Are you a first-time homebuyer looking for an innovative way to finance your dream home? HELOC piggyback loans might be the secret weapon you’ve been searching for.

At HELOC360, we’ve seen how this unique financing strategy can help buyers overcome common hurdles like high down payments and private mortgage insurance.

Let’s explore how piggyback HELOCs work and why they’re becoming increasingly popular among first-time homebuyers.

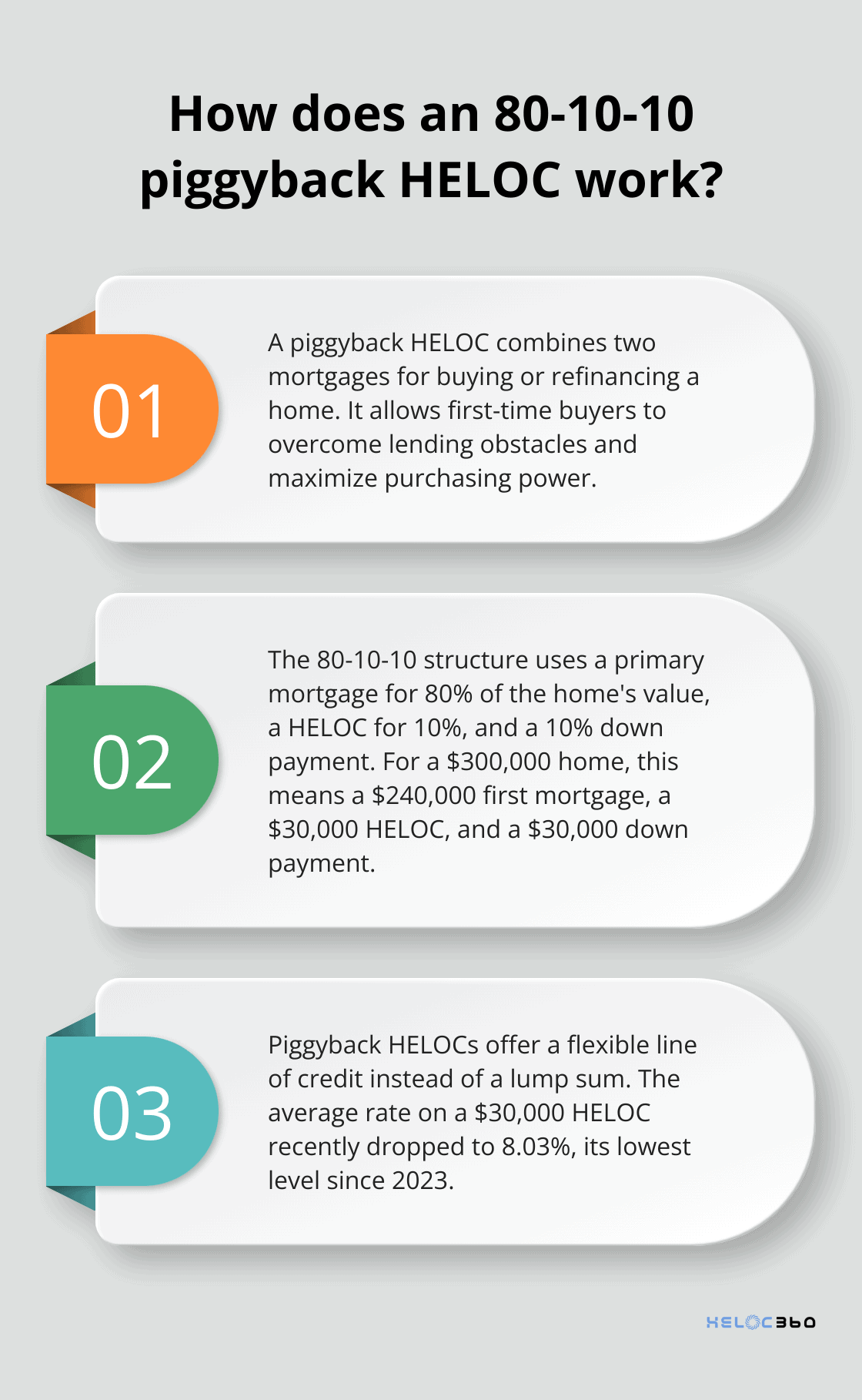

What Is a Piggyback HELOC?

The Innovative Financing Tool

A piggyback loan combines two mortgages for the purpose of buying or refinancing a home. This strategic approach allows first-time buyers to overcome traditional lending obstacles and maximize their purchasing power.

The 80-10-10 Structure Explained

In a typical piggyback HELOC arrangement, buyers take out a primary mortgage for 80% of the home’s value, a HELOC for 10%, and provide a 10% down payment. This structure is known as an 80-10-10 loan. For instance, on a $300,000 home, you’d have a $240,000 first mortgage, a $30,000 HELOC, and contribute $30,000 as a down payment.

