A frozen HELOC can throw a wrench in your financial plans. At HELOC360, we understand the stress and uncertainty this situation can cause.

This guide will walk you through the steps to take when your HELOC gets frozen, helping you navigate this challenging financial landscape. We’ll also share tips on how to prevent future freezes and maintain your financial stability.

Why Lenders Freeze HELOCs

Declining Property Values: A Major Trigger

The primary reason lenders freeze Home Equity Lines of Credit (HELOCs) is a significant drop in property values. If your home’s value falls below the appraised value when you opened the HELOC, lenders may restrict access to protect themselves from potential losses. During the 2008 housing crisis, many homeowners faced HELOC freezes as property values plummeted nationwide.

Changes in Financial Circumstances

Your financial situation plays a vital role in maintaining HELOC access. Job loss, income reduction, or increased debt can trigger a freeze. Lenders continuously monitor borrowers’ creditworthiness, and any negative changes may lead to restricted access. In fact, some lenders even froze credit lines of existing HELOCs, or called in the debt completely during economic downturns.

How to Recognize a HELOC Freeze

You’ll typically receive written notice from your lender when a freeze occurs. However, you might first notice the freeze when attempting to make a withdrawal and finding it denied. Regular checks of your online account or recent statements can help you spot any changes in your credit limit or access.

Common Misconceptions About HELOC Freezes

Many borrowers incorrectly believe that making regular payments guarantees continued access to their HELOC. However, external factors like market conditions can still lead to freezes. Another widespread myth is that freezes are permanent. In reality, most freezes are temporary and can be lifted once the underlying issues are resolved.

The Impact of Market Conditions

Market conditions (such as economic downturns or housing market fluctuations) can significantly influence a lender’s decision to freeze HELOCs. These factors often operate independently of individual borrower behavior, which means even financially responsible homeowners may face freezes during turbulent economic times.

Proactive communication with lenders and improving financial indicators often lead to the reinstatement of frozen HELOCs. A freeze doesn’t necessarily reflect poorly on you as a borrower but is often a precautionary measure taken by lenders in response to market conditions or perceived risk. Understanding these factors can help you navigate the complexities of HELOC management and prepare for potential challenges.

What Should You Do When Your HELOC Freezes?

