HELOC underwriting can be a complex process, often shrouded in mystery for many homeowners.

At HELOC360, we believe in demystifying this crucial step in obtaining a home equity line of credit.

In this post, we’ll reveal the key factors lenders consider, common challenges applicants face, and practical tips to improve your chances of approval.

What Lenders Look for in HELOC Applications

Lenders scrutinize several key factors when evaluating Home Equity Line of Credit (HELOC) applications. Understanding these elements can significantly boost your approval chances and help you secure more favorable terms.

The Credit Score Conundrum

Your credit score plays a pivotal role in HELOC underwriting. Many lenders allow you to tap your equity with a credit score in the 600s, with the norm now closer to 620, especially for HELOCs. However, higher scores may still result in better rates and terms.

Debt-to-Income Ratio: The 43% Rule

Lenders closely examine your debt-to-income (DTI) ratio to ensure you can manage additional debt. Every lender has its own specific DTI requirements, but you should aim for a DTI of no higher than 43 percent. This means your total monthly debt payments (including your potential HELOC payment) shouldn’t exceed 43% of your gross monthly income.

Equity and Loan-to-Value: The 80/20 Split

Your home’s equity and the resulting loan-to-value (LTV) ratio are crucial in HELOC underwriting. Most lenders cap combined LTV (including your first mortgage and the HELOC) at 80%. This means you need to retain at least 20% equity in your home after taking out the HELOC. For example, if your home is worth $400,000 and you owe $300,000 on your first mortgage, you could potentially borrow up to $20,000 through a HELOC.

Income Verification: Proving Your Ability to Repay

Lenders want to see a stable, reliable income that can support your HELOC payments. However, some alternatives like home equity investments (HEI) have no income requirements, making eligibility more manageable for the self-employed.

The Impact of Market Conditions

Market conditions can significantly influence HELOC underwriting. In periods of economic uncertainty, lenders might tighten their requirements or adjust their risk assessments. Factors such as interest rate trends, housing market stability, and overall economic health can all play a role in how lenders evaluate HELOC applications.

As we move forward, let’s explore some common challenges that applicants face during the HELOC underwriting process and how to overcome them.

Navigating HELOC Underwriting Hurdles

The Property Value Rollercoaster

Property values can fluctuate significantly, impacting your loan-to-value ratio. Get a recent appraisal before you apply. If your area has seen recent price drops, consider waiting for the market to stabilize or prepare to borrow less.

Proving Self-Employment Income

Self-employed individuals often struggle with income verification. Lenders typically want to see two years of tax returns, but this might not reflect your current earnings. Some lenders now accept bank statements or profit and loss reports. (Self-employed borrowers should explore lenders who offer more flexible income verification options.)

Life Changes and Their Impact

Major life events like job changes, divorces, or recent moves can complicate your HELOC application. If you’ve recently changed jobs, provide offer letters and paystubs. For divorces, have your decree ready to show how it affects your finances. If you’ve moved, prove stable residency, even if it means a slightly longer wait time before applying.

Dealing with Existing Liens

Multiple liens on your property can make lenders nervous. Each additional lien increases the risk for the lender. If you have a second mortgage or tax lien, pay it off before applying for a HELOC. Alternatively, some lenders might agree to subordinate their lien, but this process can add time and complexity to your application.

The Credit Utilization Conundrum

High credit utilization can significantly impact your HELOC application. Try to keep your credit card balances below 30% of their limits. If possible, pay down high-balance cards before applying. This not only improves your credit score but also shows lenders you manage your existing credit responsibly.

Overcoming these hurdles requires preparation and strategy. (The next section will provide practical tips to improve your chances of HELOC approval.)

