Home equity lines of credit (HELOCs) are powerful financial tools, yet they’re often misunderstood. Many homeowners hold onto HELOC misconceptions that prevent them from tapping into their home’s equity.

At HELOC360, we’ve encountered numerous myths about HELOCs that can lead to missed opportunities. In this post, we’ll debunk the top HELOC myths and provide you with accurate information to make informed decisions about your home’s equity.

Are HELOCs Just for Home Improvements?

The Versatility of HELOCs

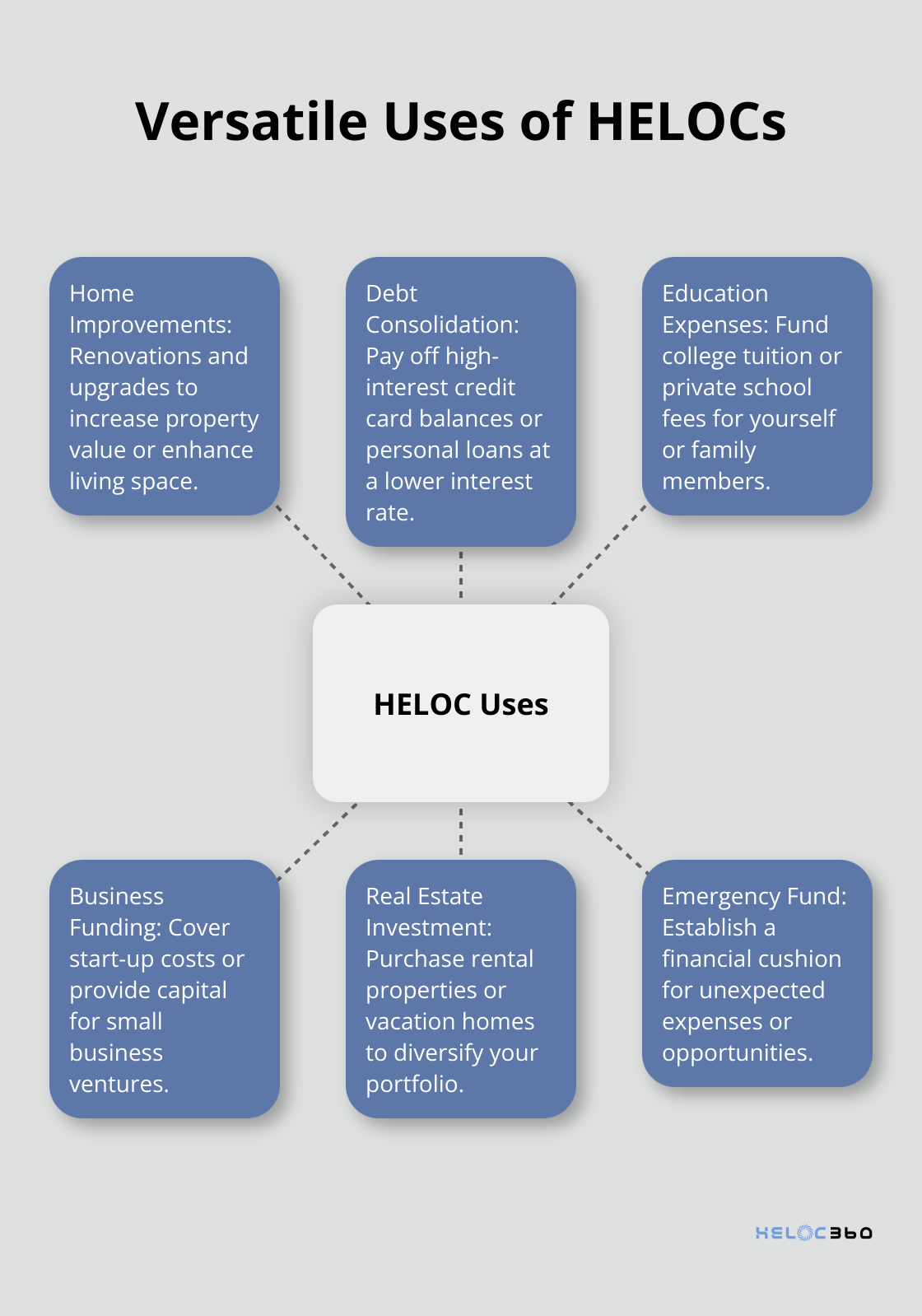

Many homeowners believe that Home Equity Lines of Credit (HELOCs) serve only one purpose: funding home improvements. This misconception limits the potential of HELOCs as versatile financial tools. In reality, HELOCs are advances that let you borrow against the equity in your home for a set time before entering a repayment period.

