In today’s uncertain economic climate, having a financial safety net is more important than ever. A Home Equity Line of Credit (HELOC) can be an excellent tool for homeowners looking to secure their financial future.

At HELOC360, we’ve seen firsthand how a HELOC can provide peace of mind and financial flexibility. Whether you’re facing unexpected expenses or seeking to capitalize on opportunities, a HELOC emergency fund can be your ultimate financial backstop.

What Is a HELOC and How Does It Work?

The Basics of a Home Equity Line of Credit

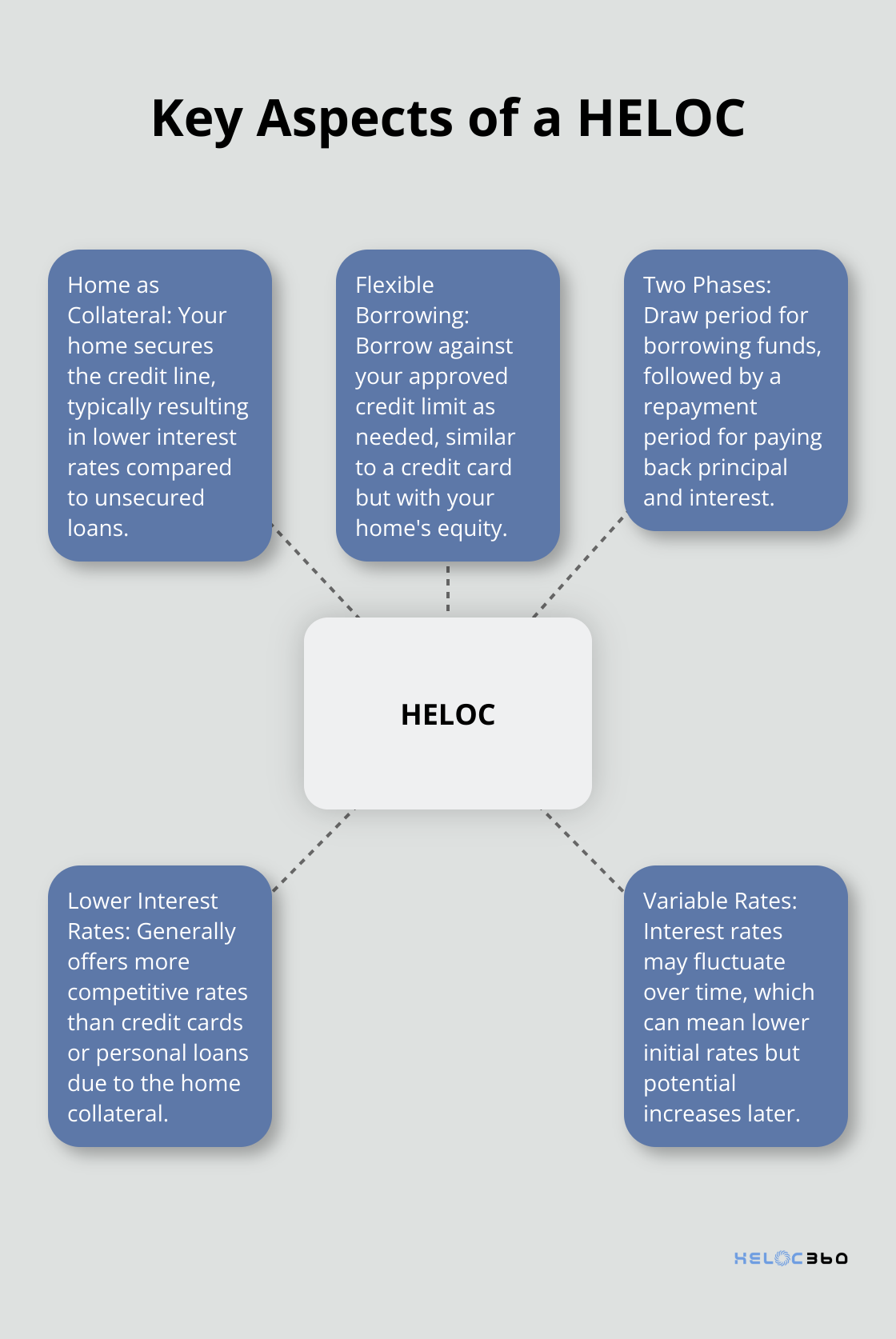

A Home Equity Line of Credit (HELOC) is a powerful financial tool that allows homeowners to access their home’s equity. It functions as a revolving credit line secured by your home, providing funds as needed.

When you open a HELOC, the lender approves you for a maximum credit limit based on your home’s value and your creditworthiness. You can then borrow against this limit as needed, similar to a credit card. The key difference is that your home serves as collateral, which typically results in lower interest rates compared to unsecured loans.

The Two Phases of a HELOC

HELOCs usually have two distinct phases:

- The Draw Period: This phase often lasts several years. During this time, you can borrow funds and may only need to make interest payments.

- The Repayment Period: After the draw period ends, you must pay back both principal and interest.

HELOC vs. Traditional Loans

HELOCs offer more flexibility than traditional loans. With a HELOC, you only pay interest on the amount you use, not the entire credit line. This can lead to significant savings compared to taking out a large loan all at once.

Another key difference is the variable interest rate typically associated with HELOCs. While this can mean lower initial rates, it’s important to prepare for potential rate increases over time. (Some lenders offer options to convert portions of your balance to fixed rates for added stability.)

