As economic uncertainties loom, homeowners are seeking financial strategies that can weather potential storms. HELOCs, or Home Equity Lines of Credit, have long been a popular option for accessing home equity, but their resilience during economic downturns is a topic of debate.

At HELOC360, we’ve analyzed the performance of HELOCs during past recessions and current market trends to provide insights on their stability in 2025. This comprehensive guide explores whether HELOCs can truly be considered recession-proof and what homeowners should know before tapping into their home equity in uncertain times.

How Do HELOCs Perform During Economic Downturns?

Understanding HELOCs: The Basics

Home Equity Lines of Credit (HELOCs) allow homeowners to borrow against their home’s equity. They function like a credit card, with a revolving credit line that homeowners can draw upon as needed. Lenders typically require at least 20 percent equity in your home to qualify for a HELOC.

HELOCs in Past Recessions

The 2008 financial crisis presented significant challenges for HELOCs. As home values plummeted, many lenders froze or reduced credit lines. After a period of slowing around the house price peak, HELOCs continued to grow until 2009, at which point they began a decline that persisted through 2018.

The COVID-19 recession in 2020 painted a different picture. HELOC balances grew by $6 billion to $402 billion, as reported by the New York Fed. Homeowners tapped into their equity to navigate financial uncertainties during this period.

Key Factors Influencing HELOC Stability

Several factors impact how HELOCs perform during economic stress:

- Home Values: Property value declines may prompt lenders to reduce HELOC limits or freeze accounts to mitigate risk. In 2025, with home prices showing cooling signs, this factor requires close monitoring.

- Unemployment Rates: Job losses can lead to HELOC defaults. The current unemployment rate of 3.7% (as of June 2025) remains relatively low, which supports HELOC stability.

- Interest Rates: HELOCs typically feature variable rates tied to the prime rate. During recessions, the Federal Reserve often lowers rates, potentially benefiting HELOC borrowers. However, rate change unpredictability adds an element of risk.

HELOC Resilience in 2025

The current economic landscape reveals mixed signs of HELOC recession resistance. While not entirely recession-proof, HELOCs have demonstrated adaptability. Homeowners should use HELOCs strategically and maintain a buffer in their home equity.

Financial experts recommend borrowing only what you can comfortably repay, even if your income decreases. It’s prudent to plan for potential rate increases or credit line reductions.

Navigating HELOCs in Uncertain Times

For those considering a HELOC in 2025, shopping around for the best terms is essential. Some lenders offer fixed-rate options or rate caps, which can provide more stability during economic uncertainty. Always read the fine print and understand the lender’s policies regarding freezing or reducing credit lines.

As we move forward, it’s important to examine the current economic landscape and its potential impact on HELOCs. Let’s explore how the 2025 economic indicators and housing market trends are shaping the HELOC environment.

How Will the 2025 Economy Shape HELOCs?

