Are you prepared for unexpected financial emergencies? At HELOC360, we believe that a Home Equity Line of Credit (HELOC) can be your ultimate emergency fund.

HELOCs offer a unique blend of flexibility, accessibility, and financial benefits that traditional emergency funds often lack. In this post, we’ll explore why a HELOC emergency fund might be the smart choice for homeowners looking to safeguard their financial future.

What Is a HELOC Emergency Fund?

Understanding HELOCs

A Home Equity Line of Credit (HELOC) is a financial tool that allows homeowners to borrow against their property’s equity. Unlike traditional emergency funds (which typically consist of cash savings in a bank account), a HELOC provides access to a revolving credit line secured by your home. Using a HELOC as an emergency fund can be a practical solution if you need immediate access to cash and prefer a flexible borrowing option.

How HELOCs Operate

When you open a HELOC, lenders approve you for a maximum credit limit based on your home’s value and your outstanding mortgage balance. You can draw from this credit line as needed, paying interest only on the amount you borrow. This flexibility makes HELOCs an attractive option for emergency funds.

Advantages Over Traditional Savings

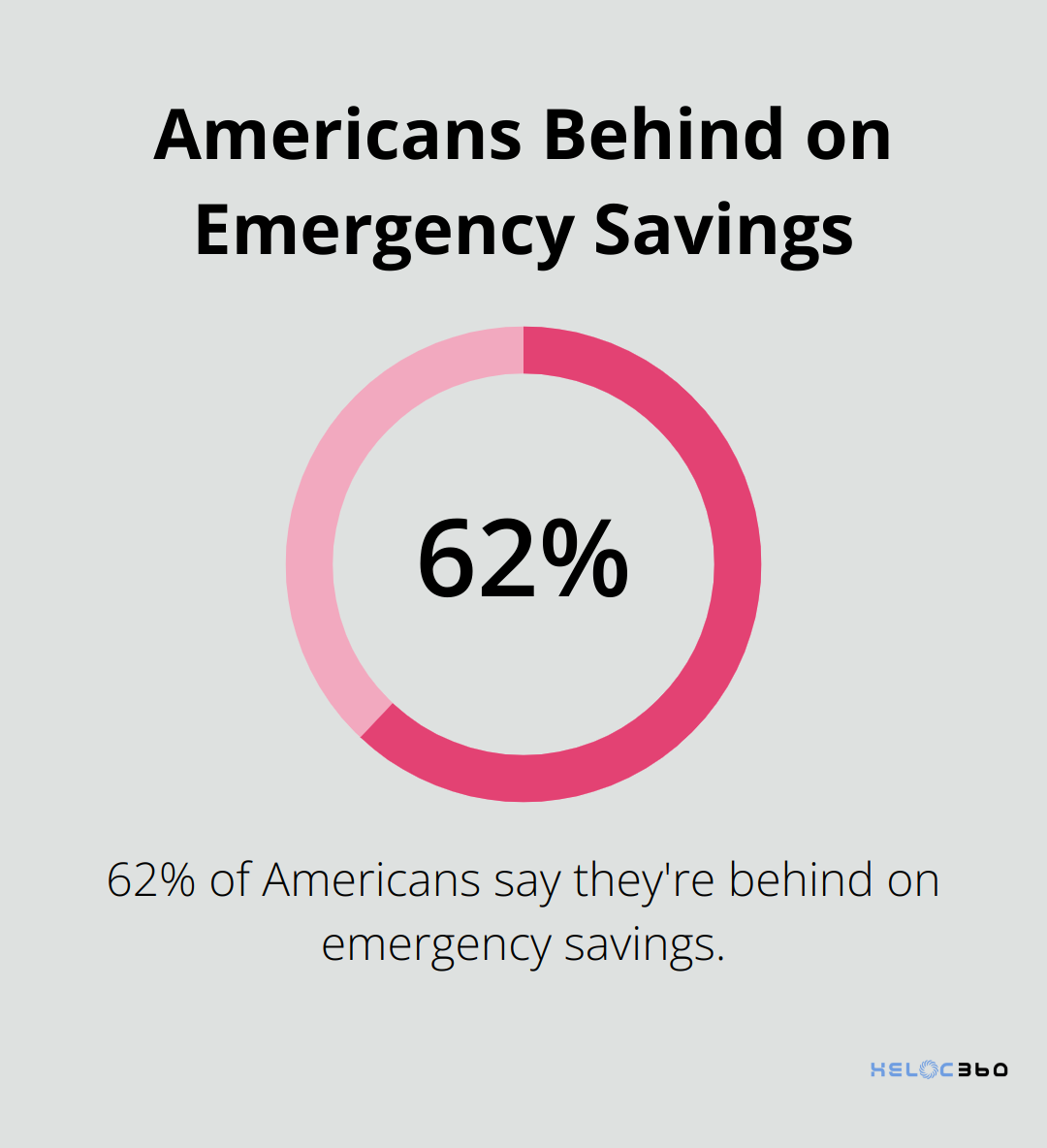

Using a HELOC as an emergency fund offers several benefits compared to traditional savings accounts. It provides access to a potentially larger sum of money than most people can save. A 2024 Bankrate survey revealed that 62 percent of Americans say they’re behind on emergency savings. With a HELOC, you could potentially access tens of thousands of dollars if needed.