How to Boost Your HELOC Approval Chances

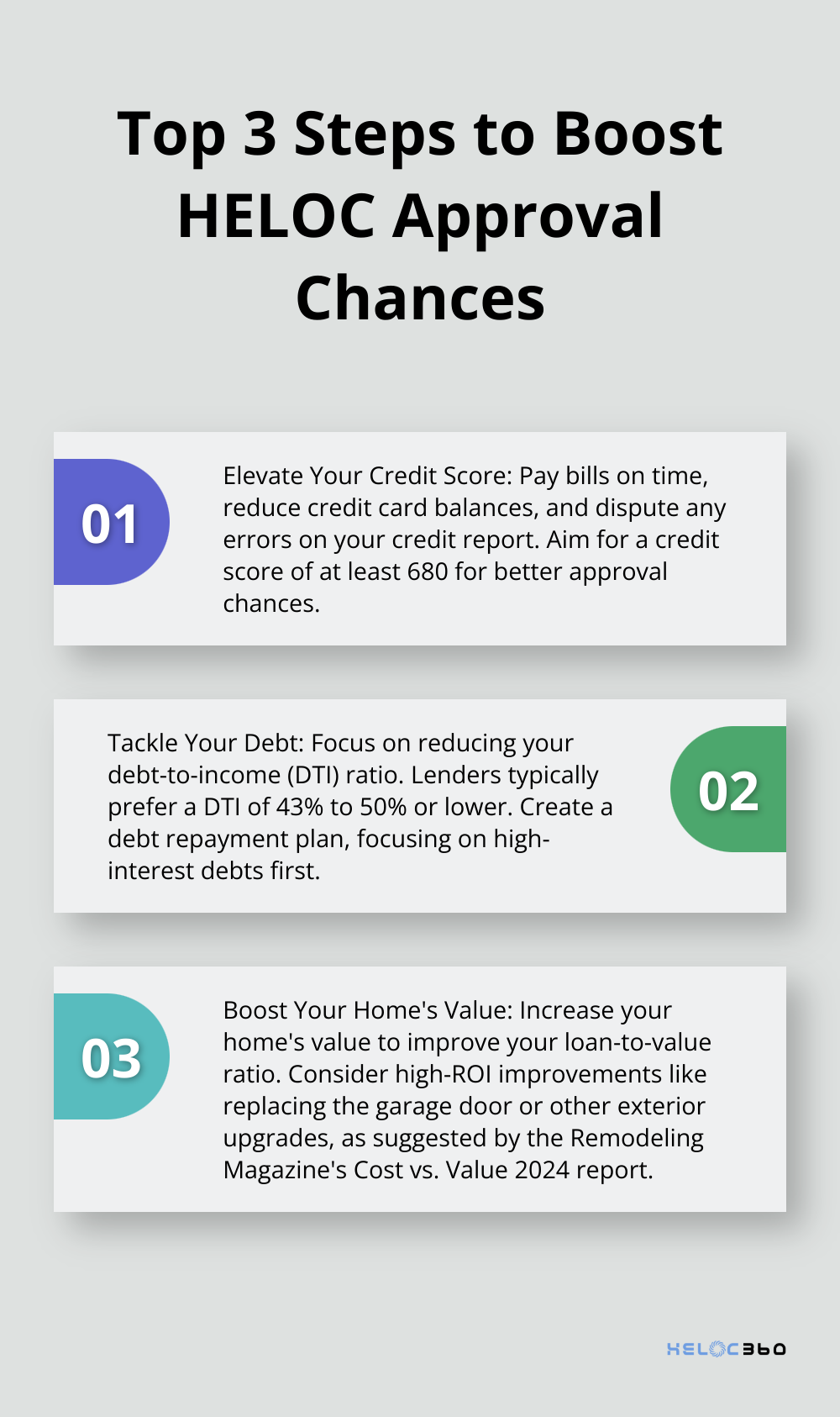

Elevate Your Credit Score

Your credit score significantly impacts HELOC approval. It’s possible to qualify for a home equity loan with a bad credit, but you’ll likely need a credit score of at least 680 for approval. To increase your score, pay bills on time, which affects 35% of your FICO score. Reduce credit card balances to lower your credit utilization ratio. Try to maintain a utilization rate below 30% across all your cards. Dispute any errors on your credit report immediately. These actions can potentially increase your score by 20-100 points within a few months.

Tackle Your Debt

Lenders scrutinize your debt-to-income (DTI) ratio. Lenders will want you to have a debt-to-income ratio of 43% to 50% at most, although some will require this to be lower. To improve your ratio, create a debt repayment plan. Focus on high-interest debts first, as they impact your finances most significantly. Consider the debt avalanche method: pay minimum payments on all debts but allocate extra money towards the highest-interest debt. This approach can save you money on interest and potentially improve your DTI faster.

Boost Your Home’s Value

Increasing your home’s value can improve your loan-to-value ratio, making you a more attractive borrower. According to the Remodeling Magazine’s Cost vs. Value 2024 report, the top three home improvement projects that have the best ROI are replacing the garage door and other exterior improvements. Even simple updates like fresh paint or landscaping can make a difference. (Consult a local real estate agent to understand which improvements are most valued in your area before making any major changes.)

Compile Comprehensive Documentation

Thorough documentation streamlines the underwriting process. Gather at least two years of tax returns, recent pay stubs, and bank statements. Self-employed applicants should prepare profit and loss statements. Have a clear explanation ready for any unusual income or expenses. For property-related documents, include your most recent mortgage statement, property tax bill, and homeowners insurance policy. (The more organized and complete your documentation, the smoother your application process will be.)

Understand Lender Requirements

Each lender has unique criteria for HELOC approval. Research different lenders’ requirements to find the best fit for your situation. Some lenders may offer more flexible terms or have specific programs for certain types of borrowers. (For example, some lenders might have special considerations for self-employed individuals or those with non-traditional income sources.)

Final Thoughts

HELOC underwriting involves complex factors that determine eligibility and terms. Your credit score, debt-to-income ratio, home equity, and income stability all influence the approval process. We at HELOC360 understand these intricacies and work to simplify the process for homeowners.

Our platform provides tailored solutions and expert guidance to connect you with suitable lenders. We equip you with the knowledge and tools to navigate the HELOC landscape effectively. HELOC360 helps turn your home’s equity into a powerful financial resource.

A HELOC can serve as a valuable financial tool when used wisely. Thorough preparation increases your approval chances and sets you up for long-term financial success. With the right approach and support, you can unlock the full potential of your home equity and achieve your financial goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.