Home equity is a powerful financial tool, but HELOCs aren’t the only way to tap into it.

At HELOC360, we understand that homeowners need options that fit their unique financial situations.

That’s why we’re exploring HELOC alternatives in this post, including home equity loans, cash-out refinancing, and shared equity agreements.

Understanding Home Equity Loans

What Are Home Equity Loans?

Home equity loans offer homeowners a way to tap into their property’s value. These loans provide a lump sum of money based on the equity you’ve built in your home. Unlike HELOCs (which offer a revolving line of credit), home equity loans give you a fixed amount upfront.

Fixed Rates and Predictable Payments

One of the main advantages of home equity loans is their fixed interest rates. Your monthly payments remain constant throughout the loan term, which simplifies budgeting. The Federal Reserve kept interest rates steady for the majority of FY24, after the final interest rate hike in 2023.

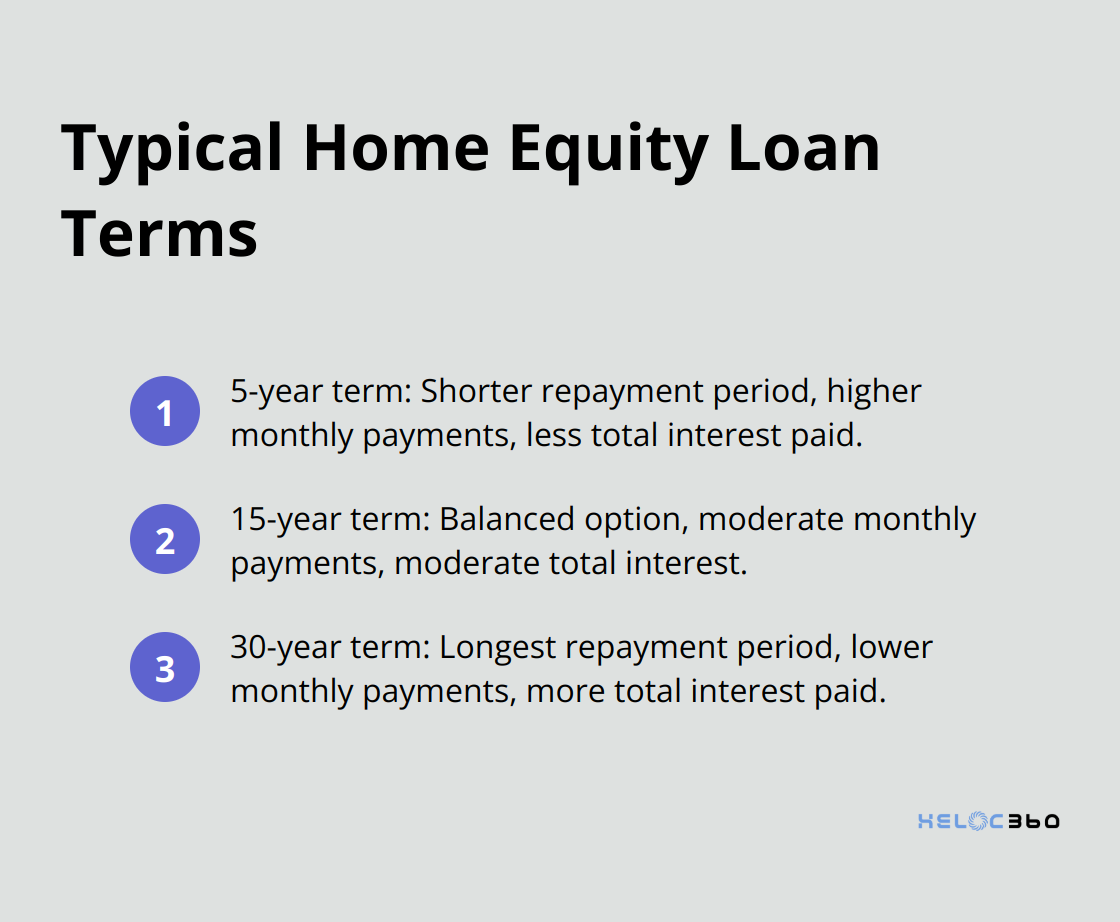

Loan Terms and Repayment

Home equity loans typically have terms ranging from 5 to 30 years. This longer repayment period can result in lower monthly payments compared to personal loans or credit cards. However, you’ll pay interest on the entire loan amount from day one, even if you don’t use all the funds immediately.

Advantages of Home Equity Loans

Home equity loans can be an excellent option for large, one-time expenses like home renovations or debt consolidation. They often have lower interest rates than credit cards or personal loans, potentially saving you thousands in interest over time. Home equity loans can be a good option to consolidate debt, as they usually carry lower interest rates and longer terms than other forms of credit.

Risks to Consider

These loans also come with risks. Your home serves as collateral, meaning you could face foreclosure if you default on payments. Additionally, you might pay more in interest over time compared to a HELOC if you don’t need all the funds at once.

