- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Curious about what a home equity line is? You’re not alone. Many homeowners are exploring this financial tool to tap into their property’s value.

At HELOC360, we’ve seen firsthand how HELOCs can provide flexible financing options for various needs. This guide will break down the basics, helping you understand if a HELOC might be right for your financial goals.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

What Is a Home Equity Line of Credit?

Definition and Basics

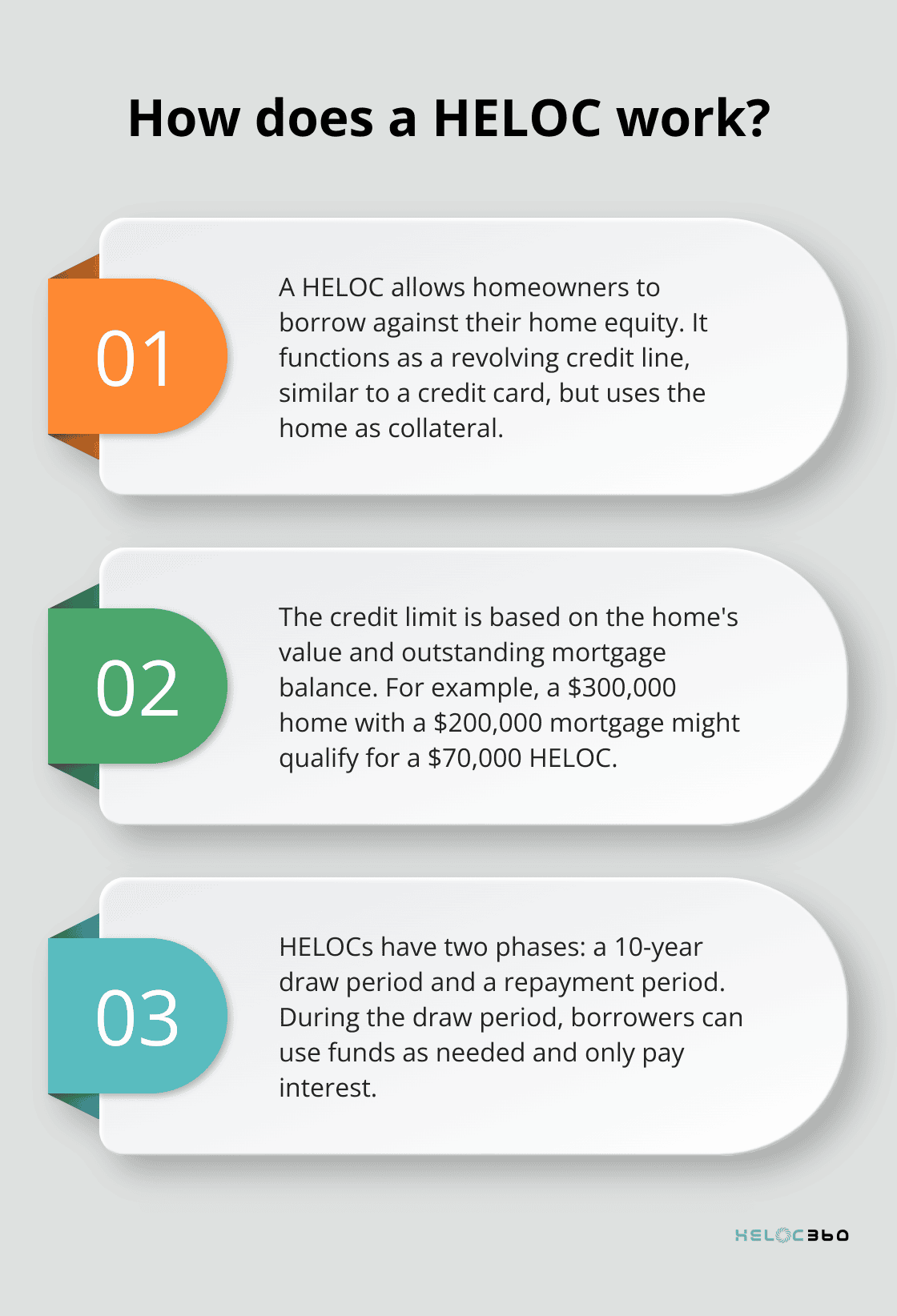

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against the equity they’ve built in their property. It functions as a revolving credit line, similar to a credit card, but uses your home as collateral.

