- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Home equity lines of credit (HELOCs) offer homeowners a flexible way to access funds, but they come with important considerations.

At HELOC360, we often field questions about HELOC collateral requirements. Understanding these requirements is essential for homeowners considering this financial tool.

This post will break down what collateral means in the context of HELOCs, typical requirements, and the risks involved in using your home as security for a loan.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

What Is HELOC Collateral?

Your Home as Security

When you apply for a Home Equity Line of Credit (HELOC), your property becomes the foundation of the loan. Collateral in a HELOC context refers to the asset that secures the loan – your home. Your house serves as a guarantee for the lender. If you default on the HELOC, the lender has the right to claim your property. This security allows lenders to offer lower interest rates compared to unsecured loans, as their risk decreases.

The Power of Equity

Equity plays a key role in determining your HELOC eligibility. It represents the difference between your home’s current market value and the amount you still owe on your mortgage. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity.

Most lenders require you to maintain at least 15-20% equity in your home after taking out a HELOC. This means if you have $100,000 in equity, you might borrow up to $80,000, keeping $20,000 as a buffer.

Assessing Your Collateral Value

To determine how much you can borrow, lenders will typically conduct an appraisal of your property. This step establishes the current market value of your home, which directly impacts your borrowing capacity.

Regular Equity Assessment

Homeowners should regularly assess their property value and equity position. This proactive approach helps you stay informed about your borrowing potential and makes it easier to leverage your home’s equity when needed.

