Home equity lines of credit (HELOCs) offer homeowners a flexible way to tap into their property’s value. But how much can you actually borrow?

At HELOC360, we often get questions about HELOC limits and how they’re determined. Understanding these factors can help you maximize your borrowing potential and make informed financial decisions.

In this post, we’ll break down the key elements that influence HELOC borrowing limits and provide strategies to increase your available credit.

What Determines Your HELOC Borrowing Limit?

The Power of Home Equity

Your home equity plays a central role in determining your HELOC limit. Lenders typically allow borrowing up to 80-85% of your home’s value, minus your existing mortgage balance. For example, if your home is worth $400,000 and you owe $250,000 on your mortgage, you might borrow up to $90,000 (($400,000 x 0.85) – $250,000).

Credit Score Impact

Your credit score significantly affects your HELOC borrowing limit. Borrowers with higher credit scores often qualify for the highest limits and best rates. If your score falls below 620, you might face challenges in approval. An improvement in your score could potentially increase your borrowing limit.

Income and Debt Considerations

Lenders closely examine your income and debt-to-income (DTI) ratio. Most prefer a DTI below 43%, though some may accept up to 50%. To calculate your DTI, divide your monthly debt payments by your gross monthly income. A reduction in your debt or an increase in your income can boost your borrowing power.

Property Type and Location

The type and location of your property also influence your HELOC limit. Single-family homes in stable markets often qualify for higher limits compared to condos or properties in volatile areas. A study by the Urban Institute found that HELOC approval rates in rural areas were 8% lower than in urban areas.

Lender Policies

Different lenders have varying policies regarding HELOC limits. Some may offer more generous terms, while others might be more conservative. It’s important to compare offers from multiple lenders to find the best fit for your financial situation. (This approach can help you maximize your borrowing potential.)

Now that we’ve explored the factors that determine your HELOC borrowing limit, let’s examine how lenders actually calculate these limits in practice.

