Home Equity Lines of Credit (HELOCs) can be powerful financial tools, but they come with their share of HELOC pitfalls. Many homeowners fall into these traps without realizing the long-term consequences.

At HELOC360, we’ve seen firsthand how these missteps can impact financial health. This post will highlight three common HELOC traps and provide practical advice on how to avoid them.

Is Your HELOC a Money Trap?

The Illusion of Free Money

A Home Equity Line of Credit (HELOC) can be a valuable financial tool, but it’s not free money. Many homeowners fall into the trap of treating their HELOC like an endless piggy bank, which leads to serious financial consequences.

Hidden Costs of Carefree Spending

When you tap into your HELOC, you borrow against your home’s equity. This means you take on debt that you need to repay with interest.

The Need for Purposeful Borrowing

Without a clear plan, it’s easy to overspend. To avoid this, create a detailed budget before you draw from your HELOC and stick to it rigorously.

Long-Term Financial Impact

The consequences of treating your HELOC like free money can be severe. A report from the Consumer Financial Protection Bureau shows that many consumers reported surprise at the size of the repayment amounts, feeling unprepared for the financial obligations. This underscores the importance of considering your future financial situation before you borrow.

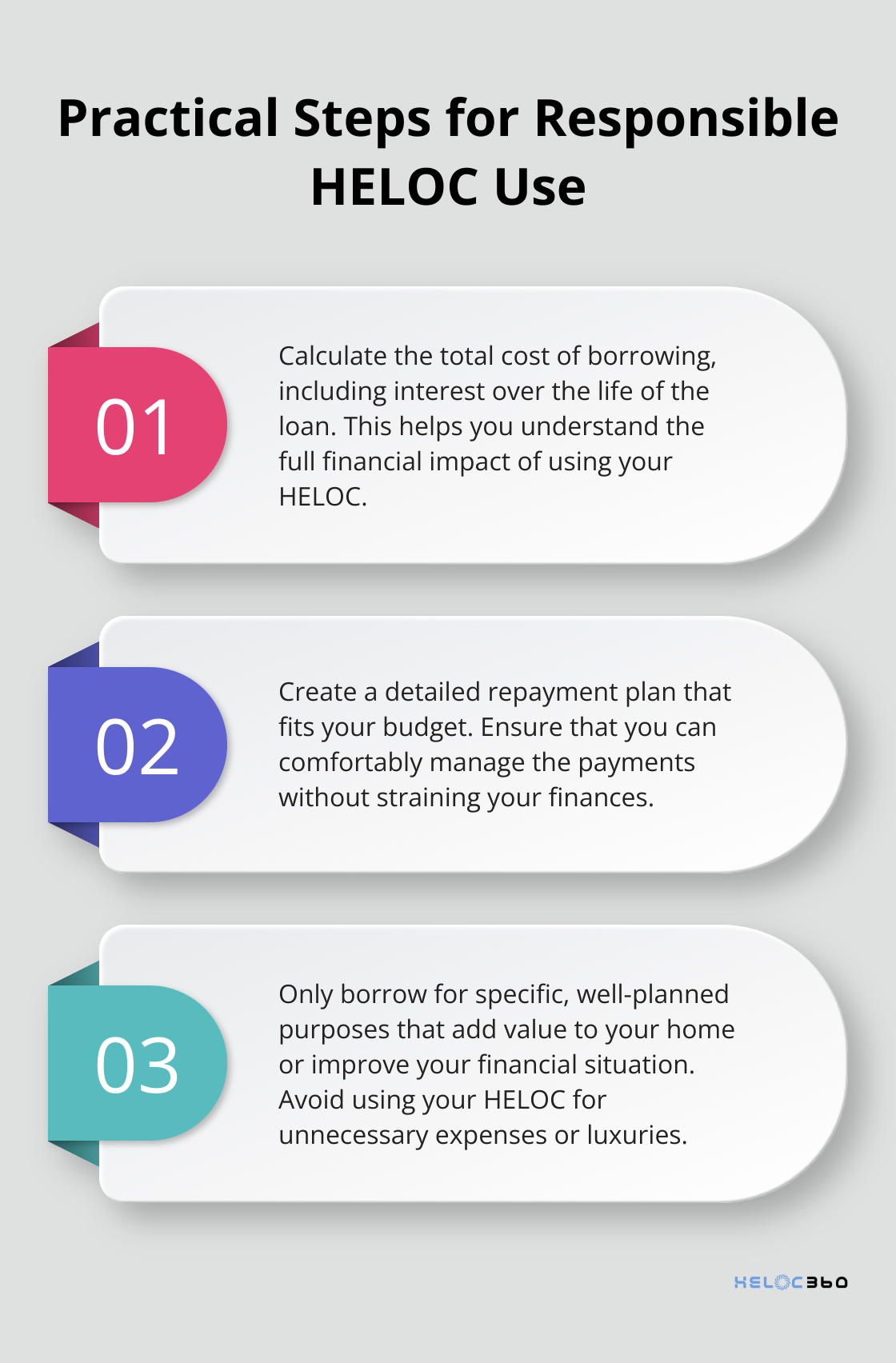

Practical Steps for Responsible HELOC Use

To use your HELOC responsibly, consider these practical steps:

A HELOC is a powerful financial tool when you use it wisely. Don’t let the allure of easy access to funds cloud your judgment. With careful planning and responsible use, you can leverage your home’s equity to achieve your financial goals without falling into the free money trap.

Now that we’ve explored the dangers of treating your HELOC like free money, let’s examine another common pitfall: failing to understand the terms and conditions of your HELOC agreement.

Are You Aware of Your HELOC’s Fine Print?