Understanding Loan-to-Value Ratio

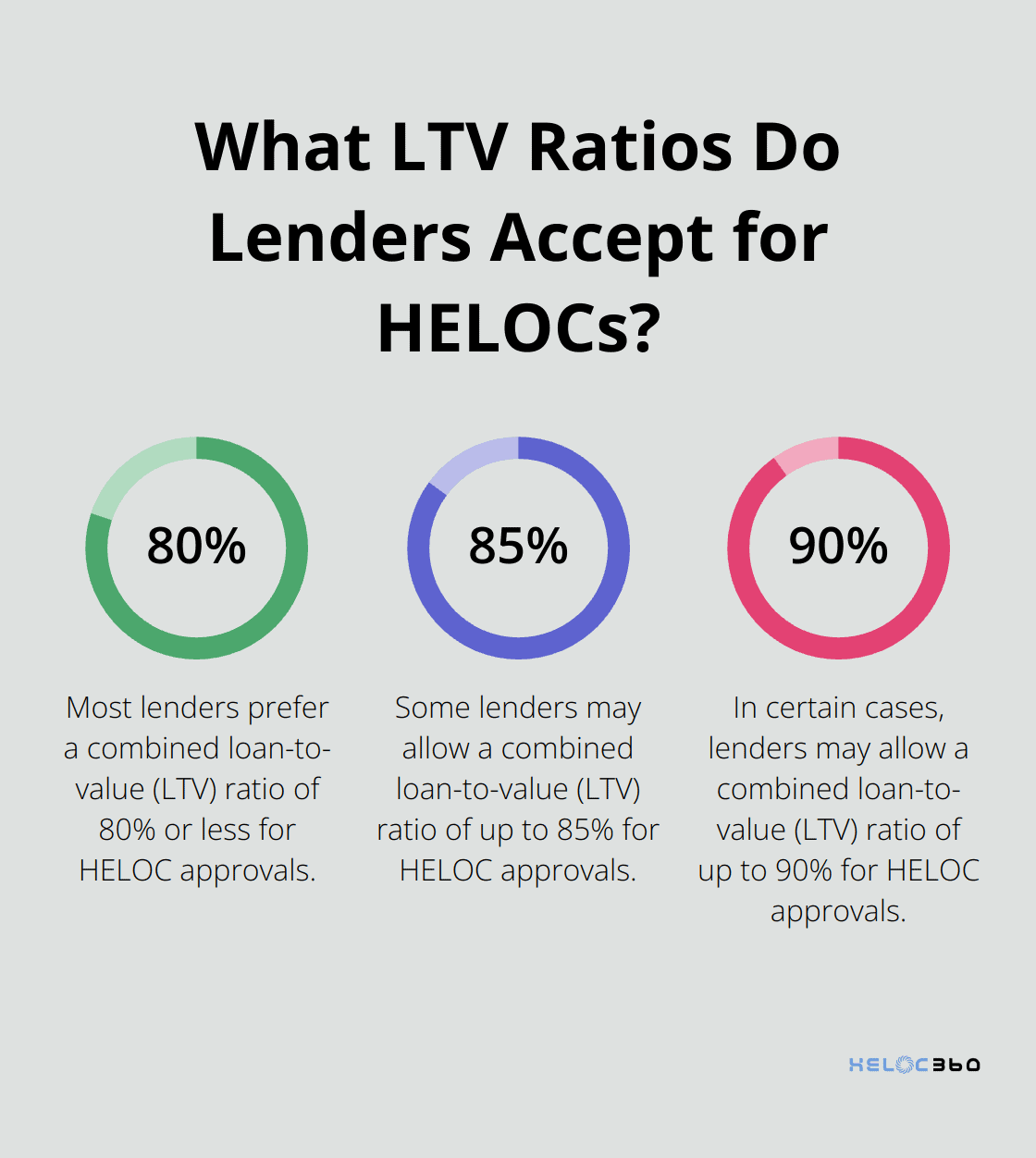

The loan-to-value (LTV) ratio is a critical factor in HELOC collateral requirements. Lenders use this ratio to assess the risk of lending money against your home. The LTV ratio compares the amount of your loan to the appraised value of your property. For instance, if your home is valued at $200,000 and you have a current loan balance of $140,000, your LTV would be 70% ($140,000 / $200,000).

Most lenders prefer a combined LTV ratio of 80% or less, though some may allow up to 85% or even 90% in certain cases. Understanding your LTV ratio can help you gauge your likelihood of HELOC approval and the amount you might be able to borrow.

As we move forward, let’s explore the typical collateral requirements for HELOCs in more detail, including minimum equity percentages and other factors lenders consider.

Typical HELOC Collateral Requirements

Equity and Loan-to-Value Ratios

Home Equity Line of Credit (HELOC) lenders set specific requirements to secure their loans. These requirements focus on equity, loan-to-value ratios, credit scores, and income.