Economic Indicators and Their HELOC Impact

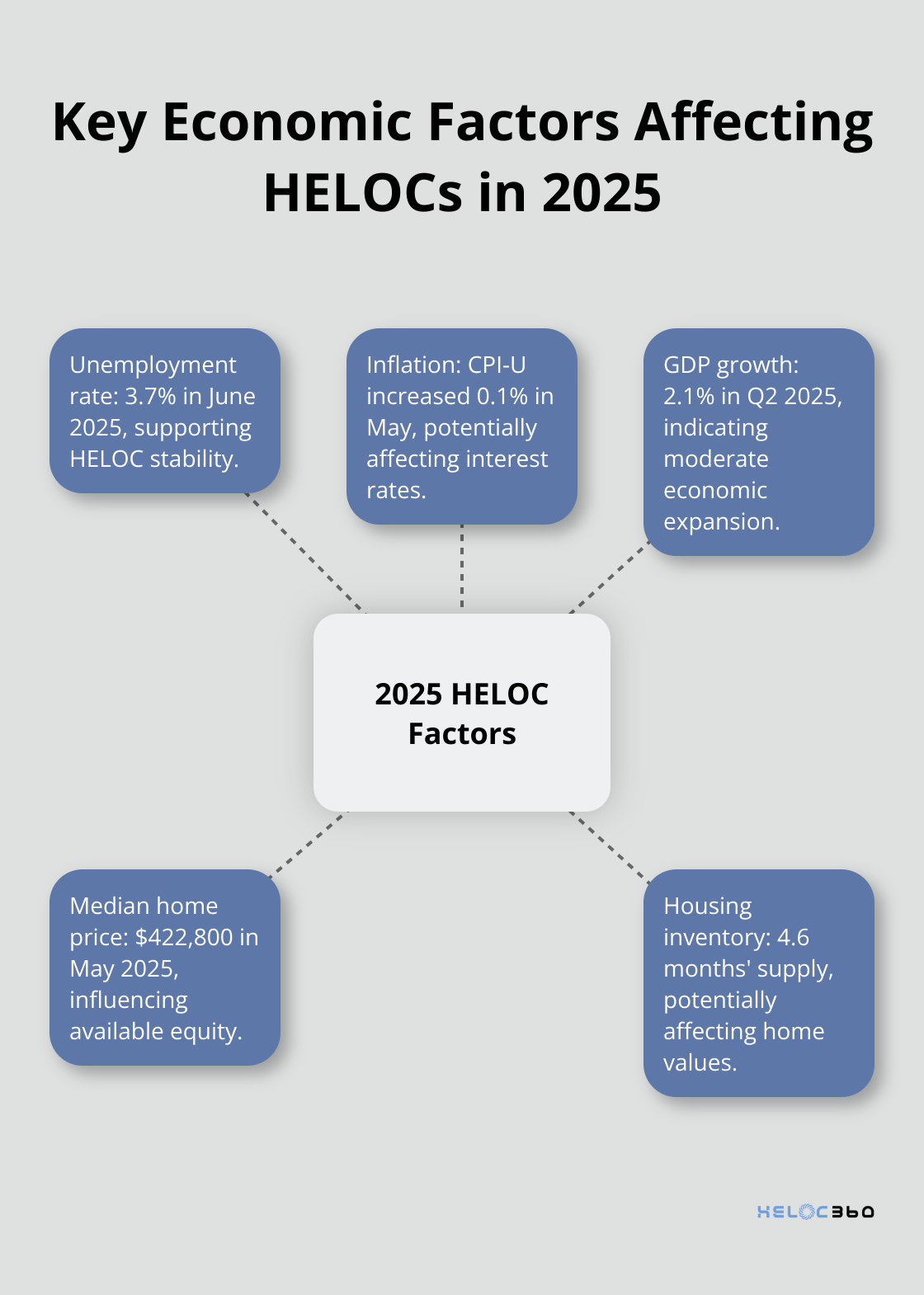

The U.S. economy in 2025 presents a complex picture that will influence the HELOC market. The unemployment rate stands at 3.7%, which supports HELOC performance as employed homeowners can meet their payment obligations more easily.

Inflation remains a concern. The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent on a seasonally adjusted basis in May, after rising 0.2 percent in April. This inflationary pressure might prompt the Federal Reserve to maintain higher interest rates, potentially increasing HELOC costs for borrowers.

The GDP growth rate for Q2 2025 reached 2.1%, indicating moderate economic expansion. While this growth is positive, it doesn’t completely eliminate recession fears. Homeowners should consider this economic uncertainty when evaluating a HELOC.

Housing Market Trends and Home Equity

The 2025 housing market shows signs of cooling after years of rapid appreciation. The National Association of Realtors reports that the median sales price was $422,800 in May 2025. This slower appreciation rate could affect the amount of equity homeowners can access through HELOCs.

Housing inventory has increased to 4.6 months’ supply at the current sales pace. This rise in supply could put downward pressure on home prices in some markets, potentially affecting HELOC availability and terms.

Regional variations are significant. Some metropolitan areas continue to see price growth, while others experience slight declines. Homeowners should research their local market conditions before pursuing a HELOC.

Lending Practices and Regulatory Changes

HELOC lending practices have become more stringent since the 2008 financial crisis. In 2025, lenders focus more on borrowers’ ability to repay.

The Consumer Financial Protection Bureau (CFPB) requires lenders to disclose the terms and costs of their home equity lines of credit, including the Annual Percentage Rate (APR). These assessments include a closer look at debt-to-income ratios and credit scores.