Safe Use of Home Equity

While using home equity for emergencies can benefit homeowners, it requires a responsible approach. Experts recommend borrowing only what you need and creating a solid repayment plan. Your home serves as collateral for the HELOC, so defaulting on payments could put your property at risk.

Competitive Interest Rates

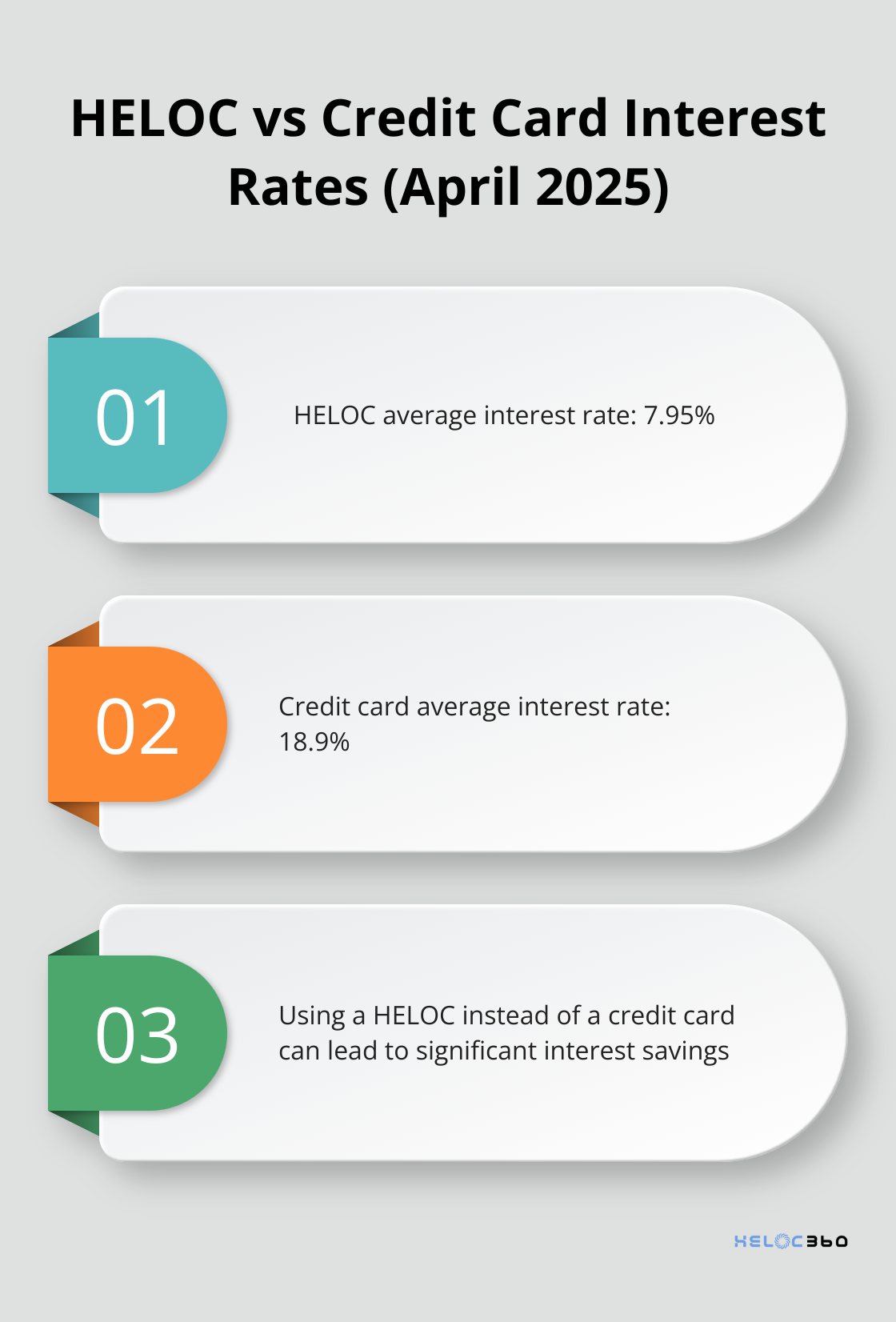

HELOCs typically offer lower interest rates compared to credit cards or personal loans. As of May 2025, HELOC rates have dropped over the past year, with average rates just below 8%, while credit card rates average 18.9% (according to Federal Reserve data). This difference can result in significant savings when you need to borrow for emergencies.

