Divorce can be a complex and emotionally charged process, especially when it comes to dividing assets like home equity lines of credit (HELOCs). At HELOC360, we understand the challenges that come with navigating HELOCs during divorce.

This guide will provide you with essential information on how HELOCs are typically handled in divorce proceedings, legal considerations to keep in mind, and practical strategies for addressing these financial obligations.

What Are HELOCs and How Do They Impact Divorce?

Understanding Home Equity Lines of Credit

Home Equity Lines of Credit (HELOCs) are financial tools that allow homeowners to borrow against their home’s equity. These loans function as revolving credit lines, secured by your home, that give you a revolving credit line to use for large expenses. In the context of divorce, HELOCs can become a significant point of contention.

The Structure of HELOCs

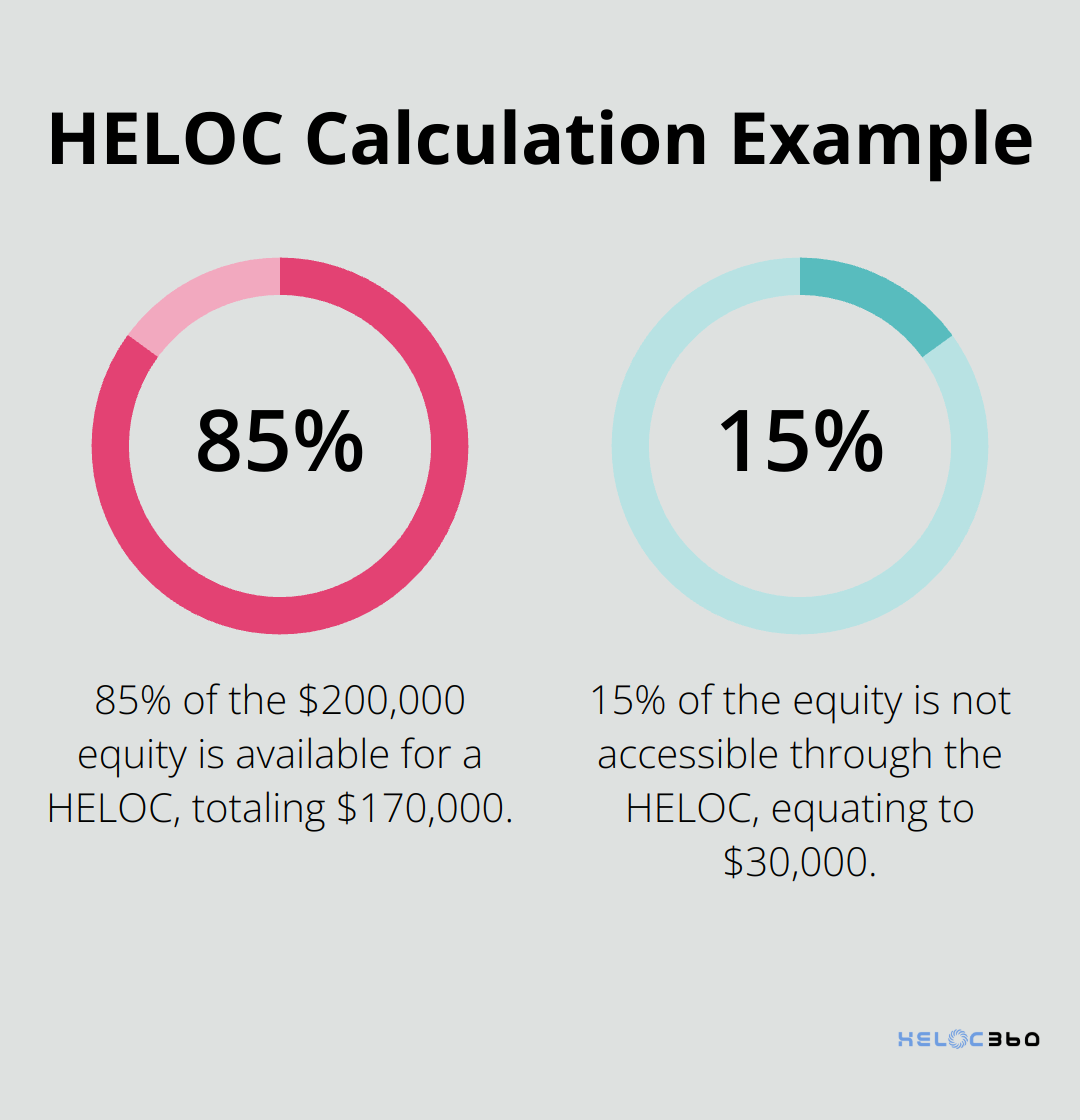

When a couple takes out a HELOC during their marriage, it becomes a shared responsibility. The credit line typically bases on a percentage of the home’s value, minus the outstanding mortgage balance. For example, if a home is worth $500,000 with a $300,000 mortgage, a HELOC might offer up to 85% of the remaining $200,000 in equity (which amounts to $170,000).

