At HELOC360, we often encounter homeowners grappling with the challenge of obtaining a HELOC on an underwater home.

An underwater home, where the mortgage balance exceeds the property’s value, presents unique obstacles for borrowers seeking additional financing.

This post explores the possibilities and limitations of securing a HELOC when your home is underwater, as well as alternative options available to homeowners in this situation.

What Are Underwater Homes and HELOCs?

Understanding Underwater Homes

An underwater home occurs when the outstanding mortgage balance surpasses the current market value of the property. For instance, if you owe $300,000 on your mortgage but your home is only worth $250,000, you’re $50,000 underwater. This situation often results from declining property values or when homeowners fall behind on payments.

The nationwide proportion of mortgaged homes considered seriously underwater has remained steady between 2 and 3 percent since early 2023. This statistic underscores the prevalence of this issue and the importance for homeowners to understand their options.

The Mechanics of HELOCs

A Home Equity Line of Credit (HELOC) is a revolving credit line secured by your home’s equity. It operates similarly to a credit card, allowing you to borrow up to a certain limit, repay, and borrow again as needed. The primary distinction is that your home serves as collateral.

HELOCs typically offer lower interest rates compared to unsecured loans or credit cards, making them an attractive option for many homeowners. However, the amount you can borrow depends on your home’s equity (the difference between your home’s value and your mortgage balance).

Home Equity and HELOC Eligibility

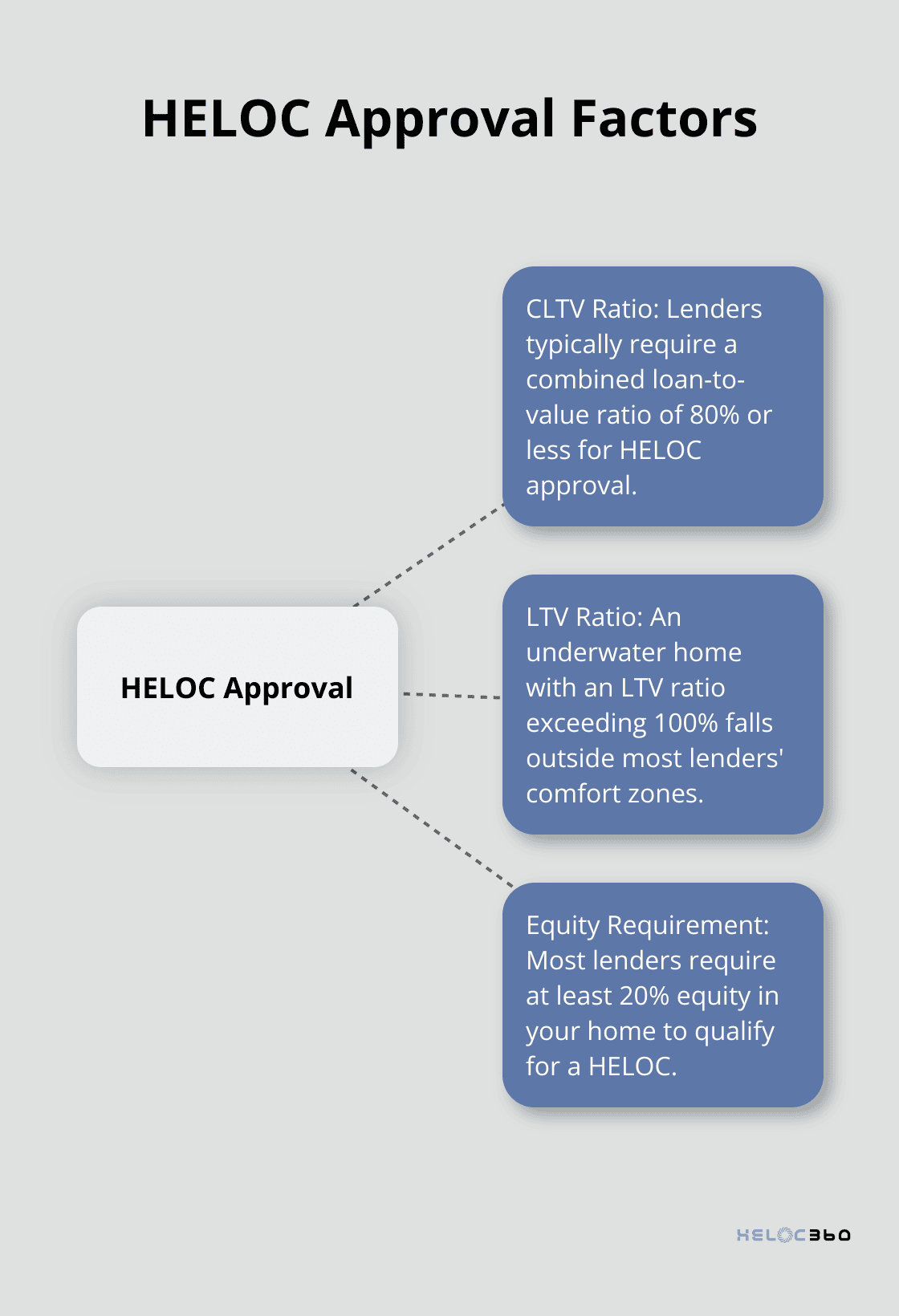

Home equity plays a vital role in HELOC eligibility. Most lenders require at least 20% equity in your home to qualify for a HELOC. This requirement presents a significant challenge for underwater homeowners.