How HELOCs Operate

When you obtain a HELOC, the lender sets a credit limit based on your home’s value and your outstanding mortgage balance. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, you might qualify for a HELOC of up to $70,000 (assuming the lender permits borrowing up to 90% of your home’s value).

HELOCs typically have two phases:

- Draw Period: This phase usually lasts 10 years. During this time, you can borrow funds as needed and only pay interest on what you use.

- Repayment Period: After the draw period ends, you start to pay back both principal and interest.

HELOC vs Traditional Loans

HELOCs differ from traditional loans in several ways:

- Flexibility: Unlike traditional loans that provide a lump sum, HELOCs offer more flexibility. You don’t have to use all the available credit at once, and you only pay interest on the amount you’ve borrowed. This feature makes HELOCs particularly useful for ongoing expenses like home renovations or education costs.

- Interest Rates: While traditional loans often have fixed rates, HELOCs typically come with variable rates. This means your payments could increase if interest rates rise.

Using Your Home as Collateral

It’s important to understand that a HELOC uses your home as collateral. This means if you can’t repay the loan, you risk losing your home.

Responsible HELOC Management

To use a HELOC effectively, you need to:

- Assess your financial situation carefully before taking on this type of debt.

- Create a solid repayment plan.

- Monitor interest rate changes and adjust your budget accordingly.

HELOCs can be powerful financial tools when managed responsibly. As you consider whether a HELOC fits your financial needs, it’s essential to weigh both the benefits and potential risks. In the next section, we’ll explore these pros and cons in more detail to help you make an informed decision.

Is a HELOC Right for You?

