Home Equity Lines of Credit (HELOCs) have become a popular financial tool for homeowners seeking flexibility in their borrowing options.

At HELOC360, we’ve seen firsthand how these versatile loans can provide unparalleled financial freedom.

This guide will explore the unique advantages of HELOCs, from their adaptable repayment structures to their potential for strategic debt management and home improvement financing.

What Makes HELOCs Unique?

The Basics of HELOCs

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against their property’s equity. Unlike traditional loans, HELOCs function as a revolving line of credit, similar to a credit card, but with your home as collateral.

When you open a HELOC, the lender sets a credit limit based on your home’s value and outstanding mortgage balance. You can withdraw funds as needed during the draw period (typically 5-10 years). During this time, you often only need to pay interest on the borrowed amount.

After the draw period, the repayment phase begins. You start paying back both principal and interest on your outstanding balance, usually over 10-20 years.

HELOC vs. Other Borrowing Options

HELOCs offer several advantages over personal loans and credit cards:

- Lower interest rates: Home equity loan rates are usually lower than what you might pay with a personal loan or credit card.

- Higher borrowing limits: While personal loans might cap at $50,000, HELOCs can potentially provide access to hundreds of thousands of dollars (depending on your home’s value).

- Flexible repayment: You only pay interest on the amount you borrow, not your entire credit limit. This can lead to significant savings compared to lump sum loans.

