Are you looking to maximize your HELOC loan-to-value ratio? Understanding this crucial factor can make a big difference in your borrowing power and terms.

At HELOC360, we’ve seen how a higher LTV can unlock better rates and larger credit lines for homeowners. This guide will show you practical ways to boost your HELOC LTV and get the most out of your home equity.

What Is HELOC Loan-to-Value Ratio?

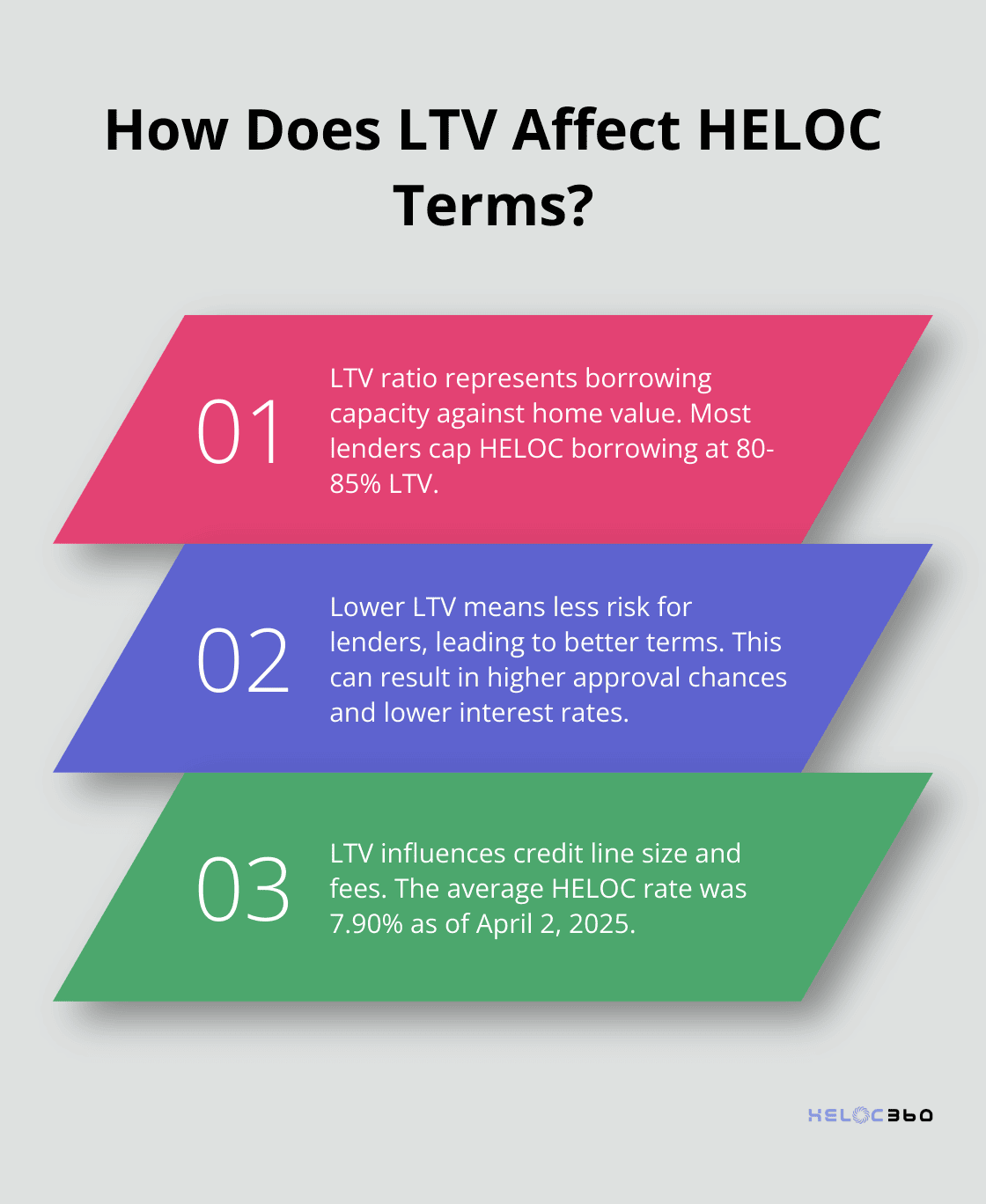

Understanding LTV Basics

Loan-to-value (LTV) ratio stands as a critical metric in the realm of home equity lines of credit (HELOCs). This percentage represents how much of your home’s value you can borrow against. For instance, if your home is worth $400,000 and you have a mortgage balance of $200,000, your current LTV is 50%.

Most lenders set a cap on HELOC borrowing at 80-85% LTV. In our example, this means you could potentially borrow up to $140,000 more against your home, bringing your total LTV to 85%.

Calculating Your LTV for HELOCs

Lenders assess your combined loan-to-value (CLTV) ratio to determine your LTV for a HELOC. This calculation includes your existing mortgage balance plus the proposed HELOC amount, divided by your home’s current appraised value.

Let’s break it down with an example:

- Home value: $200,000

- Existing mortgage: $140,000

- CLTV calculation: $140,000 ÷ $200,000 = .70 or 70%

The Significance of LTV in HELOC Approval

Your LTV directly influences both your approval odds and the terms you’ll receive. A lower LTV translates to less risk for lenders, potentially resulting in:

- Higher approval chances

- Lower interest rates

- Larger credit lines

- Fewer fees

The average rate on a home equity line of credit (HELOC) was 7.90 percent as of April 2, 2025, according to a recent report.

Home Values and LTV Fluctuations

It’s important to note that your LTV isn’t static. As your home value changes, so does your LTV. In rapidly appreciating markets, your LTV may decrease even without extra payments, potentially qualifying you for better terms.