Leveraging Your Home’s Equity

Your home equity is the difference between your home’s market value and your mortgage balance. As you pay down your mortgage and your home potentially appreciates in value, your equity grows. A HELOC allows you to tap into this equity without selling your home.

This can be a smart financial move for several reasons:

- It provides access to potentially large sums of money at relatively low interest rates.

- It offers flexibility in how you use the funds (e.g., home improvements, debt consolidation, or as an emergency fund).

However, it’s crucial to approach a HELOC with caution. Since your home secures the line of credit, defaulting on payments could put your home at risk of foreclosure. That’s why it’s essential to have a solid repayment plan in place before borrowing.

The Power of Responsible HELOC Use

Many homeowners have successfully used HELOCs to achieve their financial goals. Platforms like HELOC360 can help you understand if a HELOC is right for your situation and connect you with lenders offering competitive terms. A HELOC can be a powerful financial tool when used responsibly and with a clear purpose in mind.

As we explore the benefits of using a HELOC as a financial safety net in the next section, you’ll see how this versatile tool can provide peace of mind and financial flexibility in various situations.

Why HELOCs Are Your Financial Lifeline

Unparalleled Flexibility for Life’s Surprises

Life throws curveballs, and quick access to funds can make all the difference when unexpected expenses arise. A Home Equity Line of Credit (HELOC) provides ongoing access to funds. Unlike a conventional loan, a HELOC is a revolving line of credit, allowing you to borrow more than once. This means you can cover emergency home repairs, sudden medical bills, or even seize unexpected investment opportunities without scrambling for funds.