HELOCs in Divorce Proceedings

During divorce, courts generally treat HELOCs as marital debt, regardless of which spouse’s name appears on the account. This means both parties usually hold responsibility for repayment.

The Importance of Addressing HELOCs in Property Division

Failure to properly address a HELOC during divorce can lead to serious financial consequences. In a recent case, one spouse ended up solely responsible for a $100,000 HELOC after the divorce, despite the funds being used for joint expenses during the marriage. This oversight led to significant financial strain and legal complications.

To avoid such situations, couples should:

- Obtain a current HELOC statement

- Determine how they used the funds during the marriage

- Assess the remaining credit available

- Decide whether to close the HELOC or transfer it to one spouse

Practical Strategies for HELOC Management in Divorce

One effective strategy involves refinancing the HELOC along with the primary mortgage. This allows for a clean break, with one spouse taking full ownership of the debt. Alternatively, selling the home and using the proceeds to pay off the HELOC can provide a fresh start for both parties.

It’s important to note that simply removing one spouse’s name from the HELOC account doesn’t absolve them of responsibility in the eyes of the lender. A formal refinance or payoff typically proves necessary to fully separate financial ties.

As we move forward, we’ll explore the legal considerations that come into play when dealing with HELOCs during divorce proceedings. Understanding these legal aspects will help you navigate this complex financial landscape more effectively.

Legal Landscape of HELOCs in Divorce

State Laws and HELOC Division

State laws play a significant role in how courts divide HELOCs during divorce. Community property states divide most marital assets equally, while equitable distribution states (the majority of the U.S.) aim for a fair, but not necessarily equal, division of assets and debts.

For example, in New York (an equitable distribution state), a judge might assign a larger portion of HELOC debt to the spouse who benefited more from the funds or who has a higher earning capacity. This approach creates a fair financial outcome for both parties.

Prenuptial and Postnuptial Agreements

Prenuptial and postnuptial agreements can significantly influence how courts handle HELOCs in divorce. These legal documents often specify how debts, including HELOCs, should be divided if the marriage ends.

If you have a prenup or postnup that addresses HELOCs, review it with your attorney. These agreements can override state laws, which potentially simplifies the division process. However, courts may still scrutinize these agreements to ensure they’re fair and entered into voluntarily.

Consequences of Overlooking HELOCs

Failure to address HELOCs in divorce settlements can lead to severe financial repercussions. Even if your divorce decree assigns the HELOC to your ex-spouse, lenders still consider both parties responsible for repayment if both names appear on the original agreement.

