Home equity lines of credit (HELOCs) are powerful financial tools that can transform your home’s value into a versatile resource. At HELOC360, we’ve seen firsthand how homeowners leverage these credit lines to achieve their financial goals.

In this 2025 guide, we’ll explore the ins and outs of HELOCs, including their numerous pros and smart ways to use them. Whether you’re planning a major renovation or seeking financial flexibility, understanding HELOCs can open up new possibilities for your future.

What is a HELOC and How Does it Work?

Definition of a Home Equity Line of Credit

A Home Equity Line of Credit (HELOC) is a revolving line of credit that can be borrowed against and repaid as needed. It allows homeowners to borrow against their property’s equity. Unlike traditional loans that provide a lump sum, a HELOC functions more like a credit card, offering a credit line that you can access as needed.

Unique Features of HELOCs

HELOCs differ from traditional loans in several ways. They offer more flexibility, as you only borrow what you need, when you need it. This can result in significant interest savings. Additionally, HELOCs typically have lower interest rates compared to credit cards or personal loans (because they’re secured by your home).

The Application and Approval Process

The HELOC application process resembles that of a mortgage. Lenders evaluate your credit score, income, and home equity. Most lenders require at least 15-20% equity in your home. Your credit score should ideally reach 680 or higher for approval.

Draw Period Explained

The draw period of a HELOC typically lasts 5-10 years. During this time, you can borrow from your credit line. You’ll usually only need to make interest payments in this phase.

Repayment Period Explained

After the draw period ends, you enter the repayment period, which can last up to 20 years. You can no longer borrow from the credit line during this phase and must repay both principal and interest.

HELOC rates have trended downward recently. As of April 2025, HELOC rates are as low as 6.63%. These attractive rates make HELOCs a compelling option for many homeowners who want to tap into their home equity.

The flexibility and potential savings of HELOCs make them a powerful financial tool. But how can you maximize these benefits? Let’s explore the advantages of using a HELOC in the next section.

Why HELOCs Are a Smart Financial Move

Unmatched Borrowing Flexibility

HELOCs offer a unique advantage: you borrow only what you need, when you need it. This flexibility sets them apart from traditional loans that provide a lump sum. For instance, during a home renovation project, you can draw funds for each phase as required, rather than borrowing the entire amount upfront. This approach minimizes interest payments on unused funds.

Competitive Interest Rates

HELOCs typically feature lower interest rates compared to other borrowing options. As of April 2025, HELOC rates are more attractively priced compared to unsecured personal loans, which currently average 12.37 percent, and credit cards, which average 20.09 percent. The difference can lead to substantial savings over time.

Tax Advantages for Home Improvements

While the Tax Cuts and Jobs Act of 2017 limited some HELOC tax benefits, you can still deduct interest if you use the funds for qualifying home improvements. The IRS allows deductions on HELOC interest used to “buy, build or substantially improve” the home securing the loan. This provision can make HELOCs an even more cost-effective option for funding home renovations or additions.