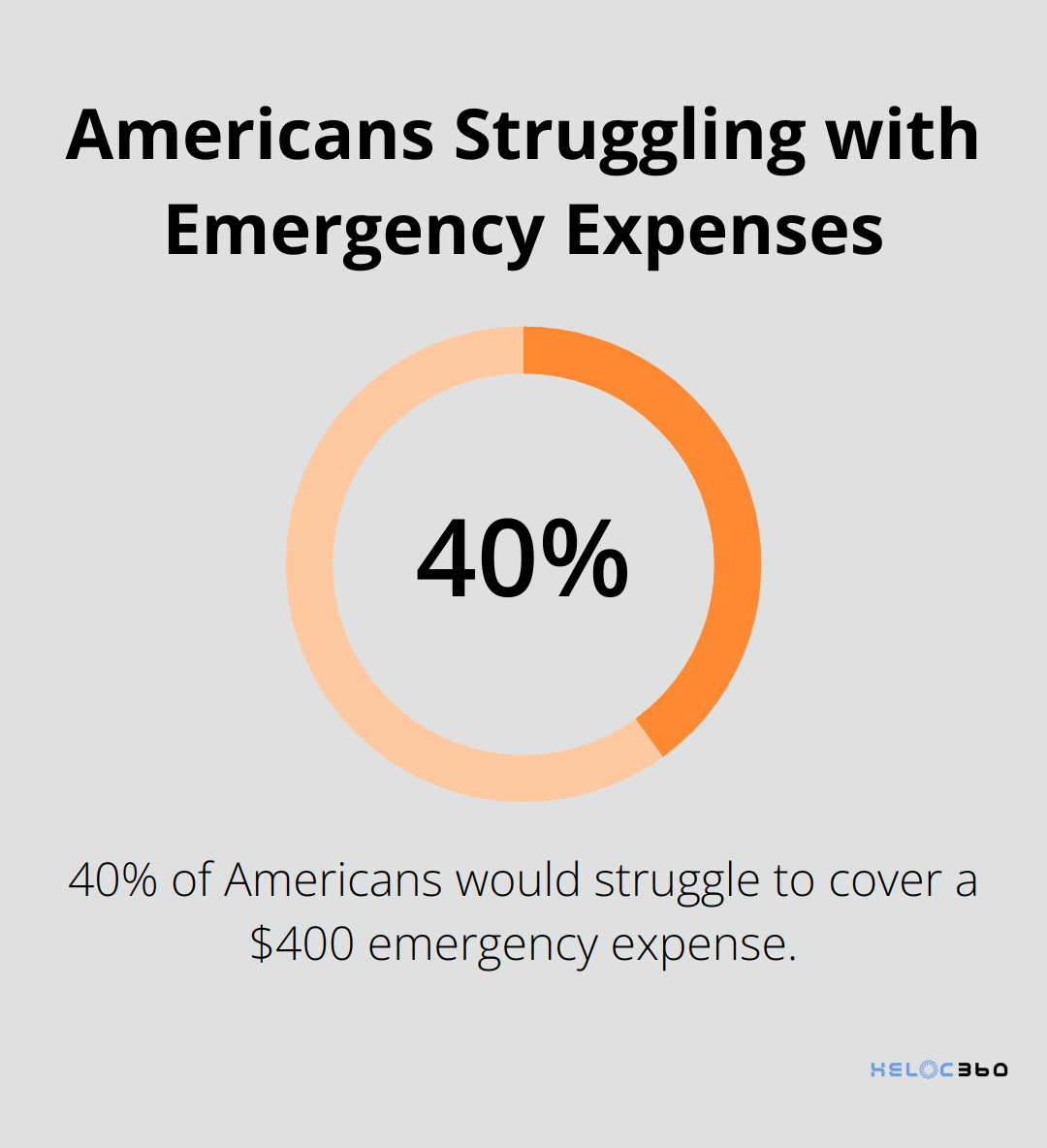

A study by the Federal Reserve reveals that 40% of Americans would struggle to cover a $400 emergency expense. A HELOC bridges this gap, offering peace of mind and financial stability.

Cost-Effective Borrowing

HELOCs typically offer significantly lower interest rates compared to credit cards and personal loans. As of June 25, 2025, the national average HELOC interest rate is 8.27%, while credit card rates often exceed 20%. This difference translates to substantial savings over time.

Consider this example: If you borrow $50,000, the interest over five years could amount to approximately $11,375 with a HELOC at 8.27%, compared to $29,000 with a credit card at 20%. That’s a potential saving of over $17,000!

Flexible Repayment Options

The draw period of a HELOC (typically lasting 5-10 years) often allows for interest-only payments. This feature can revolutionize cash flow management, especially during times of financial strain.