Contact Your Lender Immediately

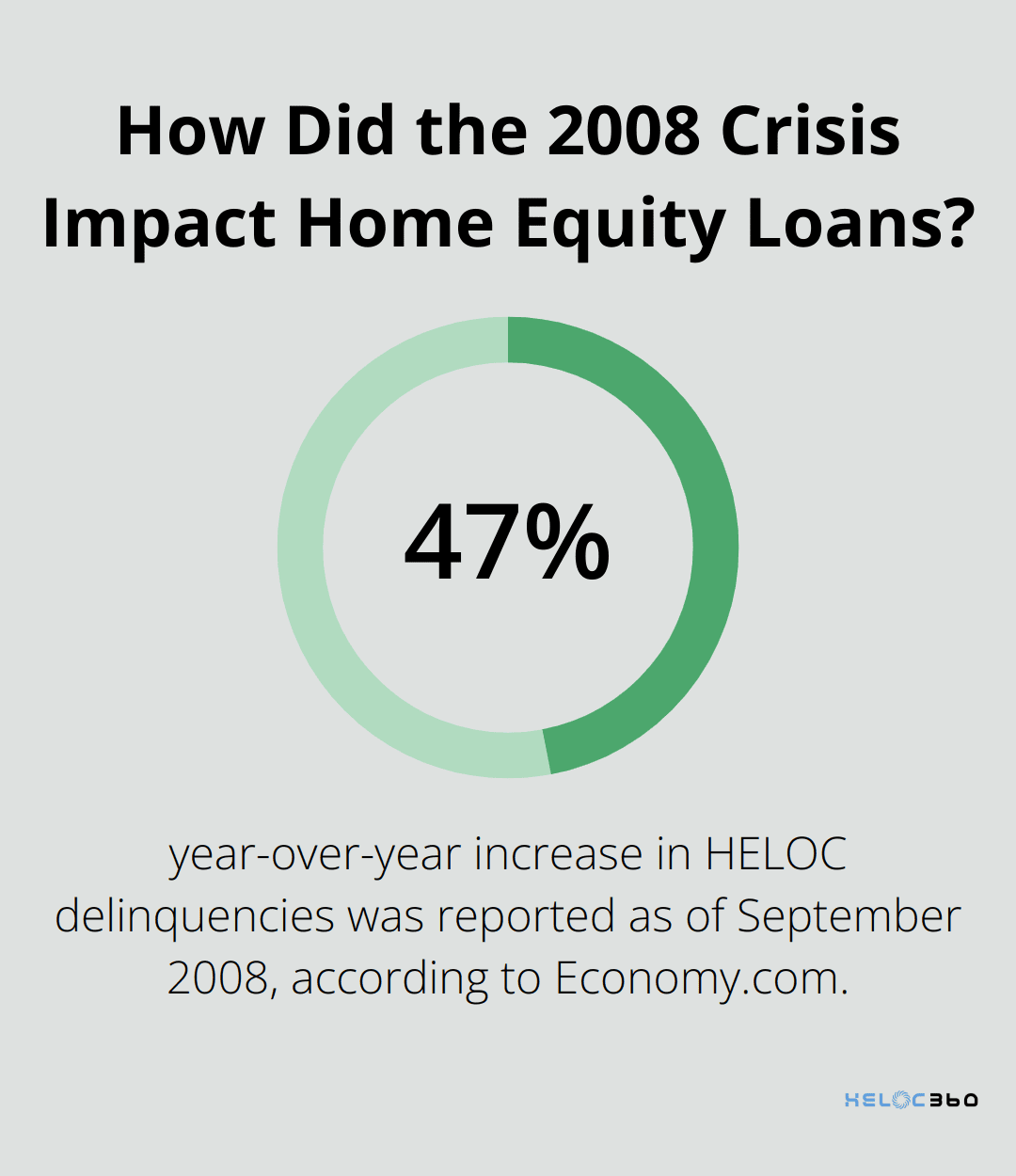

When you discover your Home Equity Line of Credit (HELOC) has been frozen, act quickly. Contact your lender immediately. Don’t wait for them to reach out to you. Ask for a detailed explanation of the freeze and the conditions needed to lift it. As of September 2008, delinquencies on HELOCs were up 47% year over year, according to Economy.com, with numbers expected to be worse in 2008.

During this conversation, ask about any appeal process. Some lenders have formal procedures for reviewing freeze decisions, especially if your financial situation has improved or if you can provide updated information about your property’s value.

Review Your Loan Agreement

Take out your original HELOC agreement and review the terms related to credit freezes or reductions. Focus on sections detailing the lender’s rights and your responsibilities. HELOCs generally permit the lender to freeze or reduce your credit line if the value of your home falls or if they see a change for the worse in your financial situation.

Understanding these terms will empower you in discussions with your lender and help you determine if the freeze aligns with your agreement. If you find discrepancies, bring them to your lender’s attention promptly.

Explore Alternative Financing Options

While you work to unfreeze your HELOC, you might need to explore other financing avenues to meet your immediate needs. Personal loans, credit cards, or even a new HELOC with a different lender could serve as viable alternatives. However, each option comes with its own set of advantages and disadvantages.

Personal loans typically offer fixed interest rates (which can be advantageous in a rising rate environment). Credit cards often carry higher interest rates but can provide quick access to funds. If you consider a new HELOC, compare offers from multiple lenders to potentially find more favorable terms than your current frozen line.

The goal is to find a solution that addresses your immediate financial needs without compromising your long-term financial health. Weigh the costs and benefits of each option carefully before you make a decision.

Provide Updated Financial Information

Your lender might have frozen your HELOC due to outdated or incomplete financial information. Provide updated financial information to your lender. This may include:

- Recent pay stubs or proof of income

- Bank statements

- Tax returns

- An updated list of assets and liabilities

This information can demonstrate your current financial stability and potentially persuade your lender to lift the freeze. It’s also important to continue making monthly payments on your HELOC while discussing options with your lender.

Consider a New Property Appraisal

If your HELOC freeze resulted from a perceived decrease in your property’s value, a new appraisal might help. While this option involves an upfront cost (typically $300-$500), it could provide evidence that your home’s value remains sufficient to support your HELOC.

Before you proceed with an appraisal, discuss this option with your lender. They might have specific requirements or preferred appraisers. A favorable appraisal could strengthen your case for unfreezing your HELOC and restore your access to this valuable financial tool.

How to Prevent HELOC Freezes

Strengthen Your Credit Profile

Your credit score significantly impacts your HELOC’s stability. As of Q3 2024, the average FICO Score in the U.S. was 715, unchanged from the same period in the previous year. Try to keep your score above this average. Pay all bills on time, maintain low credit card balances, and limit new credit applications. These actions can improve your creditworthiness in your HELOC lender’s eyes.

Protect Your Property’s Value

Home value is a key factor in HELOC decisions. Regular maintenance and strategic improvements can maintain or increase your property’s worth. The National Association of REALTORS® provides the latest real estate research and statistics that affect the industry. Consider improvements to keep your property value stable or growing.

Make All Payments on Time

Consistent, on-time payments are essential. Set up automatic payments to avoid missing due dates. Even one missed payment can potentially trigger a HELOC freeze.

