Home equity lines of credit (HELOCs) are often seen as a way to fund home improvements or cover unexpected expenses. However, these versatile financial tools offer far more potential.

At HELOC360, we’ve discovered some surprising HELOC benefits that can significantly boost your financial health. From debt consolidation to creating a robust emergency fund, HELOCs can be a powerful asset in your financial toolkit.

Can a HELOC Simplify Your Debt?

The Power of Lower Interest Rates

Debt consolidation with a HELOC offers a smart financial strategy that many homeowners overlook. HELOCs typically provide interest rates significantly lower than credit cards. Assuming the Fed cuts its rate three times by early next year, that could lower the average HELOC rate to the mid-6% range, according to ICE.

Let’s illustrate this with real numbers. A $20,000 credit card debt at a high interest rate accrues significantly more interest over a year compared to the same amount borrowed through a HELOC at a lower rate.

Streamlined Payments for Financial Clarity

Combining multiple debts into one HELOC payment simplifies your financial life. Instead of juggling various due dates and minimum payments, you manage a single, predictable monthly payment. This consolidation can improve your credit score by reducing the number of accounts with balances and lowering your credit utilization ratio.

Strategic Debt Payoff Plan

To use a HELOC effectively for debt consolidation, follow these steps:

- List all your high-interest debts (include balances and interest rates).

- Calculate the total amount you need to borrow.

- Apply for a HELOC that covers this amount.

- Use the HELOC funds to pay off all high-interest debts immediately upon approval.

- Create a repayment plan to clear the HELOC balance as quickly as possible.

It’s essential to avoid accumulating new debt while paying off your HELOC. Some homeowners find it helpful to cut up their credit cards or lock them away during this process.

Real-Life Success Stories

Many homeowners have transformed their financial situations through strategic HELOC use. A HELOC can be a money-saving debt relief option for some homeowners, but it’s not right for everyone.

The Importance of Responsible HELOC Use

While HELOCs offer significant benefits for debt consolidation, responsible use remains paramount. Always consider your long-term financial goals and ability to repay before taking on any new debt. A HELOC ties directly to your home equity, so careful management proves essential to protect your most valuable asset.

As we explore the potential of HELOCs for improving financial health, let’s turn our attention to another powerful application: funding home improvements to increase property value.

How Home Improvements Can Boost Your Property Value

Leveraging HELOCs for Smart Home Upgrades

A Home Equity Line of Credit (HELOC) offers a powerful tool to fund home improvements that can add value to your home. The National Association of Realtors reports that certain renovations can yield significant returns on investment. This means you don’t just improve your living space; you make a strategic financial move.

