Has your HELOC been frozen? This unexpected situation can leave you feeling frustrated and uncertain about your financial options.

At HELOC360, we understand the stress that comes with a frozen HELOC and want to help you navigate this challenge. In this post, we’ll explore the reasons behind HELOC freezes, their impact, and the steps you can take to address the situation.

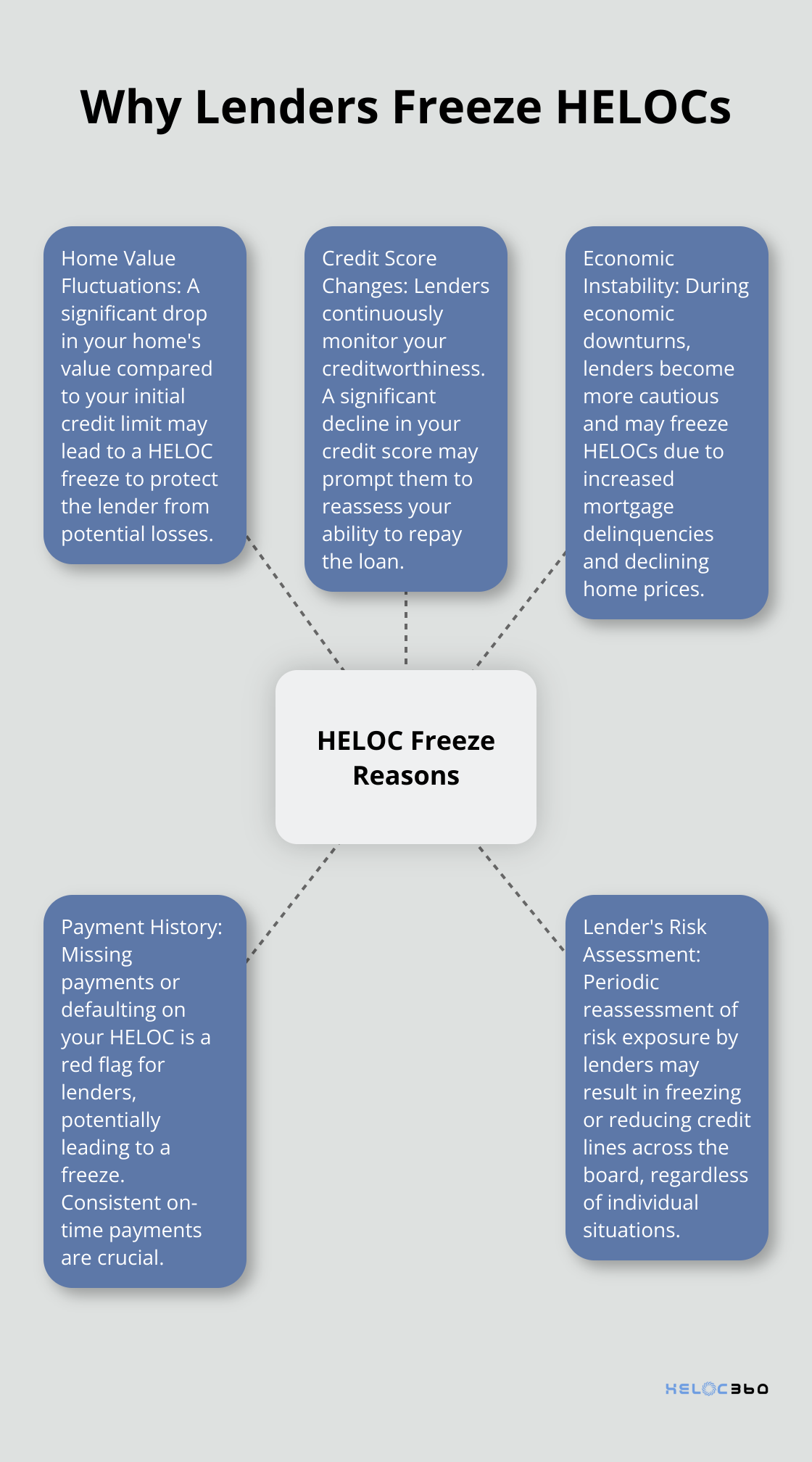

Why Do Lenders Freeze HELOCs?