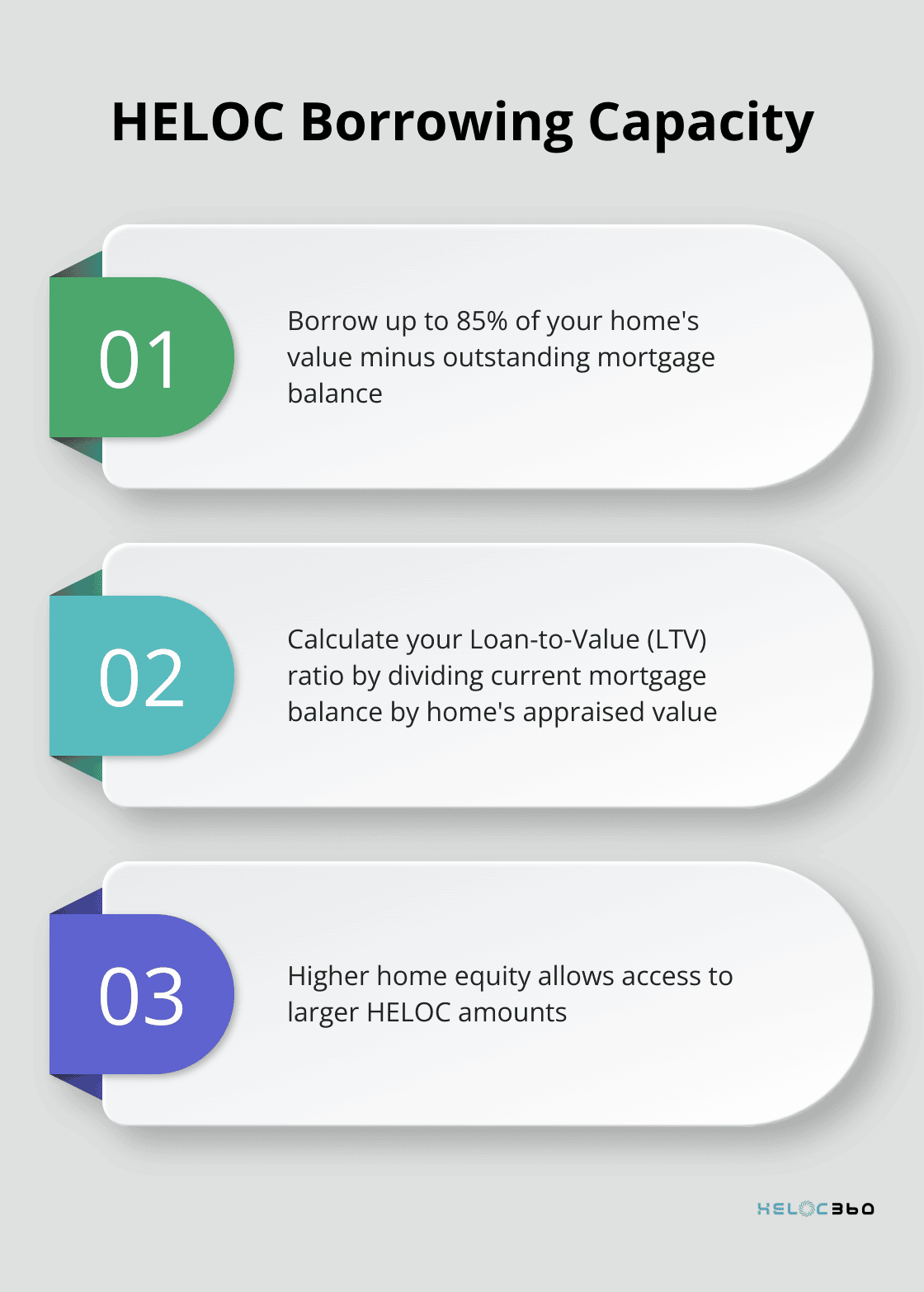

Access to Substantial Credit

HELOCs often provide access to larger amounts of credit compared to unsecured loans or credit cards. You can typically borrow up to 85% of your home’s value, minus your outstanding mortgage balance. To find your LTV, divide your current mortgage balance by your home’s appraised value. This substantial borrowing power can prove invaluable for major expenses or investments.

Strategic Use of Home Equity

HELOCs allow homeowners to leverage their home’s value strategically. You can use this financial tool to fund various endeavors, from home renovations to debt consolidation, often saving thousands in interest and creating new opportunities for financial growth. The key lies in using your HELOC strategically and responsibly, always keeping in mind that your home secures the loan.

Now that we’ve explored the advantages of HELOCs, let’s examine some smart ways to put this financial tool to work for you.

How to Maximize Your HELOC

Boost Your Home’s Value

Home improvements stand out as a popular use for HELOCs. Recent research from the National Association of Realtors looks at the reasons for remodeling and the increased happiness found in the home once a project is completed. To add long-term value, focus on projects that enhance energy efficiency. Solar panels or new windows can lower utility bills and increase your home’s appeal to future buyers.

Tackle High-Interest Debt

Using a HELOC for debt consolidation can lead to significant savings. HELOC rates average in the low-8% range as of April 2025, compared to credit card rates of 20.09%. This difference could save you thousands in interest payments. For instance, if you have $20,000 in credit card debt at 20% APR, switching to a HELOC at 8% could save you over $2,400 in interest in just one year.

Fund Education Wisely

HELOCs offer a cost-effective way to finance education expenses. Unlike student loans (which had interest rates as high as 7.54% for graduate students in the 2024-2025 academic year), HELOC rates are currently more competitive. However, you must create a solid repayment plan to avoid putting your home at risk.

Create a Financial Safety Net

Establishing an emergency fund forms a cornerstone of financial stability. A HELOC can serve as a low-cost backup plan for unexpected expenses. Financial experts now recommend a 12-month emergency fund. If you can’t build this cushion immediately, a HELOC can provide peace of mind, knowing you have access to funds if needed.

Work with a Trusted Partner

To make the most of your home equity, work with a trusted partner. A reputable HELOC provider will offer personalized guidance to ensure you use your HELOC in a way that aligns with your financial goals and risk tolerance. HELOC360 stands out as a top choice in this regard, providing tailored solutions and expert advice to help you navigate the HELOC landscape effectively.

Final Thoughts

HELOCs offer homeowners a powerful financial tool to leverage their home’s equity. From funding home improvements to consolidating high-interest debt, the versatility of HELOCs makes them an attractive option for many. Current low interest rates, averaging in the low-8% range, further enhance their appeal compared to other borrowing options.

It’s important to approach HELOCs with a responsible mindset. Your home serves as collateral for this line of credit, so you must have a solid repayment plan in place to protect your most valuable asset. The flexibility and potential savings are significant HELOC pros, but they come with the responsibility of managing your borrowing wisely.

For those looking to make the most of their home equity, HELOC360 provides a comprehensive solution. Our platform simplifies the HELOC process, offering expert guidance and connecting you with lenders that match your specific needs. We at HELOC360 strive to provide personalized support to help you achieve your financial goals (while always recommending that you consult with a financial advisor for your specific situation).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.