A HELOC freeze can throw your financial plans into disarray. This sudden halt to your line of credit can leave you scrambling for alternatives and wondering about your next steps.

At HELOC360, we understand the stress and uncertainty that comes with a HELOC freeze. In this post, we’ll guide you through the essential steps to take and explore viable options to help you navigate this challenging situation.

What Is a HELOC Freeze?

Definition and Mechanics

A HELOC freeze occurs when a lender decides to suspend access to your home equity line of credit. This action prevents new draws on your credit line, cutting off a potential source of funds you may have relied on.

Common Reasons for HELOC Freezes

Lenders typically freeze HELOCs when they perceive increased risk. The most common reasons include:

- Declining property values: If your home’s value drops significantly, your lender may freeze your HELOC to prevent you from borrowing more than your home is worth. The National Association of Realtors reported that during the final quarter of 2008, home prices dropped a record 12.4% – the biggest decline in 30 years.

- Changes in financial situation: Job loss, reduced income, or increased debt can trigger a freeze. The Bureau of Labor Statistics reported that during the COVID-19 pandemic, unemployment rates peaked at 14.7% in April 2020, causing many lenders to reassess HELOC agreements.

- Credit score drops: A significant decrease in your credit score may prompt your lender to freeze your HELOC. FICO data shows that a single missed payment can cause a 100-point drop in credit score, potentially triggering a freeze.

