Your home is more than just a place to live – it’s a powerful financial asset. Many homeowners are unaware of the potential their property holds, especially when it comes to HELOC leverage.

At HELOC360, we’ve seen firsthand how a Home Equity Line of Credit (HELOC) can transform financial situations. This flexible borrowing option allows you to tap into your home’s equity, providing opportunities for smart investments, debt consolidation, or funding major life events.

Understanding HELOCs: Your Home’s Hidden Treasure

A Home Equity Line of Credit (HELOC) is a financial tool that allows homeowners to borrow against the available equity in their home, using the house as collateral for the line of credit. It functions as a revolving credit line, similar to a credit card, but uses your home as collateral.

How HELOCs Work

When you receive approval for a HELOC, the lender assigns you a credit limit based on your home’s value and your outstanding mortgage balance. You can then withdraw from this line of credit as needed, paying interest only on the amount you borrow. This flexibility makes HELOCs particularly useful for ongoing expenses or projects with uncertain costs.

Most HELOCs operate in two phases: a draw period and a repayment period. The draw period typically lasts 3 to 5 years, during which you can borrow funds. After the draw period ends, you enter the repayment phase where you can no longer borrow and must repay both principal and interest.

HELOC vs Home Equity Loan

While both HELOCs and home equity loans allow you to borrow against your home’s equity, they function differently. A home equity loan provides a lump sum upfront with a fixed interest rate, making it ideal for one-time, large expenses. In contrast, a HELOC offers more flexibility with its revolving credit line and variable interest rates.

For instance, if you plan a home renovation project with uncertain costs, a HELOC might suit you better. You can withdraw funds as needed, potentially saving on interest compared to a lump-sum loan.

Advantages of HELOCs

HELOCs offer several benefits over other financing options:

