Thinking about HELOC conversion? You’re not alone. Many homeowners are exploring ways to transform their variable-rate Home Equity Lines of Credit into more predictable fixed-rate loans.

At HELOC360, we’ve seen a growing trend of borrowers seeking stability in their home financing. This guide will walk you through the process, benefits, and considerations of converting your HELOC to a fixed-rate loan.

Why Convert Your HELOC?

Understanding HELOC Conversion

Converting a Home Equity Line of Credit (HELOC) to a fixed-rate loan transforms the variable interest rate of your HELOC into a stable, predictable fixed rate. This strategic move attracts many homeowners, especially during times of economic uncertainty.

Stability in an Unpredictable Market

The primary motivation for homeowners to convert their HELOCs is financial stability. Variable rates can fluctuate dramatically based on market conditions. For example, the Prime Rate has seen significant changes over the years. Such significant changes can disrupt your monthly budget.

Locking in a fixed rate protects you from these market swings. Your monthly payments become predictable, which facilitates long-term financial planning.

Protection Against Rising Interest Rates

Converting your HELOC can prove advantageous if you anticipate rising interest rates. It allows you to secure a lower rate now, potentially saving substantial amounts over the life of your loan.

Consider this scenario: If you convert a HELOC balance from a variable rate to a fixed rate, you could potentially save on interest over the life of the loan. The exact savings would depend on the specific rates and terms of your loan.

Simplified Budgeting

Fixed-rate loans offer constant monthly payments. This consistency can revolutionize your budgeting process, especially if you have a fixed income or other financial obligations.

Potential Drawbacks to Consider

While HELOC conversion offers significant benefits, it’s not without potential downsides:

- Higher initial rates: Fixed rates typically exceed the initial rates offered on HELOCs.

- Conversion fees: The process might involve fees that could offset some of your savings.

- Reduced flexibility: HELOCs allow you to borrow only what you need, when you need it. Converting to a fixed-rate loan commits you to repaying the entire balance.

These factors require careful consideration. A thorough analysis of your financial situation and future plans should precede any decision.

Exploring Your Options

The right choice depends on your individual circumstances. Understanding your options marks the first step towards making an informed decision that aligns with your financial goals. The next section will guide you through the steps to convert your HELOC to a fixed-rate loan, helping you navigate this important financial decision.