Impact on Homeowners

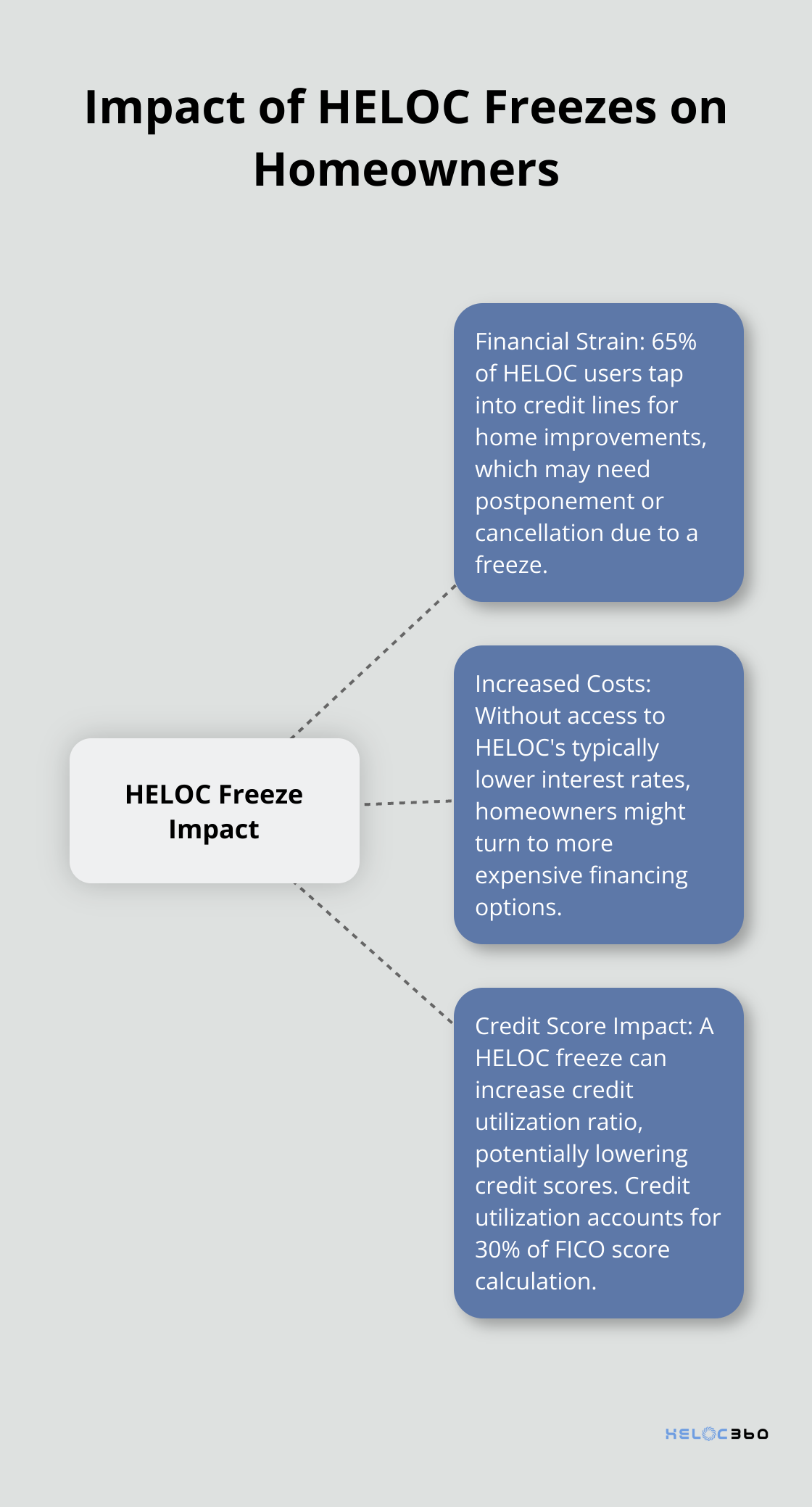

HELOC freezes can seriously affect homeowners:

- Financial strain: If you relied on your HELOC for ongoing expenses or planned projects, a freeze can force you to scramble for alternative funding. A Bankrate survey found that 65% of HELOC users tap into their credit lines for home improvements, which may need postponement or cancellation due to a freeze.

- Increased costs: Without access to your HELOC’s typically lower interest rates, you might turn to more expensive financing options.

- Credit score impact: A HELOC freeze can increase your credit utilization ratio, potentially lowering your credit score. FICO reports that credit utilization accounts for 30% of your credit score calculation.

Proactive Measures

To mitigate the risk of a HELOC freeze, you should:

- Understand your HELOC agreement (including freeze conditions)

- Monitor your home’s value and local real estate trends

- Maintain a strong credit score and stable financial situation

- Keep open communication with your lender

These steps can help you anticipate and potentially prevent a HELOC freeze. However, if a freeze does occur, you’ll need to take immediate action. In the next section, we’ll explore the critical steps to take after a HELOC freeze and discuss alternative financing options to help you navigate this challenging situation.