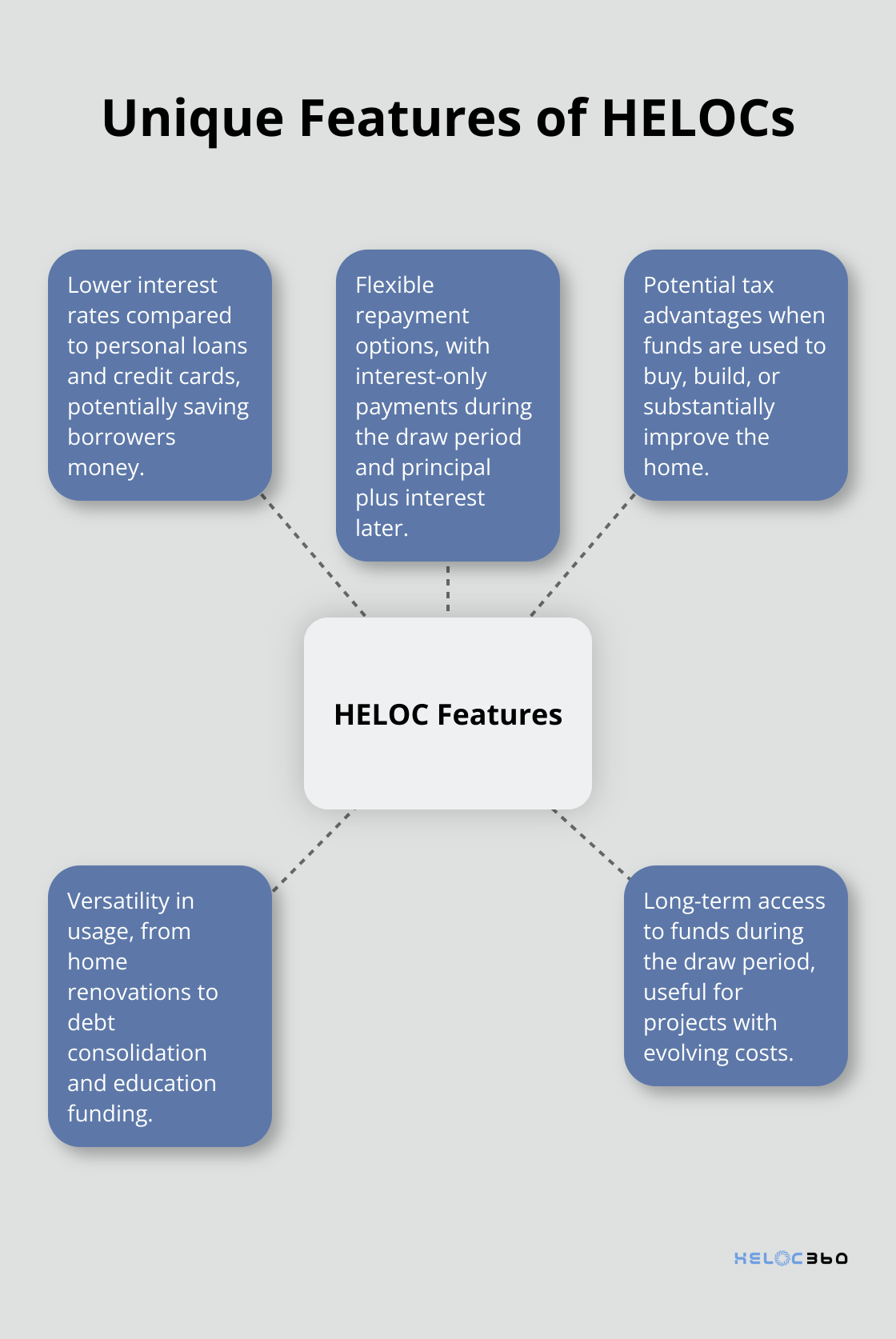

Standout Features of HELOCs

HELOCs offer unique benefits that set them apart from other financial products:

- Tax advantages: The interest on a HELOC is tax deductible as long as you use the funds to “buy, build, or substantially improve” the property. (Always consult a tax professional for specific advice.)

- Versatility: Homeowners can use HELOCs for various purposes, such as home renovations, debt consolidation, or funding education.

- Long-term access: The extended draw period provides ongoing access to funds, which can be useful for projects with evolving costs or unexpected expenses.

Strategic Uses for HELOCs

Many homeowners leverage their HELOCs for major expenses. Some popular uses include:

- Home improvements: Fund renovations that can increase your property’s value.

- Debt consolidation: Pay off high-interest debts with a lower-interest HELOC.

- Education expenses: Cover tuition and other costs for yourself or family members.

- Emergency fund: Create a financial safety net for unexpected situations.

The key to successful HELOC use lies in having a clear plan for both using and repaying the funds. This strategic approach can help you maximize the benefits while minimizing potential risks.

As you consider the unique advantages of HELOCs, you might wonder how to best utilize this financial tool for your specific situation. Let’s explore the versatility of HELOCs and how they can be applied to various financial goals.

How HELOCs Transform Your Financial Strategy

Boost Your Home’s Value

Home improvements rank as one of the most popular uses for HELOCs, and with good reason. Americans spent an estimated $603 billion in 2024 on remodeling their homes. A HELOC provides the funds needed for these value-boosting projects without the high interest rates of credit cards or personal loans.

Consider a $30,000 kitchen remodel. Using a HELOC with a 7% interest rate could save you thousands compared to a credit card with a higher APR. You also have the flexibility to draw funds as needed throughout the project, which potentially reduces your overall interest payments.