The flexibility and potential cost savings of HELOCs make them an attractive option for emergency funds. However, it’s important to understand how to access and use these funds effectively. Let’s explore the flexibility and accessibility of HELOCs in more detail.

The Unmatched Flexibility of HELOCs

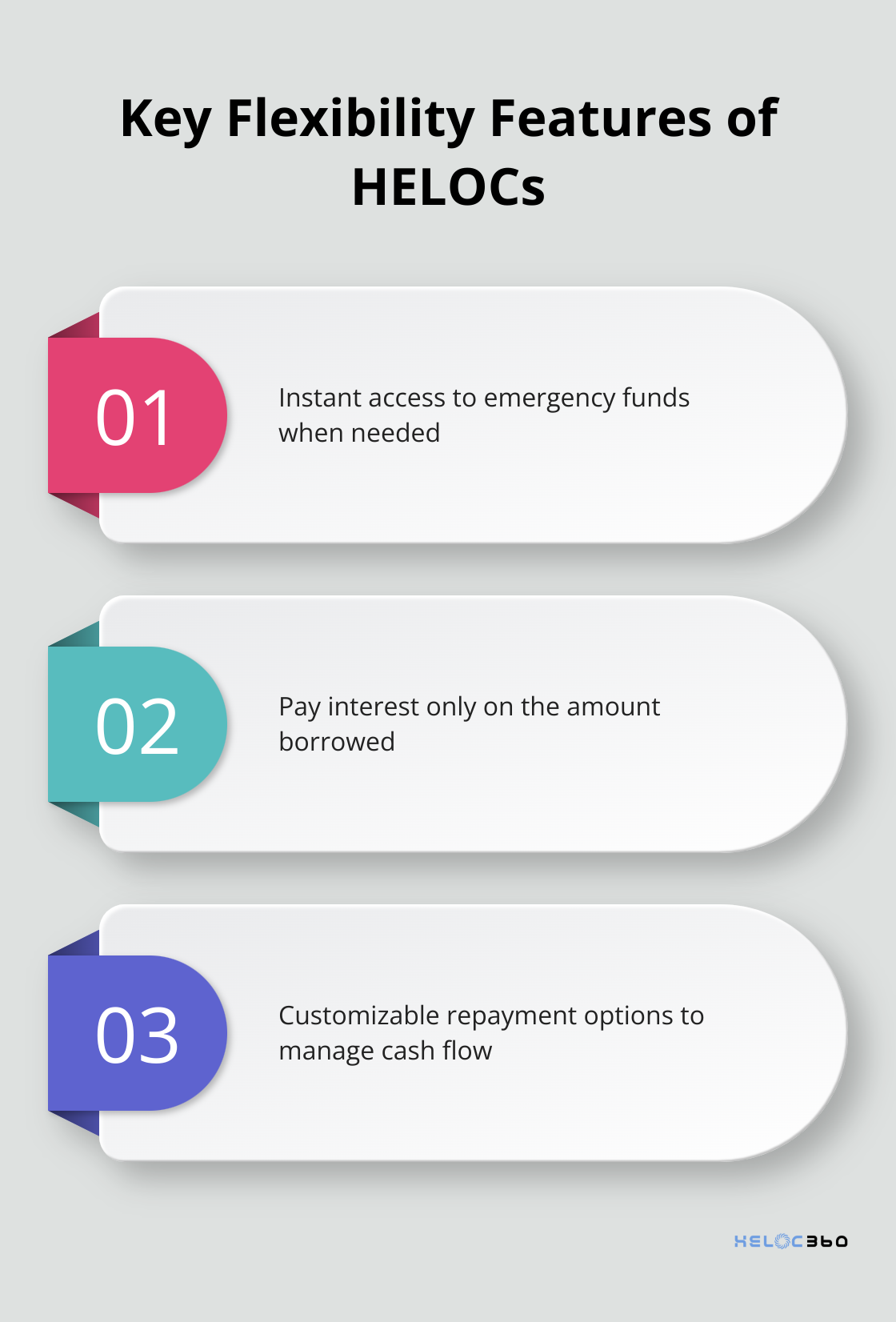

Instant Access to Emergency Funds

HELOCs offer unparalleled flexibility for emergency fund access. Like a credit card, the loan acts as a revolving line of credit for a draw period that usually lasts 10 to 15 years. This means you don’t have to empty your entire savings account when unexpected expenses arise.

