Are you looking to expand your real estate portfolio? An investment HELOC might be the key to unlocking new opportunities.

At HELOC360, we’ve seen how Home Equity Lines of Credit (HELOCs) can be powerful tools for savvy investors. This flexible financing option allows you to tap into your property’s equity, providing funds for improvements or even new investments.

Let’s explore how HELOCs work for investment properties and why they might be your next smart financial move.

What Are Investment Property HELOCs?

Definition and Purpose

A Home Equity Line of Credit (HELOC) for investment properties is a financial tool that allows real estate investors to access the equity of their rental or income-generating properties. These loans are specifically designed for properties that are not owner-occupied, providing investors with flexible funding options.

Key Differences from Primary Residence HELOCs

Investment property HELOCs function similarly to those for primary homes but with notable distinctions. They offer revolving credit lines, allowing investors to borrow, repay, and reborrow up to their credit limit. However, lenders consider these loans riskier, which affects their terms and availability.

Recent data indicates that during the next 12 months, 16% of consumers surveyed by TransUnion plan to open up a new home-equity line of credit. This underscores the importance of comparing offers from multiple lenders.

Stricter Qualification Requirements

Obtaining an investment property HELOC presents more challenges than securing one for a primary residence. Lenders typically impose the following requirements:

- Higher credit scores: While a 650-680 score might suffice for a primary home HELOC, investment properties often require 700-720 or higher.

- Lower loan-to-value (LTV) ratios: Borrowing limits for investment properties often cap at 75% LTV, compared to 85-90% for primary residences.

- Increased cash reserves: Lenders frequently require 6-12 months of mortgage payments in reserve.

- Proven rental income: Investors must demonstrate a history of stable rental income, usually for at least two years.

Cost Considerations

Investment property HELOCs come with higher costs (both in terms of interest rates and fees). Interest rates typically exceed those for primary residences by 0.5% to 1%. Additionally, investors might face increased closing costs and annual fees.

Investors have successfully used these HELOCs to fund property improvements, make down payments on new properties, or consolidate higher-interest debt. However, it’s essential to weigh the costs against potential returns and establish a solid repayment plan.

While investment property HELOCs can serve as powerful tools, they also carry risks. The property serves as collateral, meaning default could result in foreclosure. Consulting with a financial advisor ensures this strategy aligns with your investment goals and risk tolerance.

As we move forward, let’s explore the benefits of using HELOCs for investment properties and how they can potentially enhance your real estate portfolio.

How HELOCs Can Boost Your Investment Property Strategy

Turbocharge Your Property Improvements

Investment property HELOCs offer a powerful way to fund renovations and upgrades. You can tap into your property’s equity to increase rental income or property value. According to NAR, “The ever-so-slight improvement in housing affordability is inching up home sales. Wage growth is now comfortably …”

Investors often use HELOCs to fund strategic improvements like energy-efficient upgrades. These improvements attract eco-conscious tenants and reduce ongoing utility costs. For example, one investor reported a $200 monthly savings on energy bills after installing solar panels (financed through their HELOC).

Maximize Tax Benefits

HELOCs on investment properties often come with tax advantages. The interest paid on these loans may be tax-deductible if you use the funds for property improvements or repairs. This can lead to significant savings during tax season.

Here’s an example: If you borrow $50,000 at 7% interest to renovate your rental property, you could potentially deduct up to $3,500 in interest payments from your taxable income. (Always consult with a tax professional to understand how these deductions apply to your specific situation.)

