In uncertain times, having a financial safety net is more important than ever. A Home Equity Line of Credit (HELOC) can be an excellent tool for this purpose, offering flexibility and potential HELOC savings compared to other credit options.

At HELOC360, we’ve seen how HELOCs have helped homeowners weather unexpected financial storms. This post will explore why a HELOC could be the financial safety net you need and how to use it wisely.

What Is a HELOC and How Can It Protect You?

Understanding the Basics of a HELOC

A Home Equity Line of Credit (HELOC) is a revolving line of credit that allows homeowners to borrow against the equity they’ve built in their home. This type of credit can act as your safety net during uncertain times, providing access to funds when you need them most.

How a HELOC Operates

When you open a HELOC, your lender approves you for a maximum credit limit based on your home’s value and your outstanding mortgage balance. You can then draw from this credit line as needed, similar to a credit card. This flexibility stands out as a key advantage of HELOCs.

For instance, if a lender approves you for a $100,000 HELOC, you don’t have to use all of it at once. You might draw $20,000 for a home renovation project, leaving $80,000 available for future needs. This approach allows you to access funds without overextending yourself financially.

Flexible Fund Access

One of the most attractive features of a HELOC is its flexibility. Unlike a traditional loan where you receive a lump sum, a HELOC allows you to borrow only what you need, when you need it. This can prove particularly useful for ongoing expenses or unexpected costs.

Consider a series of home improvements planned over time. With a HELOC, you can draw funds as each project begins, rather than borrowing the entire amount upfront. This approach can help you manage your debt more effectively and potentially save on interest costs.