For instance, if you borrow $50,000 at 8.27%, your monthly interest-only payment would be around $345. This low payment requirement gives you room to manage other financial priorities or recover from temporary setbacks.

Tax Advantages Worth Exploring

While tax laws can change, HELOCs have historically offered potential tax benefits. As of 2025, interest paid on HELOCs used for home improvements may be tax-deductible (consult with a qualified tax professional for specifics). This can further reduce the effective cost of borrowing.

A Powerful Tool for Financial Management

HELOCs offer a unique combination of flexibility, cost-effectiveness, and potential tax advantages that make them an excellent choice for a financial safety net. By providing access to your home’s equity at competitive rates, a HELOC empowers you to navigate financial challenges and opportunities with confidence.

As we move forward, let’s explore how you can strategically use a HELOC to enhance your overall financial security and achieve your long-term goals.

Maximizing Your HELOC for Financial Stability

Creating a Robust Emergency Fund

A Home Equity Line of Credit (HELOC) serves as an excellent backup emergency fund. Financial advisors recommend saving 3-6 months of expenses, but a HELOC provides an additional safety net. Major home repairs or unexpected medical expenses can be covered without depleting your savings. Use your HELOC only for genuine emergencies and repay borrowed amounts quickly to minimize interest charges.

Smart Debt Consolidation

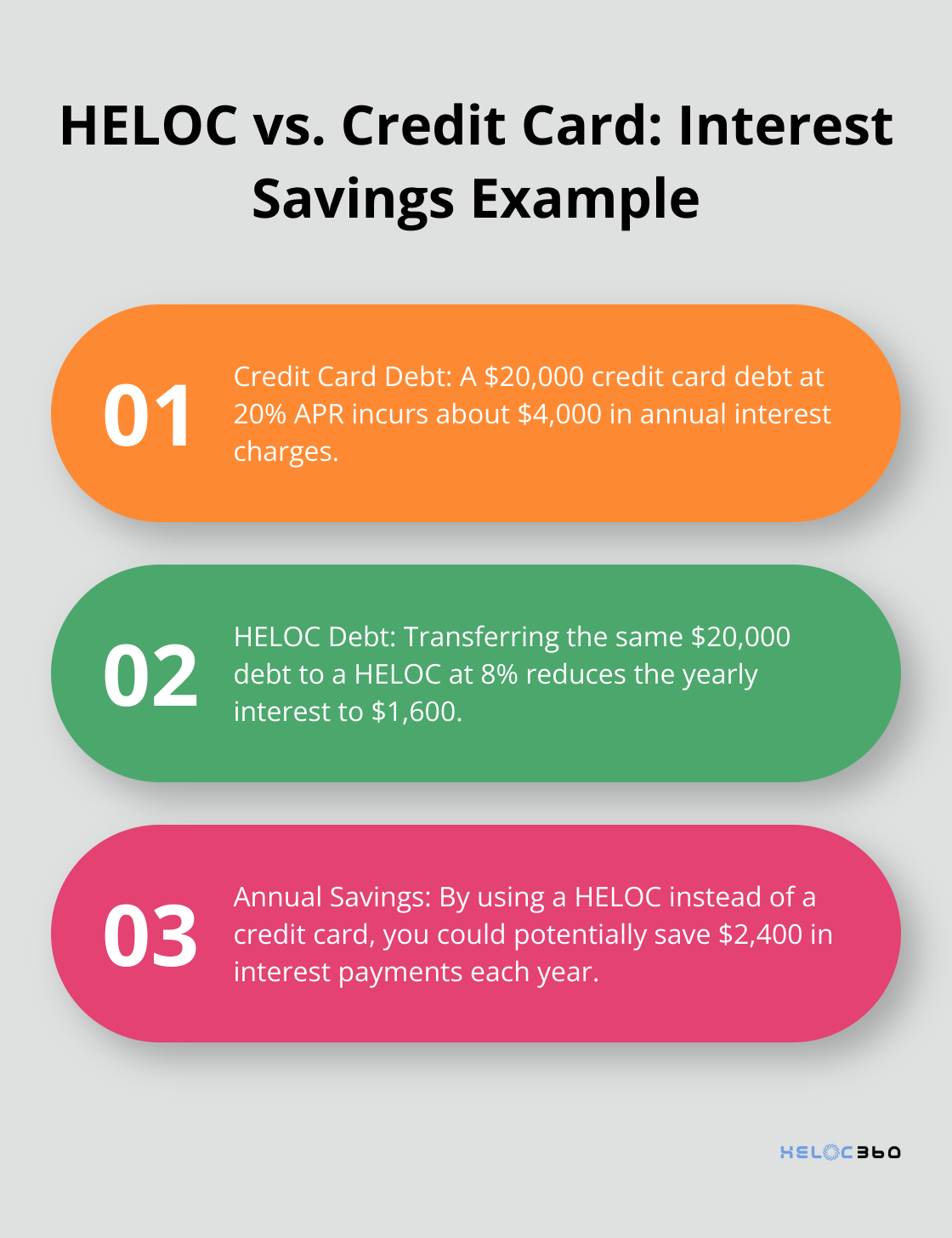

HELOCs offer a powerful strategy for debt consolidation. With credit card interest rates around 20%, consolidating these debts with a HELOC (typically under 10%) leads to substantial savings. A $20,000 credit card debt at 20% APR incurs about $4,000 in annual interest. Transferring this to a HELOC at 8% reduces yearly interest to $1,600 – a $2,400 saving. Use this strategy carefully and avoid accumulating new debt on paid-off credit cards.

Funding Education and Business Ventures

HELOCs provide excellent funding for education or business opportunities. Federal student loan interest rates for 2025-2026 are 6.39% for undergraduates, making HELOCs potentially more competitive for graduate or professional studies. Entrepreneurs can use HELOCs to start or expand businesses, often with easier access to funds at lower rates compared to traditional business loans. However, a solid business plan is essential, as you’re putting your home on the line.