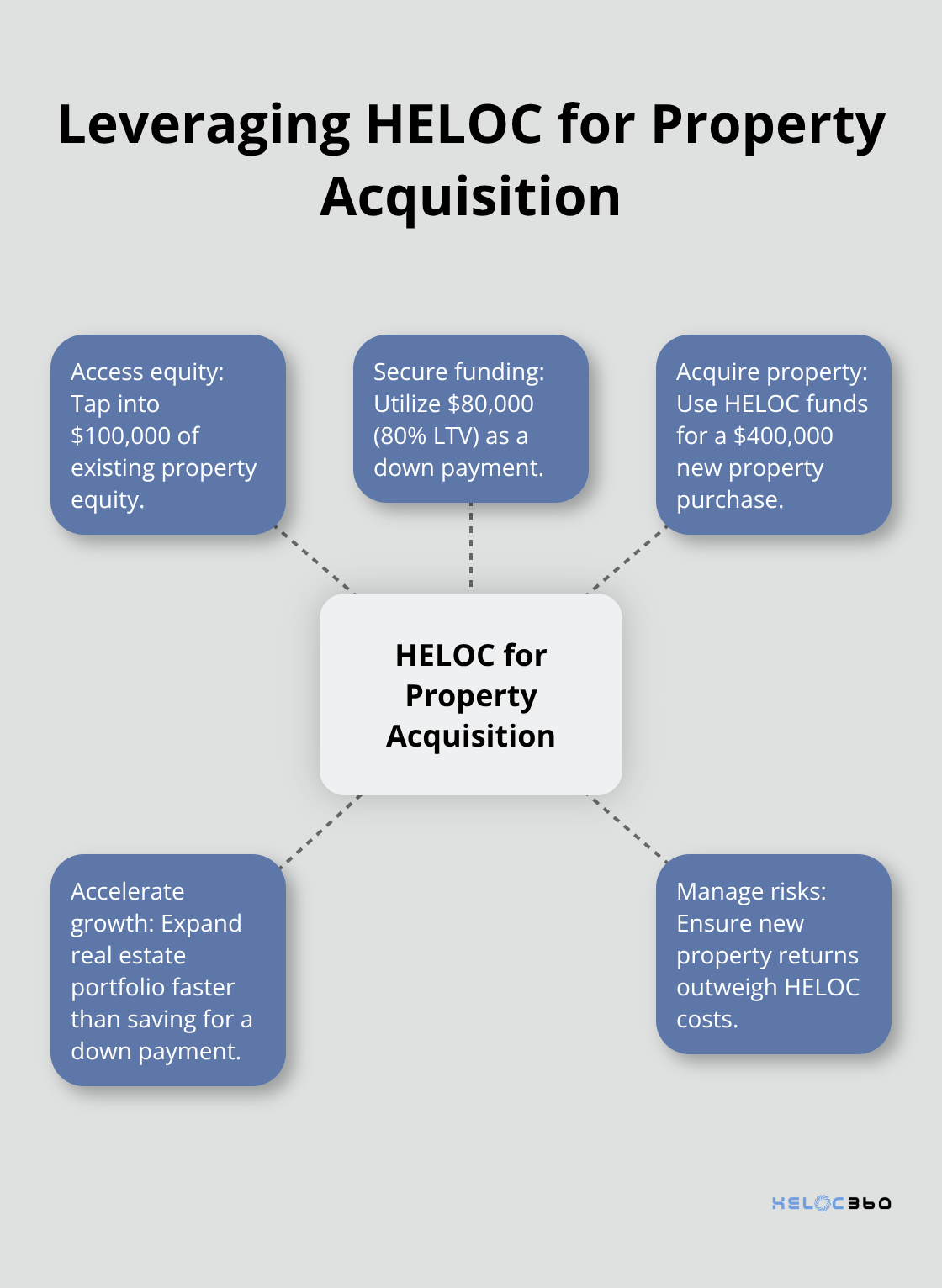

Leverage Equity for Portfolio Expansion

Investment property HELOCs allow you to leverage existing equity to expand your real estate portfolio. Instead of waiting years to save for a down payment on a new property, you can use your HELOC to act quickly on promising opportunities.

Consider this scenario: If you have $100,000 in equity in your current investment property, you could potentially use $80,000 (assuming an 80% LTV) as a down payment on a $400,000 property. This strategy allows you to acquire new properties faster, potentially accelerating your wealth-building through real estate.

However, it’s important to run the numbers carefully. You must ensure the new property’s potential returns outweigh the HELOC costs and risks.

Flexible Funding for Unexpected Expenses

Investment properties often come with unexpected expenses. A HELOC provides a financial safety net for these situations. Whether it’s an emergency repair or a sudden vacancy, you can access funds quickly without disrupting your cash flow or liquidating other assets.

This flexibility can prove invaluable in maintaining the profitability of your investment properties. It allows you to address issues promptly, minimizing downtime and potential loss of rental income.

As we explore the benefits of using HELOCs for investment properties, it’s equally important to understand the key considerations and potential risks involved. Let’s examine these factors in the next section to ensure you make informed decisions about leveraging HELOCs in your investment strategy.