What to Do When Your HELOC Freezes

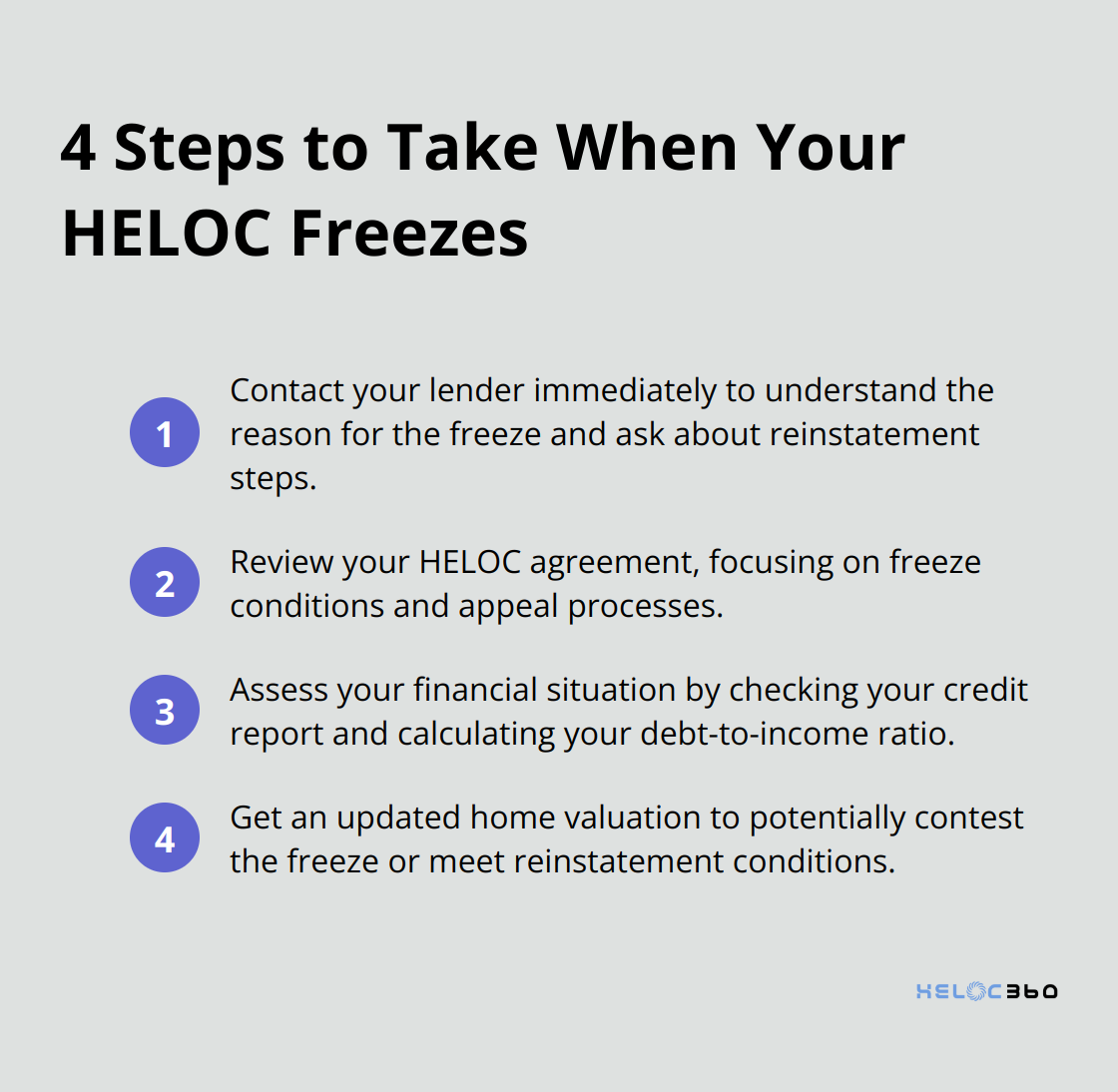

Contact Your Lender Immediately

When you discover your Home Equity Line of Credit (HELOC) has been frozen, act quickly. Call your lender right away. Ask your lender how to have your HELOC reinstated. Your lender must reinstate your credit privileges when the conditions permitting the freeze or reduction no longer exist.

Understanding the specific reason for the freeze will give you a clear picture of what you need to address to potentially lift the freeze. During this conversation, ask about the steps you can take to reinstate your HELOC. Some lenders might require a new appraisal or proof of improved financial circumstances.

Review Your HELOC Agreement

Pull out your HELOC agreement and read it carefully. Focus on the sections that detail the conditions under which the lender can freeze or reduce your credit line. This information is typically found in the fine print, so prepare to examine it closely.

Look for any clauses about appealing a freeze decision. Some agreements outline a formal process for contesting a freeze. If such a process exists, follow it precisely. You might need to provide documentation proving that the freeze was unwarranted.

Assess Your Financial Situation

Now’s the time for a thorough financial check-up. Start by pulling your credit report from all three major bureaus (Equifax, Experian, and TransUnion). A 2021 study by the Consumer Financial Protection Bureau found that 26% of consumers had at least one potentially material error on their credit report. If you spot any inaccuracies, dispute them immediately.

Next, calculate your debt-to-income ratio. Your debt-to-income ratio is calculated by adding up all your monthly debt payments and dividing them by your gross monthly income. Most lenders prefer this ratio to be below 43%. If yours is higher, create a plan to pay down some debts. This might involve cutting non-essential expenses or finding ways to increase your income.