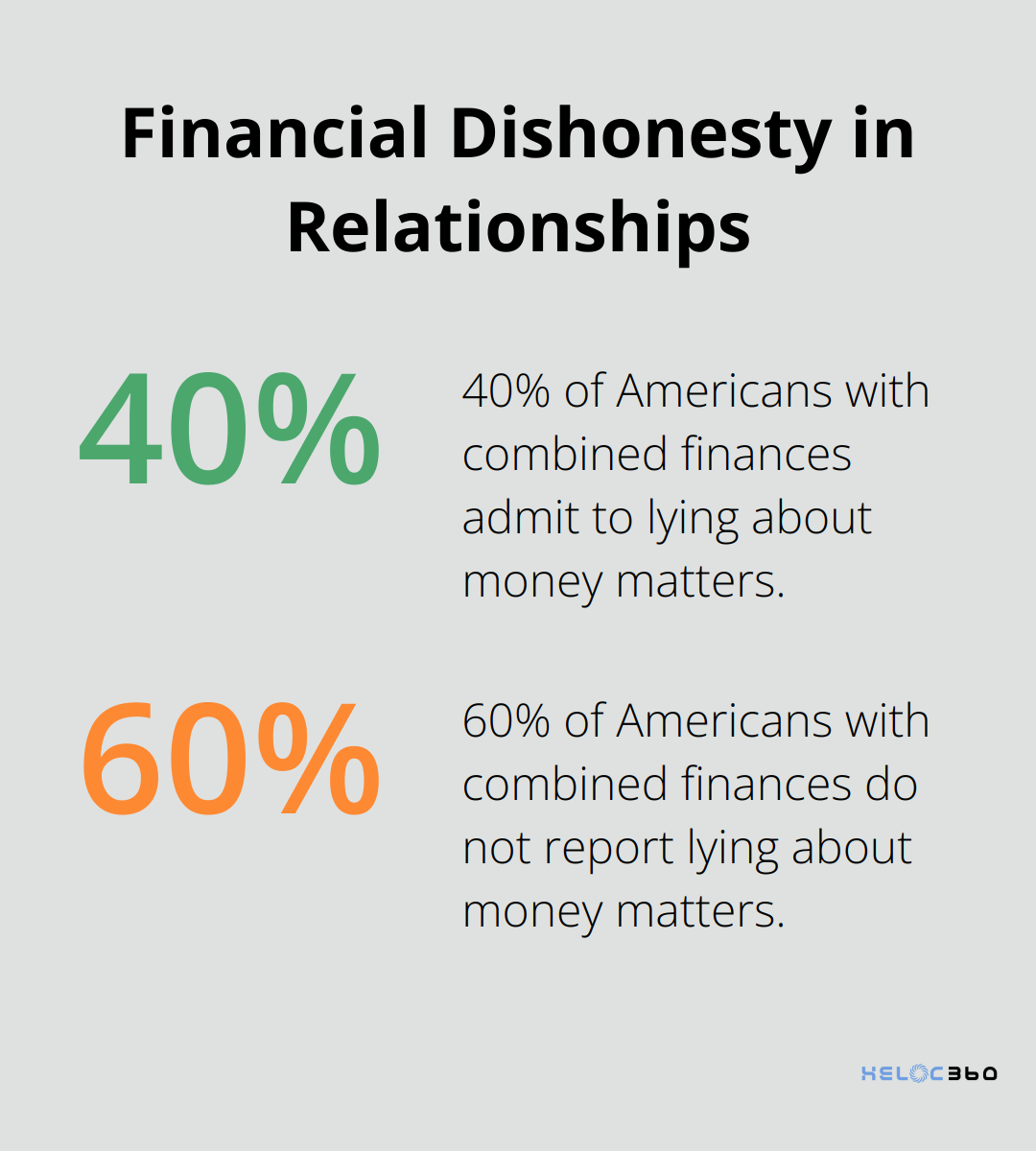

A study by Harris Poll for the National Endowment for Financial Education finds that two in five Americans who have combined finances admit to lying to their partner about money matters.

To avoid potential pitfalls, consider these steps:

- Obtain a full accounting of all HELOCs and other debts.

- Work with your attorney to ensure the divorce settlement explicitly addresses each HELOC.

- If possible, refinance HELOCs to remove one spouse’s name from the debt.

- Consider selling the property and using the proceeds to pay off the HELOC if neither spouse can afford to keep the home.

Expert Guidance for HELOC Division

Clear communication and thorough planning help divorcing couples navigate HELOC division smoothly. Experts who understand the nuances of HELOCs in divorce can ensure you make informed decisions that protect your financial future.

As we move forward, we’ll explore practical strategies for handling HELOCs during divorce, including options for refinancing, selling, or negotiating fair splits of these financial obligations.