Navigating the Challenges of Investment Property HELOCs

Higher Costs and Stricter Requirements

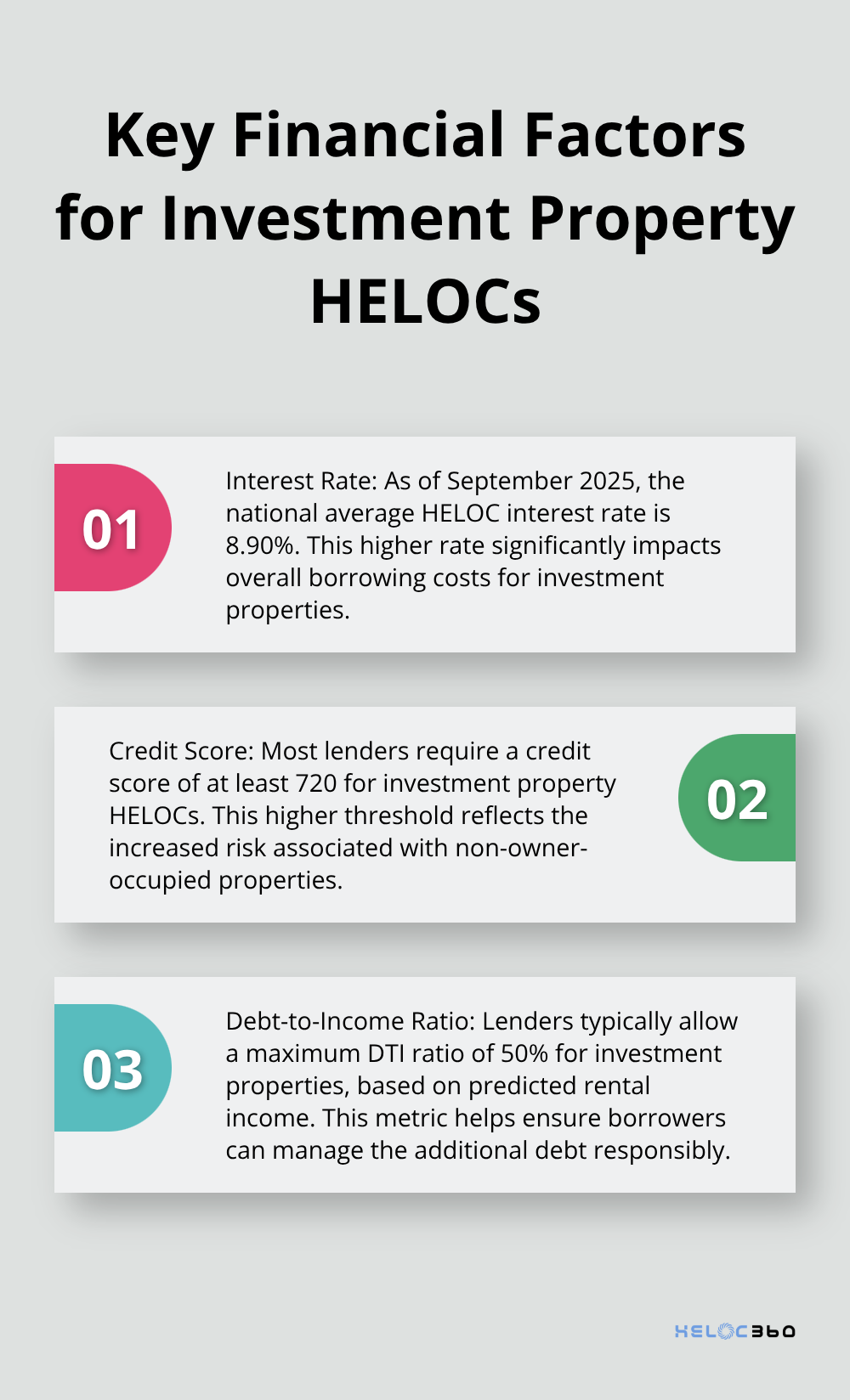

Investment property HELOCs come with higher interest rates compared to primary residence HELOCs. As of September 2025, the national average HELOC interest rate is 8.90%, which can significantly impact your overall borrowing costs.

Lenders impose stricter qualification requirements for investment property HELOCs. Most require a credit score of at least 720, a debt-to-income ratio of 43% or lower, and a combined loan-to-value ratio of 80% or less. You’ll also need to meet the lender’s income requirements.

Impact on Financial Metrics

Using a HELOC on your investment property affects important financial metrics. Your debt-to-income (DTI) ratio will increase, which could make it harder to qualify for future loans. Investment properties might allow a maximum DTI ratio of 50% based on predicted rental income.

Cash flow is another critical factor to consider. While HELOCs offer flexibility, they also introduce a new monthly payment. Make sure your rental income can cover this additional expense along with your existing mortgage, property taxes, and maintenance costs.

Risk Mitigation Strategies

The biggest risk of an investment property HELOC is the potential for foreclosure if you can’t repay. To mitigate this risk, create a solid repayment plan before borrowing. Consider setting aside a portion of your rental income specifically for HELOC payments.

It’s also wise to maintain a cash reserve. Try to keep at least six months of HELOC payments in savings to cover unexpected vacancies or repairs. This buffer can help you avoid defaulting on your HELOC during challenging times.

Analyzing Your Investment Strategy

Before pursuing an investment property HELOC, thoroughly analyze your investment strategy. Consider factors such as:

- Long-term investment goals

- Current and projected rental income

- Property appreciation potential

- Market conditions and trends

(These factors will help you determine if an investment property HELOC aligns with your overall real estate investment objectives.)

Choosing the Right Lender

Selecting the right lender is essential when considering an investment property HELOC. Look for lenders who:

- Specialize in investment property financing

- Offer competitive rates and terms

- Provide excellent customer service and support

(Some online platforms can help you compare offers from multiple lenders, making it easier to find the best fit for your needs.)

Final Thoughts

Investment HELOCs offer real estate investors a powerful tool to leverage their property’s equity. These financial instruments provide flexibility, potential tax benefits, and opportunities for portfolio expansion. However, they also come with higher costs, stricter requirements, and increased risks compared to primary residence HELOCs.

Investors must weigh the potential benefits against the risks when considering an investment HELOC. They should factor in their long-term investment goals, current market conditions, and individual financial situations. A solid repayment strategy and adequate cash reserves are essential to mitigate the risk of default.

HELOC360 offers valuable assistance for those exploring investment property HELOC options. The platform connects investors with suitable lenders and provides expert guidance (making the process more straightforward). Real estate investors can use HELOC360’s resources to make informed decisions about enhancing their investment strategies with HELOCs.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.