On the flip side, declining markets could increase your LTV, potentially putting you at risk of being “underwater” on your loans (owing more than your home is worth). This highlights the importance of staying informed about your local real estate trends and reassessing your LTV periodically.

The Role of LTV in HELOC Terms

Your LTV plays a significant role in determining the terms of your HELOC. Lenders use this metric to assess risk and set interest rates. A lower LTV often results in more favorable terms, including:

- Lower interest rates

- Higher credit limits

- More flexible repayment options

- Reduced fees

As we move forward, we’ll explore the various factors that affect your HELOC LTV and strategies to improve it, empowering you to secure the best possible terms for your financial needs.

What Impacts Your HELOC LTV?

Several key factors influence your HELOC loan-to-value ratio, ultimately affecting your borrowing power and terms. Understanding these elements can help you take proactive steps to improve your LTV and secure better HELOC conditions.

Home Value and Equity

Your home’s current market value plays a significant role in determining your LTV. As of February 2025, the median sales price of new houses sold was $414,500, according to the U.S. Census Bureau. This figure highlights the potential for equity growth in many markets.

To maximize your HELOC LTV, consider ways to increase your home’s value. Simple upgrades like fresh paint, landscaping improvements, or energy-efficient appliances can boost your property’s worth. For more significant value increases, focus on high-ROI renovations such as kitchen or bathroom remodels, which typically yield 70-80% returns on investment.

Credit Score and History

Your credit score significantly impacts your HELOC LTV. Lenders view higher credit scores as indicators of lower risk, often rewarding borrowers with higher LTV limits. According to Experian, the average FICO score in the U.S. is 716 as of April 2025.

To improve your credit score, pay bills on time, reduce credit card balances, and avoid new credit applications in the months leading up to your HELOC application. These actions can potentially increase your score by 20-30 points within a few months, potentially qualifying you for a higher LTV ratio.

