Are you tired of waiting to save up for a down payment on your dream home? At HELOC360, we’ve got a game-changing strategy that might just be the solution you’re looking for.

Using a HELOC for a down payment could be a smart move for savvy homebuyers. This approach can help you access funds quickly and potentially avoid private mortgage insurance.

Let’s explore why a HELOC down payment might be the key to unlocking your homeownership goals sooner than you thought possible.

What Is a HELOC and How Can It Fund Your Down Payment?

Understanding HELOCs

A Home Equity Line of Credit (HELOC) is a powerful financial tool that can revolutionize your approach to buying a home. This revolving line of credit uses your home’s equity as collateral. You can think of it as a credit card secured by your house. You borrow up to a certain limit, repay, and borrow again during the draw period (which typically lasts 5-10 years).

HELOCs for Down Payments

Using a HELOC for a down payment is a smart move for many homebuyers. Instead of waiting years to save up, you can tap into your existing home equity to fund the down payment on a new property. This strategy can be particularly effective in competitive real estate markets where quick action is crucial.

Benefits of This Approach

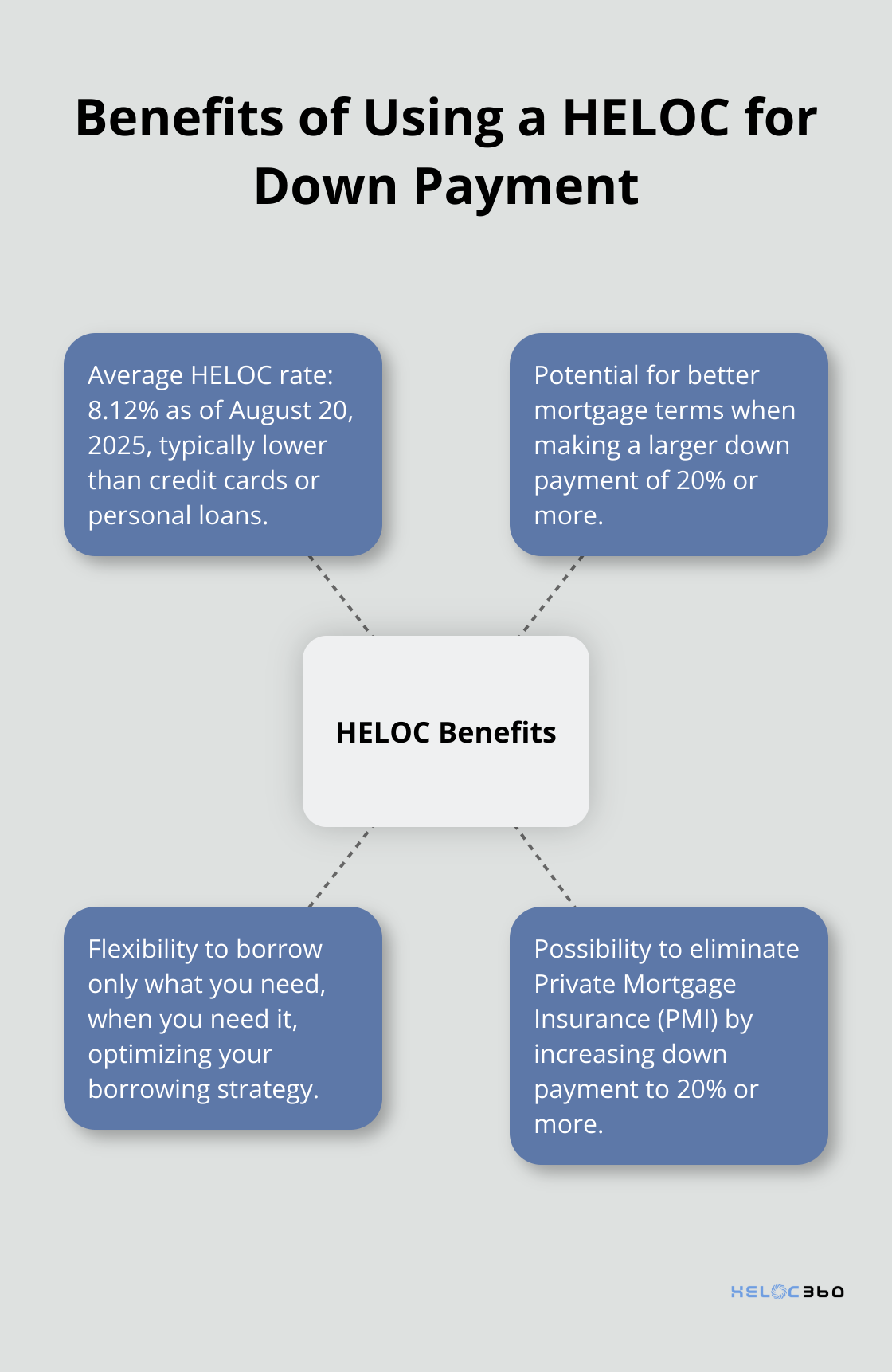

- Speed: You can access funds quickly, often within weeks.