HELOCs can be a valuable financial tool, but they’re not immune to sudden changes. Lenders may freeze your HELOC for several reasons. Understanding these can help you prevent or address the issue.

Home Value Fluctuations

The most common reason for a HELOC freeze is a significant drop in your home’s value. If your home’s value declines significantly compared to your initial credit limit, your lender might freeze your HELOC. This protects them from potential losses if you default on the loan.

Credit Score Changes

Your credit score plays a crucial role in maintaining your HELOC. Lenders constantly monitor your creditworthiness, and any significant decline may lead them to reassess your ability to repay the loan. Check your credit report regularly and address any issues promptly to avoid this situation.

Economic Instability

During economic downturns, lenders become more cautious. For instance, during the Great Recession, many lenders abruptly closed, cut or froze previously approved HELOCs due to increased mortgage delinquencies and declining home prices. While we can’t control the economy, staying informed about market trends can help you anticipate potential issues with your HELOC.

Payment History

Missing payments or defaulting on your HELOC is a surefire way to get it frozen. Lenders view this as a red flag indicating financial distress. To avoid this, set up automatic payments or reminders to ensure you never miss a due date. If you face financial difficulties, communicate with your lender early. They might offer solutions to help you stay on track.

Lender’s Risk Assessment

Sometimes, a HELOC freeze doesn’t reflect your personal financial situation at all. Lenders periodically reassess their risk exposure and may decide to freeze or reduce credit lines across the board. This can happen due to changes in the lender’s financial situation or shifts in their lending strategy.

Understanding these triggers empowers you to take proactive steps. In the next section, we’ll explore the impact a frozen HELOC can have on your financial plans and what you can do about it.

The Real Impact of a Frozen HELOC

A frozen Home Equity Line of Credit (HELOC) can disrupt your financial plans in several ways. Let’s examine the concrete consequences and how they might affect your financial stability.