Cost-Effective Borrowing Option

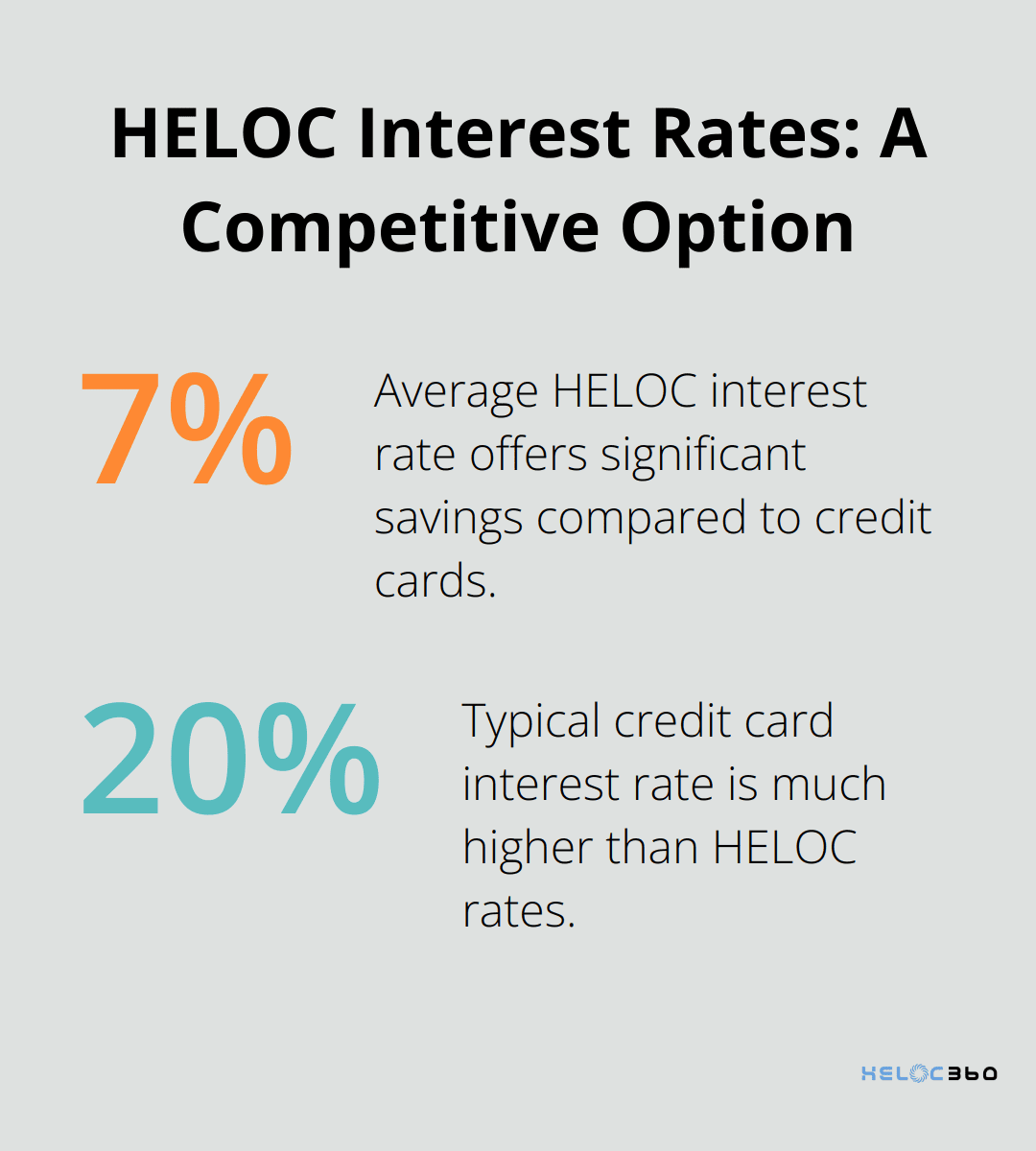

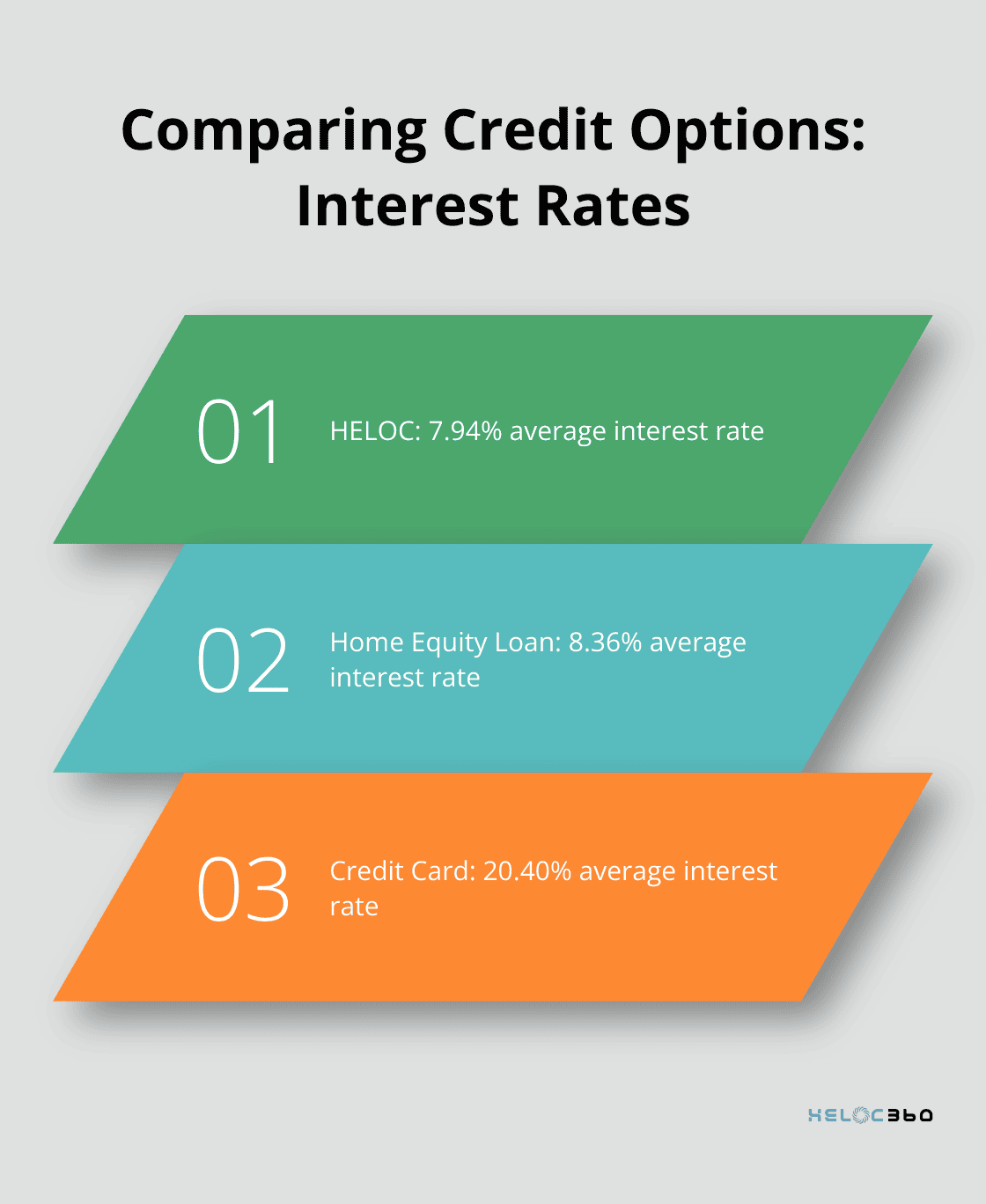

HELOCs typically offer lower interest rates compared to credit cards or personal loans. According to recent data from Bankrate, the national average HELOC interest rate is 7.94%, as of April 23, 2025.

This significant difference in rates can translate to substantial savings over time. For a $50,000 balance, the interest savings could amount to thousands of dollars per year when choosing a HELOC over a credit card.

Many homeowners leverage these lower rates to consolidate high-interest debt, fund major expenses, or create a financial buffer for emergencies. Through strategic use of a HELOC, you can potentially reduce your overall borrowing costs and improve your financial stability.

A HELOC can provide an excellent financial safety net, but it requires responsible use. Your home serves as collateral for the loan, so it’s important to have a solid repayment plan in place. With careful planning and smart use, a HELOC can provide the financial flexibility and security you need to navigate life’s uncertainties with confidence.

As we move forward, let’s explore the key benefits of using a HELOC as an emergency fund and how it can provide quick access to large sums of money when you need it most.

Why HELOCs Excel as Emergency Funds

Rapid Access to Substantial Funds

HELOCs stand out as powerful tools for emergency funds, offering unique advantages that set them apart from traditional savings accounts or credit cards. The quick access to large sums of money is one of the most significant benefits of using a HELOC as an emergency fund. Once your HELOC is set up, you can typically access funds within a day or two (sometimes even on the same day). This speed proves invaluable when facing unexpected expenses like major home repairs or medical emergencies.