High-ROI Home Improvement Projects

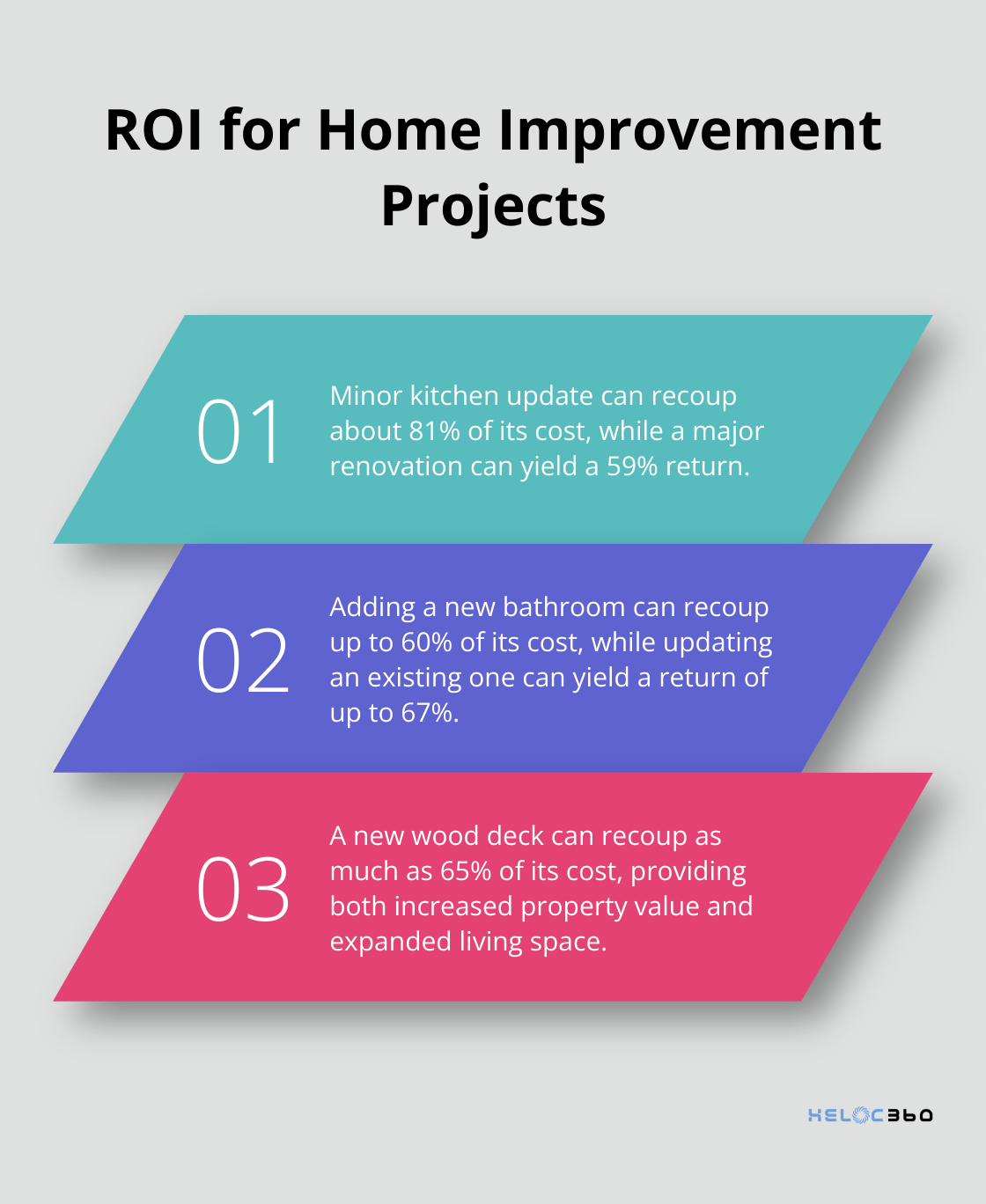

Kitchen remodels consistently top the list of value-boosting renovations. A minor kitchen update can recoup about 81% of its cost, while a major renovation can yield a 59% return. Modern appliances, updated countertops, and fresh cabinetry maximize impact.

Bathroom upgrades also prove excellent choices. Adding a new bathroom can recoup up to 60% of its cost, while updating an existing one can yield a return of up to 67%. Water-efficient fixtures and modern tile work appeal to potential buyers.

Outdoor improvements pack a punch too. A new wood deck can recoup as much as 65% of its cost, while landscaping can add up to 14% to your home’s resale value. These projects not only increase your property’s worth but also expand your living space.

Financial Benefits Beyond ROI

The advantages of using a HELOC for home improvements extend beyond immediate ROI. Upgraded homes often sell faster, reducing carrying costs if you decide to move. Additionally, improvements can lead to lower homeowners insurance premiums (especially if you update old systems or improve home security).

Energy-efficient upgrades, such as new windows or improved insulation, can significantly reduce utility bills. The EPA estimates that homeowners can save an average of 15% on heating and cooling costs (or an average of 11% on total energy costs) by air sealing their homes.