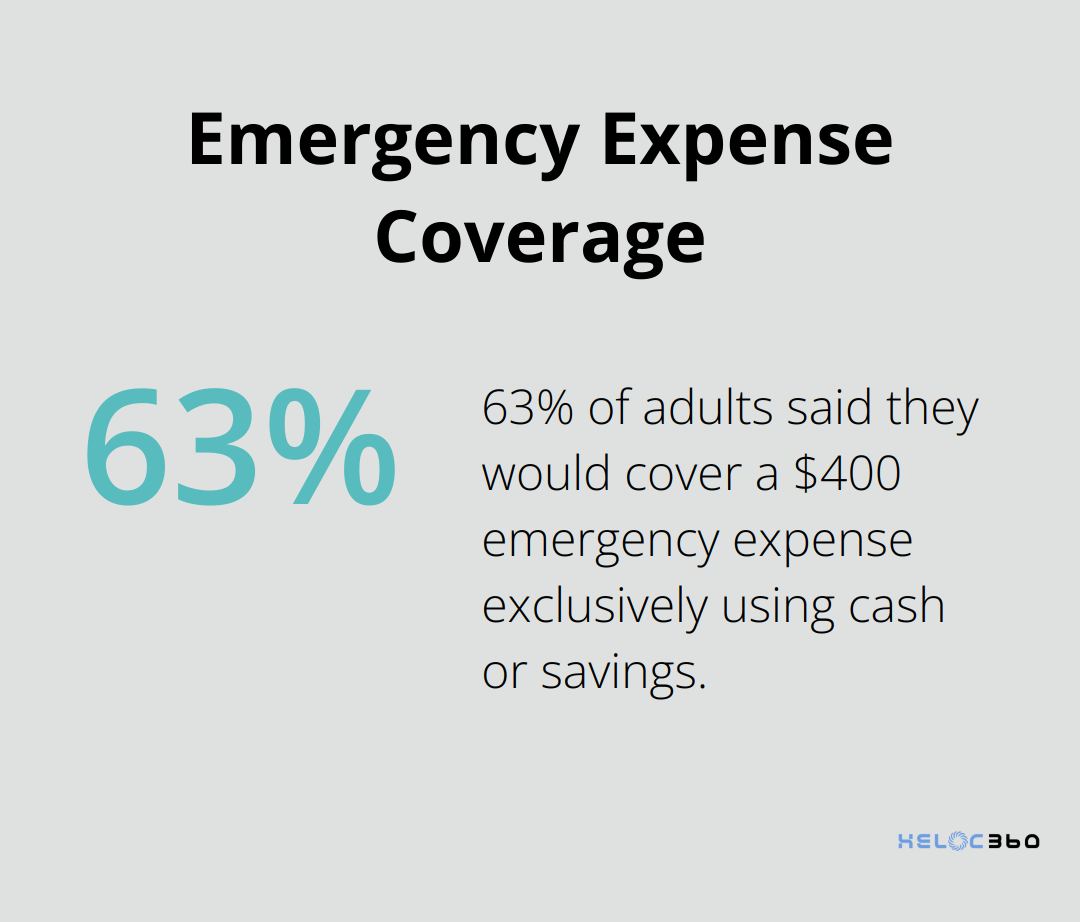

Immediate Loss of Financial Access

When your HELOC freezes, you lose instant access to your credit line. This sudden change can be jarring, especially if you’ve relied on it for ongoing expenses or emergencies. A 2023 Federal Reserve survey revealed that 63% of adults said they would have covered a $400 emergency expense exclusively using cash or savings. A frozen HELOC eliminates this safety net for those who rely on it, potentially leaving you exposed to financial shocks.

Interrupted Home Improvement Projects

Many homeowners use HELOCs to fund renovations. A freeze can stop these projects in their tracks. Picture this scenario: You’re halfway through a kitchen remodel when your HELOC freezes. You’re left with an unfinished space and contractors who demand payment. This situation isn’t just inconvenient; it can also affect your home’s value and livability.

Indirect Credit Score Effects

While a HELOC freeze doesn’t directly impact your credit score, the ripple effects might. If the sudden loss of funds forces you to max out credit cards or miss payments on other debts, your credit score could suffer. The National Foundation for Credit Counseling reports that nearly one-third of Americans (32%) are just getting by financially, and 62% fear government instability will harm their finances.

Financial Stress and Uncertainty

The psychological impact of a frozen HELOC shouldn’t be underestimated. The sudden loss of access to a significant financial resource can cause stress and anxiety. It may force you to reevaluate your financial strategy and make tough decisions about prioritizing expenses.