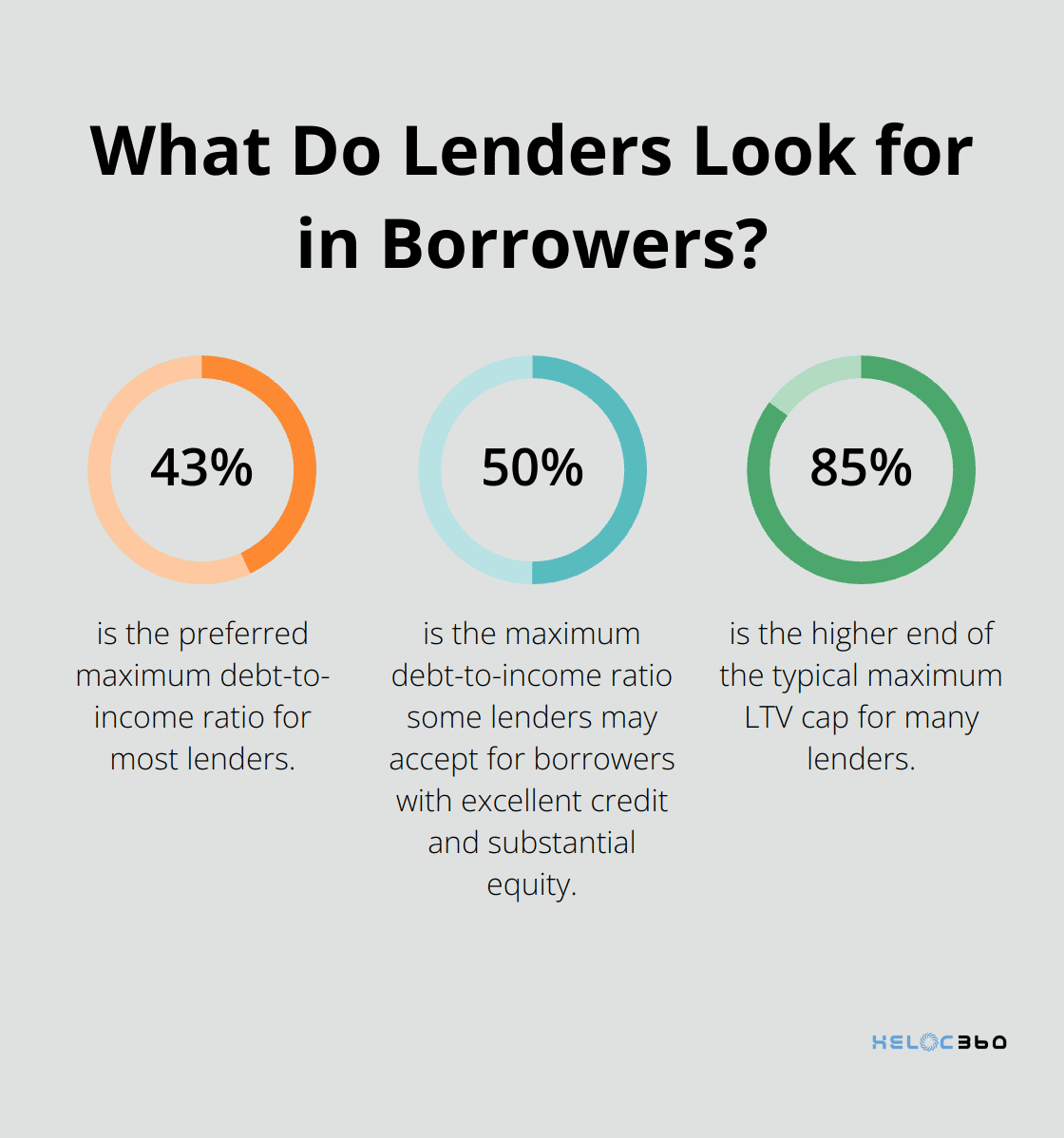

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another critical factor affecting your HELOC LTV. Most lenders prefer a DTI of 43% or lower, though some may accept up to 50% for borrowers with excellent credit and substantial equity.

To lower your DTI, pay down existing debts, particularly high-interest credit card balances. Consider using the debt avalanche method, targeting your highest-interest debts first to maximize interest savings and quickly reduce your DTI.

