- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Homeowners often face a crucial decision when tapping into their property’s value: choosing between a home equity line of credit versus home equity loan. Both options offer unique advantages, but understanding their differences is key to making the right choice for your financial needs.

At HELOC360, we’ve helped countless homeowners navigate this decision. In this post, we’ll break down the features of HELOCs and home equity loans, highlighting their pros and cons to help you determine which option aligns best with your goals.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

Understanding Home Equity Lines of Credit (HELOCs)

What Is a HELOC?

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against their home’s equity. Unlike traditional loans, a HELOC provides a revolving line of credit (similar to a credit card) with your home as collateral.

HELOC Structure: Draw and Repayment Periods

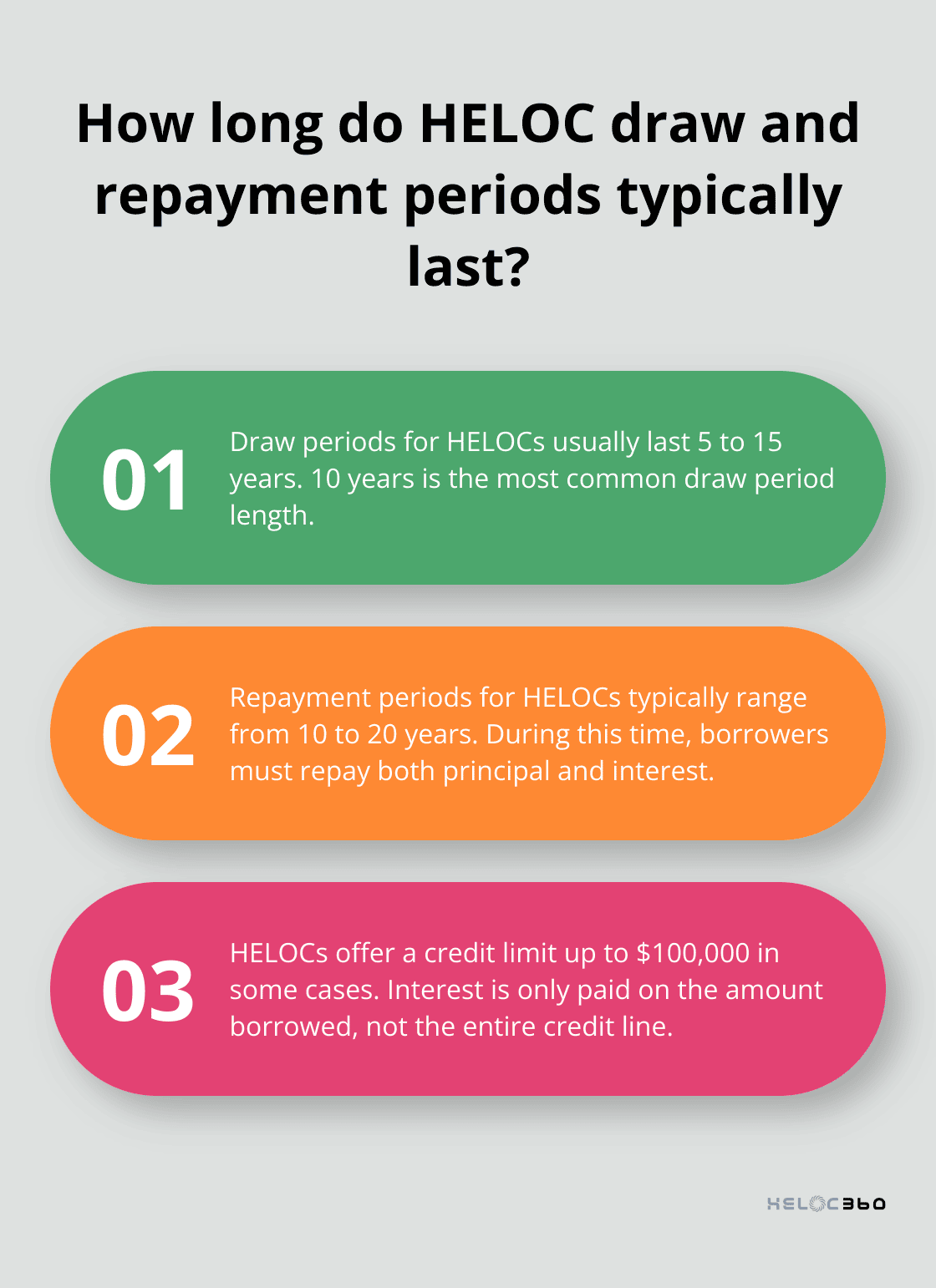

HELOCs typically have two phases:

- Draw Period: This phase usually lasts 5 to 15 years, with 10 being the most common. During this time, you can borrow up to your credit limit as needed. You’ll only pay interest on the amount you’ve borrowed, not the entire credit line.

- Repayment Period: After the draw period ends, you can no longer borrow and must repay the principal plus interest. This period is usually between 10 and 20 years.

For example, if you have a $100,000 HELOC and use only $20,000, you’ll pay interest on just that $20,000. This feature makes HELOCs attractive for ongoing expenses or projects with uncertain costs.

Advantages of HELOCs

Flexibility in Use

HELOCs offer significant flexibility. You can use the funds for various purposes, including:

- Home improvements

- Debt consolidation

- Business funding

This versatility allows you to adapt to changing financial needs without applying for new loans.

Potential Tax Benefits

HELOCs often come with potential tax advantages. The interest paid on a HELOC may be tax-deductible if you use the funds for home improvements. (Always consult with a tax professional, as tax laws can change and individual circumstances vary.)

Interest Rates and Payments

HELOCs typically feature variable interest rates, which can be both an advantage and a potential risk:

- When market rates are low, your HELOC rate may be lower than fixed-rate alternatives.

- If rates rise, your payments could increase.

Many homeowners appreciate the initial lower payments during the draw period when they often only need to pay interest. This can benefit those managing cash flow or expecting increased income in the future.

As we move on to explore home equity loans, you’ll see how these fixed-rate alternatives differ from the flexible structure of HELOCs.

Home Equity Loans Explained

What Is a Home Equity Loan?