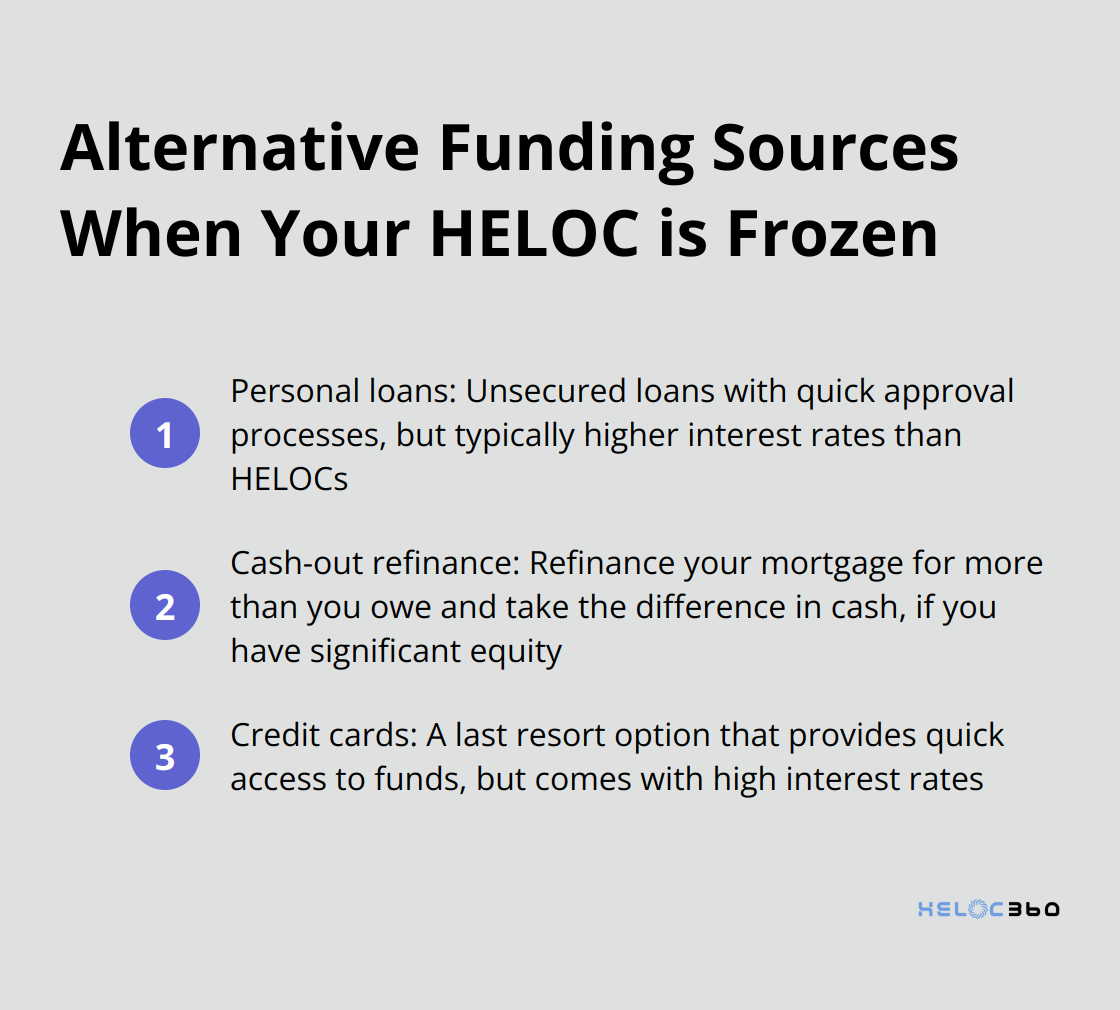

Alternative Funding Challenges

With your HELOC frozen, you might need to explore other funding options. However, these alternatives often come with higher interest rates or less favorable terms. For instance, personal loans or credit cards typically have higher interest rates than HELOCs, which could increase your overall debt burden.

The consequences of a frozen HELOC can be far-reaching, affecting everything from your home improvement plans to your financial peace of mind. In the next section, we’ll discuss practical steps you can take if you find yourself facing a HELOC freeze, helping you navigate this challenging situation with confidence.

What to Do When Your HELOC Freezes

A frozen HELOC can disrupt your financial plans, but you have options. Here’s how to address the situation and regain control of your finances.

Contact Your Lender Immediately

When you discover your HELOC is frozen, contact your lender right away. Ask for a detailed explanation of the freeze. Was it due to a drop in your home’s value? A change in your credit score? Understanding the reason will guide your next steps.

During this conversation, ask about the specific conditions for unfreezing your HELOC. Some lenders may require an updated property appraisal, while others might need to see an improvement in your credit score. Your lender must reinstate your credit privileges when the conditions permitting the freeze or reduction no longer exist.

Review Your Agreement

Examine your HELOC agreement carefully. Focus on the sections about credit line reductions or suspensions. The Truth in Lending Act requires lenders to provide clear and conspicuous written disclosures about freezing your HELOC. If your lender hasn’t complied with these regulations, you may have grounds for appeal.

Consider Alternative Funding Sources

While you work to unfreeze your HELOC, you might need access to funds. Consider these alternatives:

Improve Your Financial Position

If your HELOC was frozen due to a drop in your credit score or missed payments, take immediate steps to improve your financial standing. Create a budget, pay down existing debts, and ensure all bills are paid on time.

Seek Professional Advice

If you find the process overwhelming, consider seeking help from a financial advisor or credit counselor. These professionals can provide personalized advice and help you create a plan to address the HELOC freeze and improve your overall financial health.

Final Thoughts

A frozen HELOC can disrupt your financial plans, but you can overcome this challenge. Quick action and proactive communication with your lender are essential steps to address the issue. You should explore alternative funding sources and take steps to improve your financial position.

Understanding the reasons behind HELOC freezes empowers you to prevent future occurrences. Home value fluctuations, credit score changes, and economic instability all play a role in lenders’ decisions to freeze HELOCs. You can protect yourself by staying informed about market trends and maintaining a strong credit profile.

At HELOC360, we offer tailored solutions for homeowners facing HELOC challenges. Our platform provides expert guidance to help you navigate complex home equity financing situations (including frozen HELOCs). Don’t let a frozen HELOC derail your plans – we’re here to help you achieve your financial goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.