For instance, if your roof suddenly needs replacement after a severe storm, a HELOC can provide the necessary funds quickly, allowing you to address the issue before it causes further damage to your home.

Flexible Repayment Options

During the draw period of a HELOC (which typically lasts 5 to 10 years), you often have the option to make interest-only payments. This feature can be particularly beneficial during financial emergencies, as it allows you to keep your monthly payments low while you navigate the crisis.

Consider a scenario where you lose your job and need to tap into your HELOC. You could potentially make only interest payments for several months until you secure new employment. This flexibility helps you manage your cash flow during challenging times without defaulting on your obligations.

Potential Tax Advantages

HELOCs may offer tax benefits in certain situations (although it’s essential to consult with a qualified tax advisor for personalized advice). Deducting home equity loan interest can save you money on your tax bill, but you have to understand the rules under the Tax Cuts and Jobs Act (TCJA) of 2017.

For example, if you use your HELOC to add a new room to your house or renovate your kitchen, you might be able to deduct the interest on your taxes. This potential tax advantage can make a HELOC a more cost-effective option compared to other forms of credit, especially for home-related emergencies or improvements.

However, these tax benefits are subject to certain limits and conditions. The IRS caps the total amount of home loan debt eligible for the deduction at $750,000 for married couples filing jointly, or $375,000 for single filers.