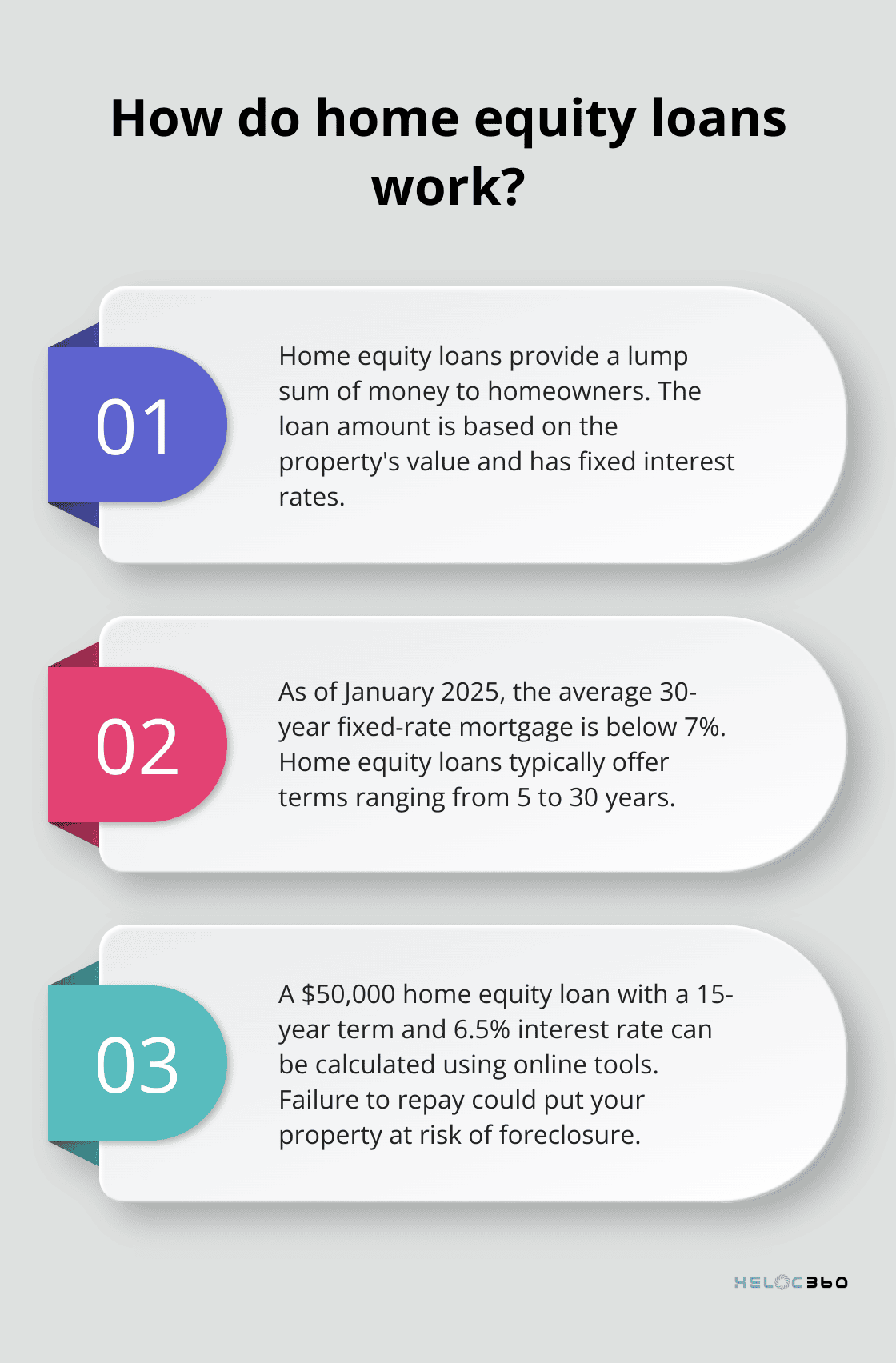

Home equity loans allow homeowners to access their property’s value, providing a lump sum of money for various purposes. These loans offer fixed interest rates and set repayment terms, which appeal to those who prefer predictable financial planning.

Fixed Interest Rates: Stability in Borrowing

A key feature of home equity loans is their fixed interest rate. Once you secure the loan, your interest rate remains constant throughout the repayment period. As of January 2025, Freddie Mac reports the average 30-year fixed-rate mortgage has dropped below seven percent. This stability enables borrowers to budget effectively, knowing their exact monthly payment.

Lump Sum Funding: Immediate Capital Access

Home equity loans provide the entire loan amount upfront. This lump sum distribution benefits large, one-time expenses. For example, a major home renovation project with a set budget could receive immediate funding, allowing you to pay contractors and purchase materials without delay.

Structured Repayment: Clear Debt Reduction Path

Home equity loans typically offer terms ranging from 5 to 30 years. You’ll make regular monthly payments that include both principal and interest during this period. This approach ensures steady debt reduction over time. For instance, a $50,000 home equity loan with a 15-year term and 6.5% interest rate would result in a monthly payment that can be calculated using online tools.

Many homeowners value this predictable repayment structure, especially when planning long-term financial goals. However, it’s essential to note that home equity loans (like HELOCs) use your home as collateral. Failure to repay could put your property at risk of foreclosure.

