- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Are you looking for a smart way to tap into your home’s equity? A Home Equity Line of Credit (HELOC) might be the financial tool you’ve been searching for.

At HELOC360, we’ve seen firsthand how HELOCs can provide homeowners with flexible borrowing options and potential financial advantages. In this post, we’ll explore the key benefits of HELOCs and help you determine if it’s the right choice for your financial strategy.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

How a HELOC Works: Unlocking Your Home’s Hidden Potential

The Mechanics of a HELOC

A Home Equity Line of Credit (HELOC) is a revolving source of funds, much like a credit card, that you can access as you choose. It empowers homeowners to access their property’s value. It provides a revolving credit line based on the equity you’ve built in your home.

Lenders typically allow borrowing up to 85% of your home’s value, minus your outstanding mortgage balance. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, you could potentially access up to $55,000 through a HELOC.

HELOCs operate in two distinct phases:

- Draw Period (5-10 years): You can borrow funds as needed and often only pay interest on the amount you’ve used.

- Repayment Period: You’ll pay back both principal and interest.

HELOC vs. Home Equity Loan

While both utilize your home’s equity, a HELOC differs significantly from a home equity loan:

- HELOC: Offers flexible access to funds as needed.

- Home Equity Loan: Provides a lump sum upfront with fixed payments.

This flexibility can benefit you if you’re uncertain about the total amount you’ll need or prefer to borrow in stages.

Calculating Your Available Home Equity

To determine your available equity:

- Estimate your home’s current market value (use online tools, recent sales of similar properties, or consult a real estate professional).

- Subtract your outstanding mortgage balance from this value.

To calculate your LTV ratio, divide the amount of your existing loan balance by the appraised value of your home.

Interest Rates and Repayment Terms

HELOCs often feature variable interest rates, which can fluctuate based on market conditions. Some lenders may offer fixed-rate options for portions of your balance (this can provide more predictability in your payments).

During the draw period, you might have the option to make interest-only payments. However, once the repayment period begins, you’ll need to pay both principal and interest.

Potential Uses for a HELOC

A HELOC’s flexibility makes it suitable for various financial needs:

- Home improvements

- Debt consolidation

- Education expenses

- Emergency fund

- Business investments

As you consider these options, it’s essential to weigh the benefits against the risks of using your home as collateral. The next section will explore the key advantages of using a HELOC and help you determine if it’s the right choice for your financial strategy.

Why Choose a HELOC for Your Financial Needs?

Unparalleled Borrowing and Repayment Flexibility

Home Equity Lines of Credit (HELOCs) offer a level of flexibility that few other financial products can match. For example, if you’re making renovations that will take several months to complete, a HELOC allows you to borrow only as needed. This feature proves particularly useful for ongoing expenses or projects with uncertain costs.

Consider a home renovation project with an estimated cost of $50,000. With a HELOC, you could receive approval for that amount but initially draw only $30,000. If you later realize you need the full amount, you can access the remaining funds without applying for a new loan.

Competitive Interest Rates

HELOCs typically offer lower interest rates compared to unsecured loans or credit cards. According to Bankrate, as of February 2025, the average HELOC rate stands at 8.12%, while the average credit card APR is around 20.09%. This significant difference can lead to substantial savings over time, especially for large expenses.

To illustrate: If you borrow $50,000 and repay it over 5 years, you could save over $15,000 in interest by choosing a HELOC over a credit card.

Potential Tax Advantages

While tax laws can change, HELOCs may offer potential tax benefits. The interest paid on a HELOC used for home improvements might qualify for tax deductions. (Always consult with a qualified tax professional to understand how this applies to your specific situation.)

The Tax Cuts and Jobs Act of 2017 placed some limitations on HELOC interest deductions, but many homeowners can still benefit. The changes introduced under the TCJA include a reduction of the cap on the mortgage interest deduction. For example, if you use your HELOC to add a new room to your house, you might deduct the interest on your taxes, effectively reducing the cost of your home improvement project.

Versatility in Use

HELOCs provide flexibility not just in borrowing, but also in how you use the funds. You can use a HELOC for various purposes:

- Home improvements

- Debt consolidation

- Education expenses

- Emergency fund

- Business investments

This versatility allows you to address multiple financial needs with a single financial tool, simplifying your overall financial management.