Lower Interest Rates

HELOCs typically offer lower interest rates compared to credit cards or personal loans. As of April 23, 2025, the national average home equity loan interest rate is 8.36%, according to Bankrate’s latest survey of the nation’s largest home equity lenders. This significant difference in rates can translate to substantial savings over time.

For a $50,000 balance, the interest savings could amount to thousands of dollars per year when choosing a HELOC over a credit card. Many homeowners leverage these lower rates to consolidate high-interest debt, fund major expenses, or create a financial buffer for emergencies.

Now that we’ve explored the key benefits of using a HELOC as an emergency fund, let’s examine some smart ways to utilize your HELOC as a safety net in various life situations.

How Can You Leverage Your HELOC Wisely?

A Home Equity Line of Credit (HELOC) can serve as a powerful financial tool when used strategically. This chapter explores smart ways to leverage your HELOC as a safety net, preparing you for various life situations.

Fund Home Improvements and Repairs

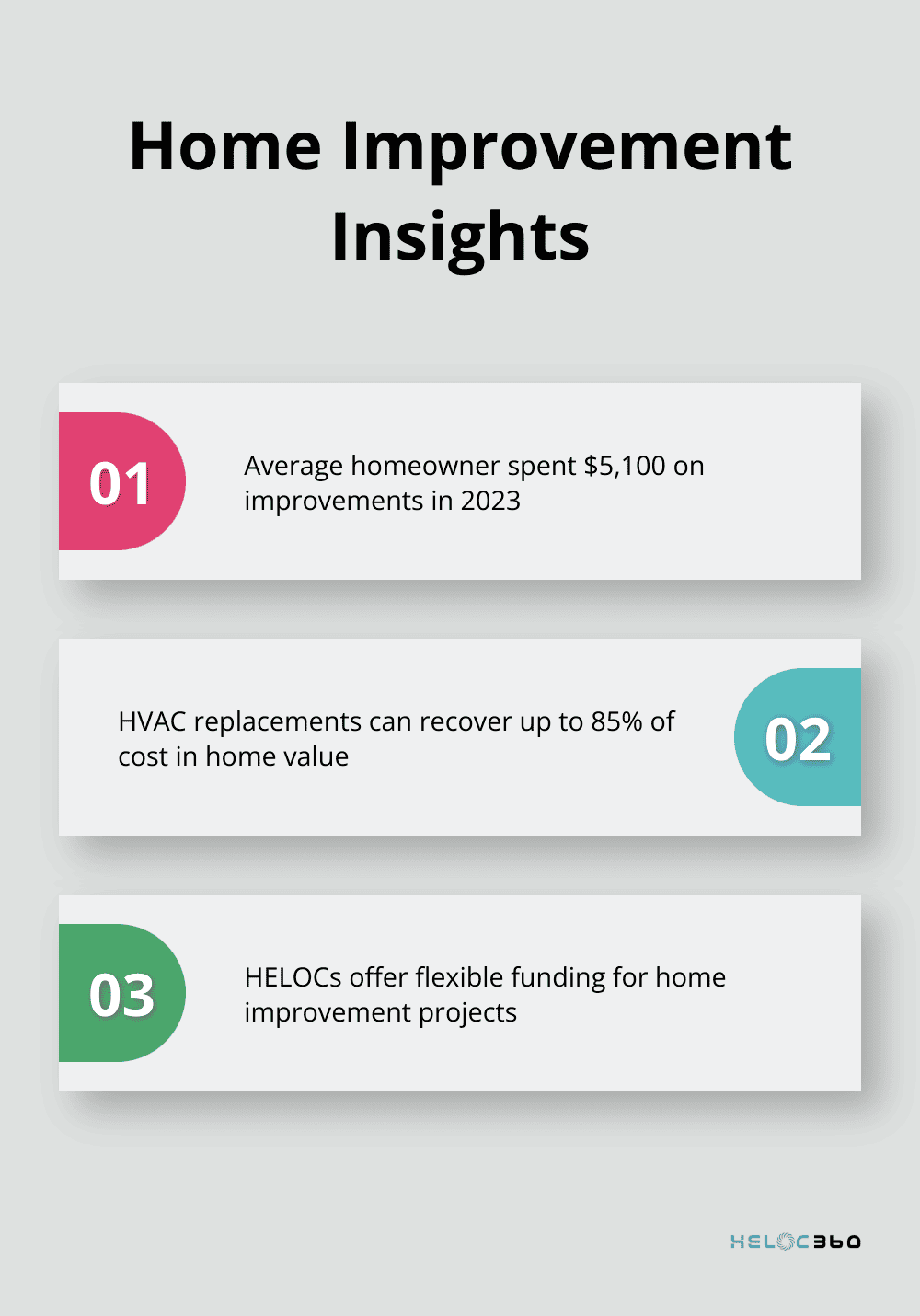

One of the most common and beneficial uses of a HELOC is for home improvements and repairs. A recent study by Harvard University’s Joint Center for Housing Studies found that homeowners spent an average of $5,100 on home improvements in 2023. A HELOC can help you tackle these projects without depleting your savings.

For example, if your HVAC system unexpectedly fails, a HELOC provides quick access to funds for replacement. This not only maintains your home’s comfort but also potentially increases its value. The National Association of Realtors reports that HVAC replacements can recover up to 85% of their cost in home value.

Manage Debt Consolidation

HELOCs often offer lower interest rates compared to credit cards, making them an excellent option for debt consolidation. The Federal Reserve Bank of New York reported that the average credit card interest rate was 20.40% in Q1 2025, while HELOC rates averaged around 8% during the same period.

If you have $20,000 in credit card debt at 20% APR, you’ll pay about $4,000 in interest annually. Transferring this debt to a HELOC at 8% APR could potentially save you $2,400 in interest payments each year. This strategy can significantly accelerate your debt repayment journey.

Cover Education Expenses

Education costs continue to rise, with the College Board reporting an average annual cost of $27,940 for in-state public colleges in the 2024-2025 academic year. A HELOC can serve as a flexible funding option for these expenses.