Get an Updated Home Valuation

Obtain an up-to-date valuation of your home. If your lender used outdated information to freeze your HELOC, a current appraisal showing a higher value could help your case. The National Association of Realtors reported that the median existing-home sales price climbed 2.7% from March 2024 to $403,700, an all-time high for the month of March and the 21st consecutive month of year-over-year price gains. This upward trend might work in your favor.

A HELOC freeze isn’t necessarily permanent. Take these immediate steps to position yourself to either contest the freeze or meet the conditions for reinstatement. Stay proactive, keep communication lines open with your lender, and be prepared to provide any necessary documentation to support your case.

If your lender remains unresponsive or you need expert guidance to navigate this process, consider reaching out to HELOC360. Our platform can connect you with professionals who specialize in HELOC challenges and provide tailored solutions to help you regain access to your home equity.

Exploring Your Financial Lifelines

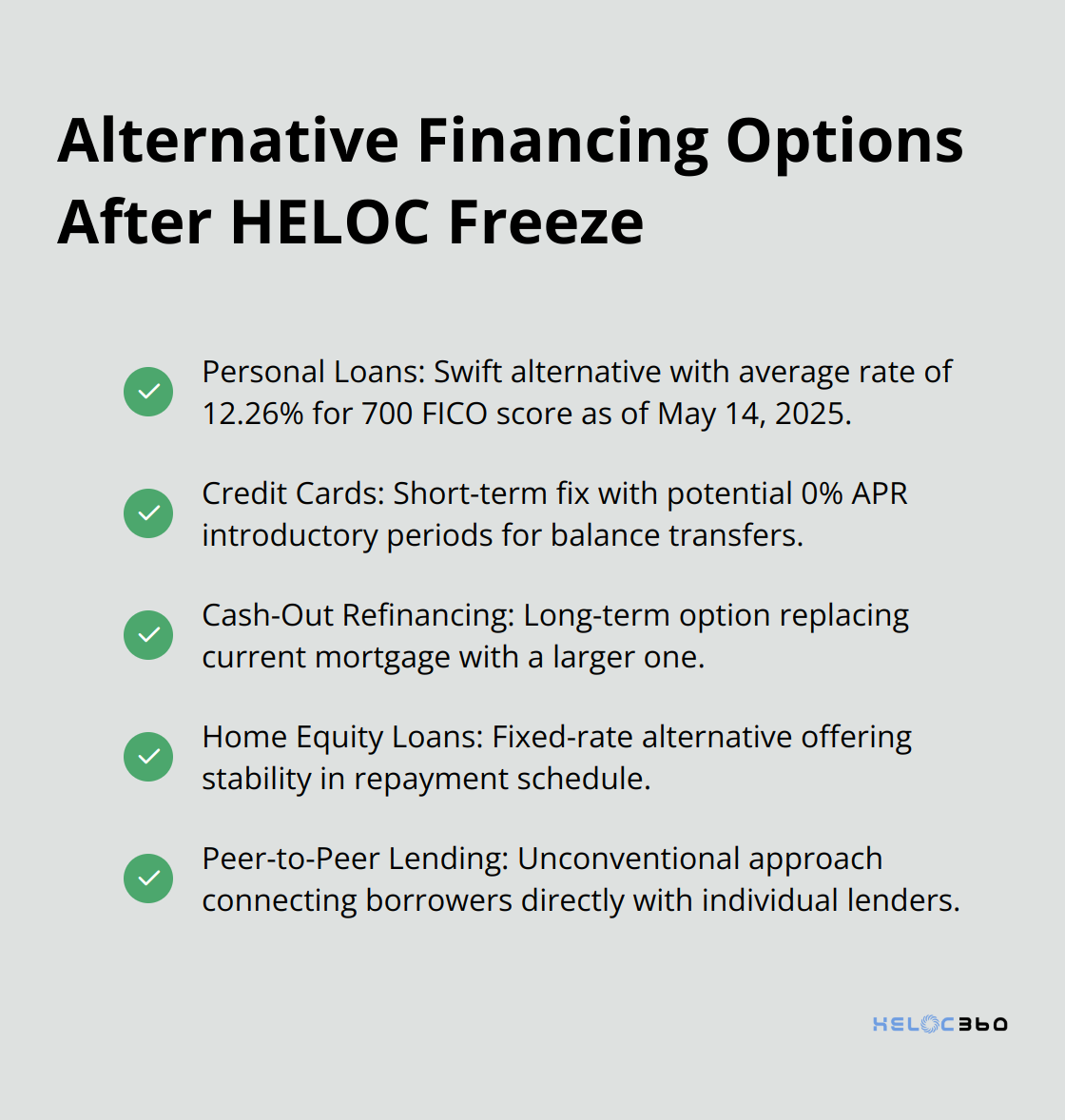

Personal Loans: A Swift Alternative

Personal loans offer a potential solution when your HELOC freezes. As of May 14, 2025, the average personal loan rate is 12.26 percent for customers with a 700 FICO score. This rate surpasses typical HELOC rates but remains lower than most credit cards. Online lenders such as SoFi and LendingClub often provide competitive rates and rapid approval processes (sometimes within 24 hours).

Exercise caution, however. Personal loans typically feature shorter repayment terms than HELOCs, which can result in higher monthly payments. Always calculate the total loan cost (including fees) before you commit.

Credit Cards: A Short-Term Fix

Credit cards can provide immediate access to funds, but at a cost. This high rate makes credit cards suitable only for short-term financing needs.

If you must use a credit card, search for balance transfer offers with 0% APR introductory periods. These can provide temporary relief, but be aware – once the intro period ends, interest rates increase dramatically. Chase and Citi often have competitive balance transfer offers, but always scrutinize the fine print.

Cash-Out Refinancing: A Long-Term Option

Cash-out refinancing involves replacing your current mortgage with a new, larger one and receiving the difference in cash. Average HELOC balances increased by 7.2% in 2024, indicating a growing trend in home equity utilization.