Comparing Options: Home Equity Loans vs. Other Financing

While home equity loans offer stability and predictability, they might not suit every financial situation. Some homeowners might prefer the flexibility of a HELOC or the potential benefits of a cash-out refinance. To determine the best option for your needs, consider factors such as your financial goals, risk tolerance, and current market conditions.

As we explore the key differences between HELOCs and home equity loans in the next section, you’ll gain a clearer understanding of which option aligns best with your financial objectives.

HELOC vs Home Equity Loan: Key Differences

Interest Rate Structures

HELOCs typically come with variable interest rates, while home equity loans offer fixed rates. Bankrate Chief Financial Analyst Greg McBride, CFA, forecasts that HELOC rates will continue to decline in 2025, averaging 7.25 percent. This potential for rate fluctuations with HELOCs is important to consider.

Variable rates can benefit borrowers in a declining rate environment. If the Federal Reserve continues its projected rate cuts in 2025, HELOC borrowers could see lower monthly payments. However, this also means payments could increase if rates rise unexpectedly.

Fixed rates provide stability. If you have a tight budget or prefer predictable expenses, a home equity loan might be the safer choice. You’ll know exactly what your monthly payment will be for the entire loan term (which can range from 5 to 30 years).

Funding and Accessibility

The way you receive and access funds differs significantly between these two options. Home equity loans provide a lump sum upfront, ideal for large, one-time expenses like major home renovations or debt consolidation. You’ll receive the entire amount at closing (typically ranging from 80% to 85% of your home’s equity).

HELOCs offer a revolving line of credit. You can draw funds as needed during the draw period, which usually lasts 10 years. This flexibility proves particularly useful for ongoing expenses or projects with uncertain costs. For instance, if you plan a series of home improvements over time, a HELOC allows you to borrow only what you need, when you need it.

Repayment Flexibility

Repayment structures vary considerably between these two options. Home equity loans have fixed monthly payments that include both principal and interest from the start. This structure ensures you pay down your debt steadily over time.