Many homeowners have successfully used home equity loans to fund major life events or investments. However, it’s important to carefully consider your financial situation and long-term goals before deciding. Exploring various options and connecting with lenders offering competitive rates for home equity loans can help you make an informed decision.

As we move on to our next topic, let’s explore another popular method of accessing home equity: cash-out refinancing. This option offers unique benefits and considerations that might align better with certain financial goals.

Cash-Out Refinancing: A Powerful Alternative to HELOCs

What is Cash-Out Refinancing?

Cash-out refinancing offers homeowners a way to tap into their home equity. This method replaces your existing mortgage with a new, larger loan, allowing you to pocket the difference in cash.

The Mechanics of Cash-Out Refinancing

When you choose cash-out refinancing, you take out a new mortgage for more than you currently owe. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity. With cash-out refinancing, you might take out a new loan for $250,000, pay off the existing $200,000 mortgage, and receive $50,000 in cash.

The Federal Reserve Bank of New York reports that mortgage originations, which include refinances, dropped sharply in the first quarter of 2023 to $324 billion, the lowest level seen since 2014.

Advantages of Cash-Out Refinancing

One significant benefit of cash-out refinancing is the potential for lower interest rates. If market rates have dropped since you took out your original mortgage, you could reduce your monthly payments. Additionally, mortgage interest is often tax-deductible (consult with a tax professional for specifics), which could lead to further savings.

Considerations and Costs

It’s important to weigh the costs associated with refinancing. Closing costs typically range from 2% to 5% of the loan amount. You’ll also reset your loan term, which means you might pay your mortgage for a longer period.

When to Opt for Cash-Out Refinancing

Cash-out refinancing can be an excellent choice when you need a large sum of money for a specific purpose, such as home improvements or debt consolidation. It’s particularly attractive if you can secure a lower interest rate than your current mortgage.

For instance, if you plan a major home renovation that will increase your property value, cash-out refinancing could be a smart move. The National Association of Realtors reports that remodeling projects can increase happiness in the home once completed.

However, if you only need a smaller amount or want more flexibility, other options might be more suitable. HELOCs, for example, allow you to borrow as needed and only pay interest on what you use.

As we explore alternatives to traditional HELOCs, let’s now turn our attention to a newer and increasingly popular option: shared equity agreements. These innovative financial products offer a unique approach to accessing home equity without taking on additional debt.

Shared Equity Agreements: A New Frontier in Home Equity Access

Understanding Shared Equity Agreements

Shared equity agreements represent an innovative approach to accessing home equity without traditional debt. These agreements allow multiple parties to go in on the purchase of a property, splitting the equity ownership accordingly.

The Mechanics of Shared Equity

In a shared equity agreement, an investor provides homeowners with a lump sum of cash. In return, the investor receives a percentage of the home’s future increase in value. For example, a homeowner might receive $50,000 in exchange for 25% of their home’s appreciation over the next 10 years.

Market Growth and Popularity

The equity sharing market has experienced significant growth. As of 2024, the market is dominated by four companies: Unison, Point, Hometap, and others.

Benefits for Homeowners

Shared equity agreements offer several advantages:

- No monthly payments: This feature appeals to homeowners who want to access their equity without increasing monthly expenses.

- Risk-sharing: If the property value decreases, the homeowner typically doesn’t owe anything to the investor.

- Financial flexibility: Homeowners can use the funds for various purposes without restrictions.

Important Considerations

While shared equity agreements offer unique benefits, they come with potential drawbacks:

- Long-term implications: Homeowners should carefully consider the impact of giving up a portion of their home’s future appreciation.

- Terms and conditions: The Financial Industry Regulatory Authority (FINRA) advises homeowners to thoroughly review agreement terms, including fees and restrictions on refinancing or selling the property.

- Valuation methods: Understanding how the home’s value will be determined at the end of the agreement is crucial.

Comparing Options

Homeowners should weigh shared equity agreements against other alternatives (such as HELOCs or cash-out refinancing) to determine the best fit for their specific situation. Each method offers distinct advantages and considerations, highlighting the importance of thorough research and professional guidance in making these significant financial decisions.

Final Thoughts

Homeowners have several HELOC alternatives to access their home equity. Home equity loans provide fixed rates and predictable payments for large expenses. Cash-out refinancing can offer lower interest rates and potential tax benefits when market conditions favor it. Shared equity agreements allow homeowners to tap into equity without additional debt.

The best choice depends on your financial situation, goals, and risk tolerance. You must evaluate your needs, understand the terms, and consider long-term implications before deciding. These choices can be complex, but you don’t have to navigate them alone.

At HELOC360, we help homeowners make informed decisions about their home equity. Our platform simplifies the process and connects you with lenders that match your requirements. We can help you explore HELOC alternatives to achieve your financial goals and make the most of your home’s value.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.