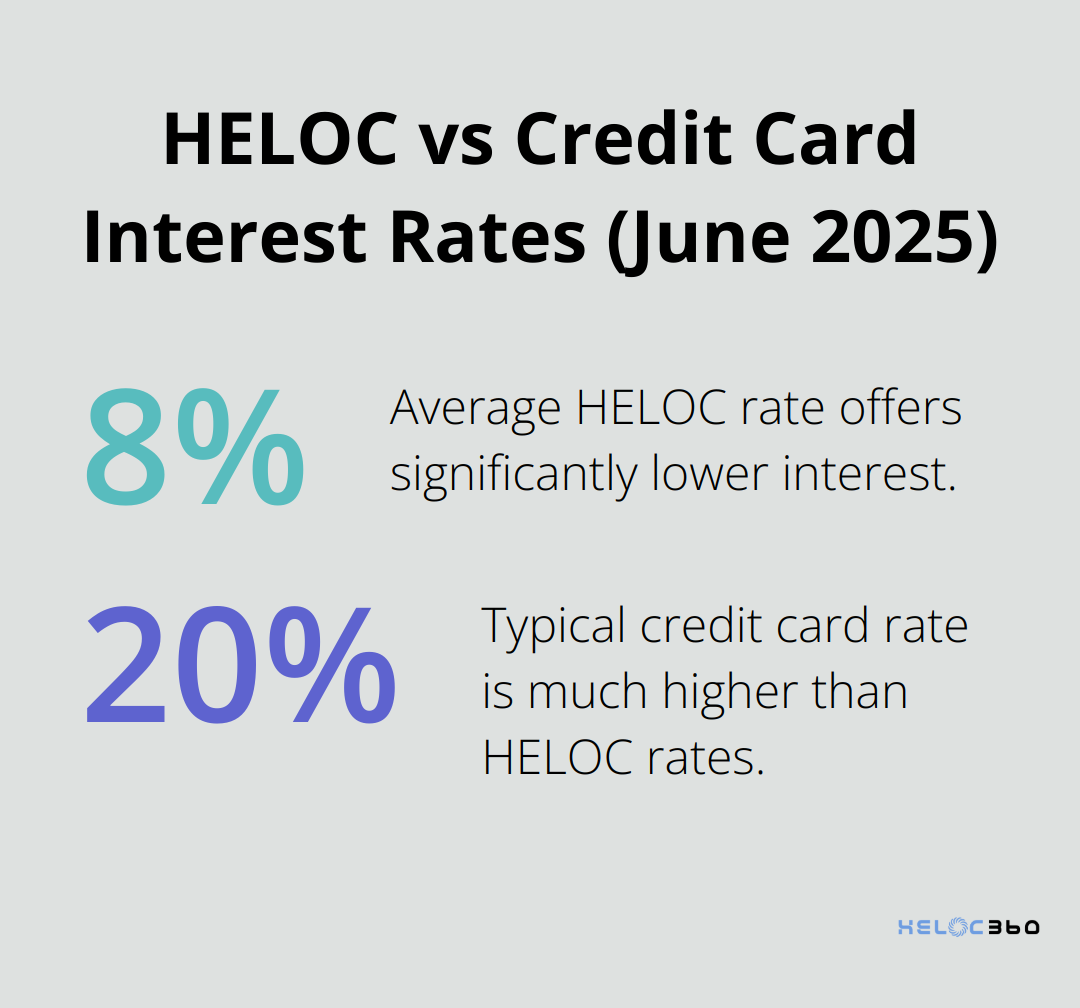

- Lower Interest Rates: HELOCs typically have lower interest rates than credit cards or personal loans. According to recent data, as of June 2025, the average HELOC rate is 8.14%.

- Tax Advantages: The interest paid on a HELOC used for home improvements may be tax-deductible (consult with a tax professional for specifics on your situation).

- Unparalleled Flexibility: Unlike a personal loan where you receive a lump sum and immediately start accruing interest on the full amount, with a HELOC, you only pay interest on what you’ve borrowed. This can lead to significant savings if you’re unsure of exactly how much money you’ll need.

Responsible Use of HELOCs

While HELOCs can be powerful financial tools, it’s important to understand their terms and use them responsibly. Platforms like HELOC360 can help you navigate the process, ensuring you make informed decisions about leveraging your home equity.

Now that we’ve explored the basics of HELOCs, let’s look at some smart ways to use this financial tool to your advantage.