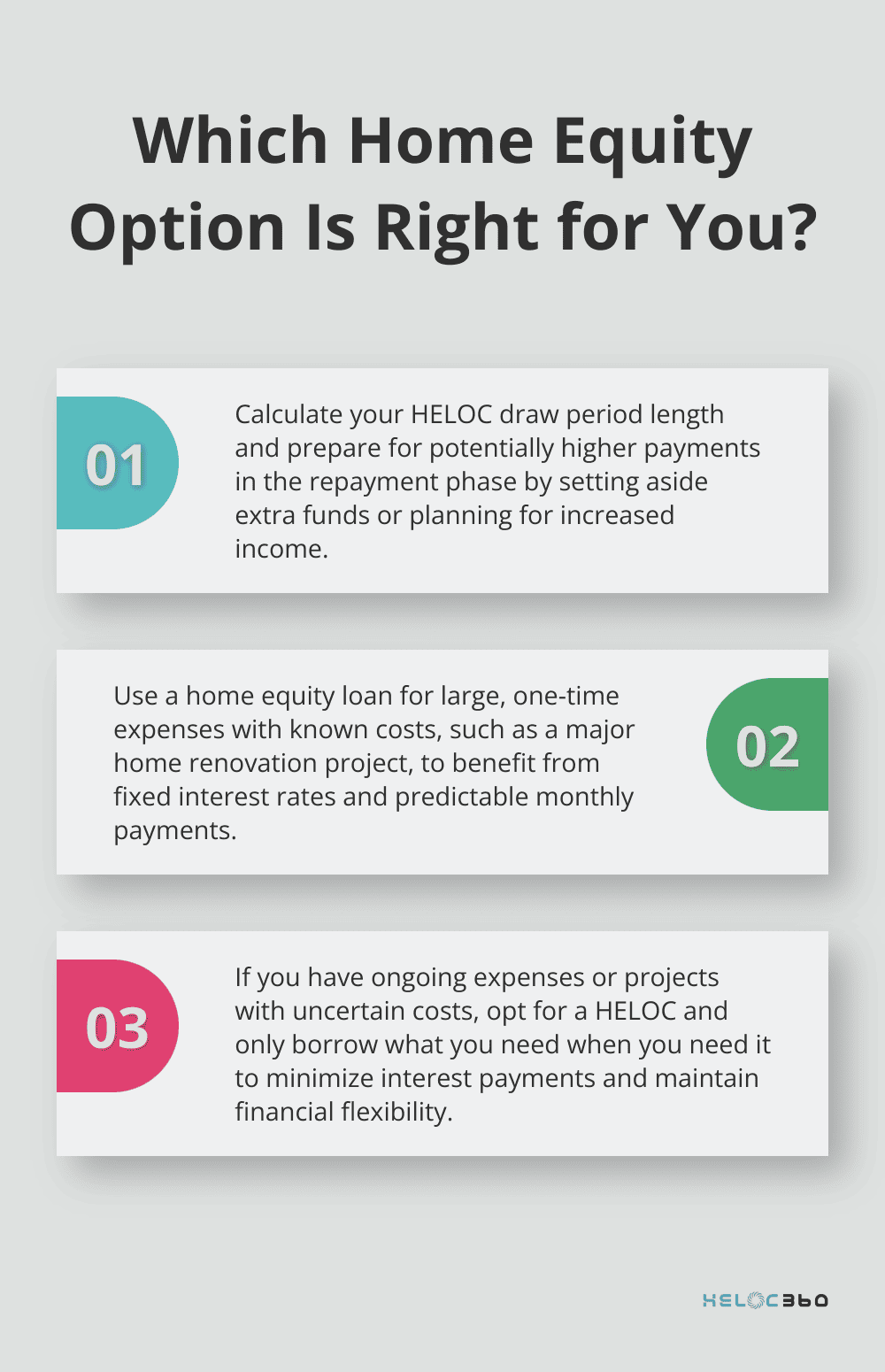

HELOCs offer more flexibility during the draw period. The typical length of a HELOC draw period is 10 years, although some can be as short as three or five years. Many lenders only require interest payments during this time, which can lower your initial monthly costs. However, it’s important to prepare for potentially higher payments once the repayment period begins and you start paying back the principal.

For example, on a $100,000 HELOC with a 10-year draw period and a 20-year repayment period, your monthly payments could jump significantly once you enter the repayment phase. Try to factor this into your long-term financial planning.

Best Use Cases

Home equity loans work well for:

- Large, one-time expenses with known costs

- Borrowers who prefer predictable payments

- Long-term financial planning with fixed costs

- Ongoing projects or expenses with variable costs

- Borrowers who want flexibility in accessing funds

- Those comfortable with potential payment fluctuations

Risk Considerations

Both options use your home as collateral, which means you risk foreclosure if you fail to make payments. However, the risk profile differs slightly:

Home equity loans have a fixed repayment schedule, which can make budgeting easier and potentially reduce the risk of default.

HELOCs offer more flexibility but also require more discipline. The variable interest rates and potential for large balance accumulation during the draw period can lead to payment shock when the repayment period begins.

Final Thoughts

Your choice between a home equity line of credit versus home equity loan depends on your financial situation and goals. HELOCs offer flexibility with revolving credit and variable rates, ideal for ongoing projects. Home equity loans provide stability with fixed rates and predictable payments, suiting those who prefer structured borrowing.

Consider your financial stability, risk tolerance, and expense nature when deciding. Evaluate your long-term financial plans, current market conditions, and repayment ability. Both options use your home as collateral, so careful consideration protects your valuable asset.

HELOC360 simplifies the process and provides information and tools for informed decisions. We connect you with lenders that align with your specific needs, ensuring you find the best solution for your financial goals. Whether you’re funding home improvements, consolidating debt, or creating financial flexibility, HELOC360 offers tailored solutions to help you leverage your home’s equity effectively.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.