HELOC interest rates can be a complex topic, but understanding them is essential for homeowners considering this financing option.

At HELOC360, we’ve created this guide to break down the key factors that influence these rates and how they compare to other loan types.

We’ll also share practical strategies to help you secure the best possible rates for your home equity line of credit.

What Drives HELOC Interest Rates?

HELOC interest rates depend on several key factors that every homeowner should understand. The prime rate forms the foundation for most HELOC pricing. Existing HELOC borrowers should expect their rates to adjust within a month or two after a Fed rate move – with a corresponding change in their payments.

The Prime Rate’s Ripple Effect

The prime rate, set by the Federal Reserve, creates a domino effect on HELOC rates. When the Fed adjusts its rates, HELOC rates follow. For example, a change in the prime rate will likely cause your HELOC rate to rise by a similar amount. This relationship means that economic conditions and Fed policies significantly influence the cost of borrowing against your home equity.

Your Credit Score: A Key Factor

Your credit score plays a critical role in securing favorable HELOC rates. Lenders use this three-digit number to assess your creditworthiness. Recent data shows that the current average HELOC interest rate in the 10 largest U.S. markets is 8.01 percent. Borrowers with higher credit scores often qualify for better rates, while those with lower scores may face higher rates or struggle to get approved.

The Loan-to-Value Ratio: Equity Matters

The loan-to-value (LTV) ratio is another important factor in determining your HELOC rate. This ratio compares the amount you want to borrow against the value of your home. Home equity loan and HELOC loan-to-value (LTV) limits may impact your eligibility for a loan and how much money you might be able to borrow. A lower LTV ratio often results in better rates, as it represents less risk for the lender.

Fixed vs. Variable: Rate Type Options

HELOC rates typically come in two flavors: fixed and variable. Variable rates are more common and usually start lower than fixed rates. However, they can fluctuate with the prime rate, potentially increasing your payments over time. Fixed-rate options, while less common, offer stability but often come with higher initial rates.

Understanding these factors will help you navigate the HELOC landscape more effectively. The next section will explore how HELOC interest rates stack up against other loan types, providing you with a comprehensive view of your borrowing options.

