Home equity lines of credit (HELOCs) are gaining traction among homeowners in 2025. The current economic landscape has sparked renewed interest in these flexible financing options.

At HELOC360, we’ve observed a surge in savvy homeowners leveraging HELOC advantages to achieve their financial goals. From funding home improvements to consolidating debt, HELOCs offer unique benefits that set them apart from traditional loans.

Why HELOCs Are Booming in 2025

Record-Low Interest Rates Attract Homeowners

HELOC rates hit an 18-month low earlier in 2025, attracting many homeowners. This dramatic drop has caught the eye of many homeowners. With rates at this level, borrowing against home equity has become an attractive option for those who want to finance large expenses or investments.

Unmatched Flexibility Outshines Traditional Loans

HELOCs generally offer lower interest rates than home equity loans, personal loans, and credit cards. This pay-as-you-go structure means you don’t pay interest on money you’re not using.

A recent LendingTree study revealed that 62% of homeowners believe HELOCs offer better financial outcomes than traditional loans. This sentiment reflects the growing popularity of HELOCs among savvy homeowners.

HELOCs vs. Alternative Financing Options

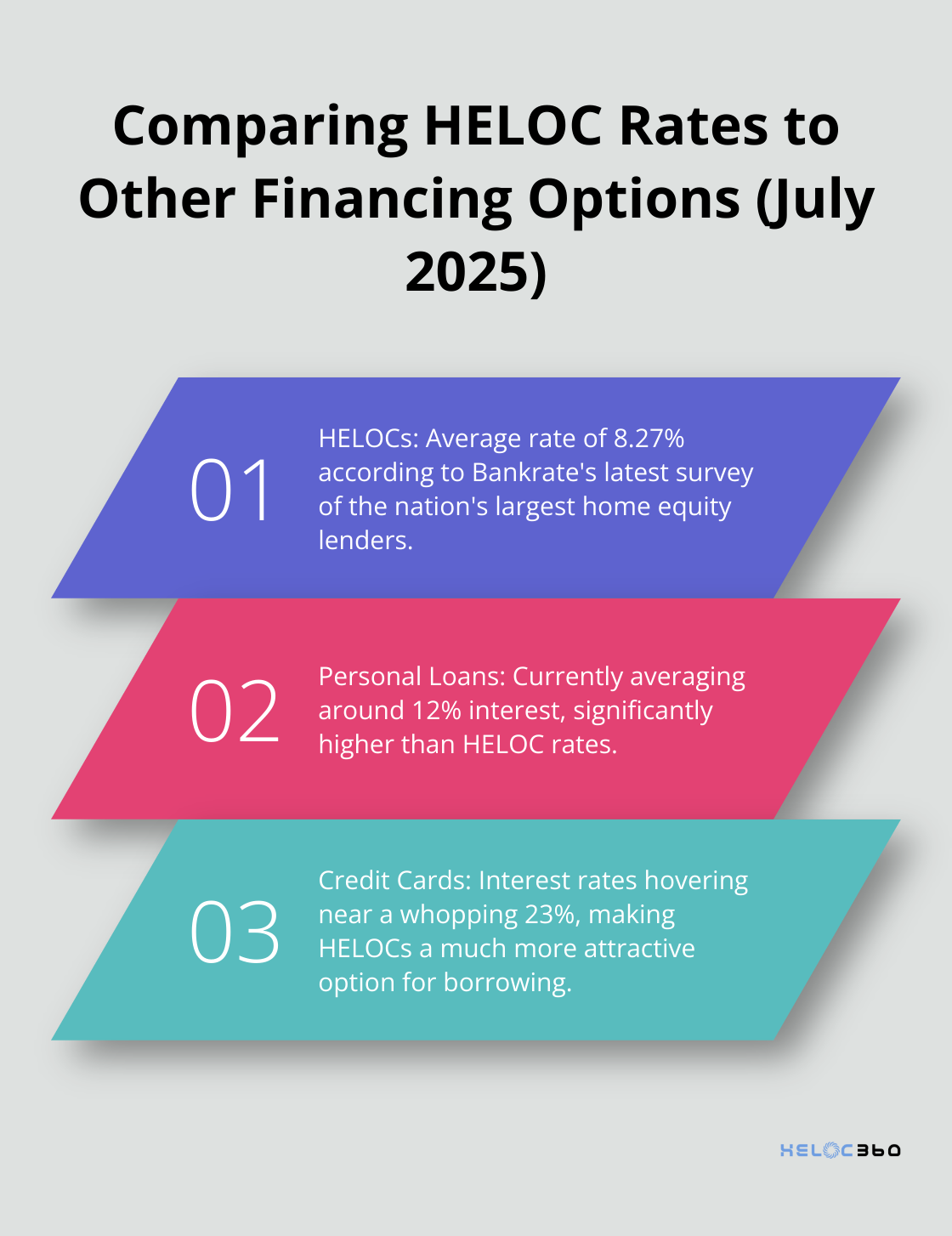

When compared to other financing options, HELOCs often emerge as the top choice. Personal loans currently average around 12% interest, while credit cards hover near a whopping 23%. In contrast, the current HELOC rates look incredibly appealing.