Streamline Your Debt

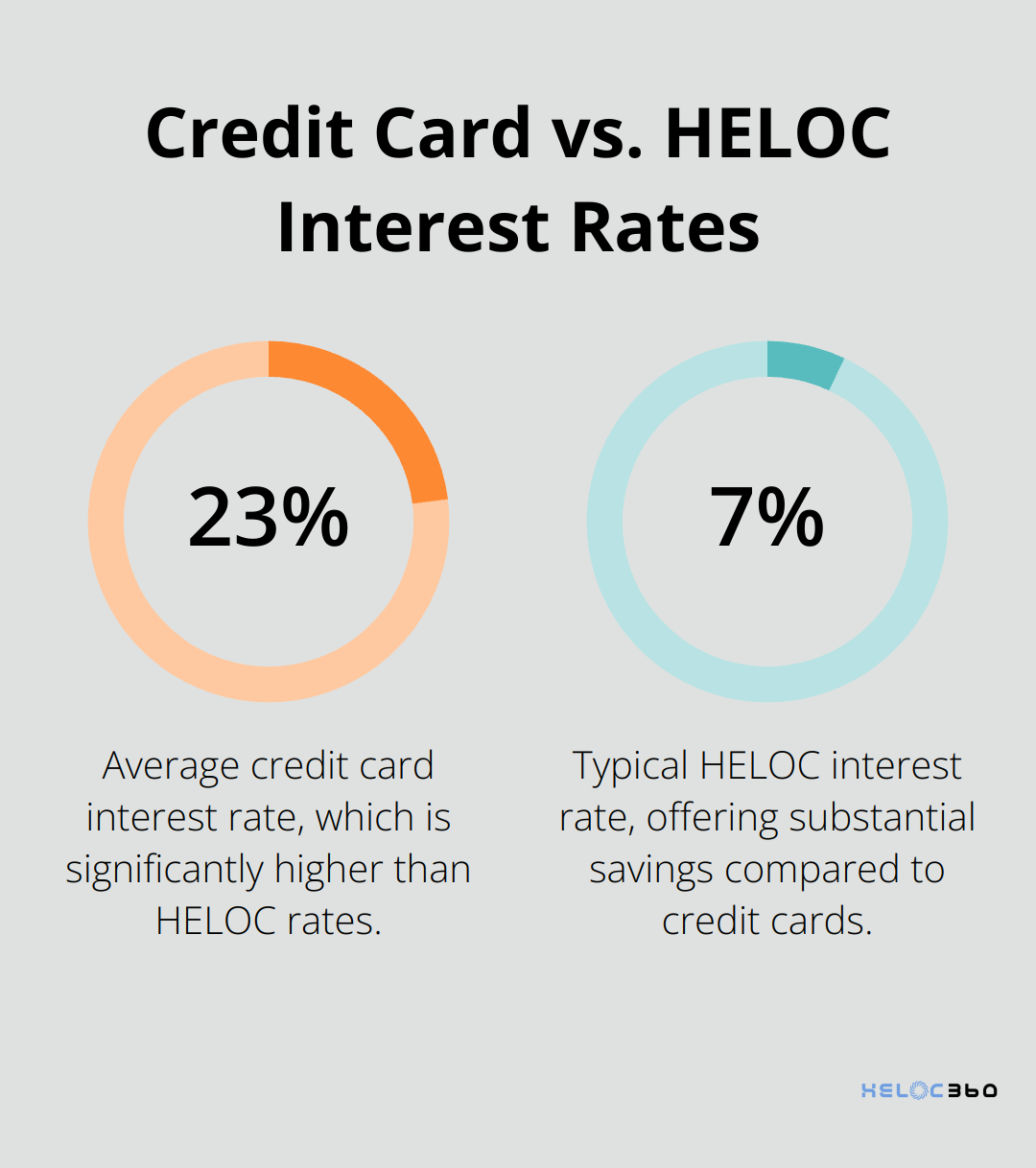

Debt consolidation presents another smart use of HELOCs. If you juggle multiple high-interest debts, a HELOC can help you simplify your finances and potentially save money. The average credit card interest rate is 23.99%, while HELOC rates typically fall much lower.

Picture this scenario: You have $20,000 in credit card debt at 23.99% APR. By transferring this to a HELOC at 7% APR, you could save over $3,400 in interest in the first year alone. This strategy not only saves money but also simplifies your monthly payments into one manageable sum.

Invest in Education

Using a HELOC to fund education expenses can prove a savvy move. Tuition and fees at private ranked colleges have climbed by about 5.5% over the last year, according to data for the 2024-2025 school year. A HELOC can provide a more affordable alternative to traditional student loans.

For instance, if you need $50,000 for your child’s education, a HELOC at 7% could offer significant savings compared to private student loans, which often have rates of 10% or higher. The flexible draw period allows you to access funds as needed throughout their academic career.

Create a Financial Safety Net

Establishing an emergency fund is essential for financial stability, and a HELOC can serve as an excellent backup plan. Financial experts often recommend having 3-6 months of living expenses saved, but this can challenge many households.