How HELOC Interest Rates Compare to Other Loans

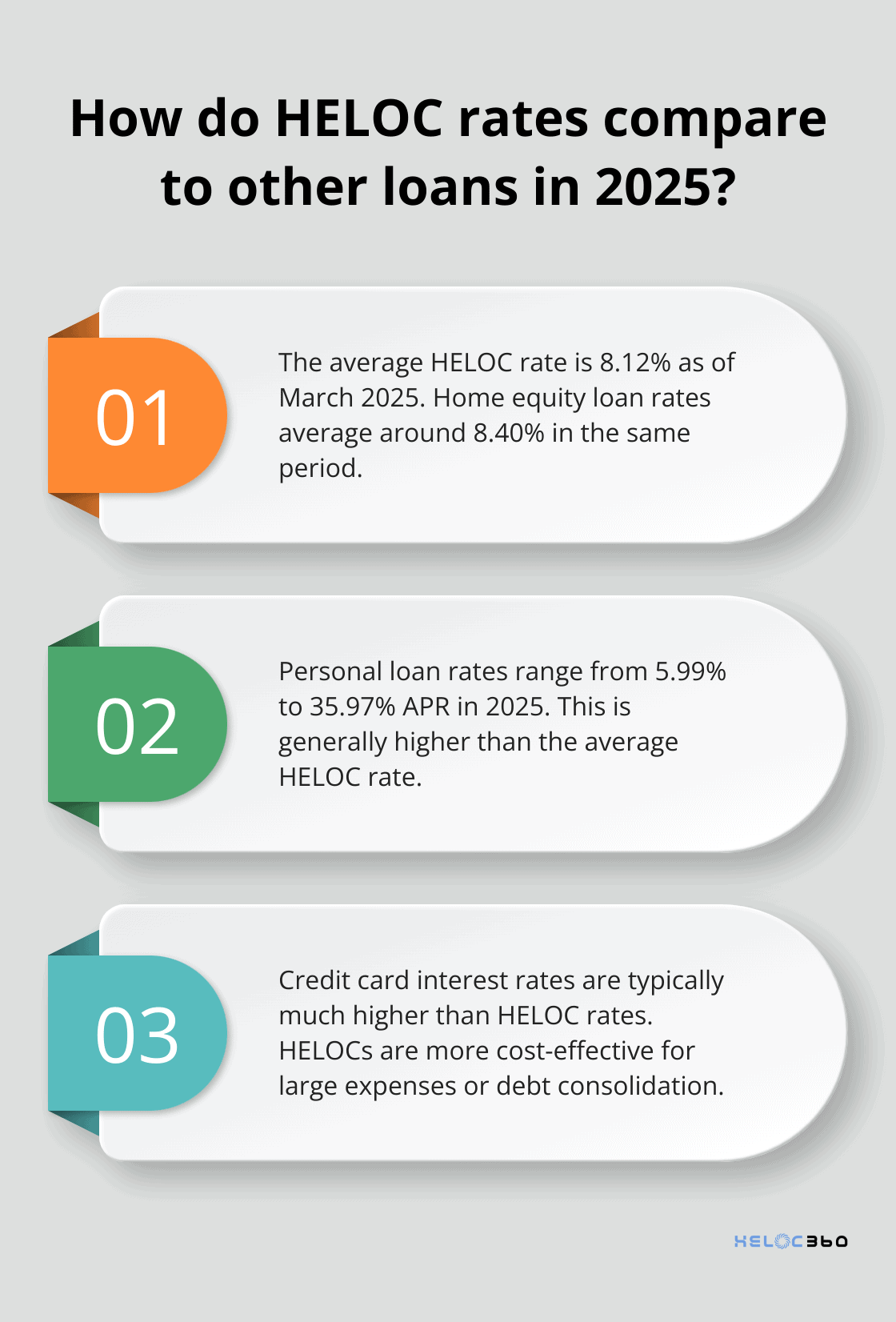

HELOC vs Home Equity Loans

HELOCs and home equity loans both use your home as collateral, but their rate structures differ. HELOCs typically offer variable rates, while home equity loans come with fixed rates. As of March 2025, the average HELOC rate stands at 8.12%. In contrast, home equity loan rates average around 8.40%.

The variable nature of HELOC rates means they can fluctuate over time (potentially offering lower initial rates but with the risk of increasing later). Home equity loans provide predictable payments throughout the loan term. If you value stability and can secure a competitive fixed rate, a home equity loan might suit you better. However, if you need flexibility and can tolerate some uncertainty, a HELOC could be more appropriate.

HELOC vs Personal Loans

Personal loans typically come with higher interest rates compared to HELOCs. As of 2025, personal loan rates can vary widely, with some lenders offering rates between 5.99% and 35.97% APR. This range can be significantly higher than the average HELOC rate. This substantial difference can translate to thousands of dollars saved over the life of the loan for those who qualify for a HELOC.

However, personal loans don’t require collateral, which might appeal to you if you’re uncomfortable putting your home on the line. They also often have faster approval processes. But for homeowners with significant equity and strong credit, a HELOC will likely be the more cost-effective choice.

HELOC vs Credit Cards

Credit cards generally carry the highest interest rates among these options. The average credit card interest rate is typically much higher than HELOC rates. This stark difference makes HELOCs a much more affordable option for large expenses or debt consolidation.

However, credit cards offer unmatched convenience for smaller, everyday purchases. They also often come with rewards programs that can provide additional value. But for substantial borrowing needs, a HELOC’s lower interest rate can lead to significant savings.

Understanding these comparisons will help you make an informed decision about the most cost-effective way to borrow. Now, let’s explore strategies to secure the best HELOC interest rates for your specific situation.

How to Secure the Best HELOC Rates

Improve Your Credit Score

Your credit score significantly influences your HELOC interest rate. HELOCs can be a good option if you have solid credit and enough equity, but they also have drawbacks and aren’t a great fit for every situation. To enhance your score, pay bills on time, reduce credit card balances, and avoid new credit applications before your HELOC application.

A good credit score can help you qualify for a better loan. Sign up for a Lending Tree Spring account to monitor your credit score and potentially improve your chances of getting better HELOC offers.

Shop Around for Multiple Offers

Don’t accept the first offer you receive. Comparison shopping can lead to substantial savings. A recent Freddie Mac survey revealed that borrowers who obtained five rate quotes saved an average of $3,000 over the life of their loan compared to those who didn’t compare offers.

Use online comparison tools to get a quick overview of rates from multiple lenders. For the most accurate rates, submit formal applications to several lenders (this step is essential for precise rate information).

Negotiate with Lenders

Many borrowers don’t realize that HELOC rates and terms are often negotiable. Arm yourself with competing offers to strengthen your negotiating position. If a lender knows you’re considering other options, they may lower their rate or waive certain fees to win your business.