Flexibility and Lower Interest Rates

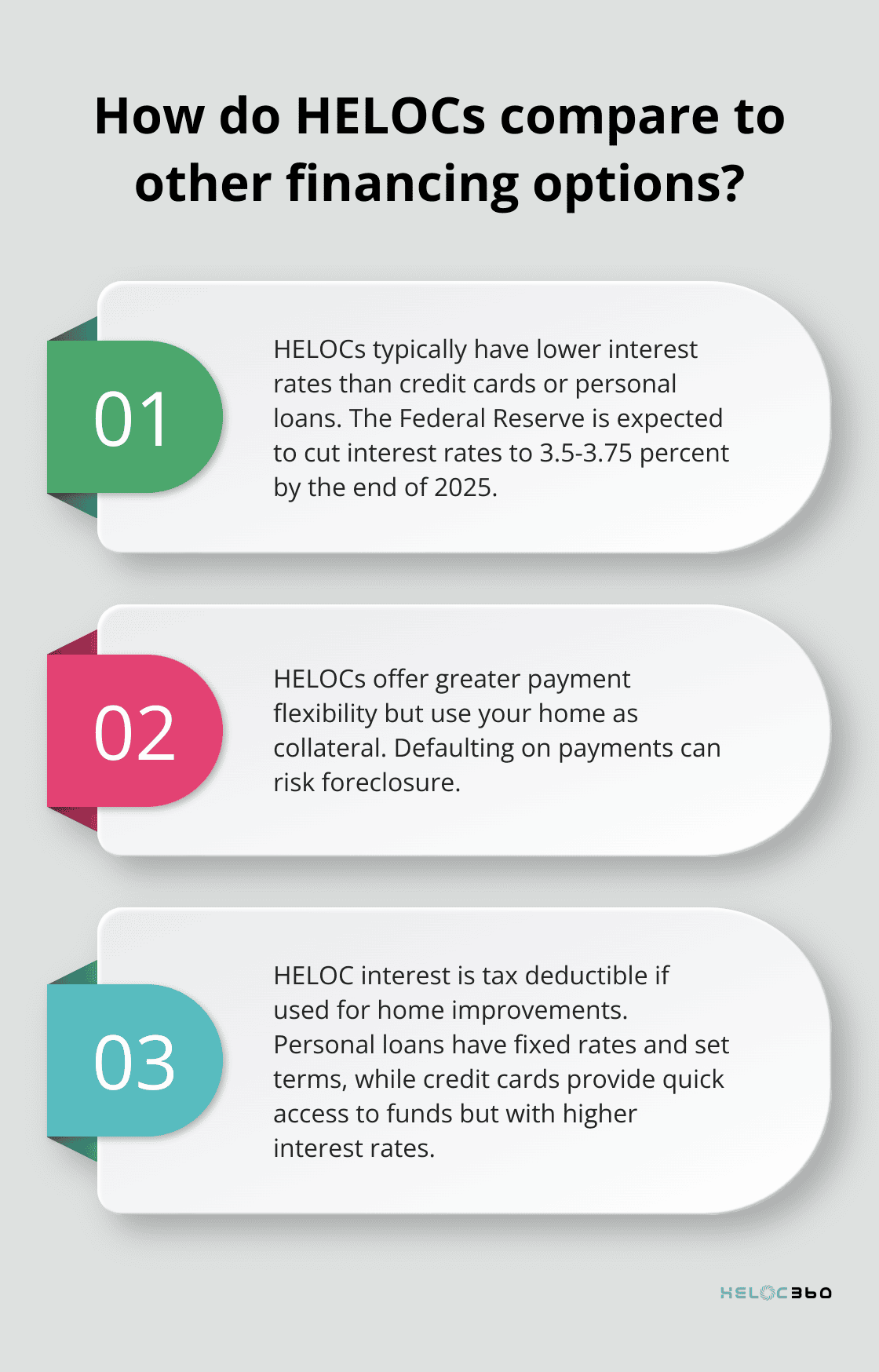

Home Equity Lines of Credit (HELOCs) offer unique advantages. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. This makes HELOCs ideal for ongoing expenses like home renovations or education costs.

Interest rates on HELOCs are often lower than those on credit cards or personal loans. According to projections, as of January 2025, the Federal Reserve is expected to cut interest rates three more times in 2025, bringing the key borrowing benchmark to 3.5-3.75 percent. This difference can lead to significant savings over time.

Tax Benefits and Potential Risks

Recent changes have limited the tax benefits of HELOCs. The interest on home equity loans and HELOCs is tax deductible as long as you use the funds to “buy, build or substantially improve your home.” Consult a tax professional to understand how this might apply to your situation.

Your home serves as collateral for a HELOC. If you default on payments, you risk foreclosure. This risk increases with variable interest rates, which can increase your monthly payments unexpectedly.

Comparison with Other Financing Options

Personal loans offer fixed rates and set repayment terms, which can be easier to budget for. However, they typically have higher interest rates than HELOCs.

Credit cards provide quick access to funds but come with much higher interest rates.

Avoiding Overborrowing

The ease of access to funds can lead to accumulating more debt than you can comfortably repay. It’s important to have a clear plan for using and repaying the funds before opening a HELOC.

Successful HELOC users typically create a detailed budget and stick to it, treating their HELOC as a strategic financial tool rather than an easy source of cash.

Qualifying for a HELOC

To qualify for a HELOC, lenders will evaluate several factors. These include your credit score, debt-to-income ratio, and the amount of equity in your home. Understanding these requirements can help you determine if you’re a good candidate for a HELOC.

How to Qualify for a HELOC

Credit Score Requirements

Most lenders require a credit score of at least 620 for HELOC approval. However, a score of 700 or higher will typically qualify you for better rates. If your score falls below the required minimum, you should improve it before applying.

