HELOC tax benefits can significantly impact your financial strategy. In 2025, understanding these advantages is more important than ever.

At HELOC360, we’ve compiled the latest information on maximizing your HELOC tax benefits. This guide will help you navigate current IRS regulations, avoid common pitfalls, and make the most of your home equity line of credit.

What Are the HELOC Tax Deductions for 2025?

Updated IRS Regulations

The IRS has revised its regulations for HELOC interest deductions in 2025. HELOC interest remains deductible, but only for funds used for qualifying home improvements. The IRS defines these as substantial improvements that add value to your home, extend its useful life, or adapt it for new uses. General repairs or maintenance do not qualify.

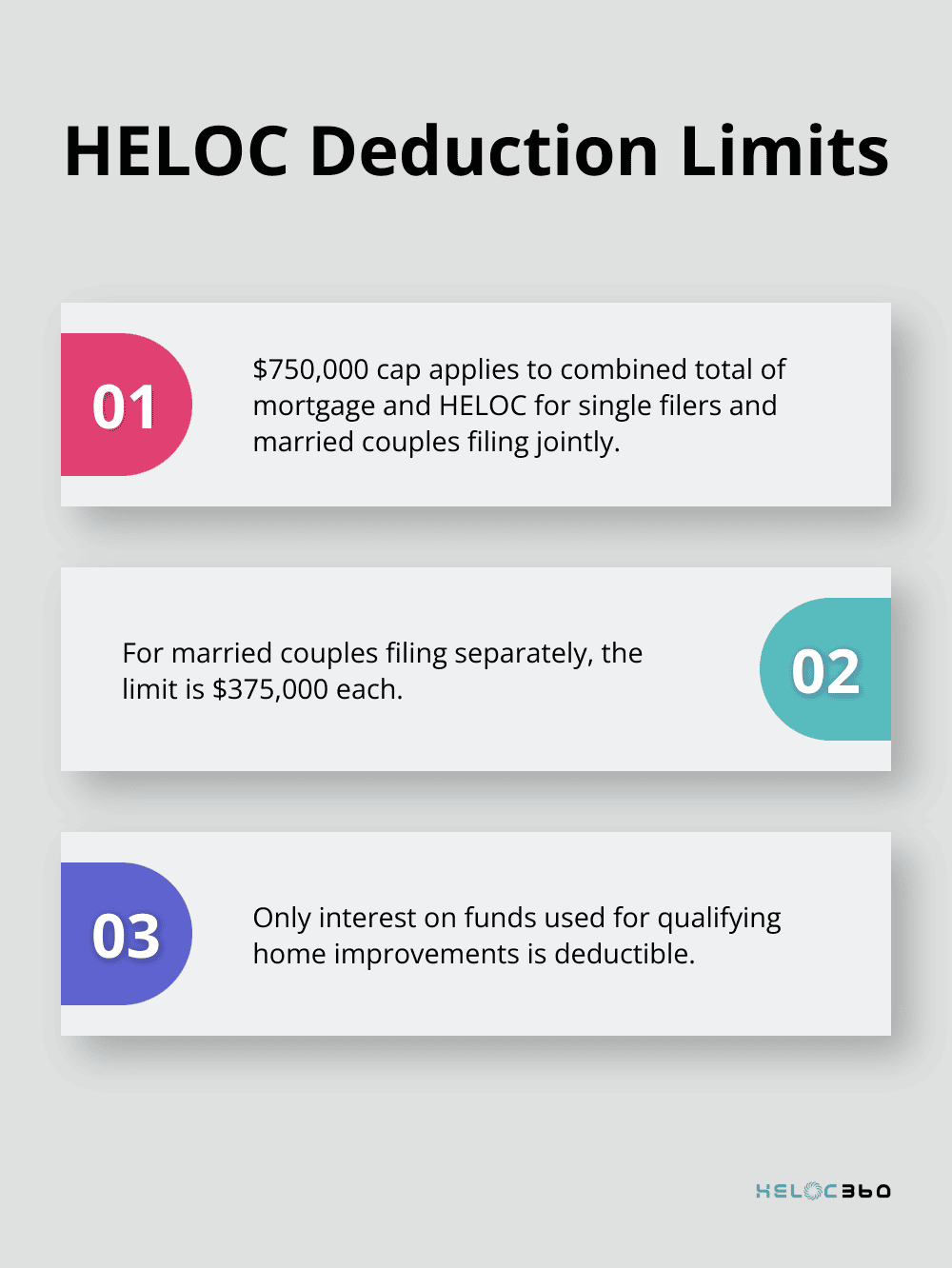

The Tax Cuts and Jobs Act of 2017 continues to impact HELOC deductions. You can only deduct interest on loans up to $750,000 for single filers and married couples filing jointly. This cap applies to the combined total of your mortgage and HELOC.