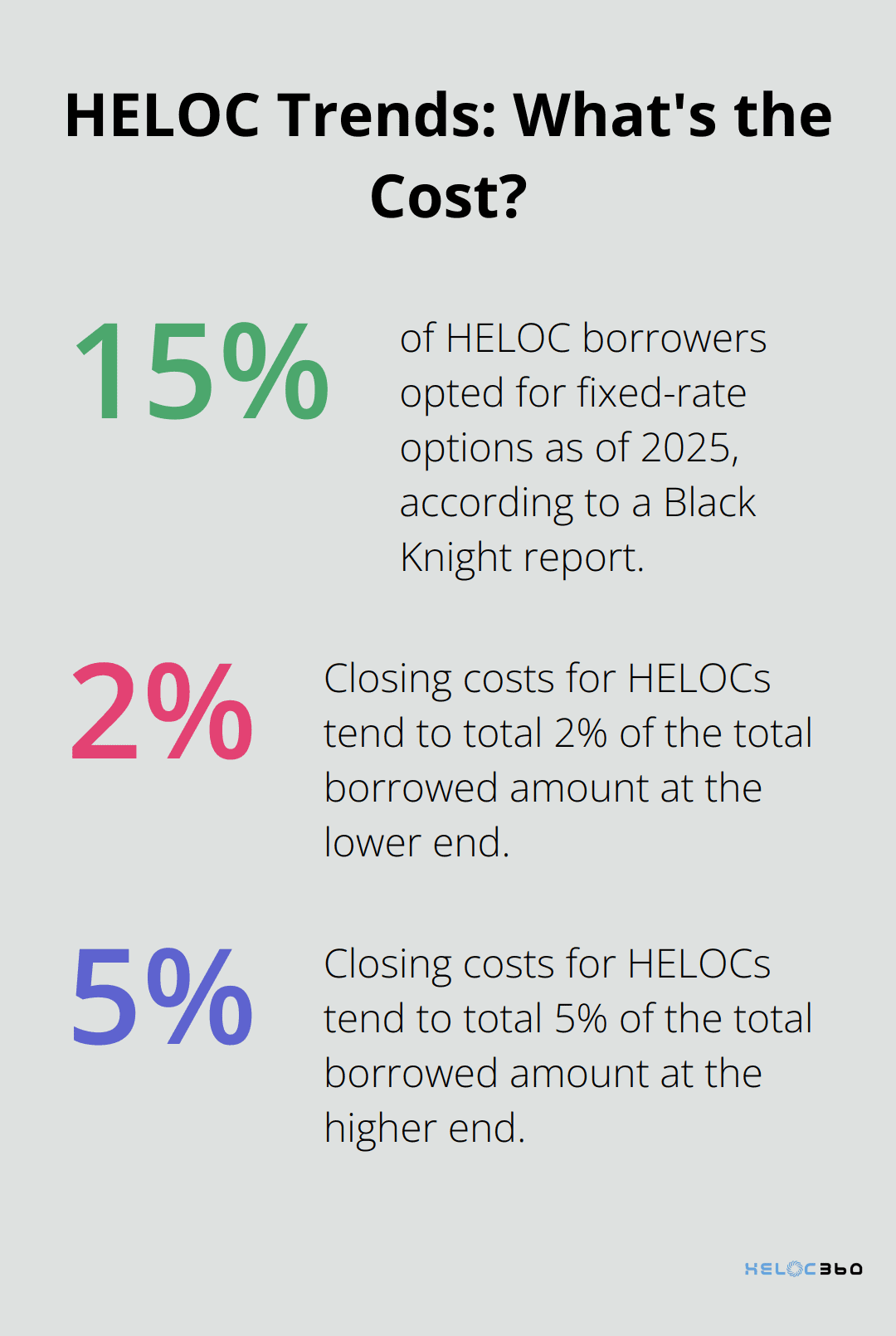

Closing costs tend to total 2% to 5% of the total borrowed amount. You may be able to roll them into the loan balance, but that means you’ll pay higher interest over time. Don’t hesitate to ask for better terms – the worst a lender can say is no.

Explore Fixed-Rate Options

While variable rates are common for HELOCs, some lenders offer fixed-rate options. These provide more stability and predictability in your monthly payments. According to a Black Knight report, about 15% of HELOC borrowers opted for fixed-rate options as of 2025.

Fixed-rate HELOCs typically start with higher rates than variable-rate options. However, they can be advantageous if you expect interest rates to rise significantly in the future. Analyze your financial situation and risk tolerance to determine if this option suits you best.

Leverage Your Home Equity

The amount of equity you have in your home can impact your HELOC rates. Lenders often offer better rates to borrowers with higher equity (as this represents lower risk). Try to maintain a loan-to-value ratio below 80% for the most competitive rates.

Consider making extra mortgage payments or waiting until your home value increases before applying for a HELOC. This strategy can potentially lower your interest rate and increase your borrowing capacity.

Final Thoughts

HELOC interest rates depend on various factors, including the prime rate, credit scores, and loan-to-value ratios. Homeowners who understand these elements can make better decisions about their borrowing options. HELOCs often offer lower interest rates compared to personal loans and credit cards, making them an attractive choice for those with strong credit and significant home equity.

To secure the best HELOC interest rates, improve your credit score, compare multiple offers, and negotiate with lenders. Consider fixed-rate options for stability and use your home equity to your advantage. These strategies can help you find a HELOC that aligns with your financial goals and provides the most value.

We at HELOC360 simplify the process of obtaining a HELOC and connect you with lenders that match your needs. Visit HELOC360 to explore how we can help you achieve your financial goals through a tailored HELOC solution. Our platform offers expert guidance to help you navigate the complexities of home equity borrowing and find the right option for your situation.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.