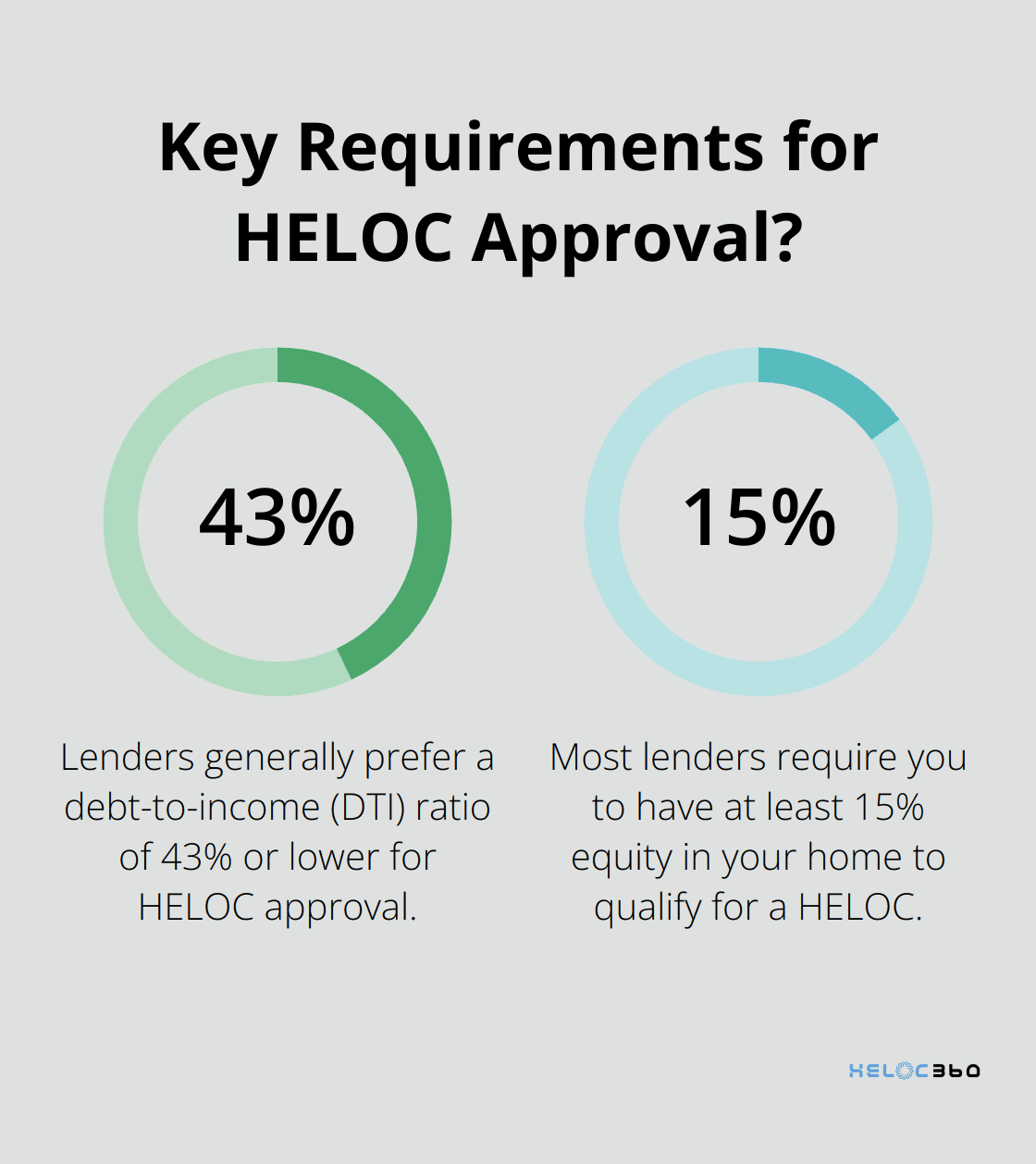

Debt-to-Income Ratio Considerations

Your debt-to-income (DTI) ratio plays a significant role in HELOC approval. Lenders generally prefer a DTI ratio of 43% or lower. To calculate your DTI, divide your monthly debt payments by your gross monthly income. For example, if you earn $5,000 monthly and have $1,500 in debt payments, your DTI is 30%.

Home Equity Calculation

Most lenders require you to have at least 15% equity in your home. To calculate your equity, subtract your current mortgage balance from your home’s current market value. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity (or about 33%).

Application Process

When you apply for a HELOC, you need to provide extensive documentation. This typically includes:

- Proof of income (W-2 forms, tax returns, pay stubs)

- Property information (deed, property tax statements)

- Mortgage statements

- Bank statements

- Investment account statements

The application process can take anywhere from 2-6 weeks (depending on the lender and your specific situation). Some online lenders may offer faster processing times.

Streamlining Your HELOC Application

HELOC360 simplifies this process by connecting you with lenders that match your profile and needs. Our platform helps you gather the necessary documentation and understand your options more clearly. We provide expert guidance to empower you with knowledge and make it easier to achieve your financial aspirations.

While meeting these qualifications is important, you should also assess whether a HELOC aligns with your financial goals and risk tolerance. Try to consult with a financial advisor to determine if a HELOC is the right choice for your situation.

Final Thoughts

Home Equity Lines of Credit (HELOCs) provide homeowners with a flexible way to access their property’s value. HELOCs offer potentially lower interest rates than other borrowing options, but they also carry risks such as variable rates and the possibility of foreclosure. Homeowners should assess their financial situation carefully before deciding on a HELOC, considering long-term goals, repayment ability, and comfort level with using their home as collateral.

Qualifying for a HELOC requires meeting credit score requirements, maintaining a healthy debt-to-income ratio, and having sufficient equity in your home. The application process can be complex and requires extensive documentation. If you want to understand what a home equity line is and how it might benefit you, HELOC360 can help simplify the process.

HELOC360 connects homeowners with lenders that match their unique profile and needs. We provide knowledge and tools to help you make informed decisions about home equity borrowing. Our platform aims to help you unlock the full potential of your home equity for renovations, debt consolidation, or creating financial flexibility.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.