Beyond Renovations

While home improvements remain a popular use for HELOCs, they’re far from the only option. Homeowners use HELOCs for a wide range of financial needs. Debt consolidation allows borrowers to pay off high-interest credit card balances or personal loans at a lower interest rate. Education expenses (such as college tuition or private school fees) are another frequent use of HELOC funds.

Creative HELOC Applications

Some homeowners think outside the box when it comes to leveraging their home equity. For instance, entrepreneurs have used HELOCs to fund start-up costs for small businesses. Others have tapped into their HELOC to invest in real estate, purchasing rental properties or vacation homes. Some homeowners even use HELOCs as a financial cushion for emergencies.

The Power of Financial Flexibility

The beauty of a HELOC lies in its flexibility. Unlike a traditional loan with a fixed amount, a HELOC allows you to borrow as needed up to your credit limit. This feature makes it an excellent tool for ongoing expenses or projects with uncertain costs. For example, if you plan a series of home improvements over several years, a HELOC lets you access funds as projects arise, rather than borrowing a lump sum upfront.

Unlocking Your Financial Future

HELOCs offer a world of possibilities beyond home improvements. Understanding the full potential of these financial tools empowers homeowners to make informed decisions about leveraging their home equity to achieve their financial goals. Whether you want to consolidate debt, invest in education, or explore entrepreneurial ventures, a HELOC could unlock your financial future. As we move forward, let’s address another common misconception: the perceived risks associated with HELOCs.

Are HELOCs Really That Risky?

Comparing HELOC Risks to Other Borrowing Options

Many homeowners avoid Home Equity Lines of Credit (HELOCs) due to perceived risks. However, when compared to other borrowing options, HELOCs often prove to be a smart and manageable choice. The primary concern for many is the potential loss of their home if they default on payments. While this is a serious consideration, it’s important to note that this risk exists with any loan secured by your home, including your primary mortgage.

According to Federal Reserve data, of the $12.8 trillion in mortgages outstanding, commercial banks only held $2.37 trillion, or 18.6%. This suggests that a significant portion of mortgage debt is held by entities other than commercial banks.

When weighing the risks of HELOCs against other borrowing methods, HELOCs often come out favorably. For example, credit cards typically carry much higher interest rates. HELOC rates average 8.27 percent as of June 18, 2025, while home equity loan rates are at 8.25 percent.

Personal loans, while unsecured, often have higher interest rates than HELOCs and shorter repayment terms, which can strain monthly budgets.

Built-in Safeguards for HELOC Borrowers

HELOCs come with several built-in protections that mitigate risks for borrowers. For instance, most HELOCs have a draw period (typically 10 years) during which you can borrow funds as needed and only pay interest on what you use. This feature provides flexibility and can help prevent overborrowing.

Additionally, many lenders offer fixed-rate conversion options. This allows you to lock in a portion of your balance at a fixed rate, protecting you from potential interest rate hikes. The Consumer Financial Protection Bureau reviewed 38 complaints about home equity contracts, where consumers reported surprise at the size of the repayment amounts and feeling misled.

Tips for Responsible HELOC Management

To minimize risks associated with HELOCs, consider these practical tips:

- Create a repayment plan: Before borrowing, calculate how much you can comfortably repay each month. The National Association of Home Builders suggests allocating no more than 28% of your gross monthly income to all housing-related debts.

- Use an amortization calculator: This tool helps you understand how long it will take to repay your HELOC based on different payment amounts. Many online calculators are available for free.

- Set up automatic payments: This ensures you never miss a payment, protecting your credit score and reducing the risk of default.

- Monitor your credit utilization: Try to keep your HELOC balance below 30% of your credit limit. This practice not only helps manage your debt but also positively impacts your credit score.