Unlike student loans (which often have disbursement schedules tied to academic terms), a HELOC allows you to draw funds as needed. This flexibility proves particularly useful for covering unexpected education-related costs or bridging gaps in financial aid.

Handle Medical Emergencies

Medical emergencies can devastate finances. A study by the American Journal of Public Health found that 66.5% of bankruptcies were tied to medical issues. A HELOC can provide a financial buffer for these unexpected health-related expenses.

For instance, if you face a $5,000 medical bill, using a HELOC at 8% APR instead of a credit card at 20% APR could save you $600 in interest over the course of a year. This approach can help you manage medical debt more effectively and prevent it from spiraling out of control.

Create a Financial Safety Net

A HELOC can act as a financial safety net, providing peace of mind for unexpected expenses or income disruptions. You can establish a HELOC without immediately drawing funds, ensuring you have access to credit when needed without incurring interest charges until you use it.

This strategy allows you to maintain liquidity without keeping large sums of cash in low-yield savings accounts. However, it’s important to use this safety net responsibly and have a solid repayment plan in place to avoid overextending yourself.

Final Thoughts

A Home Equity Line of Credit (HELOC) offers homeowners a versatile financial safety net. HELOCs provide quick access to substantial funds, flexible repayment options, and potential tax advantages, helping you navigate various financial challenges. The potential for HELOC savings compared to other credit options makes it an attractive choice for many homeowners, especially when used for debt consolidation or large expenses.

Responsible HELOC borrowing requires careful planning and strategic use. Your home serves as collateral for the loan, so you must have a solid repayment plan in place. HELOC360 understands the importance of making informed decisions about your home equity and offers expert guidance to help you unlock your home’s full potential.

Our platform connects you with lenders that fit your unique needs, simplifying the HELOC process and offering comprehensive support. HELOC360 empowers homeowners to transform their home’s value into a gateway for new opportunities (including potential tax benefits), making it easier to achieve financial aspirations and secure a stable future.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.