- Flexibility: You borrow only what you need, when you need it.

- Lower Interest Rates: HELOCs typically offer lower rates than credit cards or personal loans.

- Potential Tax Benefits: Interest may be tax-deductible (consult your tax advisor for specifics).

The National Association of Realtors reports that 88 percent of home buyers used a real estate agent or broker to purchase their home in 2024. This trend highlights the importance of professional guidance in the home buying process.

Maximizing Your HELOC Strategy

To make the most of this approach, consider these tips:

- Calculate your available equity. Some lenders allow you to borrow up to 90% of your home’s value, with some even offering up to 100%.

- Shop around for the best HELOC terms. Rates and fees can vary significantly between lenders.

- Create a solid repayment plan. You’re borrowing against your home, so responsible management is crucial.

Navigating the HELOC Process

The HELOC process might seem complex, but with the right guidance, it becomes manageable. Many homeowners find that working with a specialized platform (like HELOC360) can simplify the journey. These platforms often connect you with top lenders and provide expert advice to ensure you make informed decisions about your home equity.

Using a HELOC for your down payment isn’t just a clever trick – it’s a strategic move that can accelerate your path to homeownership or expand your real estate portfolio. Now that we’ve covered the basics of HELOCs and their potential for down payments, let’s explore the specific advantages this strategy offers in more detail.

Why a HELOC Down Payment Makes Financial Sense

Accelerate Your Property Acquisition

Using a Home Equity Line of Credit (HELOC) for your down payment can significantly speed up your path to homeownership. This strategy allows you to leverage your existing home equity to act swiftly in competitive real estate markets. HELOCs offer the most flexibility in terms of how much you can borrow and when you can pay it off, compared with other home equity products.

Reduce Your Overall Costs

HELOCs typically offer lower interest rates compared to other financing options. As of August 20, 2025, the national average HELOC rate is 8.12%, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

Furthermore, using a HELOC to make a larger down payment may qualify you for better mortgage terms. Lenders often provide more favorable rates to borrowers who can put down 20% or more, potentially saving you thousands over the life of your mortgage.

Enjoy Flexible Borrowing and Repayment

HELOCs offer unparalleled flexibility in accessing funds. You can draw exactly what you need for your down payment and only pay interest on the amount you use. This feature allows you to optimize your borrowing strategy and minimize unnecessary interest payments.

Many homeowners use this flexibility to their advantage, drawing additional funds for unexpected closing costs or immediate home improvements without the need for separate loan applications.

Eliminate Private Mortgage Insurance

Private Mortgage Insurance (PMI) is typically required when you put down less than 20% on a conventional mortgage. By using a HELOC to boost your down payment to 20% or more, you can avoid this additional expense. When you pay 20 percent down, PMI is not required with a conventional loan. You could also receive a lower interest rate with a 20 percent down payment.

Maximize Your Investment Potential

A HELOC down payment strategy can open doors to investment opportunities that might otherwise be out of reach. You can use your HELOC to:

- Purchase investment properties

- Fund renovations to increase property value

- Diversify your real estate portfolio

This approach allows you to leverage your existing assets to create new wealth-building opportunities.

The financial advantages of using a HELOC for your down payment are clear. However, it’s important to understand the potential risks and considerations associated with this strategy. Let’s explore these factors to help you make an informed decision about whether a HELOC down payment is right for your situation.

Navigating the Risks of HELOC Down Payments

Impact on Debt-to-Income Ratio

Using a Home Equity Line of Credit (HELOC) for your down payment creates a dual debt structure. This structure affects your debt-to-income (DTI) ratio significantly. Most lenders prefer a DTI of 43% or lower (according to the Consumer Financial Protection Bureau). To calculate your DTI, add all monthly debt payments and divide by your gross monthly income. If a HELOC pushes your DTI above 43%, you might face challenges in qualifying for your primary mortgage.

Variable Interest Rates

HELOCs typically come with variable interest rates that fluctuate based on market conditions. As of August 19, 2025, the average home equity loan rate is 8.23%, according to Bankrate’s regular survey of rates. A 1% increase in your HELOC rate could add hundreds of dollars to your annual payments. Some lenders offer rate caps or the option to convert a portion of your balance to a fixed rate. Always ask potential lenders about these features to protect yourself from rate volatility.