- Regularly review your HELOC terms: Interest rates and other conditions can change. Stay informed about your HELOC’s current terms and how they might affect your finances.

The Reality of HELOC Risks

While HELOCs do carry some risks, they’re often overstated. With proper management and understanding, a HELOC can be a valuable and relatively safe financial tool. The key lies in educating yourself about the terms, understanding your financial situation, and using the HELOC responsibly.

Now that we’ve addressed the perceived risks of HELOCs, let’s tackle another common misconception: the belief that qualifying for a HELOC is an insurmountable challenge. In the next section, we’ll explore the typical requirements for HELOC approval and how they might be more achievable than you think.

Is Qualifying for a HELOC Difficult?

Understanding HELOC Requirements

Many homeowners believe that qualifying for a Home Equity Line of Credit (HELOC) is an uphill battle. This misconception often prevents them from exploring this valuable financial tool. In reality, the qualification process for a HELOC is often more straightforward than many assume.

Lenders typically evaluate several key factors when reviewing HELOC applications. These include credit score, debt-to-income ratio, and the amount of equity in your home. While requirements vary by lender, most look for a credit score in the mid-600s, a debt-to-income ratio of 43 percent or less, and at least 20% equity in your home.

A 2023 report by Experian revealed that the average FICO score in the U.S. was 716, suggesting that many homeowners meet the credit score requirements for a HELOC. Additionally, CoreLogic reported that by the end of Q2 2024, the aggregate equity gain was 8% year over year, bringing total equity on mortgaged properties to more than $17.6 trillion, putting many in a strong position for HELOC approval.

Beyond the Credit Score

Your credit score is important, but it’s not the only factor lenders consider. Your income stability, employment history, and overall financial picture play significant roles. Some lenders may work with lower credit scores if you have substantial equity in your home or a strong income.

For instance, if you’ve worked for your current employer for several years and have a steady income, this stability can work in your favor. Similarly, if you’ve consistently made on-time payments on your existing mortgage, this demonstrates financial responsibility that lenders value.

Simplifying the HELOC Process

The HELOC application process has become more accessible to a wider range of homeowners. Clear information about requirements and connections to suitable lenders demystify the process and increase approval chances.

Pre-qualification tools can give you an idea of your eligibility without impacting your credit score. This allows you to explore your options without commitment, helping you make informed decisions about leveraging your home equity.

Overcoming Common Obstacles

If your initial application doesn’t succeed, don’t lose hope. You can take steps to improve your chances:

- Improve your credit score: Pay down existing debts and ensure all payments are made on time.

- Increase your home equity: Consider making extra mortgage payments or completing value-adding home improvements.

- Reduce your debt-to-income ratio: Try to pay off some existing debts or increase your income.

- Provide additional documentation: If you have non-traditional income sources, detailed documentation can strengthen your application.

The Reality of HELOC Qualification

The myth that qualifying for a HELOC is nearly impossible is just that – a myth. With the right information and resources, many homeowners find that they’re in a stronger position to qualify than they initially thought. The key lies in understanding the requirements, preparing your finances, and exploring your options thoroughly.

If you face difficulty with HELOC payments, you should contact your lender immediately. Many lenders offer hardship programs that can help you avoid default and maintain your financial stability.

Final Thoughts

This blog post has addressed several HELOC misconceptions that often prevent homeowners from effectively using their home equity. HELOCs offer versatility beyond home improvements, including debt consolidation, education funding, and business startup costs. With proper management, HELOCs can serve as safe and valuable financial tools, contrary to common risk perceptions. Many homeowners are better positioned to qualify for a HELOC than they realize, dispelling the myth of insurmountable qualification challenges.

Accurate information about HELOCs empowers homeowners to make informed financial decisions and leverage their home equity wisely. Your home’s value should open new opportunities, not cause confusion or anxiety. Understanding how HELOCs work, their potential benefits, and associated responsibilities is essential for financial growth and stability.

HELOC360 simplifies the HELOC process, providing expert guidance and connecting you with suitable lenders. We strive to help homeowners navigate home equity lines of credit confidently (transforming home equity into a powerful tool for achieving financial aspirations). Your home’s equity can be a gateway to new opportunities with the right information and support.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.