However, refinancing comes with closing costs (typically 2-5% of the loan amount). It also resets your mortgage term, potentially extending your debt. Carefully consider the long-term implications before you choose this route.

Home Equity Loans: A Fixed-Rate Alternative

Home equity loans provide another option for accessing your home’s value. Unlike HELOCs, these loans offer a fixed interest rate and a lump sum payment.

This option can provide stability in your repayment schedule, as your monthly payments remain constant throughout the loan term. However, you’ll need sufficient equity in your home (usually 15-20%) to qualify.

Peer-to-Peer Lending: An Unconventional Approach

Peer-to-peer lending platforms (like Prosper or Upstart) connect borrowers directly with individual lenders. These platforms can offer competitive rates, especially for borrowers with good credit scores.

While this option can provide quick access to funds, it’s important to compare the terms carefully with traditional lending options. Some peer-to-peer loans may have higher origination fees or shorter repayment terms than bank loans. Before making a decision, it’s crucial to explore all potential drawbacks and hidden costs associated with different financing options.

Final Thoughts

A HELOC freeze can disrupt your financial plans, but you can overcome this challenge with the right approach. Act quickly by contacting your lender, reviewing your agreement, and assessing your financial situation. Consider alternative financing options such as personal loans, credit cards, or cash-out refinancing, each with its own advantages and drawbacks.

Financial preparedness will help you anticipate and potentially prevent HELOC freezes. Monitor your credit score, maintain a healthy debt-to-income ratio, and stay informed about your home’s value. These steps will position you to navigate the complexities of home equity borrowing more effectively.

HELOC360 offers expert guidance and connects you with lenders that fit your unique financial needs. We aim to help homeowners unlock the full potential of their home equity (even in challenging situations). Don’t let a HELOC freeze derail your financial goals – with the right knowledge and support, you can turn this setback into an opportunity for growth.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.