Smart HELOC Use for Home Improvements

When using a HELOC for home improvements, plan carefully. Get multiple quotes for your project and factor in a 10-20% buffer for unexpected costs. Address structural issues or outdated systems before cosmetic upgrades.

Consider the local real estate market when choosing projects. What’s valuable in one area might not yield the same returns in another. A local real estate agent can provide insights into the most sought-after improvements in your neighborhood.

A solid repayment plan proves essential when using a HELOC. The increased property value and potential energy savings can contribute to your ability to repay, but always ensure the monthly payments fit comfortably within your budget.

As we explore the potential of HELOCs for improving financial health, let’s turn our attention to another powerful application: creating a robust emergency fund to weather unexpected financial storms.

Can a HELOC Be Your Financial Safety Net?

The HELOC Advantage in Emergencies

A Home Equity Line of Credit (HELOC) can serve as a powerful financial safety net, offering unique advantages over traditional emergency savings accounts. While cash emergency funds remain advisable, a HELOC provides an additional layer of financial security that can prove particularly beneficial in certain situations.

HELOCs offer several key benefits as an emergency fund. They provide quick access to funds, often with lower interest rates compared to other forms of credit, and offer flexible borrowing options.

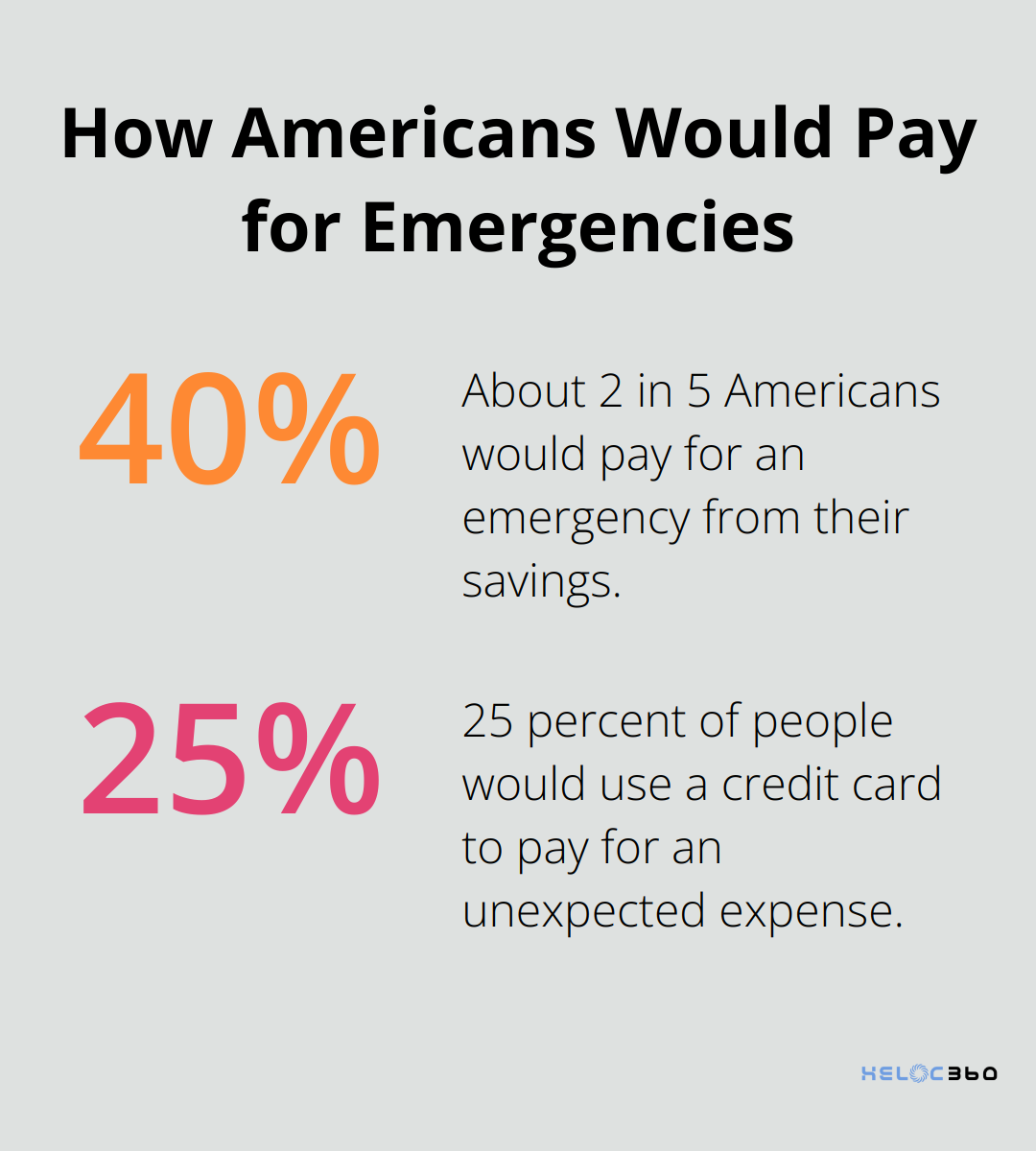

A 2025 Bankrate survey revealed that only around 2 in 5 Americans would pay for an emergency from their savings. Another 25 percent of people would use a credit card to pay for an unexpected expense. A HELOC can bridge this gap, providing peace of mind and financial flexibility.

HELOCs vs. Traditional Savings

Unlike traditional savings accounts, which typically offer low interest rates (national average of 0.46% as of June 2023, according to the FDIC), HELOCs allow you to keep your money invested in potentially higher-yielding assets while still having access to funds when needed.

Moreover, HELOCs only charge interest on the amount you borrow, not the entire credit line. This means you don’t pay for access to emergency funds until you actually need them.

Tips for Responsible HELOC Use