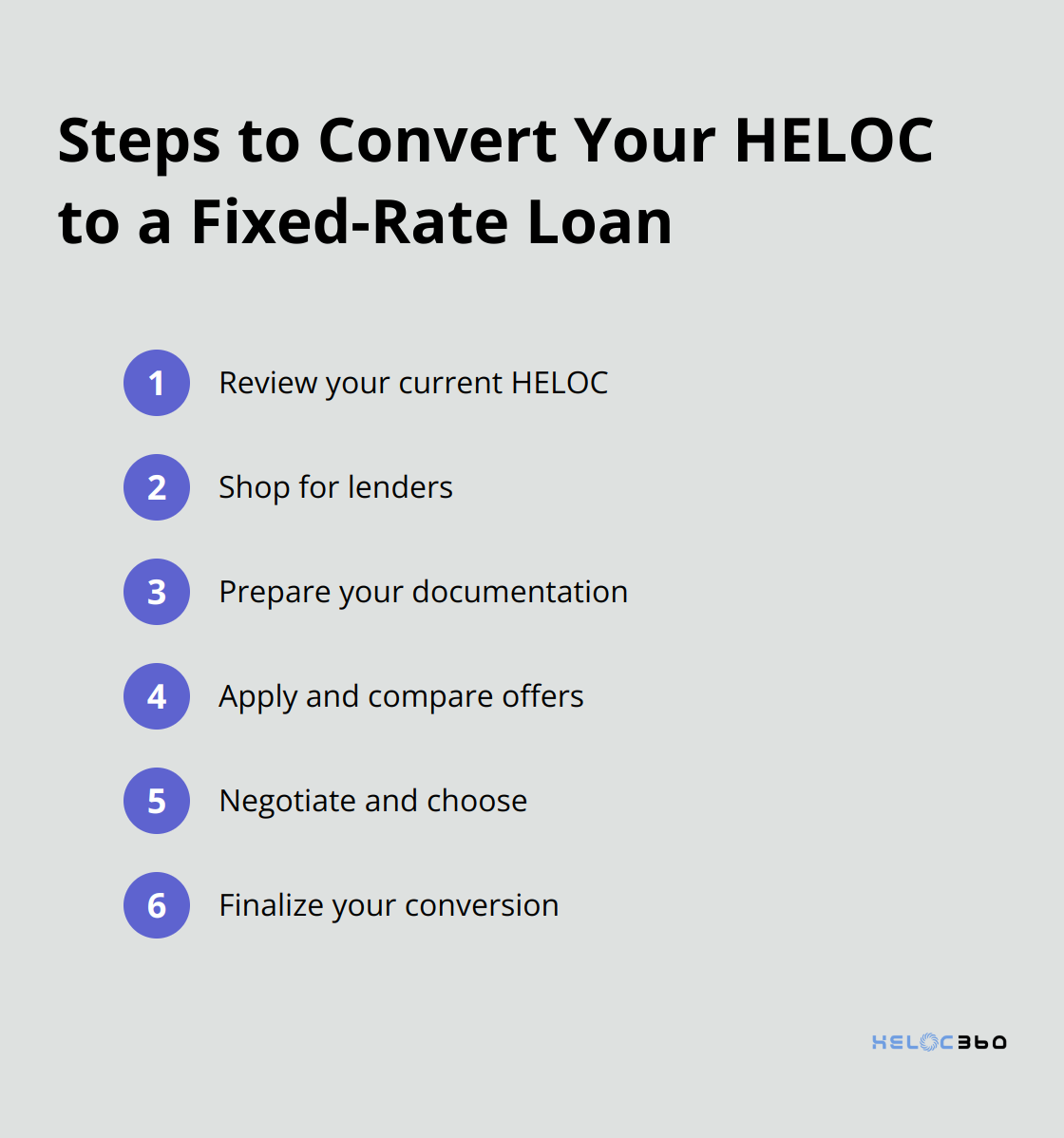

How to Convert Your HELOC to a Fixed-Rate Loan

Converting your HELOC to a fixed-rate loan doesn’t require a complex process. Follow these straightforward steps to navigate this financial decision with confidence.

Review Your Current HELOC

Take a close look at your existing HELOC. Note your current balance, interest rate, and remaining draw period. This information forms the foundation of your conversion strategy. Compare your rate to current benchmarks to determine if conversion is the right move for you.

Shop for Lenders

Don’t restrict yourself to your current lender. Many financial institutions offer HELOC conversion options, each with unique terms and rates. For example, Bank of America allows up to three fixed-rate conversions within a single HELOC (while HELOC360 offers even more flexible options). U.S. Bank offers fixed-rate conversions with a minimum of $2,000. Cast a wide net to find the best deal.

Prepare Your Documentation

Lenders typically require proof of income, assets, and debts. Gather recent pay stubs, tax returns, and bank statements. Having these documents ready can speed up the application process. Your preparation can help you streamline the process.

Apply and Compare Offers

Submit applications to multiple lenders. This allows you to compare offers side-by-side. Pay attention to interest rates, fees, and loan terms. A difference of even 0.5% in interest rate can translate to thousands of dollars over the life of your loan.

Negotiate and Choose

Don’t hesitate to negotiate. If you have a strong credit score (typically 720 or higher for the best rates), use it as leverage. Ask lenders if they can match or beat competitors’ offers.

Finalize Your Conversion

Once you’ve selected an offer, carefully review the terms before signing. Pay special attention to any prepayment penalties or conversion fees. Some lenders charge a fee for each conversion (which can range from $50 to $500).

These steps will guide you through converting your HELOC to a fixed-rate loan. This process can provide the stability and predictability you need in your financial planning. However, before you make your final decision, it’s important to consider several key factors. Let’s explore these in the next section to ensure you make the most informed choice for your financial future.