The Hidden Costs of Variable Interest Rates

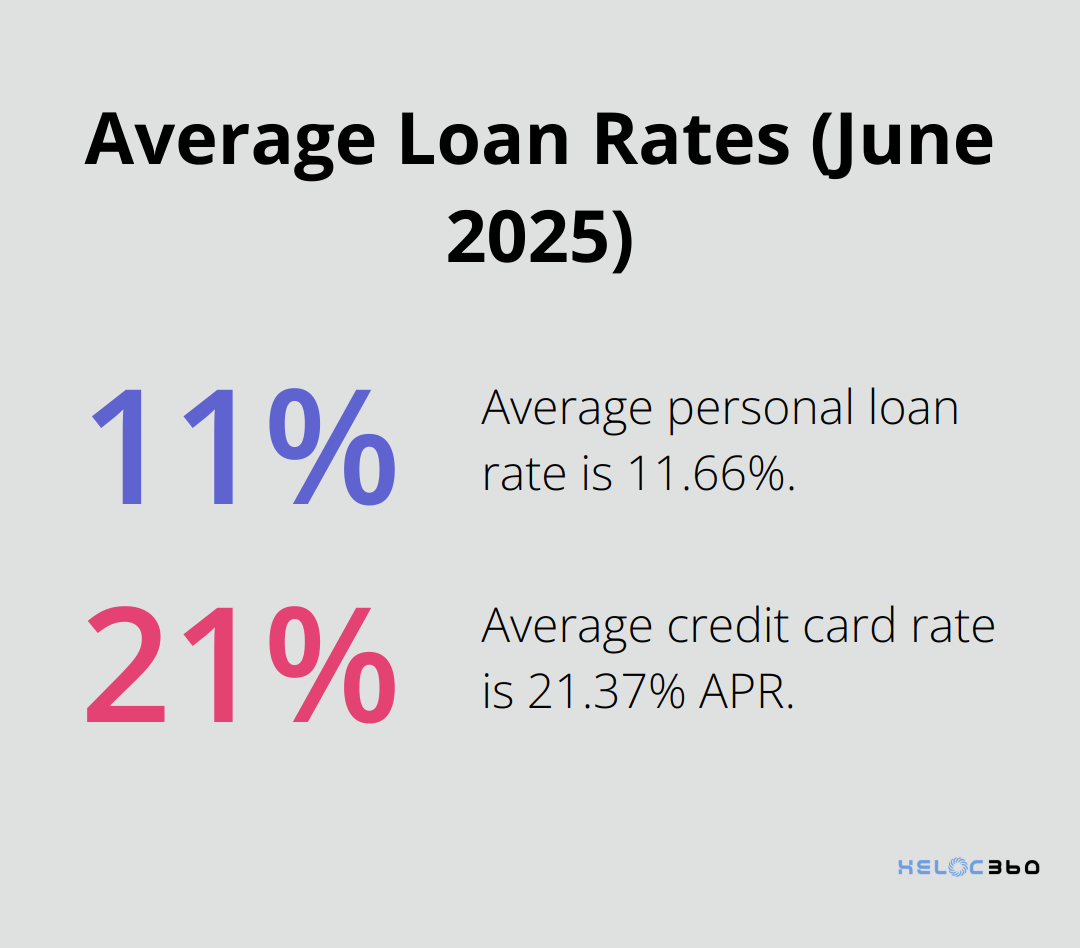

Home Equity Lines of Credit (HELOCs) often come with variable interest rates. These rates fluctuate based on market conditions, which can increase your monthly payments. As of June 2025, the average personal loan rate is 11.66% and the average credit card rate is 21.37% APR.

To protect yourself from rate fluctuations:

- Ask your lender about rate caps

- Calculate potential payments at higher interest rates

- Explore options to convert a portion of your HELOC to a fixed-rate (if available)

Understanding Draw and Repayment Periods

HELOCs typically have two distinct phases: the draw period and the repayment period. The draw period usually lasts 5-10 years, during which you can borrow funds and may only need to make interest payments. When the repayment period starts, you must pay both principal and interest.

To avoid potential financial difficulties:

- Create a repayment plan before the draw period ends

- Make principal payments during the draw period

- Set reminders for when your repayment period begins

Uncovering Hidden Fees and Penalties

Many HELOC agreements include fees and penalties that can surprise borrowers. Common charges include annual fees, inactivity fees, and early closure fees.

To minimize unexpected costs:

- Request a full fee schedule from your lender

- Ask about waiving annual fees

- Understand the terms for closing your HELOC early

The Importance of Thorough Review

A thorough review of your HELOC agreement can save you from costly surprises. Clear explanations of terms and conditions will help you make informed decisions about your home equity. Understanding the fine print allows you to leverage your HELOC effectively while avoiding potential pitfalls.

Now that we’ve explored the importance of understanding your HELOC’s terms and conditions, let’s examine another common trap: using a HELOC for the wrong reasons.