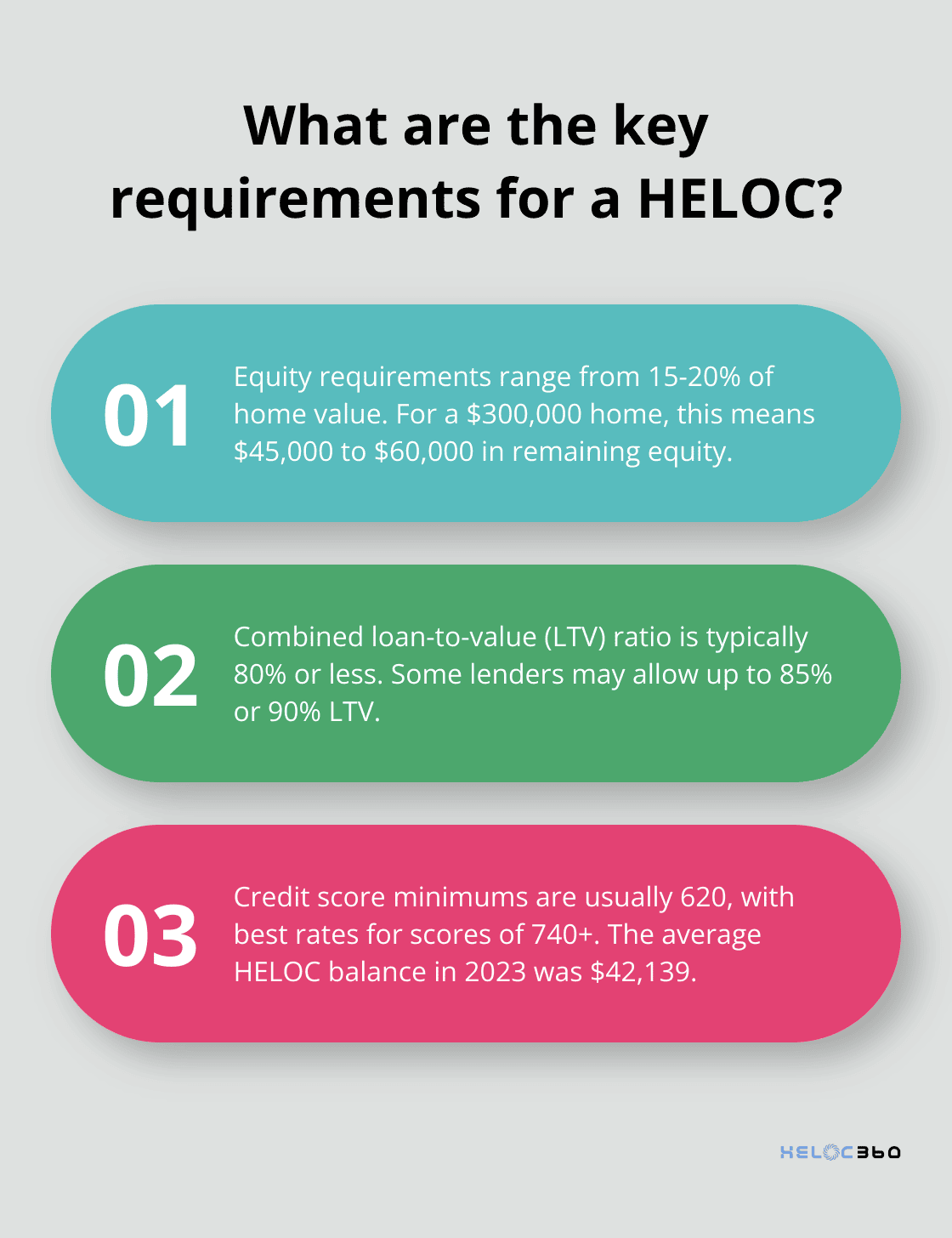

Most lenders require homeowners to maintain 15-20% equity in their home after HELOC approval. For a $300,000 home, this translates to $45,000 to $60,000 in remaining equity.

The loan-to-value (LTV) ratio is another key factor. Lenders typically prefer a combined LTV ratio (including first mortgage and HELOC) of 80% or less. Some may extend this to 85% or 90%, but higher ratios often come with stricter requirements or increased interest rates.

For instance, if your home’s value is $250,000 and you owe $150,000 on your mortgage, your current LTV is 60%. A lender allowing a combined LTV of 80% might approve a HELOC up to $50,000 ($250,000 x 80% = $200,000, minus the $150,000 mortgage balance).

Credit Score and Income Requirements

Your credit score significantly impacts HELOC approval. Most lenders require a minimum score of 620, but the best rates and terms usually go to those with scores of 740 or higher. In 2023, the average HELOC balance grew 2.7% to $42,139, and more than $20 billion was added to the total HELOC debt across all U.S. consumers.

Income requirements vary among lenders, but most look for a debt-to-income ratio below 50% and a credit score above 680 to qualify. Some lenders may accept higher DTI ratios, but this often results in higher interest rates or lower credit limits.

Property Type and Condition

The type and condition of your property also affect HELOC collateral requirements. Single-family homes, condos, and townhouses are generally accepted, while mobile homes or properties in poor condition may face additional scrutiny or ineligibility.

Lenders typically require a property appraisal to confirm its value. For lower loan amounts or in areas with stable property values, lenders might use automated valuation models instead of full appraisals.