Maximizing Your HELOC Potential

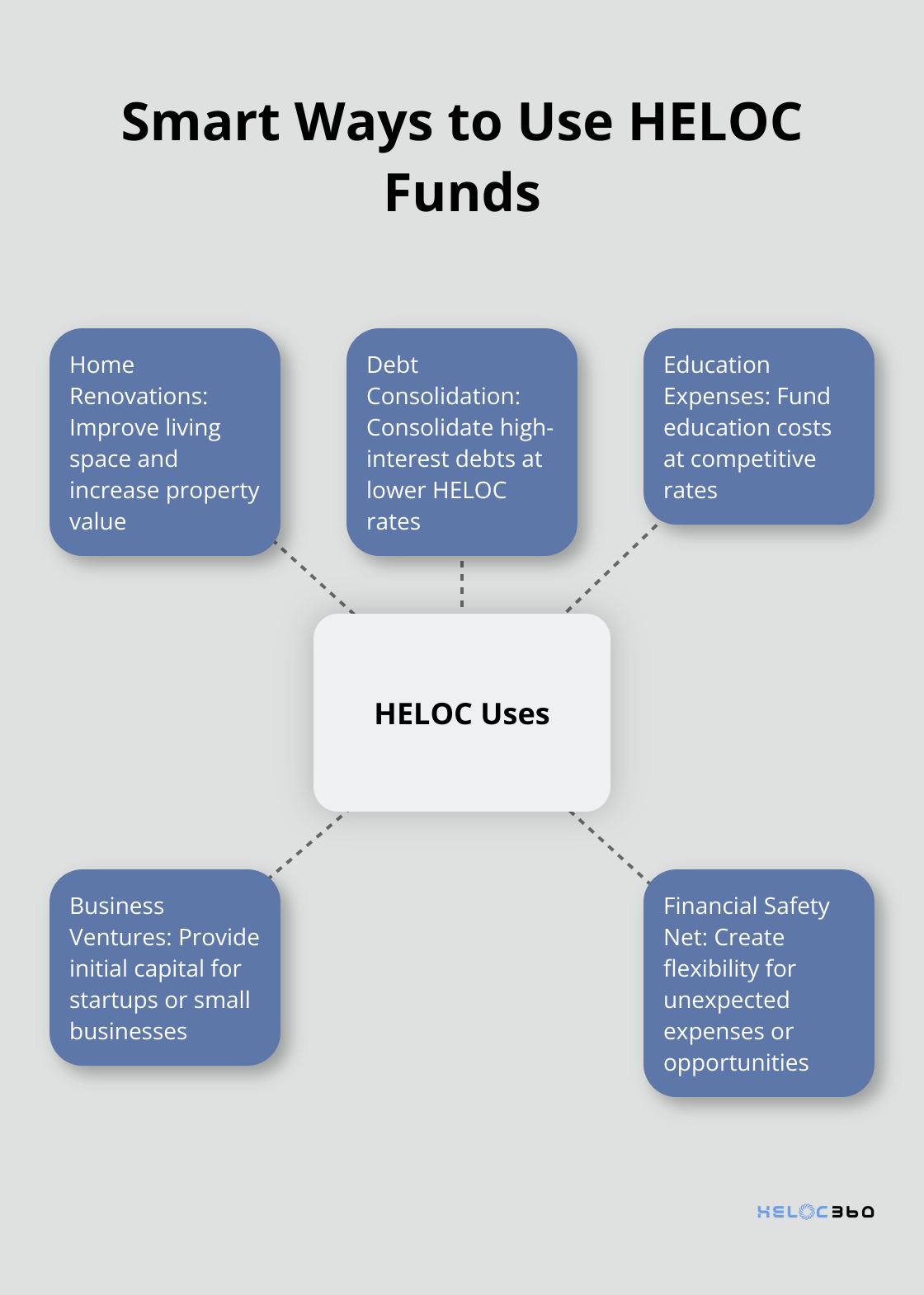

Boosting Property Value Through Smart Renovations

Home Equity Lines of Credit (HELOCs) offer homeowners a powerful tool to enhance their property value. Americans spent an estimated $603 billion in 2024 on remodeling their homes. Among NARI members, 42% found a greater demand for contracting in recent years. These upgrades not only improve your living space but also increase your home’s market appeal.

Energy-efficient improvements present another smart use of HELOC funds. Replacing old windows with ENERGY STAR certified windows lowers household energy bills by an average of up to 13 percent nationwide when replacing single-pane windows. Such upgrades lead to long-term utility bill reductions while boosting your home’s attractiveness to potential buyers.

Strategic Debt Consolidation

HELOCs prove invaluable for debt consolidation. With credit card interest rates averaging around 20% (as of June 2025), consolidating high-interest debts using a HELOC (average rate: 8.14%) can result in substantial savings.

Consider this scenario: A $20,000 credit card debt at 20% APR incurs about $4,000 in annual interest. Transfer this debt to a HELOC at 8.14%, and your yearly interest drops to approximately $1,628 – a saving of over $2,300 in just one year.

Investing in Education and Business Ventures

HELOCs also serve as excellent funding sources for education or business startups. Average 2024-25 public four-year in-state tuition and fees range from $6,360 in Florida and $6,960 in Wyoming to $17,360 in New Hampshire and $17,490 in Vermont. Using a HELOC to cover these expenses often proves more cost-effective than traditional student loans, which carried interest rates as high as 7.54% for graduate students in the same period.

For aspiring entrepreneurs, HELOCs provide initial capital at competitive rates. The U.S. Small Business Administration estimates that most microbusinesses require around $3,000 to start, while home-based franchises typically need $2,000 to $5,000. A HELOC can cover these startup costs at lower interest rates than many business loans.

Creating Financial Flexibility

HELOCs excel at providing financial safety nets. Access to a line of credit offers peace of mind, ensuring funds availability for unexpected expenses or opportunities. This flexibility allows for more effective financial management, whether you face sudden home repairs or spot an attractive investment opportunity.

While HELOCs offer numerous advantages, responsible use remains paramount. Always evaluate your repayment ability and potential risks before tapping into your home equity. Expert guidance can help you navigate the complexities of leveraging your home’s value effectively.

As we explore the process of obtaining a HELOC, you’ll discover how to streamline your application and connect with suitable lenders to make the most of your home’s hidden potential.