One of the biggest advantages of using a HELOC as an emergency fund is the speed at which you can access your money. Some HELOC transfer and withdrawal options can be instant, while others take longer to process, so it’s a good idea to choose your withdrawal method wisely. This allows you to cover emergency expenses almost instantly, without waiting for bank transfers or withdrawals to process.

Pay Interest Only on What You Borrow

With a HELOC, you pay interest only on the amount you actually borrow. This is a significant advantage over personal loans or credit cards, where you might face interest charges on the entire credit limit or loan amount. For example, if you have a $50,000 HELOC but only need to borrow $5,000 for an emergency, you’ll only pay interest on that $5,000. This can result in substantial savings over time.

Higher Credit Limits for Greater Security

HELOCs typically offer much higher credit limits compared to traditional savings accounts or credit cards. The amount you can borrow is based on your home’s equity, which can be substantial if you’ve owned your home for a while or if property values in your area have increased.

Customizable Repayment Options

Another flexible aspect of HELOCs is the repayment structure. Many lenders offer various repayment options, allowing you to choose between interest-only payments during the draw period or principal-and-interest payments from the start. This flexibility enables you to manage your cash flow more effectively, especially during times of financial stress.

Revolving Credit for Ongoing Needs

Unlike a traditional emergency fund that depletes as you use it, a HELOC replenishes as you repay the borrowed amount. This revolving nature means you can use your HELOC multiple times for different emergencies or ongoing needs without having to reapply or go through additional approval processes.

The flexibility of HELOCs makes them an attractive option for emergency funds. However, it’s important to understand not just how to access these funds, but also the financial benefits they can provide. Let’s explore the potential cost savings and tax advantages of using a HELOC for emergencies.

Why HELOCs Make Financial Sense for Emergencies

Lower Interest Rates Boost Savings

Home Equity Lines of Credit (HELOCs) offer a significant financial advantage as emergency funds due to their lower interest rates. As of April 30, 2025, the national average HELOC interest rate is 7.95%, while credit card rates average 18.9% (according to Federal Reserve data). This difference translates to substantial savings over time.

Consider this scenario: You need to borrow $10,000 for an emergency. Using a HELOC at 7.95% instead of a credit card at 18.9% could save you over $1,000 in interest in just one year. These savings can significantly impact your ability to recover from financial setbacks.

Tax Benefits to Consider

HELOCs may offer potential tax benefits that other forms of borrowing don’t provide. The interest you pay on a home equity loan (HELOC) may be tax deductible for tax years 2018 through 2025 if the funds are used for home improvements. While this doesn’t directly apply to emergency fund usage, it’s worth noting for homeowners who might use their HELOC for multiple purposes.

(It’s important to consult with a tax professional to understand the current tax implications of using a HELOC. They can provide personalized advice based on your specific financial situation and the latest tax laws.)

Preservation of Liquid Savings

Using a HELOC as an emergency fund allows you to preserve your liquid savings. Instead of depleting your cash reserves for unexpected expenses, you can tap into your home equity while keeping your savings intact.

This strategy offers several benefits:

- It maintains your financial flexibility, allowing you to take advantage of investment opportunities or handle other planned expenses.

- It provides peace of mind knowing that you have cash on hand for other needs.

- In some cases, keeping money in high-yield savings accounts or other investments might earn you more than the interest you’d pay on a HELOC.

Flexible Borrowing Options

HELOCs offer flexibility in borrowing that traditional emergency funds can’t match. You can borrow only what you need, when you need it, and pay interest only on the amount you’ve borrowed. This flexibility allows you to manage your finances more effectively during emergencies.

Higher Credit Limits for Greater Security

HELOCs typically offer much higher credit limits compared to traditional savings accounts or credit cards. The amount you can borrow is based on your home’s equity, which can be substantial if you’ve owned your home for a while or if property values in your area have increased. This higher limit provides a greater safety net for larger emergencies or multiple unexpected expenses.

Final Thoughts

HELOCs offer a powerful alternative to traditional emergency funds. They provide homeowners with flexibility, accessibility, and financial benefits. The ability to tap into home equity for unexpected expenses can make a significant difference, especially when faced with large, unforeseen costs.

A HELOC emergency fund can save you money while providing peace of mind. It offers lower interest rates compared to credit cards and potential tax advantages (consult a tax professional for specific advice). However, you must use your HELOC responsibly and create a solid repayment plan to protect your home.

We at HELOC360 understand the importance of leveraging home equity safely and effectively. Our platform helps homeowners navigate the complexities of HELOCs, providing expert guidance and connecting you with suitable lenders. You can explore HELOC options to make informed decisions and unlock the full potential of your home’s value.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.