Are You Using Your HELOC Wisely?

The Luxury Trap

Many homeowners use Home Equity Lines of Credit (HELOCs) to fund luxuries or vacations. This risky move jeopardizes financial stability and home ownership. While a dream vacation or expensive car might seem tempting, it’s crucial to remember that you borrow against your home’s equity. This type of spending doesn’t add value to your property and can lead to long-term financial strain.

A Federal Reserve Bank of New York study found that a significant portion of HELOC borrowers use the funds for home improvements, which can potentially increase home value. However, others use it for debt consolidation and major purchases or other expenses, which may include non-essential items.

The Daily Expense Dilemma

Relying on a HELOC for day-to-day expenses indicates underlying financial issues that need addressing. Using your home’s equity to cover regular bills or groceries can quickly spiral into unmanageable debt.

Financial experts warn that using a HELOC for everyday expenses can lead to a hard-to-break debt cycle. HELOCs offer flexible borrowing but also have significant risks, including unpredictable payments and the potential to inadvertently lead to excessive debt. They recommend creating a budget and finding ways to increase income or reduce expenses instead.

The Debt Shuffle

Using a HELOC to pay off unsecured debt without addressing spending habits is another common mistake. While consolidating high-interest debt with a lower-interest HELOC can seem like a good idea, it’s only effective if you also change your spending habits.

According to the Consumer Financial Protection Bureau, if you use your home equity to consolidate your credit card debt, it may not be available in an emergency or for expenses like home renovations.