How Lenders Set Your HELOC Limit

The CLTV Ratio: Your Borrowing Benchmark

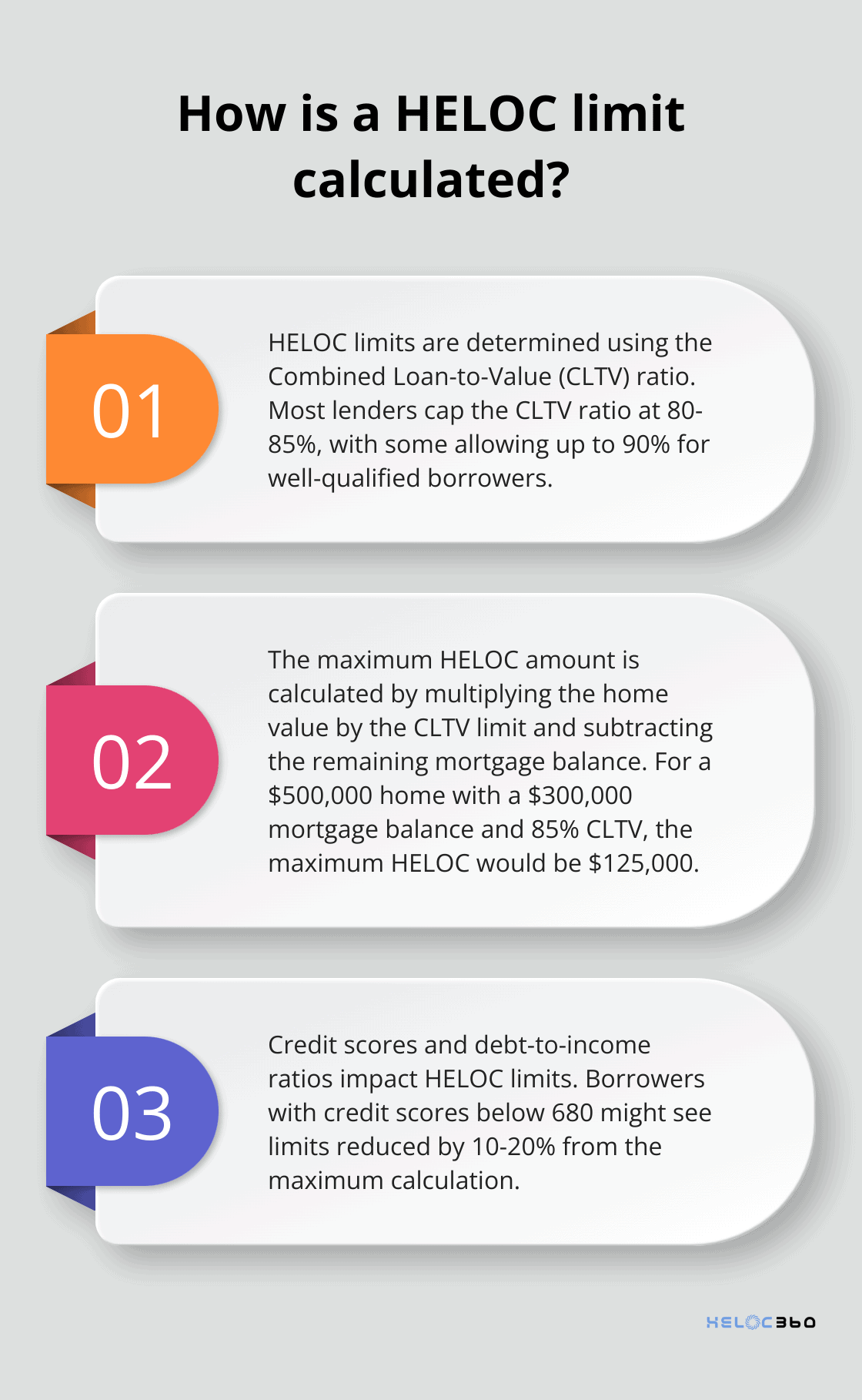

Lenders use a specific calculation method called the Combined Loan-to-Value (CLTV) ratio to determine your HELOC borrowing limit. This ratio represents the ratio of all loans on a property to the property’s value. Lenders use it to determine risk of default. Most lenders cap the CLTV ratio at 80-85%, though some may go as high as 90% for well-qualified borrowers.

Calculating Your Maximum HELOC Amount

Let’s break down how this works in practice. Suppose your home is valued at $500,000, and you have a remaining mortgage balance of $300,000. A lender with an 85% CLTV limit would calculate your maximum HELOC amount as follows:

($500,000 x 0.85) – $300,000 = $125,000

This means you could potentially borrow up to $125,000 through a HELOC.

Beyond the Numbers: Other Influencing Factors

While the CLTV ratio sets the upper boundary, your actual HELOC limit may be lower based on other factors. A 2024 report by the Federal Reserve Bank of New York found that total household debt increased by $109 billion (0.6%) in Q2 2024, to $17.80 trillion.

Borrowers with excellent credit scores (740+) and low debt-to-income ratios often qualify for limits closer to the maximum CLTV. On the other hand, those with credit scores below 680 or higher debt loads might see their limits reduced by 10-20% from the maximum calculation.

Regional Differences in HELOC Limits

HELOC limits can vary significantly by region. CoreLogic’s data-driven insights into housing market trends help home shoppers navigate what can sometimes be a difficult and stressful process.

These calculations can help you set realistic expectations for your HELOC borrowing potential. Now, let’s explore practical ways to potentially increase your HELOC borrowing limit.