A HELOC can act as a low-cost safety net. If your monthly expenses total $5,000, you might want a $30,000 HELOC as an emergency backup. The beauty lies in the fact that you only pay interest if you need to use it, unlike a personal loan where you’d pay interest on the full amount from day one.

HELOCs offer unparalleled versatility in financial planning. Whether you want to increase your home’s value, streamline your debt, invest in education, or create a financial safety net, a HELOC can provide the flexibility and cost-effectiveness you need. Now that we’ve explored the transformative power of HELOCs, let’s examine how to maximize their benefits through smart usage strategies.

How to Maximize Your HELOC Benefits

Leverage Interest-Only Payments

The draw period of your HELOC (typically 5-10 years) often allows for interest-only payments. This feature can lower your monthly obligations and free up cash flow for other financial priorities.

For example, a $50,000 HELOC at 7% interest would require a monthly interest-only payment of about $292. This compares favorably to a fully amortizing payment of $581 (assuming a 20-year repayment term), resulting in a monthly savings of $289.

However, you should plan for the repayment period. We recommend you set aside the difference between your interest-only payment and what your full payment would be. This strategy builds a cushion for when principal payments start.

Explore Tax Benefits

The Tax Cuts and Jobs Act of 2017 changed HELOC interest deductions, but opportunities remain. The IRS still allows deductions for interest paid on home equity loans and lines of credit if the funds buy, build, or substantially improve the home that secures the loan.

For instance, $30,000 from your HELOC used to add a new bedroom could result in tax-deductible interest. However, the same amount used to pay off credit card debt wouldn’t qualify for a deduction.

You should keep detailed records of your HELOC fund usage. This documentation proves valuable during tax season. Always consult a qualified tax professional to understand how these deductions apply to your situation.