While HELOCs can be an effective financial tool, they require careful management. Here are some tips for responsible use:

- Set a clear threshold for emergencies. Define what constitutes a true financial emergency to avoid tapping into your HELOC for non-essential expenses.

- Create a repayment plan before borrowing. If you need to use your HELOC, have a strategy in place to repay the borrowed amount as quickly as possible.

- Regularly review and adjust your credit line. As your financial situation changes, work with your lender to ensure your HELOC limit remains appropriate for your needs.

- Consider a HELOC with a fixed-rate option. Some lenders offer the ability to convert all or a portion of your outstanding HELOC variable-rate balance to a fixed-rate loan option, providing protection against potential interest rate increases.

- Maintain a cash buffer. While a HELOC can serve as a backup, try to keep some cash savings for immediate, smaller emergencies.

The Importance of Responsible Management

A HELOC is secured by your home, so it’s important to use it responsibly. Effective management of your HELOC (through platforms like HELOC360) can help you navigate the process of setting up and managing a HELOC effectively, ensuring you’re well-prepared for financial uncertainties while protecting your most valuable asset.

Final Thoughts

Home Equity Lines of Credit (HELOCs) offer surprising ways to enhance your financial health. HELOCs provide versatile solutions for homeowners, from strategic debt consolidation to funding value-boosting home improvements and creating a robust emergency fund. These financial tools can lower interest rates on existing debts, increase property value, and offer a safety net for unexpected expenses.

The power of HELOCs comes with responsibility. Homeowners must approach HELOC use with a clear strategy and disciplined repayment plan. Your home serves as collateral, so careful management will protect your most valuable asset.

To fully leverage HELOC benefits, homeowners need expert guidance and tailored solutions. HELOC360 simplifies the process of exploring and utilizing your home equity, connecting you with lenders that match your unique financial goals. Our platform provides the tools and knowledge you need to make informed decisions about using your HELOC (whether for debt consolidation, home improvements, or establishing a financial safety net).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.