How to Boost Your HELOC Borrowing Power

Elevate Your Credit Score

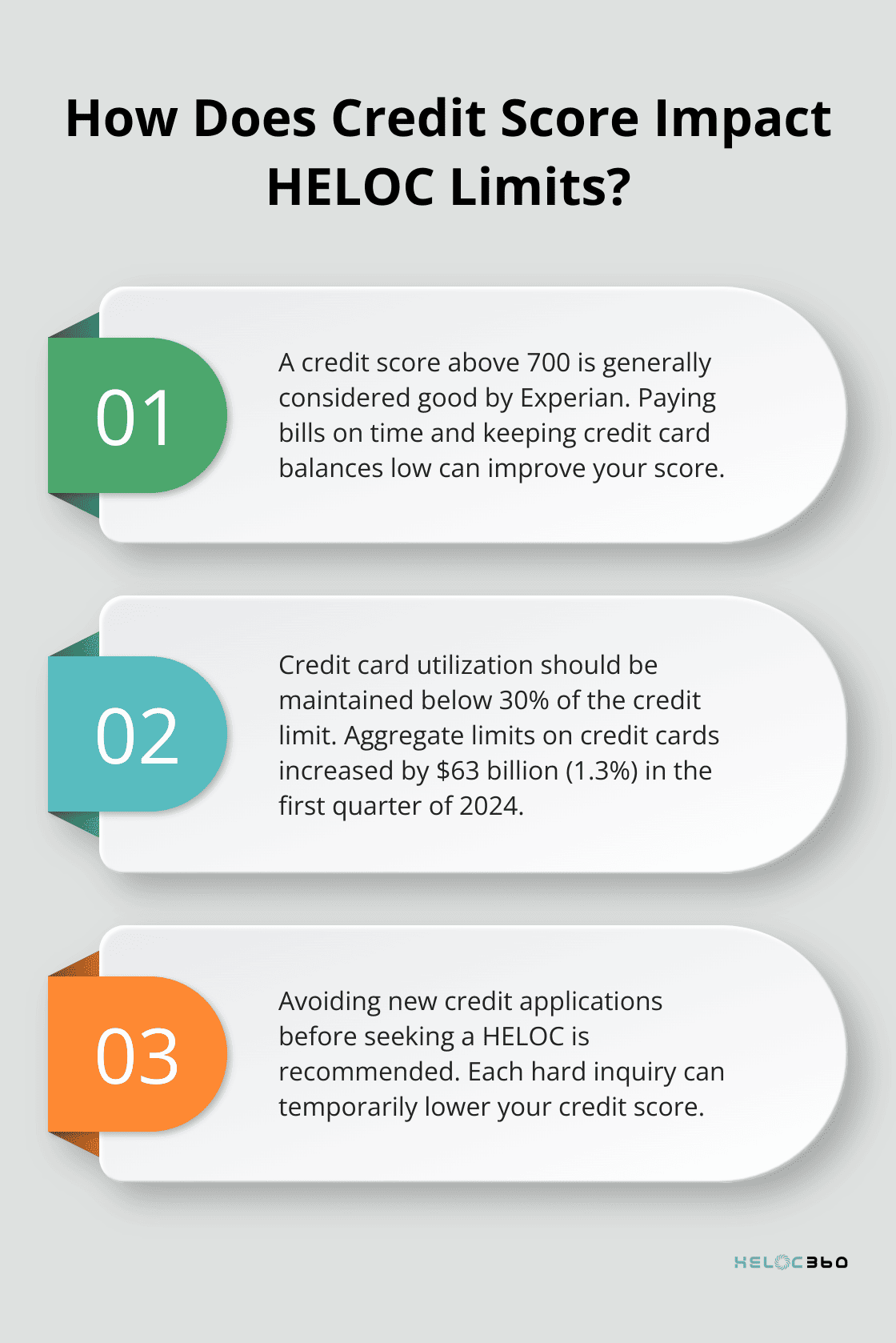

Your credit score significantly impacts your HELOC limit. Experian, a major credit bureau, considers a score above 700 generally good. To improve your score:

- Pay bills on time. Set up automatic payments to avoid late fees.

- Keep credit card balances low. Try to maintain a utilization rate below 30% of your credit limit.

- Don’t apply for new credit before seeking a HELOC. Each hard inquiry can temporarily lower your score.

Aggregate limits on credit cards increased modestly, by $63 billion (1.3%) in the first quarter, after eleven consecutive quarters of meaningful increases.