Bridge Financing in Real Estate

In real estate transactions, timing is critical. HELOCs serve as bridge financing, allowing down payments on new homes before selling current ones. This flexibility proves invaluable in competitive housing markets where contingent offers might be less attractive. For instance, if you need an $80,000 down payment (20% on a $400,000 home) but your funds are tied up in your current home, a HELOC can provide this bridge. Once your current home sells, you can pay off the HELOC, effectively transferring your equity to the new property.

Leveraging Home Equity Responsibly

While HELOCs offer numerous benefits, responsible use is paramount. Always consider the risks involved and have a clear repayment plan. Your home secures the HELOC, so defaulting could put your property at risk. Be aware of acceleration clauses and their potential impact on your repayment schedule. Platforms like HELOC360 can provide valuable guidance in navigating these decisions, ensuring you make the most of your home equity while maintaining financial stability.

Final Thoughts

A Home Equity Line of Credit (HELOC) offers homeowners a versatile safety net for unexpected financial challenges. It provides access to funds at competitive interest rates, often lower than credit cards or personal loans. This cost-effective borrowing option can help manage emergencies, consolidate high-interest debt, fund education, or seize investment opportunities.

HELOCs provide quick access to funds when needed most, allow interest-only payments during the draw period, and offer potential tax advantages for certain uses. A HELOC emergency fund can provide peace of mind without depleting savings. However, homeowners must approach HELOCs responsibly, as defaulting on payments could put their property at risk.

HELOC360 simplifies the process of exploring HELOC options, providing expert guidance and connecting homeowners with suitable lenders. This platform helps make informed decisions about using home equity to create new financial opportunities. With a well-managed HELOC, homeowners can build a stronger, more resilient financial future.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.