Documentation and Verification

Lenders will ask for various documents to verify your financial situation. These may include:

- Proof of income (pay stubs, tax returns)

- Bank statements

- Mortgage statements

- Property tax bills

- Homeowners insurance policy

The lender will use these documents to assess your ability to repay the HELOC and verify the details of your property.

As we move forward, it’s important to consider the risks and responsibilities that come with using your home as collateral for a HELOC. The next section will explore these aspects in detail, helping you make an informed decision about whether a HELOC is the right choice for your financial needs.

What Are the Risks of Using Your Home as Collateral?

The Threat of Foreclosure

Using your home as collateral for a HELOC offers financial flexibility but carries significant risks. The most severe consequence is the potential loss of your home if you default on payments. Unlike unsecured loans, a HELOC gives lenders the right to initiate foreclosure proceedings. ATTOM Data Solutions reported that lending to home buyers shrank 7.5 percent from the third to the fourth quarter of 2024, to about 732,000, while the number of home equity credit lines also decreased.

To reduce this risk, create a solid financial plan before obtaining a HELOC. Set up automatic payments and maintain an emergency fund to cover at least six months of HELOC payments. If you face financial difficulties, contact your lender immediately. Many offer hardship programs or payment plans to help you avoid default.

Complications in Home Sales and Refinancing

A HELOC can create obstacles when selling your home or refinancing your mortgage. When you sell, you must pay off the HELOC balance from the sale proceeds, which may reduce your profit. In a down market, you might even find yourself underwater if your home’s value drops below the combined balances of your mortgage and HELOC.

For refinancing, a HELOC becomes a second lien on your property. This can make it harder to qualify for a new primary mortgage or result in less favorable terms. Some lenders might require you to close out the HELOC before refinancing, which could disrupt your financial plans.

To address these challenges, monitor your home’s value and HELOC balance regularly. Consider paying down your HELOC aggressively if you plan to sell or refinance soon. Tools like Zillow’s home value estimator can help you stay informed about your property’s worth.

Property Maintenance Becomes Critical

With a HELOC, maintaining your property’s value becomes even more important. Neglecting repairs or improvements can lead to a decrease in home value, potentially putting you at risk of owing more than your home is worth.

Invest in regular maintenance and strategic upgrades. Remodeling Magazine’s 2024 Cost vs. Value Report indicates that a minor kitchen remodel with new hardware has an ROI of 96.1%.

Create a home maintenance schedule and budget for both routine upkeep and larger projects. This proactive approach not only protects your home’s value but can also increase it, providing more equity to draw from if needed.

Interest Rate Fluctuations

HELOCs typically come with variable interest rates, which can lead to unpredictable monthly payments. If interest rates rise significantly, your payments could become unaffordable. To mitigate this risk, consider a HELOC with a fixed-rate option or convert a portion of your balance to a fixed-rate loan if your lender offers this feature.

Temptation of Easy Credit

The accessibility of funds through a HELOC can lead to overspending. It’s easy to tap into your home equity for non-essential purchases, which can erode your wealth over time. To avoid this pitfall, create a clear plan for HELOC funds and stick to it. Use the money for value-adding home improvements or debt consolidation rather than discretionary spending.

Final Thoughts

HELOC collateral requirements demand careful consideration from homeowners. Your home’s equity forms the basis for HELOC eligibility, with lenders typically requiring 15-20% equity retention and combined loan-to-value ratios of 80% or less. Credit scores, income, and property condition also play significant roles in the approval process.

HELOCs offer financial flexibility but come with substantial responsibilities. The risk of foreclosure, potential complications in home sales or refinancing, and the need for property maintenance highlight the importance of responsible borrowing. Fluctuating interest rates and easy access to credit further emphasize the need for caution when using a HELOC.

At HELOC360, we help homeowners understand and leverage their home equity effectively. Our platform connects you with lenders that match your specific needs, providing expert guidance throughout the process. We encourage you to assess your financial goals and explore your options before pursuing a HELOC, ensuring you make informed decisions about using your home’s value to achieve your financial aspirations.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.