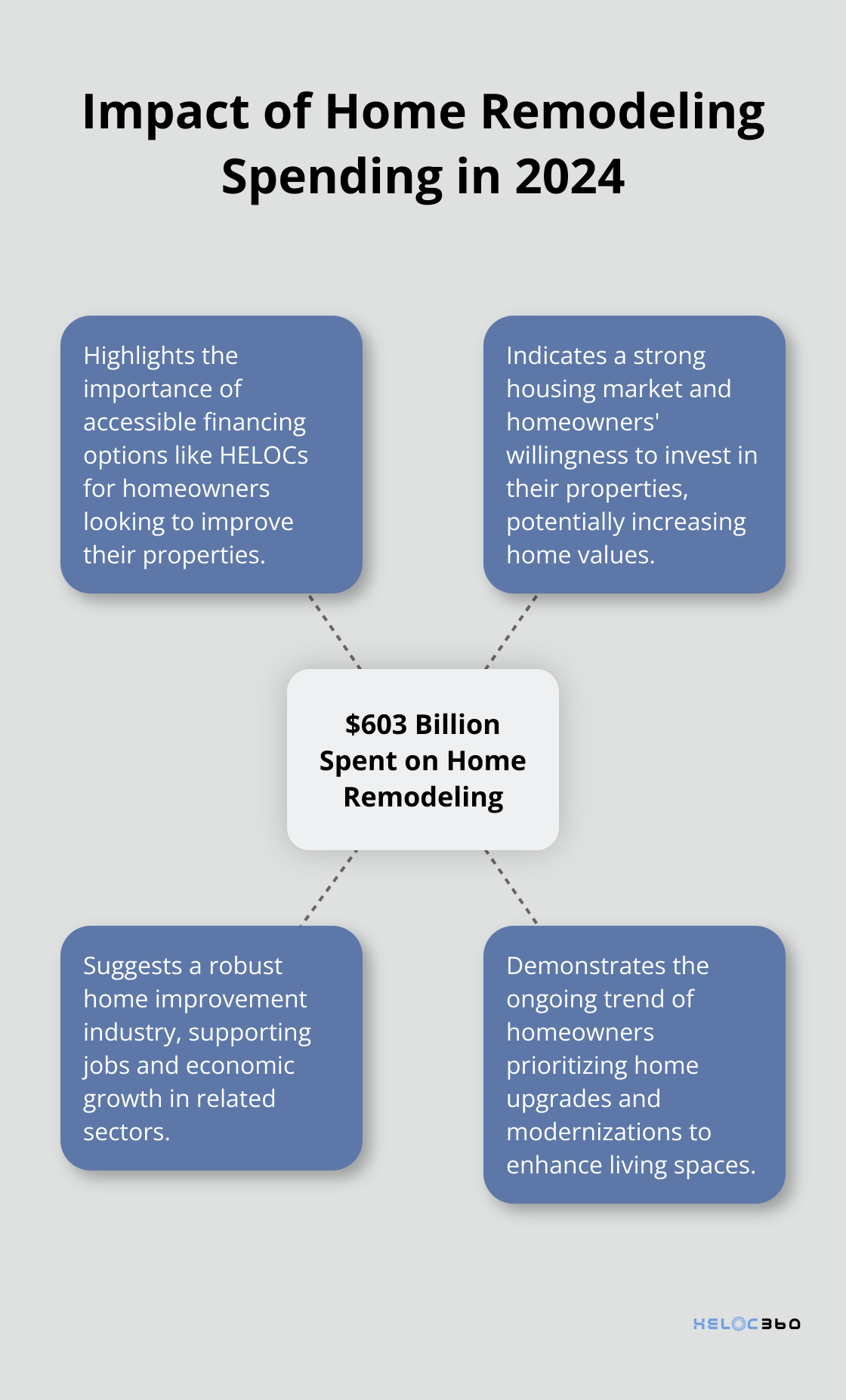

A 2024 study revealed that Americans spent an estimated $603 billion in 2024 on remodeling their homes. This statistic highlights the importance of maintaining access to this credit line for many households.