How to Handle HELOCs During Divorce

Pay Off the HELOC Before Finalizing Divorce

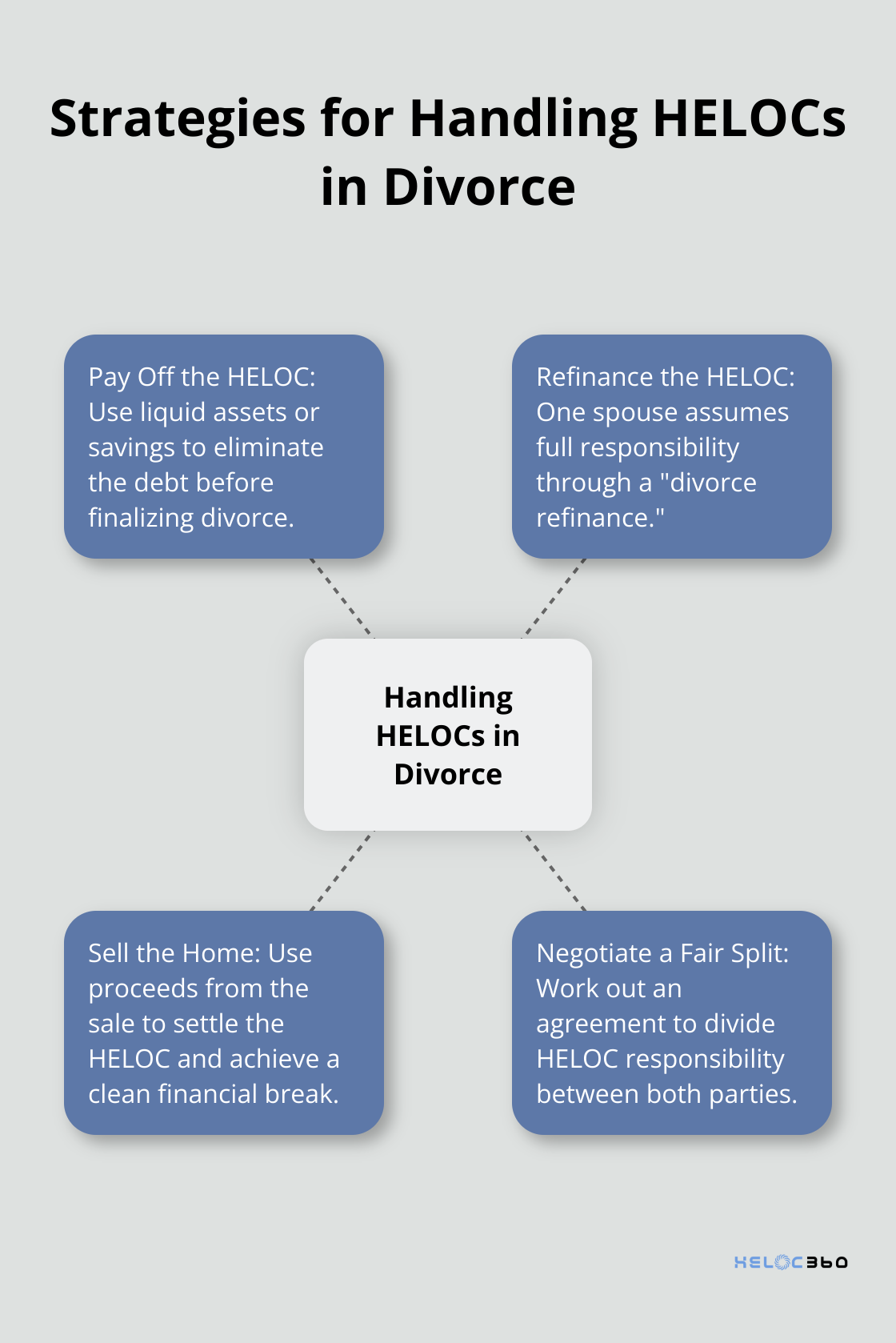

One straightforward solution involves paying off the HELOC before you finalize your divorce. This approach eliminates the debt entirely, which simplifies the division of assets and liabilities.

To implement this strategy:

- Assess your financial situation to determine if you have sufficient liquid assets to pay off the HELOC.

- Consider using savings, investments, or even borrowing from family members if the interest savings justify it.

- If you decide to use marital assets to pay off the HELOC, document this in your divorce agreement to maintain fairness in overall asset division.

Refinance the HELOC

Refinancing the HELOC into one spouse’s name presents another viable option. This strategy, also known as a “divorce refinance,” allows one party to assume full responsibility for the debt, which frees the other from any future obligations.

Steps to refinance your HELOC:

- Determine which spouse will take on the HELOC.

- The responsible spouse should check their credit score and debt-to-income ratio to ensure they qualify for refinancing.

- Shop around for the best refinancing terms (HELOC360 can connect you with lenders offering competitive rates).

- Complete the refinancing process before you finalize the divorce to ensure a clean break.

Sell the Home to Settle the HELOC

In some cases, selling the home and using the proceeds to pay off the HELOC might offer the best solution. This approach works well when neither spouse can afford to keep the house or when you desire a clean financial break.

Consider these factors:

- Current market conditions and your home’s value

- Outstanding mortgage balance and HELOC amount

- Potential capital gains tax implications

Negotiate a Fair Split

If none of the above options prove feasible, you might need to negotiate a fair split of the HELOC responsibility. This approach requires open communication and a willingness to compromise. Consider working with a mediator who can provide a neutral setting to help you work out an agreement without going to court.

Tips for negotiating:

- Review how you used the HELOC funds during the marriage.

- Consider each spouse’s financial capacity to repay the debt.

- Explore options like one spouse taking on a larger share of the HELOC in exchange for other assets.

- Document the agreed-upon split clearly in your divorce settlement.

The goal involves finding a solution that’s fair and financially manageable for both parties. Seek advice from financial professionals and divorce attorneys to help you navigate this complex process and make informed decisions about your HELOC during divorce.

Final Thoughts

HELOCs in divorce scenarios present unique challenges, but you can protect your financial interests with the right approach. State laws and prenuptial agreements significantly impact HELOC division, making it essential to address these debts properly in your divorce settlement. Professional advice from financial advisors, divorce attorneys, and HELOC experts will provide invaluable guidance tailored to your specific circumstances.

We at HELOC360 understand the complexities you face when dealing with HELOCs during divorce. Our platform offers expert guidance and connects you with lenders who can help you refinance or restructure your HELOC as part of your divorce settlement. We support you in making informed decisions about your home equity, ensuring you’re well-equipped to start your new chapter on solid financial footing.

HELOC divorce situations require careful consideration and proactive steps to secure a stable financial future. You can navigate this complex process successfully and move forward with confidence by seeking expert advice and addressing your HELOC responsibly. Take control of your financial future today and explore your options for managing HELOCs during divorce.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.