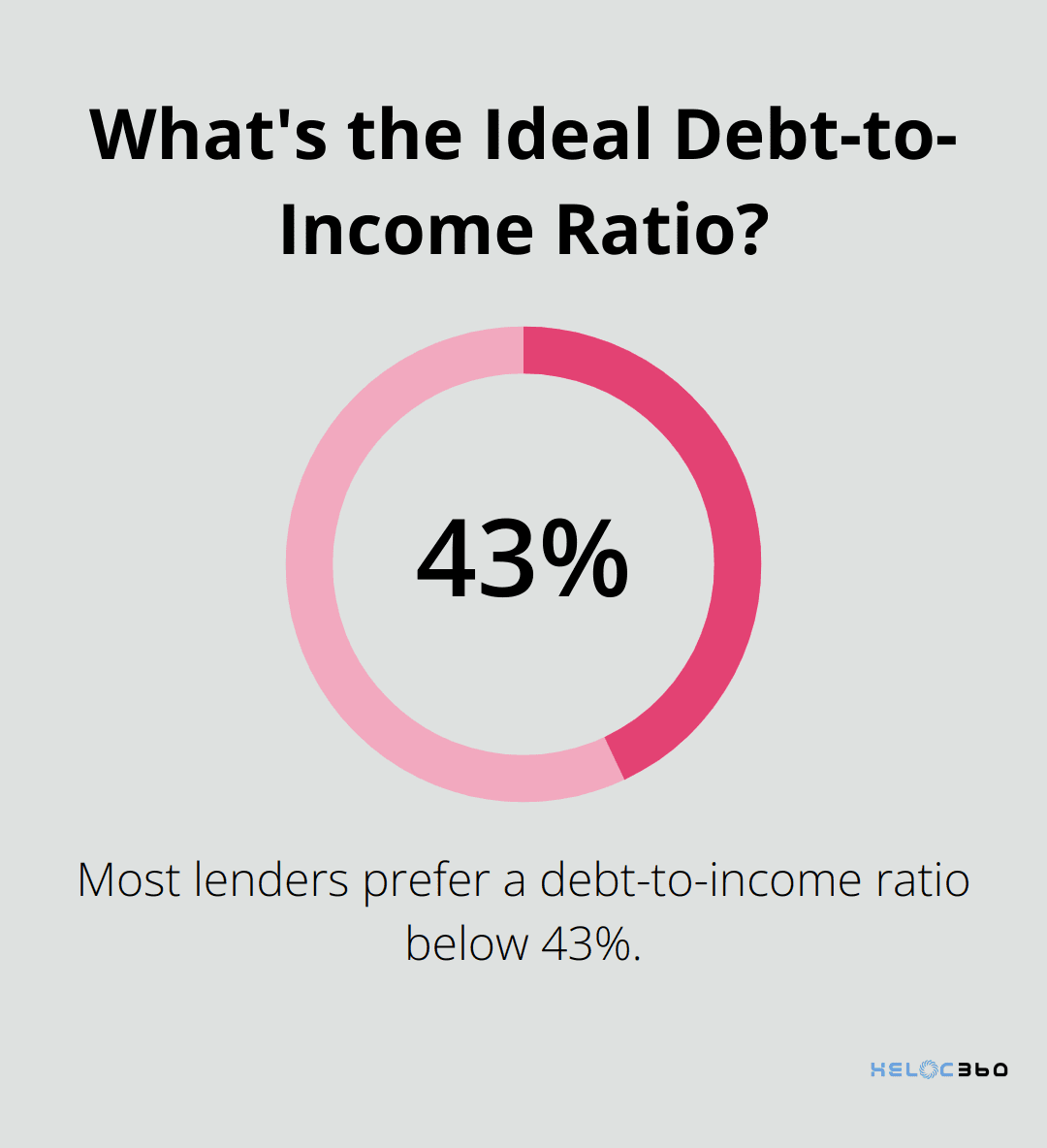

Control Your Debt-to-Income Ratio

Lenders closely monitor your debt-to-income (DTI) ratio. Most prefer a DTI below 43%. If your ratio increases, pay down some debts or find ways to increase your income. This proactive approach can prevent your lender from viewing you as a higher risk borrower.

Communicate with Your Lender Regularly

Don’t wait for your lender to contact you. Establish a habit of regular check-ins, especially if you anticipate changes in your financial situation. This open line of communication can help you address potential issues before they lead to a freeze.

Final Thoughts

A frozen HELOC can cause stress, but swift action will help you overcome this challenge. Contact your lender immediately, review your loan agreement, and explore alternative financing options. You can strengthen your case by providing updated financial information and considering a new property appraisal.

You can take steps to prevent HELOC freezes. Maintain a strong credit profile, protect your property’s value, and pay all bills on time. Keep your debt-to-income ratio low and communicate regularly with your lender (these proactive measures can help you avoid future freezes).

At HELOC360, we simplify the HELOC process and offer expert guidance. Our platform connects you with lenders that match your unique needs. We provide the tools and knowledge you need to make informed decisions about your home equity.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.