Many lenders now offer HELOCs with rate caps or fixed-rate options, providing borrowers with more stability. Some financial institutions have introduced hybrid products that combine features of HELOCs and home equity loans, offering more flexibility to homeowners.

The Federal Housing Finance Agency has adjusted its policies, allowing Fannie Mae and Freddie Mac to purchase certain HELOC products. This change has increased liquidity in the HELOC market, potentially making these products more accessible to a broader range of homeowners.

Navigating HELOCs in the Current Economic Climate

In this evolving economic landscape, homeowners considering a HELOC should carefully evaluate their financial situation, research local market conditions, and compare offerings from multiple lenders. While HELOCs can provide valuable financial flexibility, they come with potential risks that require careful consideration.

As we move forward, it’s important to weigh the advantages and disadvantages of using HELOCs during economic uncertainty. Let’s explore the pros and cons of HELOCs in a potential recession and how they compare to other financing options.

Are HELOCs Smart During a Recession?

The Advantages of HELOCs in Economic Uncertainty

HELOCs offer several benefits during economic downturns. Lower borrowing rates can help stimulate the economy by encouraging more households to spend and take out loans. They provide access to substantial funds at lower interest rates compared to credit cards or personal loans.

Flexibility is another key advantage. You only pay interest on the amount you borrow, not the entire credit line. This proves useful if you face uncertainty about future expenses or income. For example, if you lose your job, you can use your HELOC for essential expenses without committing to a large loan upfront.

HELOCs may also offer tax benefits. While the Tax Cuts and Jobs Act of 2017 limited HELOC interest deductions, you might still deduct interest if you use the funds for home improvements. (Always consult a tax professional for the most current information.)

The Risks of HELOCs During Economic Downturns

Despite their benefits, HELOCs carry risks that can intensify during a recession. The most significant risk is the potential loss of your home if you can’t make payments. This risk increases if your income becomes unstable due to job loss or reduced hours.

HELOCs typically have variable interest rates, which can increase your monthly payments if rates rise. Looking ahead to the end of 2025, HELOC rates are forecasted to average 7.25 percent, the lowest level in almost three years.

Lenders may freeze or reduce your credit line, which presents another risk. If your home value decreases or your financial situation worsens, lenders may take these actions to mitigate their risk. This occurred frequently during the 2008 financial crisis and could happen again in a severe downturn.

HELOCs vs Alternative Financing Options

HELOCs often excel during recessions. They typically offer lower interest rates than credit cards or personal loans.

Home equity loans provide an alternative, offering a lump sum at a fixed interest rate. While this ensures more certainty in monthly payments, it lacks the flexibility of a HELOC. You’ll pay interest on the entire loan amount from the start, even if you don’t need all the funds immediately.

Cash-out refinancing is another option, but it may not suit a high-interest rate environment.

Many homeowners use HELOCs strategically during economic uncertainty. Some set up HELOCs as a precautionary measure, providing a financial cushion without the immediate cost of a loan.

Making the Right Choice for Your Financial Situation

While HELOCs can be a smart choice during a recession, they’re not without risks. You must carefully consider your financial situation, future income stability, and ability to repay. We recommend consulting with a financial advisor to determine the best course of action for your unique circumstances.

Final Thoughts

HELOCs have demonstrated resilience during economic downturns, but they are not entirely recession-proof. Their performance depends on various factors, including home values, employment rates, and lending practices. Homeowners who contemplate HELOCs should evaluate their financial situation, income stability, and local housing market conditions.

The current economic landscape presents opportunities and challenges for HELOC borrowers. Interest rates are projected to decrease, making HELOCs more attractive, but the cooling housing market could affect home equity levels. HELOCs during a recession can provide financial flexibility and lower interest rates compared to other borrowing options (however, they also carry risks, particularly the potential loss of your home if you can’t make payments).

At HELOC360, we understand the complexities of navigating HELOCs in changing economic conditions. Our platform helps you make informed decisions about your home equity, connecting you with lenders that fit your unique needs. HELOC360 provides the guidance and solutions to help you achieve your financial goals, whether you’re considering a HELOC for home improvements, debt consolidation, or as a financial safety net.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.