Implement Smart Borrowing Strategies

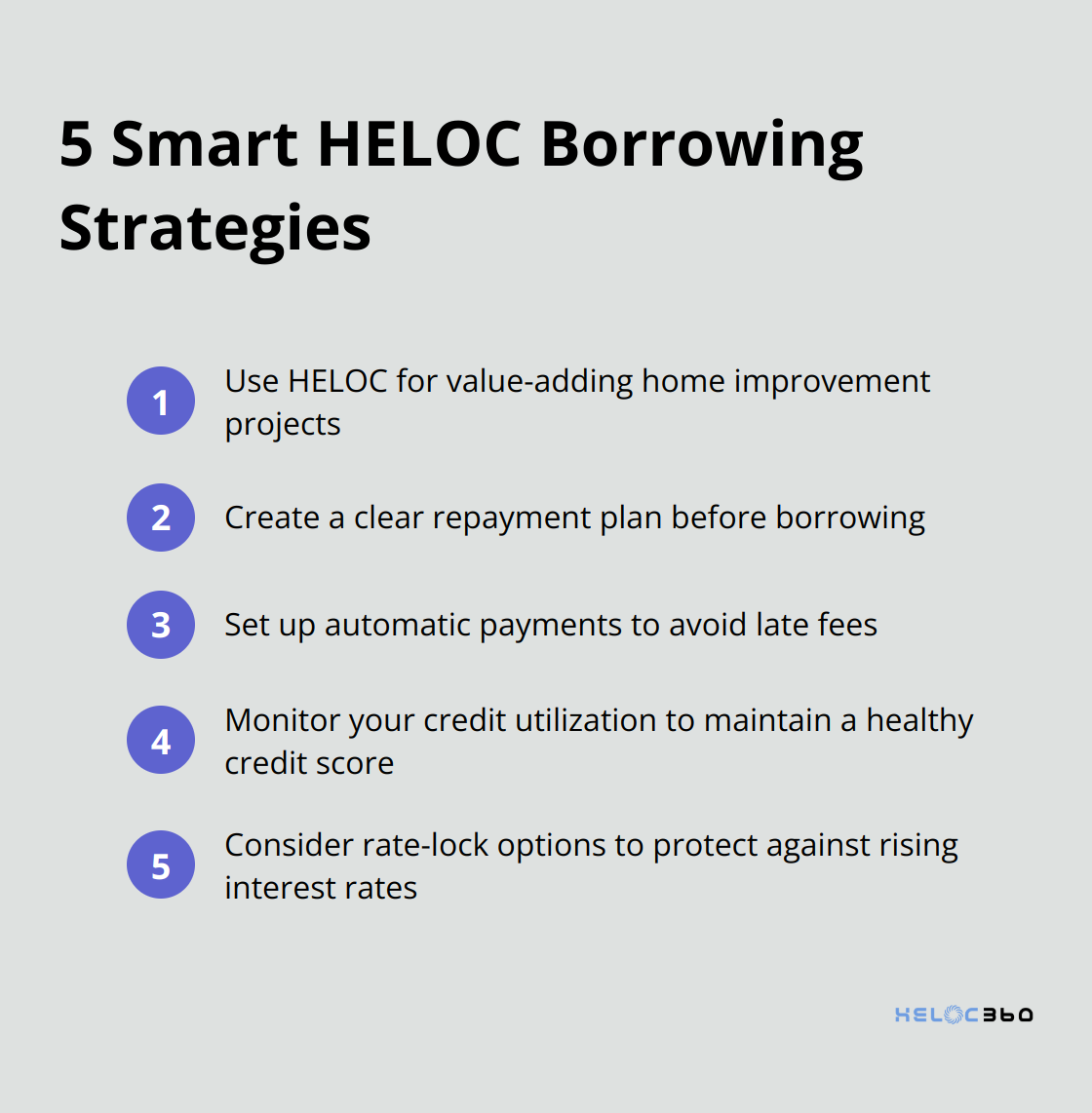

To optimize your HELOC use, consider these practical strategies:

- Use it for value-adding projects: Prioritize improvements that increase your home’s value. A minor kitchen remodel could recoup more than 83% of its cost at resale (according to the latest Cost vs. Value report from Remodeling magazine).

- Create a repayment plan: Before borrowing, map out a clear repayment strategy. If you use the HELOC for home renovation, consider how the project might increase your home’s value and potentially your income (through rent or increased equity).

- Set up automatic payments: This simple step helps you avoid late fees and potential credit score impacts. Many lenders offer a small interest rate reduction for setting up auto-pay.

- Monitor your credit utilization: Your HELOC factors into your overall credit picture. Try to keep your total credit utilization (across all credit lines) below 30% to maintain a healthy credit score.

- Consider rate-lock options: Some HELOCs offer the ability to lock in a fixed rate on a portion of your balance. This can protect against rising interest rates.

Use Your HELOC Strategically

A HELOC serves as a powerful financial tool, but its effectiveness depends on how you use it. You can employ several strategies to maximize its benefits:

- Home improvements: Use your HELOC for renovations that add value to your home. This not only enhances your living space but can also increase your property’s worth.

- Debt consolidation: If you have high-interest debts (like credit card balances), you can use your HELOC’s lower interest rate to pay them off and save money in the long run.

- Education expenses: A HELOC can provide a more flexible and potentially less expensive alternative to traditional student loans for funding education costs.

- Emergency fund: Your HELOC can act as a low-cost safety net. You only pay interest if you need to use it, unlike a personal loan where you’d pay interest on the full amount from day one.

Final Thoughts

Home Equity Lines of Credit (HELOCs) provide unmatched financial flexibility, allowing homeowners to access their property’s value for various purposes. HELOCs offer versatile solutions that adapt to changing needs, from funding home improvements to consolidating high-interest debt. The ability to draw funds as needed, potential tax benefits, and lower interest rates compared to many other borrowing options make HELOCs an attractive choice for many homeowners.

HELOC flexibility comes with responsibility, and careful planning is essential when using this financial tool. Users must have a clear purpose for the funds and a solid repayment strategy in place. Your home serves as collateral, so managing your HELOC wisely protects your most valuable asset and maintains financial stability.

HELOC360 can guide you through every step of the HELOC process. Our platform helps you understand your options, connect with suitable lenders, and make informed decisions about leveraging your home equity. We provide the tools and expertise you need to unlock your home’s potential and achieve your financial goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.