Lower Upfront Costs

Compared to other loan types, HELOCs often come with lower upfront costs. Many lenders offer HELOCs with minimal or no application fees, appraisal fees, or closing costs. This can make a HELOC a more cost-effective option for accessing funds, especially if you don’t need the entire amount immediately.

The combination of these advantages makes HELOCs an attractive option for many homeowners. However, it’s important to understand that HELOCs use your home as collateral. This fact underscores the importance of responsible borrowing and having a solid repayment plan. In the next section, we’ll explore specific scenarios where a HELOC can be particularly beneficial and how to determine if you’re a good candidate for this type of financing.

Is a HELOC Right for You?

Ideal Scenarios for Using a HELOC

Home Equity Lines of Credit (HELOCs) can be a good option to consolidate debt, as they usually carry lower interest rates and longer terms than other financing options. Home renovations stand out as a prime example. A kitchen remodel that spans several months allows you to draw funds as needed, potentially reducing interest compared to a lump-sum loan.

Debt consolidation presents another scenario where HELOCs prove beneficial. If you have high-interest credit card debt, a HELOC can significantly reduce your interest payments. For instance, consolidating $20,000 in credit card debt at 20% APR with a HELOC at 8% APR could save you thousands in interest over time.

Education expenses also suit HELOC financing well. With college tuition costs rising annually, a HELOC can provide a lower-interest alternative to traditional student loans.

HELOC vs Other Financing Options

When comparing a HELOC to other financing options, consider these factors:

Credit Cards: While convenient, credit cards typically have much higher interest rates than HELOCs. The average credit card APR hovers around 20%, while HELOC rates often fall under 10%.

Personal Loans: These unsecured loans can be easier to obtain but usually come with higher interest rates than HELOCs. The average personal loan rate was 10.3% in 2024, compared to 8.12% for HELOCs.

Cash-Out Refinance: This option replaces your entire mortgage, which can benefit you if current rates are lower than your original mortgage rate. However, it typically involves higher closing costs than a HELOC.

Assessing Your HELOC Candidacy

To determine if you qualify for a HELOC, consider these factors:

Home Equity: Most lenders require at least 15-20% equity in your home. Calculate your loan-to-value (LTV) ratio by dividing your current mortgage balance by your home’s value. An 80% or lower ratio puts you in a good position.

Stable Income: Lenders want to see a reliable source of income to ensure you can make payments. A steady job or consistent self-employment income improves your chances of approval.

Debt-to-Income Ratio: Your DTI should typically be 43% or lower. Calculate this by dividing your monthly debt payments by your gross monthly income.