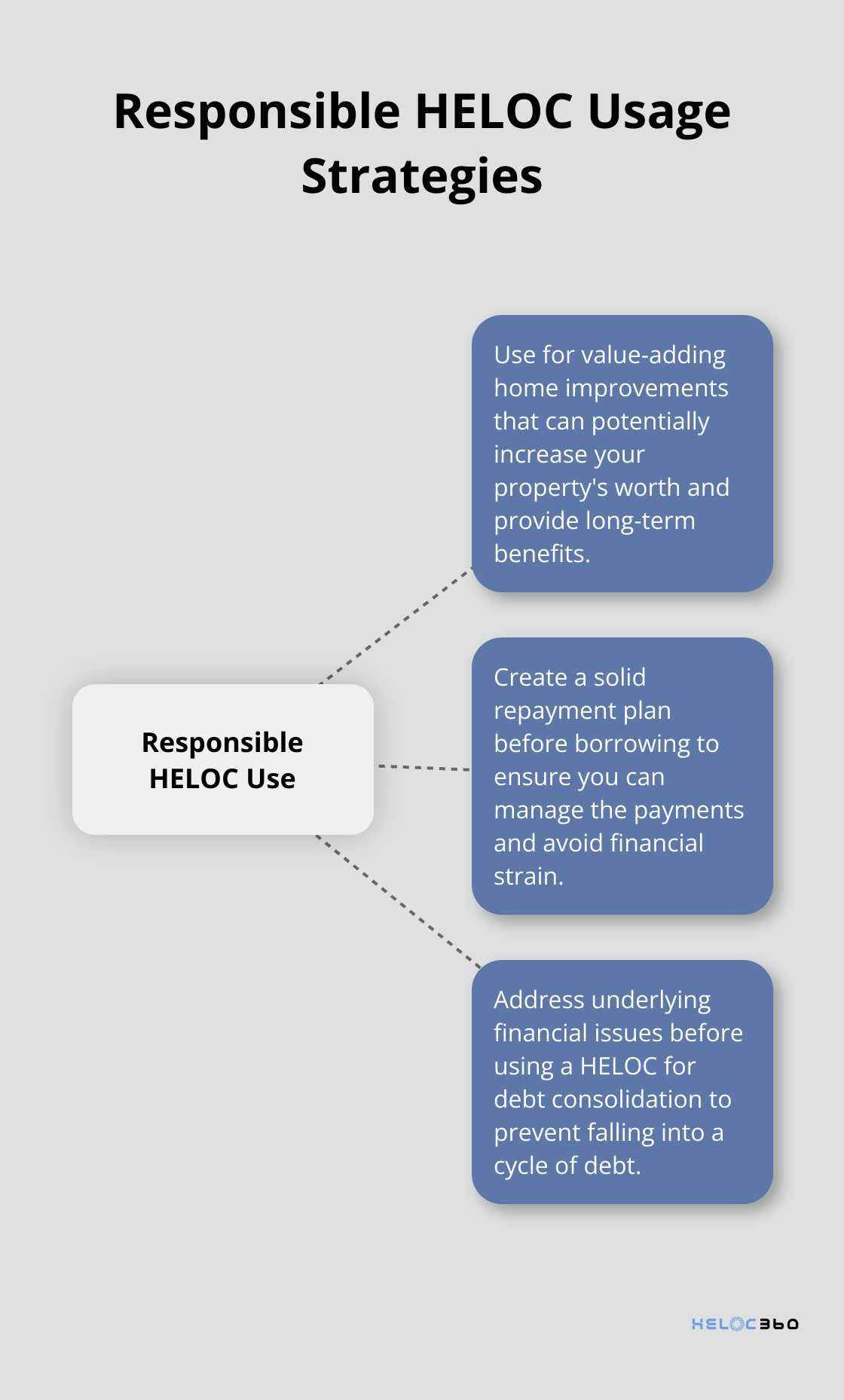

Responsible HELOC Usage

To use your HELOC responsibly, consider these strategies:

Expert Guidance for HELOC Decisions

Navigating HELOC decisions can be complex. Expert guidance (like that provided by HELOC360) can help ensure you use your home’s equity wisely and avoid common pitfalls. With tailored solutions, you can make informed choices about leveraging your home’s value for your financial goals.

Final Thoughts

Home Equity Lines of Credit (HELOCs) offer homeowners a powerful financial tool, but they come with potential pitfalls that can derail your financial goals. Responsible HELOC use requires a clear purpose for borrowing, understanding the full terms of your agreement, and using the funds for value-adding purposes. You must approach your HELOC with a well-thought-out plan and a realistic repayment strategy to avoid common HELOC traps.

Navigating the complexities of HELOCs can challenge even the most financially savvy homeowners. HELOC360 helps homeowners make the most of their home equity while avoiding common pitfalls. Our platform provides tailored solutions and expert guidance to connect you with lenders that match your unique needs.

A HELOC represents a significant financial decision that requires careful consideration. You can harness the power of your home equity while steering clear of potential traps with proper planning and expert advice. Your home is more than just a place to live – it can become a stepping stone to financial success with responsible HELOC use.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.