Home equity loans, while similar, lack the flexibility of HELOCs. With a fixed structure, they don’t allow borrowers to benefit from potential future rate drops without refinancing.

Increased Home Values Expand HELOC Potential

Home prices are softening across the country, with annual home price growth slowing to +2.7% in February, and early data for March showing further cooling to +2.2%. Despite this, many homeowners still have substantial equity, making HELOCs a powerful financial tool.

For those who consider a HELOC, understanding the terms and conditions is essential. Variable interest rates mean your payments could change over time, and responsible usage is key to maximize benefits while minimizing risks. As you explore your options, platforms like HELOC360 can provide valuable guidance and connect you with lenders that best fit your unique financial situation.

The next chapter will explore smart ways to use a HELOC in today’s market, including home improvements that increase property value and strategic debt consolidation.

How to Leverage Your HELOC in 2025

Boost Your Home’s Value with Strategic Improvements

A Home Equity Line of Credit (HELOC) offers homeowners a powerful financial tool in 2025. Current market conditions favor borrowers, making it an ideal time to explore how to maximize your HELOC’s potential.

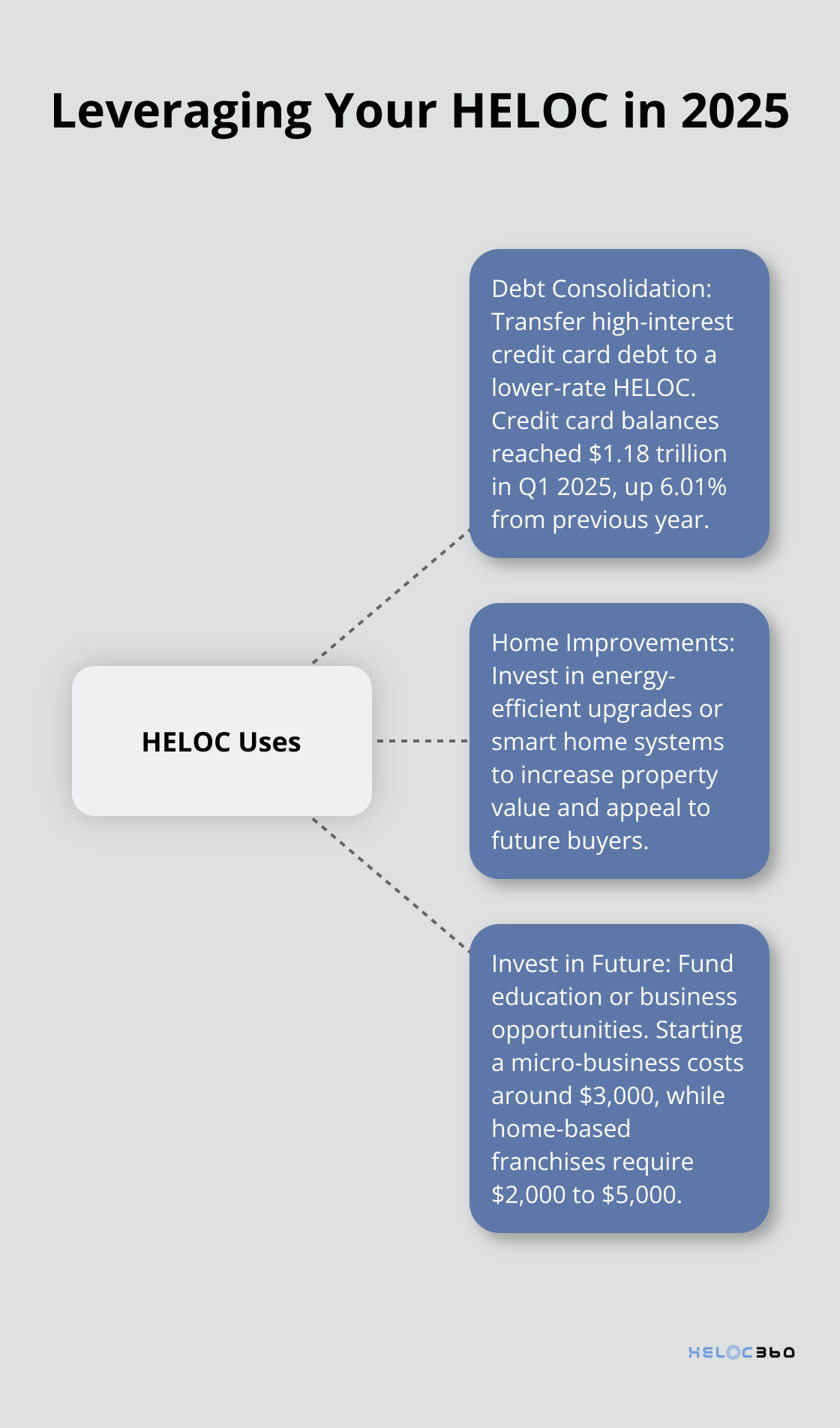

One of the smartest uses for your HELOC is home improvements that increase your property’s value. The National Association of Realtors’ 2025 Remodeling Impact Report highlights the increased happiness found in the home once a project is completed.