Potential for Better Terms

HELOC renewal can sometimes lead to more favorable terms, especially if your financial situation has improved since you first obtained the line of credit. For example, if your credit score has increased or your home’s value has appreciated significantly, you might qualify for a lower interest rate or a higher credit limit.

Cost-Effective Solution

Renewal of your existing HELOC often proves more cost-effective than applying for a new one. When you renew, you typically avoid many of the closing costs associated with opening a new line of credit. These costs can include appraisal fees, title search fees, and application fees, which can add up to thousands of dollars.

Simplified Process

Renewing your HELOC often involves a simpler process compared to applying for a new line of credit. Your lender already has much of your information on file, which can streamline the renewal process. This simplification can save you time and reduce the stress associated with gathering and submitting extensive documentation.

Tailored to Your Needs

As your financial situation evolves, so do your needs. HELOC renewal provides an opportunity to reassess and adjust your credit line to better align with your current financial goals. You might find that you need a higher credit limit to fund a child’s education, or perhaps you want to reduce your limit to minimize temptation for unnecessary spending. Renewal allows for these adjustments, ensuring your HELOC continues to serve your specific needs.

While HELOC renewal offers numerous benefits, it’s important to consider potential drawbacks as well. The next section will explore some of the cons associated with HELOC renewal, providing a balanced view to help you make an informed decision.

The Hidden Risks of HELOC Renewal

Shifting Terms and Conditions

When you renew your Home Equity Line of Credit (HELOC), your lender might adjust the terms and conditions. These changes can significantly impact your financial situation. Your lender might introduce new fees or alter the repayment structure. When closing on a HELOC, a draw period is typically established for five or 10 years. During this time, homeowners can withdraw money and only make payments on the interest.

Interest Rate Uncertainty

One of the biggest risks of HELOC renewal is the potential for higher interest rates. HELOCs typically have variable interest rates, which means they can fluctuate based on market conditions. If you initially secured your HELOC during a period of low interest rates, you might face a substantial increase upon renewal.

The Temptation of Easy Credit

Renewing your HELOC extends your access to a large sum of money, which can be a double-edged sword. The ease of access might lead to overspending or using the funds for non-essential purposes. A study by the Urban Institute revealed that 30% of HELOC borrowers used the funds for discretionary spending rather than home improvements or debt consolidation.

Impact on Your Home’s Equity

Each time you draw from your HELOC, you reduce your home’s equity. This can be particularly risky if property values decline. If you’ve heavily utilized your HELOC and your home’s value drops, you could end up owing more than your home is worth.

Long-term Debt Burden

Renewing your HELOC extends your debt obligations. This long-term commitment can impact your overall financial health and limit your ability to save for other goals (like retirement). Financial advisors often caution against carrying HELOC debt into retirement, as it can strain fixed incomes.

Overlooking Alternative Options

Automatically opting for renewal might cause you to miss out on more suitable financial products. For example, a fixed-rate home equity loan could offer more stability if you need a lump sum. Or, if you want to consolidate debt, a personal loan might provide better terms without putting your home at risk.

Final Thoughts

HELOC renewal offers both advantages and risks for homeowners. Your personal financial situation will determine if renewal is the right choice for you. Consider your long-term financial goals, current equity position, and ability to manage potential interest rate changes before you make a decision.

HELOC360 has developed a platform to simplify the process of home equity financing and provide expert guidance. Our full-circle solutions are designed to help you make informed decisions about your HELOC renewal or explore other options that might better suit your financial needs.

Your home’s equity is a valuable asset (use it wisely to create opportunities and achieve your financial goals). Whether you choose to renew your HELOC or explore alternative financing options, make sure your decision aligns with your long-term financial strategy. HELOC360 can be your partner in unlocking the full potential of your home equity.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.