Slash Your Debt-to-Income Ratio

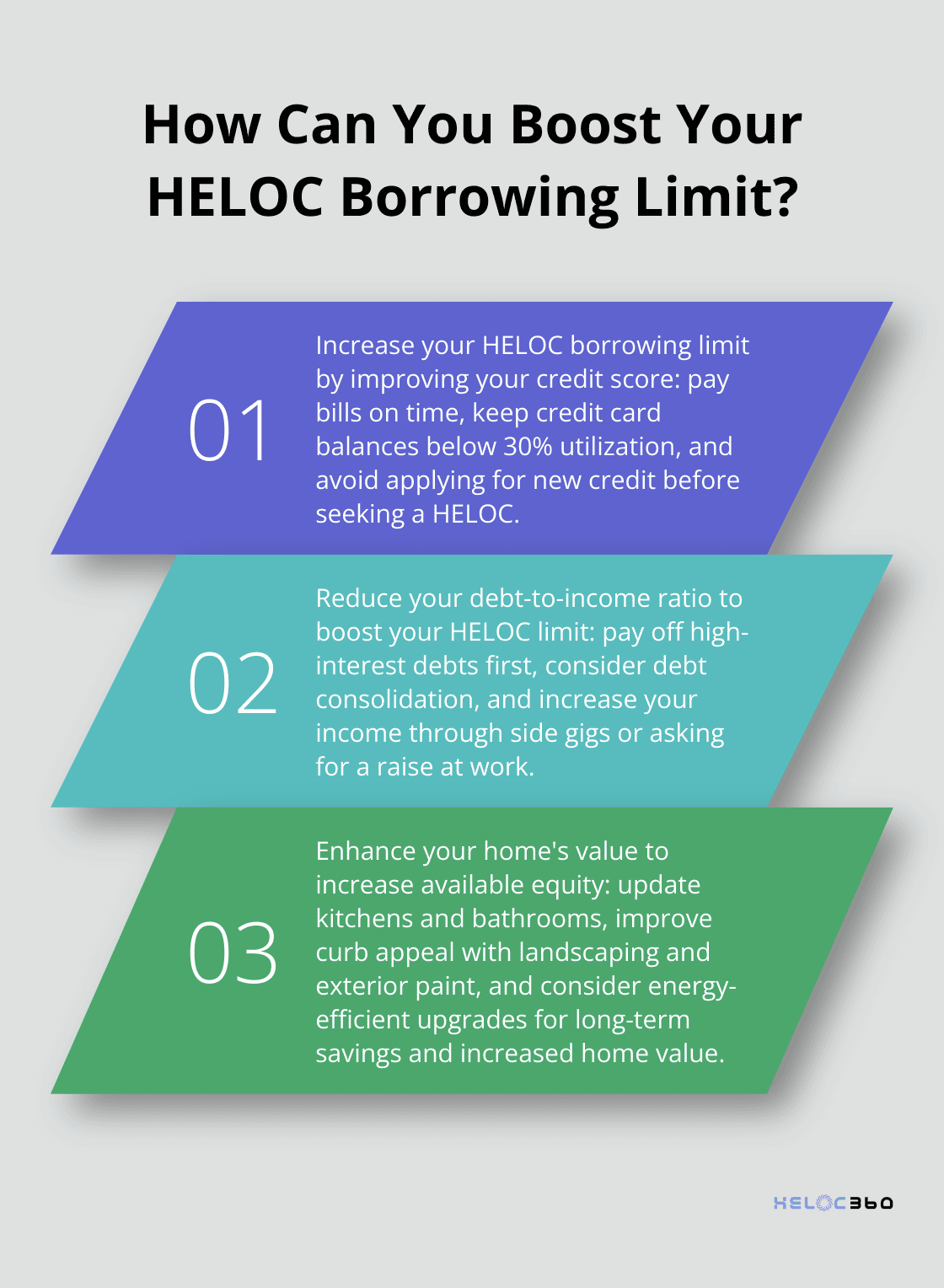

Lenders prefer borrowers with lower debt-to-income (DTI) ratios. The Consumer Financial Protection Bureau defines DTI as all your monthly debt payments divided by your gross monthly income. To reduce your DTI:

- Pay off high-interest debts first (like credit card balances).

- Consider debt consolidation to lower overall monthly payments.

- Increase your income through side gigs or asking for a raise at work.

A 5% reduction in DTI could potentially increase your HELOC limit by thousands of dollars.

Boost Your Home’s Value

Increasing your home’s value directly impacts your available equity. Focus on high-ROI improvements:

- Update kitchens and bathrooms.

- Enhance curb appeal with landscaping and exterior paint. These relatively low-cost improvements can significantly boost perceived value.

- Consider energy-efficient upgrades. They increase home value and can lead to long-term savings on utility bills.

Remodeling Magazine’s Cost vs. Value Report compares average costs for 23 remodeling projects with the value those projects retain at resale in 162 U.S. markets.

Shop Around for the Best Offers

Different lenders have varying policies on HELOC limits. Don’t settle for the first offer you receive. A study by Freddie Mac found that getting just one additional quote could save borrowers an average of $1,500 over the life of the loan.

Comparing offers from multiple lenders ensures you find the best terms for your situation. Side-by-side comparisons of HELOC limits and rates from various lenders can simplify the process and help you make an informed decision.

Final Thoughts

HELOC limits depend on various factors including home equity, credit score, income, and property characteristics. Homeowners who understand these elements can make better decisions about their financial future. You can increase your HELOC borrowing potential by improving your credit score, lowering your debt-to-income ratio, and enhancing your home’s value.

HELOC360 helps you unlock the full potential of your home equity. Our platform simplifies the process of understanding and accessing HELOCs. We provide tailored solutions that align with your financial goals.

A HELOC can open doors to new financial opportunities. You can turn your home’s value into a pathway toward achieving your aspirations. HELOC360 offers expert guidance and connects you with lenders that match your unique needs.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.