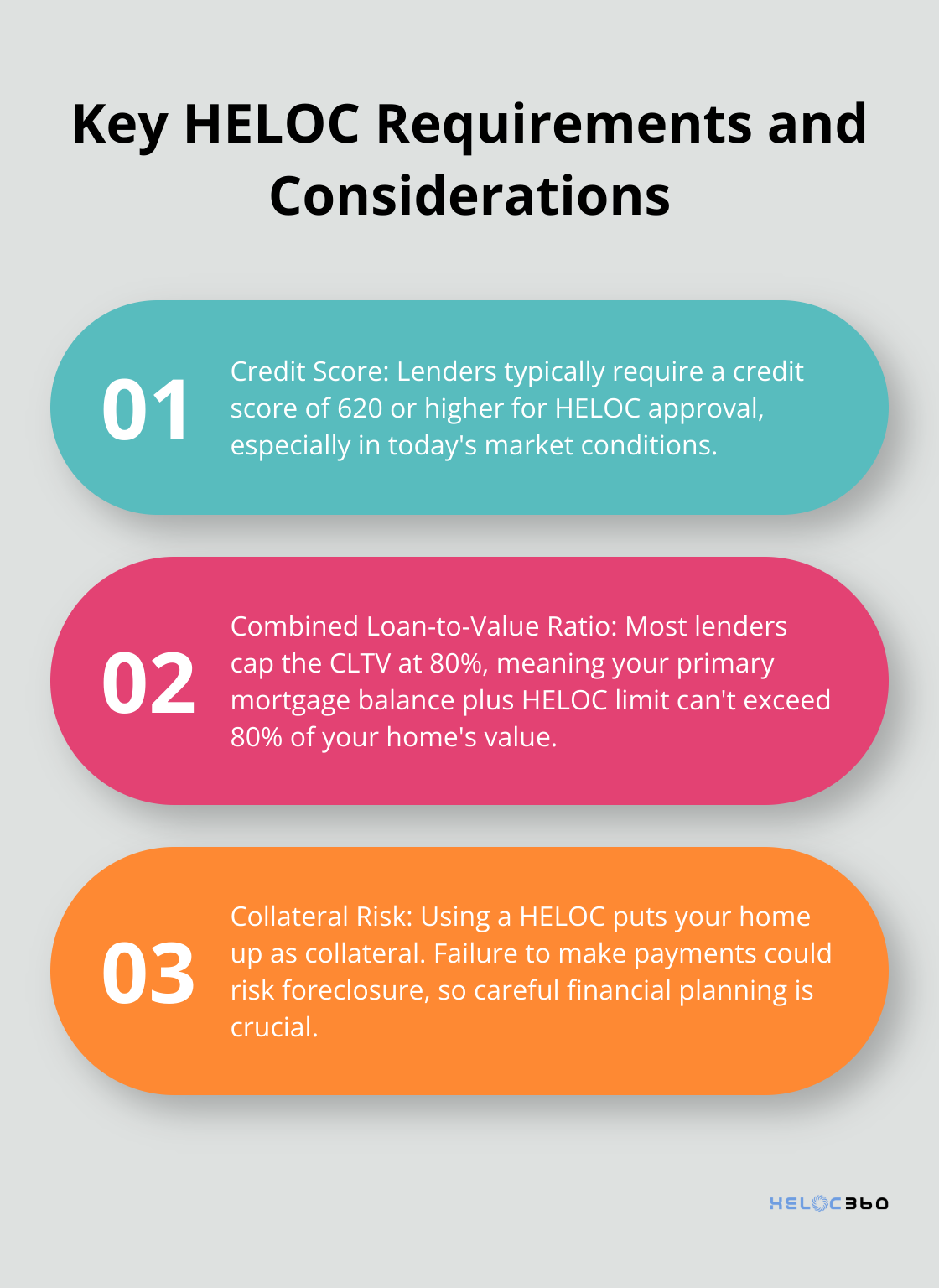

Home as Collateral

A HELOC puts your home up as collateral. Failure to make payments risks foreclosure. This risk compounds when you use the HELOC for a down payment on a second property. You leverage one property to buy another, which can become a high-risk strategy if not managed carefully. Create a detailed budget that accounts for both your primary mortgage and HELOC payments (plus a buffer for unexpected expenses).

Strict Lender Requirements

Lenders have tightened HELOC requirements in recent years. You’ll typically need a credit score of 620 or higher, especially for HELOCs. Additionally, most lenders cap the combined loan-to-value ratio (CLTV) at 80%. This means if your home is worth $450,000, your primary mortgage balance plus your HELOC limit typically can’t exceed $360,000.

Market Fluctuations

Real estate markets can be unpredictable. If property values decline, you might end up owing more than your home is worth. This situation (known as being “underwater” on your mortgage) can limit your financial flexibility and make it difficult to refinance or sell your property. Consider the stability of your local real estate market before using a HELOC for a down payment.

Final Thoughts

A HELOC downpayment strategy offers quick access to funds and flexibility in borrowing. This approach can help you avoid private mortgage insurance and potentially secure lower interest rates. However, you must consider the risks, including variable interest rates and using your home as collateral.

Proper financial planning plays a vital role in successfully using a HELOC for your down payment. You should create a detailed budget that accounts for both your primary mortgage and HELOC payments. It’s also wise to maintain a buffer for unexpected expenses and potential interest rate increases.

We at HELOC360 can help you explore the possibilities a HELOC offers for your down payment needs. Our platform connects you with lenders that fit your unique situation and provides expert guidance. Explore your HELOC options with HELOC360 to unlock your home’s full potential and achieve your homeownership dreams faster.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.