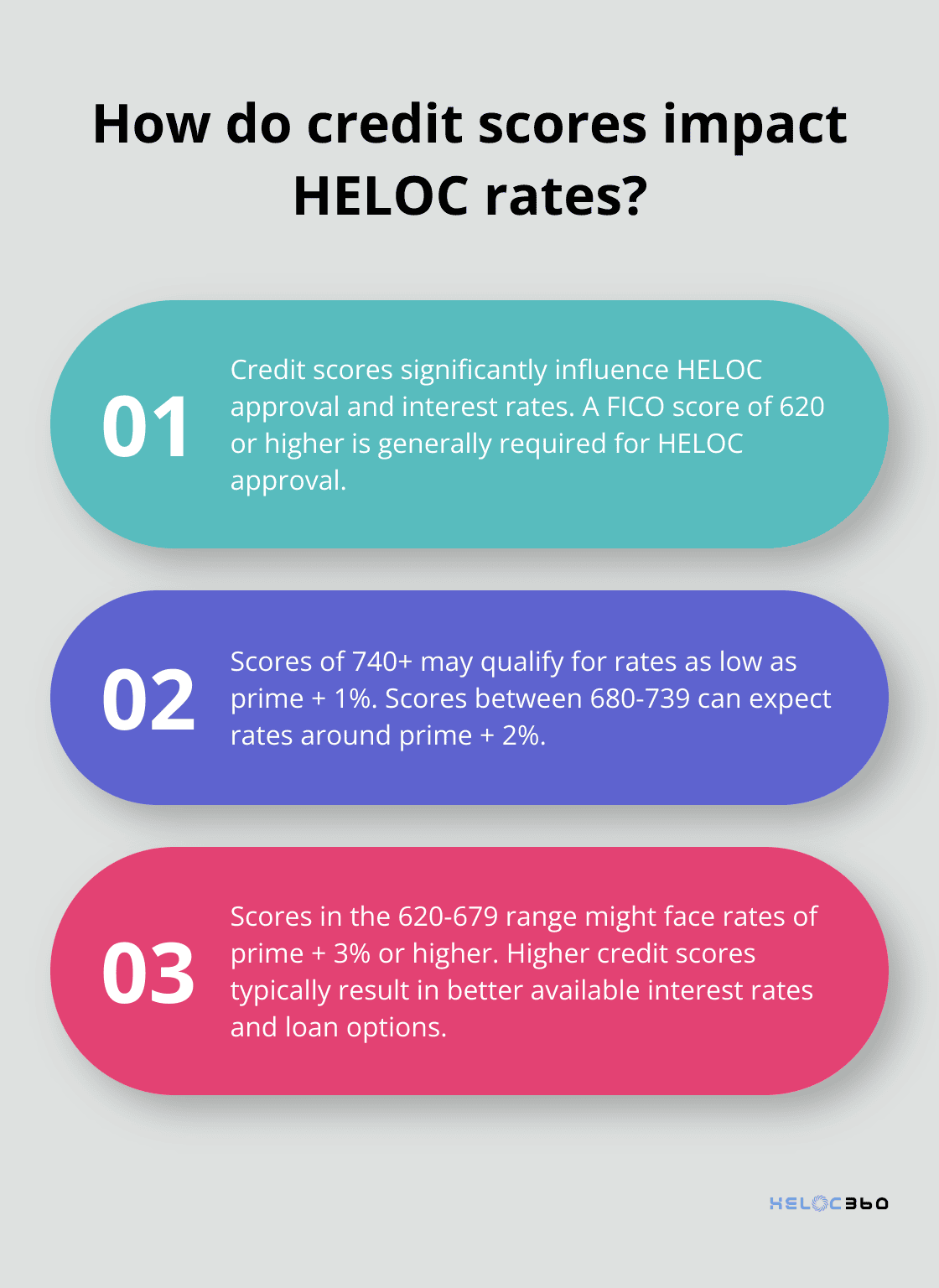

Credit Score: While requirements vary, a FICO score of 620 or higher is generally needed. Typically, the higher your credit score is, the more likely you are to qualify for the best available interest rates and loan options.

Long-Term Financial Goals: Consider how a HELOC aligns with your financial objectives. If you plan to sell your home soon, a HELOC might not be the best choice due to potential prepayment penalties.

The Impact of Credit Scores and DTI

Your credit score plays a key role in HELOC approval and terms. Here’s how your score might affect your HELOC rate:

- 740+: You might qualify for rates as low as prime + 1%

- 680-739: Expect rates around prime + 2%

- 620-679: Rates could be prime + 3% or higher

Your debt-to-income ratio is equally important. A lower DTI not only improves your chances of approval but can also lead to better terms. Try to achieve a DTI of 36% or lower for the best rates and terms.

Responsible Use of HELOCs

While HELOCs offer many advantages, they also use your home as collateral. It’s essential to have a solid repayment plan and to use the funds responsibly. If you’re unsure about whether a HELOC fits your needs, consider seeking guidance from financial professionals or exploring platforms that can connect you with suitable lenders.

Final Thoughts

Home Equity Lines of Credit (HELOCs) offer homeowners a powerful financial tool to leverage their property’s value. The HELOC advantages include lower interest rates compared to credit cards and personal loans, cost-effective access to funds, and flexibility to borrow as needed during the draw period. Your home serves as collateral, so careful planning and budgeting are essential before taking out a HELOC.

We recommend you assess your financial situation, consider your long-term goals, and create a solid repayment strategy. HELOCs can provide financial flexibility, potentially lower interest rates, and the ability to tap into your home’s equity for significant expenses or investments. However, these benefits come with responsibilities and risks that require careful consideration.

If you want to explore your HELOC options thoroughly, HELOC360 can help you navigate the world of home equity financing. Our platform connects you with suitable lenders and simplifies the process of unlocking your home’s potential. A HELOC can become a valuable addition to your financial toolkit when you use it wisely and make informed decisions.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.