How to Obtain a HELOC

Evaluate Your Eligibility

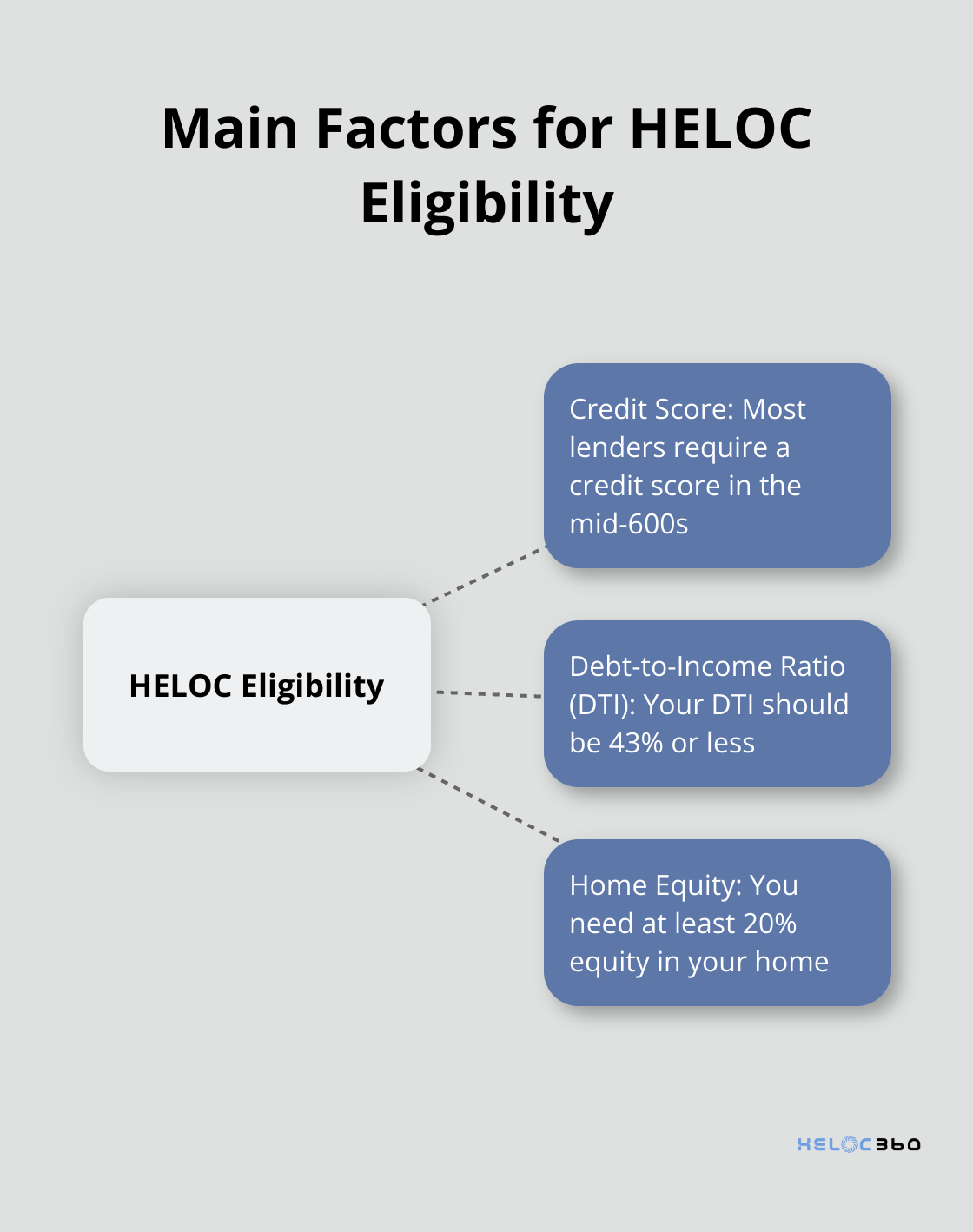

To obtain a Home Equity Line of Credit (HELOC), you must first assess your eligibility. Lenders typically examine three main factors:

- Credit Score: Most lenders require a credit score in the mid-600s.

- Debt-to-Income Ratio (DTI): Your DTI should be 43% or less.

- Home Equity: You need at least 20% equity in your home.

Collect Necessary Documents

After determining your eligibility, gather the required documents. These typically include:

- Proof of income (W-2 forms, tax returns, pay stubs)

- Property information (deed, property tax statements)

- Mortgage statements

- Bank statements

- Proof of homeowners insurance

Having these documents ready will speed up the application process.

Compare Rates from Multiple Lenders

Don’t accept the first offer you receive. When comparing offers, focus on:

- Interest rates (variable vs. fixed)

- Annual Percentage Rate (APR)

- Fees (application fees, annual fees, closing costs)

- Draw period and repayment terms

Submit Your Application

Once you’ve selected a lender, submit your application. Many lenders offer online applications for convenience. Be prepared to provide detailed information about your finances and property.

After submission, the lender will review your application and may request additional documentation. They’ll also order a home appraisal to determine your property’s current value.

The approval process can take anywhere from 2-6 weeks or even longer, depending on your situation.

Consider Long-Term Financial Goals

Obtaining a HELOC is a significant financial decision. Take time to understand the terms and consider your long-term financial goals. Ensure you’re comfortable with using your home as collateral. With the right approach and resources, you can navigate the HELOC process confidently and unlock your home’s hidden potential.

Final Thoughts

Home Equity Lines of Credit (HELOCs) empower homeowners to access their property’s value, offering financial flexibility and growth opportunities. HELOCs serve as versatile tools for various financial goals, from funding home improvements to consolidating high-interest debts. HELOC leverage extends beyond immediate needs, potentially saving thousands in interest payments and increasing property market value.

The HELOC landscape can present complexities, which is why HELOC360 exists to simplify the process. HELOC360 provides comprehensive solutions tailored to specific financial goals, offering expert guidance and connecting users with suitable lenders. This empowers individuals to make informed decisions about leveraging their home equity.

As you explore HELOC options, take time to understand your choices and evaluate your long-term financial objectives. The journey to financial empowerment starts now. HELOC360 can help you unlock your home’s hidden potential and secure a brighter financial future.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.