Lender Policies and Risk Assessment

Different lenders have varying policies regarding HELOC LTVs. While many cap their LTVs at 80-85%, some may offer higher limits for well-qualified borrowers. It’s essential to shop around and compare offers from multiple lenders to find the best terms for your situation.

When evaluating lenders, look beyond just the LTV limits. Consider factors such as interest rates, fees, and repayment terms. Some lenders may offer higher LTVs but compensate with higher interest rates or fees.

Keep in mind that lenders also assess overall market conditions when determining LTV limits. In times of economic uncertainty, they may tighten their lending criteria, potentially lowering maximum LTVs across the board.

Now that we’ve explored the factors impacting your HELOC LTV, let’s examine some effective strategies to improve your loan-to-value ratio and secure more favorable terms.

How to Boost Your HELOC LTV

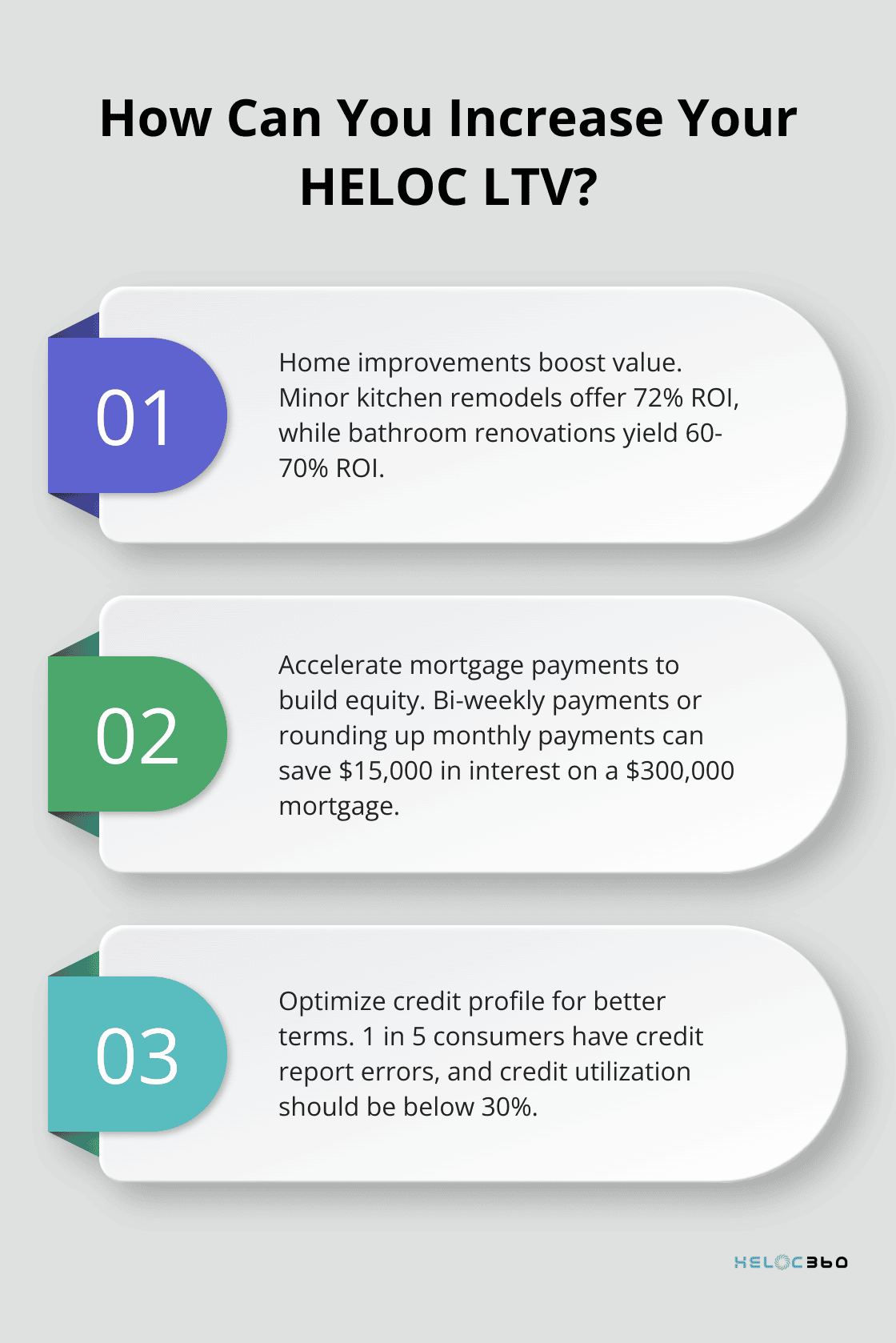

Increase Your Home’s Value

One of the most effective ways to improve your HELOC LTV is to increase your home’s value. Focus on high-ROI renovations that appeal to potential buyers. Minor kitchen remodels offer an average 72% return on investment, according to Remodeling Magazine’s 2025 Cost vs. Value Report. Bathroom renovations can yield a 60-70% ROI. Even simple upgrades like fresh paint or new fixtures can make a difference.

Energy-efficient improvements are particularly attractive in today’s market. Installing solar panels can increase your home’s value by an average of 4.1% (according to a recent study by Zillow). These upgrades not only boost your home’s worth but also reduce energy costs, making your property more appealing to lenders.

Accelerate Your Mortgage Payments

Paying down your existing mortgage faster directly improves your LTV ratio. Consider making bi-weekly payments instead of monthly ones. This strategy cuts down on interest and helps build home equity faster, with no downside (assuming you can afford it).

Another approach is to round up your mortgage payments. If your monthly payment is $1,450, pay $1,500 instead. This small increase can add up significantly over time. For a $300,000 30-year mortgage at 4% interest, rounding up by just $50 per month could save you over $15,000 in interest and pay off your loan 1.5 years earlier.

Optimize Your Credit Profile