Piggyback HELOC vs. Traditional Mortgages

Unlike standard mortgages that provide a lump sum, a piggyback HELOC offers access to a line of credit. This flexibility enables you to draw funds as needed, potentially reducing interest costs. A recent report showed that the average rate on a $30,000 home equity line of credit (HELOC) dropped to 8.03 percent, its lowest level since 2023.

Benefits of the 80-10-10 Structure

The 80-10-10 structure helps buyers avoid private mortgage insurance (PMI), which lenders typically require when the down payment is less than 20%. Even if you don’t have a 20% down payment, you can avoid the cost of PMI with an 80-10-10 loan.

Exploring Piggyback HELOC Options

Many first-time buyers use piggyback HELOCs to enter the housing market sooner than expected. Platforms like HELOC360 can help you determine if this option aligns with your homebuying goals and connect you with lenders offering competitive rates on piggyback HELOCs.

As we move forward, let’s examine the specific benefits that piggyback HELOCs offer to first-time homebuyers, including lower down payment requirements and increased financial flexibility.

Why Piggyback HELOCs Are a Game-Changer for First-Time Buyers

Lower Barrier to Entry

Piggyback HELOCs significantly reduce the down payment hurdle for first-time buyers. The main reason to consider a piggyback HELOC is when you don’t have a 20% down payment ready when buying a home.

The National Association of Realtors reported that the median down payment for first-time homebuyers in 2024 was 7%. With a piggyback HELOC, you’re already ahead of the curve, which puts you in a stronger position to compete in hot markets.

Elimination of PMI

Private Mortgage Insurance (PMI) adds a significant cost that many first-time buyers face when they can’t put 20% down. Piggyback loans can be an excellent method for obtaining a conventional loan without PMI, even with less than a 20% down payment.

Flexible Financing Options

Piggyback HELOCs offer unparalleled flexibility. You can use the HELOC portion for various purposes beyond just the down payment. Do you need to furnish your new home? Do you want to make immediate renovations? Your HELOC serves as a financial cushion for these needs.

A study by Houzz found that for the first time since 2018, homeowners plan to spend more on their renovations compared with the previous year. The planned median spend was $10,000 in 2018.

Competitive Interest Rates

Piggyback HELOCs often come with competitive interest rates, especially when compared to other financing options. This can result in significant savings over the life of your loan. Try to compare rates from multiple lenders to find the best deal for your situation.

Increased Purchasing Power

By combining a traditional mortgage with a HELOC, you can potentially afford a more expensive home than you might with a conventional loan alone. This increased purchasing power can open up opportunities in more desirable neighborhoods or allow you to buy a home that better fits your long-term needs.

As we move forward, it’s important to consider the potential risks and considerations associated with piggyback HELOCs. While they offer numerous benefits, understanding the full picture will help you make an informed decision about whether this financing strategy is right for your unique situation.