Projects that modernize your home and improve energy efficiency should take priority. Upgrading to smart home systems or installing solar panels not only enhances your living experience but also appeals to future buyers. The Annual Energy Outlook 2025 explores potential long-term energy trends in the United States, which can inform your decisions on energy-efficient upgrades.

Tackle High-Interest Debt Head-On

HELOC rates sit significantly lower than credit card interest rates, making debt consolidation a potential game-changer. The Federal Reserve Bank of New York reported that credit card balances totaled $1.18 trillion outstanding in Q1 2025, with a 6.01% increase from the previous year.

A practical example illustrates this point: $20,000 in credit card debt at a high APR incurs substantial annual interest. Transfer this debt to a HELOC with a lower rate, and your yearly interest could drop significantly.

However, a solid repayment plan proves essential. The flexibility of a HELOC can become a double-edged sword if not managed properly. Create a budget that allows you to pay more than the minimum payment each month to reduce your principal faster.

Invest in Your Future

Your HELOC can fund education or business opportunities, yielding long-term benefits. The U.S. Bureau of Labor Statistics consistently shows that higher education levels correlate with increased earning potential and lower unemployment rates.

For entrepreneurs, a HELOC can provide the capital needed to start or expand a business. The Small Business Administration reports that the average cost to start a micro-business is around $3,000, while home-based franchises might require $2,000 to $5,000. These amounts typically fall within the HELOC borrowing range for many homeowners.

Before investing, conduct thorough research and consider consulting with financial advisors. While the potential returns can be significant, it’s important to weigh the risks and have a clear plan for repayment.

As you explore these options, keep in mind that your home serves as collateral for your HELOC. Make informed decisions and use this financial tool responsibly to maximize its benefits while minimizing risks. The next section will guide you through navigating HELOC terms and conditions, ensuring you’re well-equipped to make the most of this financial opportunity.

How HELOC Terms Work

Variable Interest Rates Explained

HELOCs come with variable interest rates that can change over time. These rates often link to the prime rate, which the Federal Reserve’s decisions influence. As of July 2, 2025, HELOC rates average 8.27%, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

This variability can benefit you when rates drop, potentially lowering your monthly payments. However, you must prepare for potential increases. Some lenders offer rate caps (which limit how high your rate can go). Ask about these caps when you shop for a HELOC.

Key HELOC Features to Evaluate

When you assess HELOC options, focus on the draw period and repayment terms. Most HELOCs have a draw period of 5 to 10 years. During this time, you can borrow funds as needed and typically only pay interest on the amount used.

The repayment phase follows the draw period. You can no longer borrow funds and must repay both principal and interest. Some lenders offer interest-only payments during the draw period, which can seem attractive but may result in higher payments later.

Try to find HELOCs with flexible repayment options. Some lenders allow you to convert a portion of your balance to a fixed-rate loan, which provides stability in an uncertain rate environment.

Common HELOC Pitfalls to Avoid

A major pitfall to avoid is overlooking fees. While HELOCs often have lower upfront costs compared to home equity loans, they may include annual fees, inactivity fees, or early closure fees. These fees can add up (potentially offsetting the benefits of a lower interest rate).

Another mistake is to treat your HELOC like a credit card. Your home serves as collateral. If you overborrow or miss payments, you can put your property at risk. Create a solid repayment plan before you tap into your HELOC.

Don’t ignore the fine print. Some HELOCs have minimum draw requirements or prepayment penalties. Understanding these details can save you from unexpected costs in the future.

The Importance of Careful HELOC Management

You must manage your HELOC carefully to maximize its benefits. Set up a budget that accounts for potential rate increases. Monitor your borrowing and make sure it aligns with your long-term financial goals.

Consider setting up automatic payments to ensure you never miss a due date. This practice can help you maintain a good credit score and avoid potential penalties.

If you struggle to understand HELOC terms or manage your line of credit effectively, seek professional advice. Financial advisors or HELOC specialists (like those at HELOC360) can provide valuable insights and help you make informed decisions.

Final Thoughts

HELOCs offer homeowners unique advantages in 2025. With interest rates at historic lows and substantial home equity, HELOCs present an opportunity for savvy financial management. The flexibility to borrow as needed, coupled with lower interest rates compared to other options, makes HELOCs attractive for various financial goals.

Responsible HELOC usage maximizes benefits while minimizing risks. Create a solid repayment plan, avoid treating it like a credit card, and set up automatic payments. Stay informed about potential rate changes and how they might affect your payments (this knowledge empowers you to make smart financial decisions).

We at HELOC360 help you navigate the complexities of home equity lines of credit. Our platform simplifies the process, offering expert guidance and connecting you with suitable lenders. We empower homeowners to make informed decisions about leveraging their home equity, turning property value into a gateway for new financial opportunities.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.