Eligible Expenses

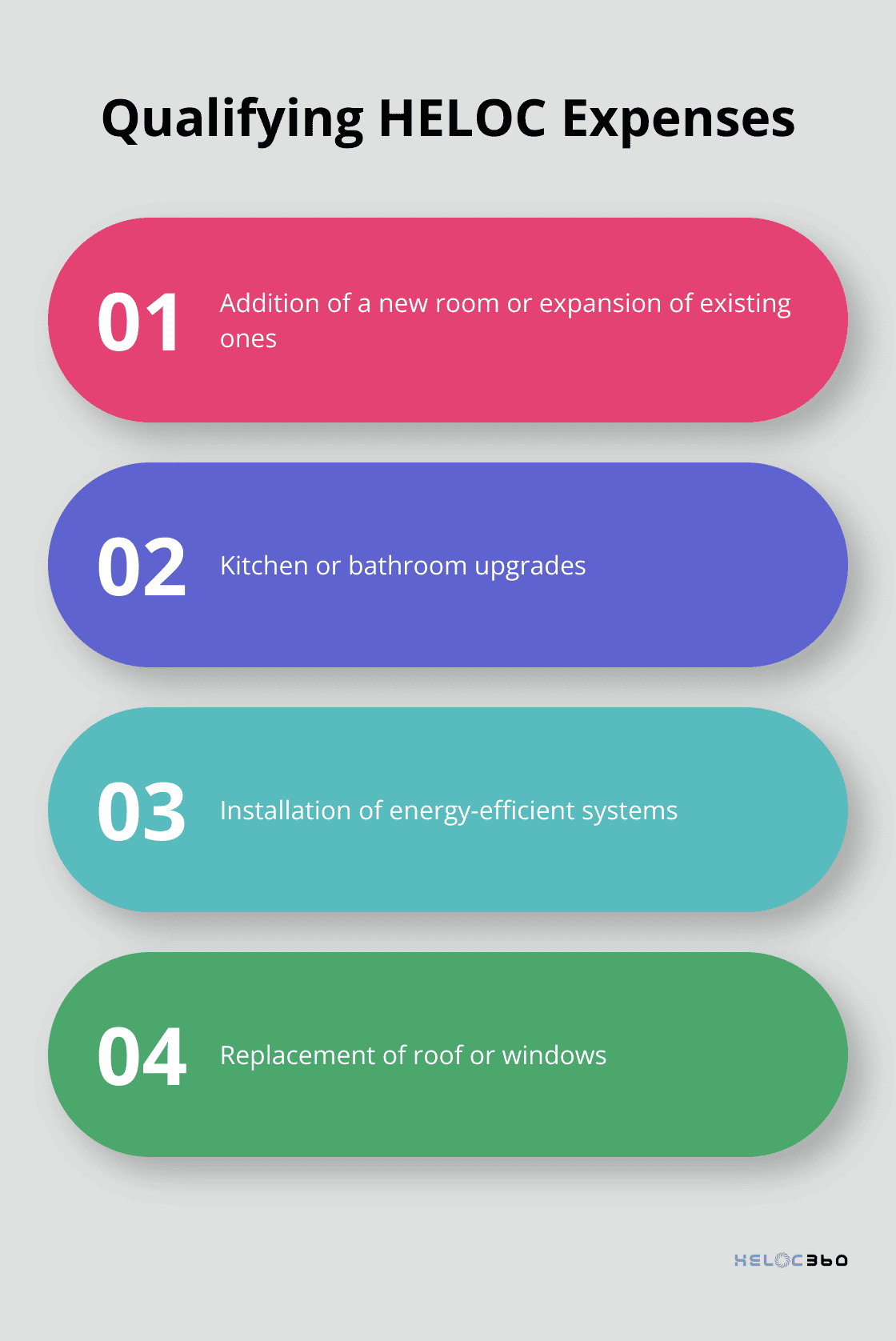

To claim HELOC interest deductions, you must use the funds for specific purposes. Examples of qualifying expenses include:

- Addition of a new room or expansion of existing ones

- Kitchen or bathroom upgrades

- Installation of energy-efficient systems

- Replacement of roof or windows

Keep detailed records of all expenses, including receipts and contractor invoices. The IRS may request this documentation to verify your deductions.

Deduction Limits and Considerations

The amount you can deduct has certain limits. For 2025, you can deduct interest on up to $750,000 of qualified residence loans (this limit applies to the combined amount of your mortgage and HELOC). For married couples filing separately, the limit is $375,000 each.

These deductions are only available if you itemize your deductions. With the standard deduction for 2025 set at $15,000 for single filers and $30,000 for married couples filing jointly, you’ll need to determine if itemizing will provide greater tax savings.

Professional Advice Matters

Tax laws are complex and subject to change. A tax professional can help you navigate the intricacies of HELOC tax deductions and ensure you maximize your benefits within the current IRS regulations. They can provide personalized advice based on your specific financial situation.