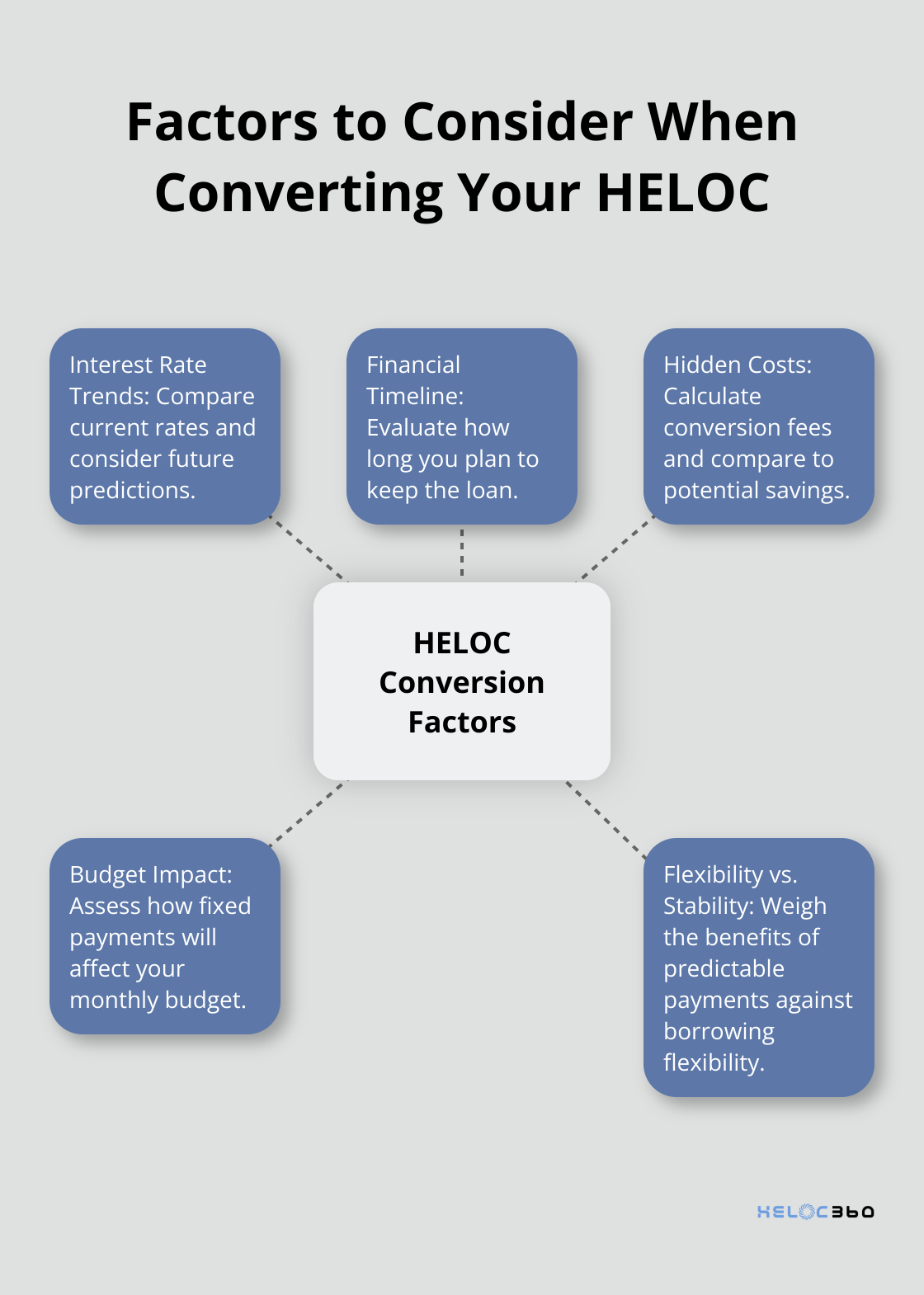

Is Converting Your HELOC Right for You?

Interest Rate Trends

The current interest rate environment plays a key role in your decision. As of June 2025, interest rates fluctuate. Compare your current HELOC rate to other available rates. If your HELOC rate is significantly lower, conversion might not benefit you right now.

However, if economists predict a rise in interest rates, locking in a fixed rate could save you money in the long run. Watch economic indicators and consult financial experts to gauge future rate trends.

Your Financial Timeline

Consider how long you plan to keep the loan. If you’ll sell your home or pay off the loan within a few years, the stability of a fixed rate might not outweigh the potential costs of conversion.

Conversely, if you’re in your forever home and plan to carry the loan for many years, a fixed rate could provide long-term stability and potentially save you money over time.

Hidden Costs

Converting your HELOC isn’t free. Lenders often charge fees for the conversion process. These can include application fees, appraisal costs, and closing costs.

Calculate these costs and compare them to your potential savings from a fixed rate. If the fees outweigh the benefits, conversion might not be worth it.

Impact on Your Budget

Switching to a fixed-rate loan will change your monthly payments. While you gain predictability, you might also face higher initial payments. This happens because you’ll start paying both principal and interest, unlike the interest-only payments common in HELOC draw periods.

Use a loan calculator to estimate your new monthly payments. Make sure they fit comfortably within your budget. If the increase stretches your finances too thin, you might want to reconsider or look for ways to increase your income (or reduce other expenses).

Flexibility vs. Stability

HELOCs offer flexibility in borrowing and repayment. You can borrow what you need, when you need it (up to your credit limit). Fixed-rate loans, on the other hand, provide stability but less flexibility.

Consider your future financial needs. If you anticipate needing to borrow more in the future, keeping your HELOC might be advantageous. However, if you value predictable payments and want to lock in your rate, converting your HELOC to a fixed-rate option could be the right choice.

Final Thoughts

HELOC conversion offers stability in monthly payments, which proves valuable during rising interest rates. However, you must weigh this against potential drawbacks such as higher initial rates and reduced borrowing flexibility. Your decision should align with your current financial situation, future goals, and the broader economic landscape.

The conversion process involves several steps, from reviewing current terms to comparing offers from different lenders. Each stage requires careful consideration to ensure you make the best decision for your financial future. We at HELOC360 understand the complexity of these decisions and strive to provide homeowners with the necessary tools and information.

Our platform connects you with lenders that match your specific needs, simplifying the process of exploring your HELOC options. We encourage you to take time to understand your options and seek professional advice when needed. This approach will support your long-term financial health and help you achieve your goals.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.