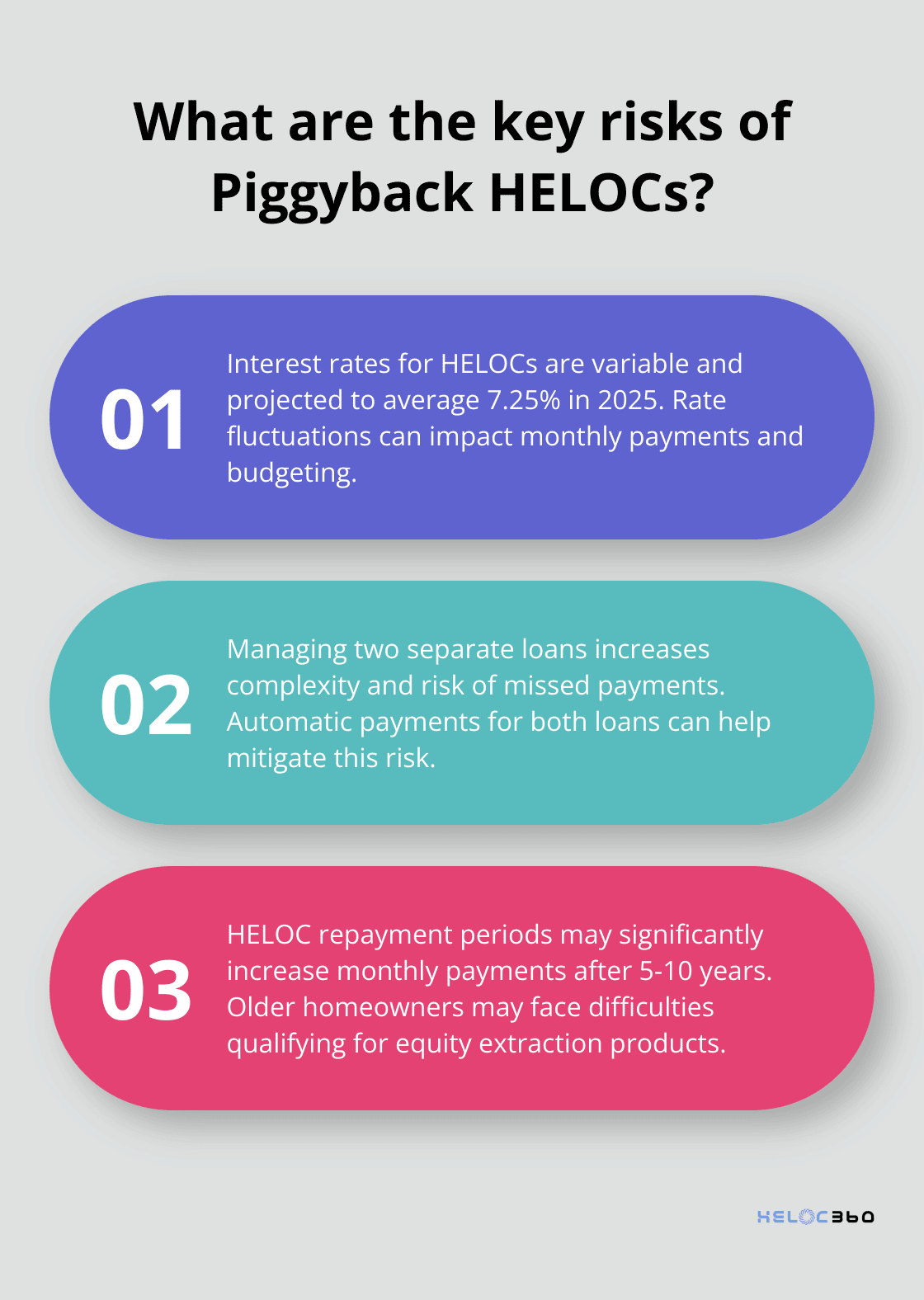

What Are the Risks of Piggyback HELOCs?

Interest Rate Volatility

Piggyback HELOCs come with variable interest rates on the HELOC portion. Unlike fixed-rate mortgages, HELOC rates fluctuate based on market conditions. McBride forecasts that HELOC rates will average 7.25 percent in 2025, but this can change rapidly. You must factor in potential rate changes when you budget for your monthly payments.

Managing Multiple Loans

Handling two separate loans proves more complex than dealing with a single mortgage. You need to track different payment schedules, interest rates, and terms. This complexity can cause confusion and potentially missed payments if not managed properly. Many financial advisors suggest setting up automatic payments for both loans to reduce this risk.

Long-Term Financial Impact

Piggyback HELOCs can help you purchase a home sooner, but they may affect your long-term financial planning. The HELOC portion typically has a draw period of 5-10 years, followed by a repayment period. During the repayment period, your monthly payments may increase significantly. Research suggests that older homeowners may find it more difficult to qualify for equity extraction products like HELOCs.

Potential for Negative Equity

If property values decline, you could owe more than your home is worth. This situation (known as negative equity) can be particularly challenging with a piggyback HELOC structure. Recent reports indicate that pricing declines, especially in sectors like core business districts, are slowing, providing hope for stabilization.

Prepayment Penalties and Future Borrowing Limitations

Some lenders impose prepayment penalties on HELOCs, which can make it costly to refinance or sell your home within the first few years. Always read the fine print and ask your lender about any potential penalties before you commit to a piggyback HELOC.

Using a piggyback HELOC may limit your ability to borrow against your home equity in the future. This could cause problems if you need to access funds for emergencies or major expenses down the line. Financial planners often advise you to maintain at least 20% equity in your home to provide a financial cushion.

Final Thoughts

HELOC piggyback loans offer first-time homebuyers a powerful tool to enter the housing market sooner and with greater financial flexibility. This innovative financing strategy combines a traditional mortgage with a home equity line of credit, allowing buyers to sidestep private mortgage insurance and reduce their initial down payment. However, variable interest rates on the HELOC portion and the complexity of managing multiple loans require careful consideration against personal financial situations and long-term goals.

Expert guidance can make all the difference for those considering a HELOC piggyback loan. At HELOC360, we help first-time buyers navigate the complexities of home equity financing. Our platform connects you with lenders offering competitive rates on piggyback HELOCs and provides the knowledge you need to make informed decisions.

A HELOC piggyback loan can turn your homeownership dreams into reality with the right approach and support. This financing strategy might be the key to unlocking your first home purchase. Your home’s value represents more than just a place to live – it opens the door to new financial opportunities.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.