As you consider the tax implications of your HELOC, it’s important to also think about how to best use these funds to improve your home and financial situation. In the next section, we’ll explore strategies to maximize your HELOC tax benefits and make the most of your home equity.

How to Maximize HELOC Tax Benefits

Focus on Substantial Home Improvements

To qualify for tax deductions, use your HELOC funds for significant home improvements that add value to your property. Americans spent an estimated $603 billion in 2024 on remodeling their homes. These types of projects not only qualify for tax deductions but also increase your home’s value.

Time Your HELOC Spending Strategically

The timing of your HELOC spending can significantly impact your tax benefits. Interest is only deductible in the year it’s paid, so consider front-loading your home improvement projects early in the tax year. This approach allows you to maximize your deductions for the current tax period. For example, if you plan a major renovation, starting in January rather than December could mean a full year’s worth of deductible interest payments.

Keep Meticulous Records

The IRS may require proof that your HELOC funds were used for qualifying home improvements. Keep all receipts, invoices, contracts, and before-and-after photos of your projects. Use digital tools or apps to organize these documents, making it easier to track expenses and calculate deductions accurately. Some homeowners create separate bank accounts for HELOC funds to simplify expense tracking.

Seek Professional Tax Advice

Tax laws are complex and ever-changing. What qualifies for a deduction this year might not next year. Schedule regular consultations with a tax professional who specializes in real estate. They can provide up-to-date advice on maximizing your HELOC tax benefits and help you avoid costly mistakes.

Integrate HELOC with Other Tax Strategies

Consider how your HELOC strategy fits into your overall tax plan. For example, if you’re also making energy-efficient home improvements, you might qualify for additional tax credits. The Residential Renewable Energy Tax Credit offers a 30% credit for solar electric systems, solar water heaters, and other renewable energy installations (subject to certain conditions and limitations). Combining these credits with your HELOC deductions can significantly reduce your tax liability.

These strategies can help you maximize the tax benefits of your HELOC while improving your home and financial situation. However, it’s important to note that even with careful planning, mistakes can happen. In the next section, we’ll explore common pitfalls to avoid when claiming HELOC tax deductions.

HELOC Tax Deduction Pitfalls to Avoid

Misuse of HELOC Funds

Many homeowners fall into the trap of using HELOC funds for non-qualifying expenses. The IRS strictly allows deductions only for interest on HELOC funds used for substantial home improvements. To prevent this mistake, create a separate account for your HELOC funds. Use this account exclusively for home improvement projects. This separation simplifies tracking and provides proof of fund usage in case of an audit.

Exceeding Deduction Limits

Homeowners often overlook the $750,000 cap that applies to the combined total of mortgage and HELOC. If your primary mortgage approaches this limit, you might not deduct additional HELOC interest.

For instance, with a $700,000 mortgage and a $100,000 HELOC, you can only deduct interest on $50,000 of the HELOC. Many miss this nuance and claim more than they should. Always calculate your total loan amount before claiming deductions.

DIY Tax Preparation Errors

While DIY tax software has simplified filing, it’s not foolproof for complex deductions like HELOCs. These mistakes range from simple calculation errors to misinterpretation of IRS guidelines. Some homeowners incorrectly deduct points paid on their HELOC (which isn’t allowed under current tax laws).

Neglecting Professional Advice

The complexity of HELOC tax deductions often requires expert guidance. Many homeowners try to navigate these waters alone, leading to costly mistakes. A tax professional who specializes in real estate can help you maximize your benefits within legal limits.

While it might seem like an added expense, the potential tax savings often outweigh the cost of professional advice. These experts stay updated on the latest tax laws and can provide personalized strategies based on your unique financial situation.

Inadequate Record-Keeping

Poor documentation is a common pitfall in HELOC tax deductions. The IRS may require proof that your HELOC funds were used for qualifying home improvements. Failing to keep detailed records can result in denied deductions or even trigger an audit.

Maintain all receipts, invoices, contracts, and before-and-after photos of your projects. Use digital tools or apps to organize these documents (this makes it easier to track expenses and calculate deductions accurately). Some homeowners find it helpful to create a dedicated file or folder for all HELOC-related paperwork.

Final Thoughts

Strategic use of your home equity line of credit leads to significant HELOC tax advantages in 2025. The $750,000 cap on deductible interest for qualified residence loans remains a key consideration, highlighting the need for careful planning. Professional guidance ensures you maximize your HELOC while complying with tax laws.

HELOC use extends beyond tax advantages to achieving broader financial goals. It allows you to increase your property’s worth through renovations or consolidate high-interest debt. A clear plan and understanding of how your HELOC fits into your financial picture are essential for success.

HELOC360 simplifies the process of understanding and utilizing your home equity. We connect you with lenders that match your unique needs (our platform is designed to help homeowners unlock their home equity’s full potential). HELOC360 can help you turn your home’s value into a powerful financial tool, opening doors to new opportunities.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.