Your credit score plays a key role in determining your HELOC LTV. Start by obtaining your free credit report from AnnualCreditReport.com. Review it carefully for errors – a Federal Trade Commission study found that 1 in 5 consumers had an error on at least one of their credit reports.

To improve your score, pay down high-interest credit card debt. The credit utilization ratio (which accounts for 30% of your FICO score) should ideally be below 30%. If you have multiple cards, use the debt avalanche method, targeting the highest-interest debt first.

Explore Multiple Lender Options

Don’t settle for the first HELOC offer you receive. Different lenders have varying policies on LTV ratios. Some online lenders may offer higher LTVs than traditional banks. A recent survey by J.D. Power found that online-only lenders had higher customer satisfaction scores compared to traditional banks in the home equity lending space.

When comparing lenders, look beyond just the LTV ratio. Consider factors like interest rates, fees, and customer service. Some lenders may offer slightly lower LTVs but compensate with better rates or fewer fees.

Stay Informed About Market Trends

Regularly reassess your home’s value and stay informed about market trends. This knowledge will help you make informed decisions about when to apply for a HELOC or refinance an existing one. Keep tabs on local real estate prices, interest rate movements, and economic indicators that might affect property values in your area.

Final Thoughts

Maximizing your HELOC loan-to-value ratio unlocks the full potential of your home equity. Your home’s value, credit score, and debt-to-income ratio determine your HELOC LTV. High-ROI home improvements, faster mortgage payments, and credit profile optimization can boost your LTV significantly.

Multiple lender options and market trend awareness help you make the most of your home equity. HELOC360 simplifies the process and provides expert guidance tailored to your unique financial goals. Our platform offers comprehensive solutions to help you achieve your aspirations.

HELOC360 can transform your home’s equity into a powerful financial tool. Take control of your financial future today and discover how HELOC360 can help you maximize your HELOC loan-to-value ratio. Our resources will empower you to make the most of your home’s value.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.