Consider this example: if your home is worth $250,000 and you owe $300,000, your LTV ratio is 120%. This high LTV ratio makes it nearly impossible to qualify for a traditional HELOC. Lenders view underwater homes as high-risk investments, as there’s no equity to secure the loan.

The Impact of Negative Equity

Negative equity (when you owe more than your home is worth) significantly limits your financial options. It not only affects your ability to obtain a HELOC but also restricts refinancing opportunities and makes selling your home more challenging.

Many homeowners find themselves in this situation due to factors beyond their control, such as market downturns or economic recessions. Understanding the implications of negative equity is the first step in exploring potential solutions.

Exploring Alternatives

While obtaining a HELOC on an underwater home presents extreme challenges, it doesn’t mark the end of the road. Various options and strategies exist for homeowners in this situation. In the next section, we’ll examine the specific hurdles you might face when seeking a HELOC on an underwater home and discuss potential alternatives to consider.

Why Is Getting a HELOC on an Underwater Home So Challenging?

The Lender’s Risk Assessment

Securing a Home Equity Line of Credit (HELOC) on an underwater home presents significant challenges. The difficulties stem from the fundamental nature of HELOCs and the risks they pose to lenders when negative equity exists.

From a lender’s perspective, an underwater home represents a substantial risk. When a property’s value falls below the outstanding mortgage, lenders lack a safety net if the borrower defaults. This absence of security prompts extreme caution in extending additional credit.

Lenders typically require a combined loan-to-value (CLTV) ratio of 80% or less for HELOC approval. This means the total of your first mortgage and the HELOC should not exceed 80% of your home’s value. An underwater home already surpasses this threshold, making HELOC approval unlikely.

The Loan-to-Value Ratio Dilemma

The loan-to-value (LTV) ratio plays a critical role in HELOC approvals. Lenders calculate this ratio by dividing your current mortgage balance by your home’s appraised value. For underwater homes, this ratio exceeds 100%, which falls far outside most lenders’ comfort zones.

Consider this example: If your home’s value is $200,000 and you owe $220,000 on your mortgage, your LTV stands at 110%. This high LTV not only disqualifies you from most traditional HELOCs but also restricts other refinancing options.

The Widespread Impact of Negative Equity

Negative equity affects more than just your ability to obtain a HELOC; it limits your overall financial flexibility. Here are some key consequences:

- Restricted Refinancing Options: Most conventional refinancing programs require some equity in your home. Without it, you often become ineligible for better interest rates or terms.

- Selling Difficulties: If you need to sell your home, you’ll likely face a shortfall between the sale price and your mortgage balance.

- Higher Foreclosure Risk: Should you encounter financial hardship, the lack of equity leaves you with fewer options to avoid foreclosure.

Potential for Improvement

While the current outlook might appear bleak, situations can improve. As you continue to make mortgage payments and if property values in your area increase, you may eventually build positive equity. In the meantime, exploring alternative financing options or government assistance programs could provide some relief.

The challenges of securing a HELOC on an underwater home underscore the importance of understanding all available options. In the next section, we’ll explore alternative strategies for homeowners facing this situation, including refinancing programs and methods to build equity in an underwater home.

Navigating Options for Underwater Homeowners

Government-Backed Refinancing Programs

The federal government offers several refinancing programs for underwater mortgages. HARP ended in December 2018, but new options emerged to assist homeowners with little to no equity.

Fannie Mae’s High Loan-to-Value Refinance Option and Freddie Mac’s Enhanced Relief Refinance allow eligible borrowers to refinance into lower interest rates or more favorable terms, even if they owe more than their home’s worth. To qualify, Fannie Mae or Freddie Mac must own your loan, and you must have made on-time payments for the past 12 months. (Check your loan’s eligibility on the Federal Housing Finance Agency’s website.)

FHA Streamline Refinance

Homeowners with FHA loans can benefit from the FHA Streamline Refinance program. This option doesn’t require a new appraisal, which makes it ideal for underwater homes. You must have made at least six payments on your current FHA loan and show that the refinance will result in a “net tangible benefit” (typically a lower monthly payment).

Building Equity in an Underwater Home

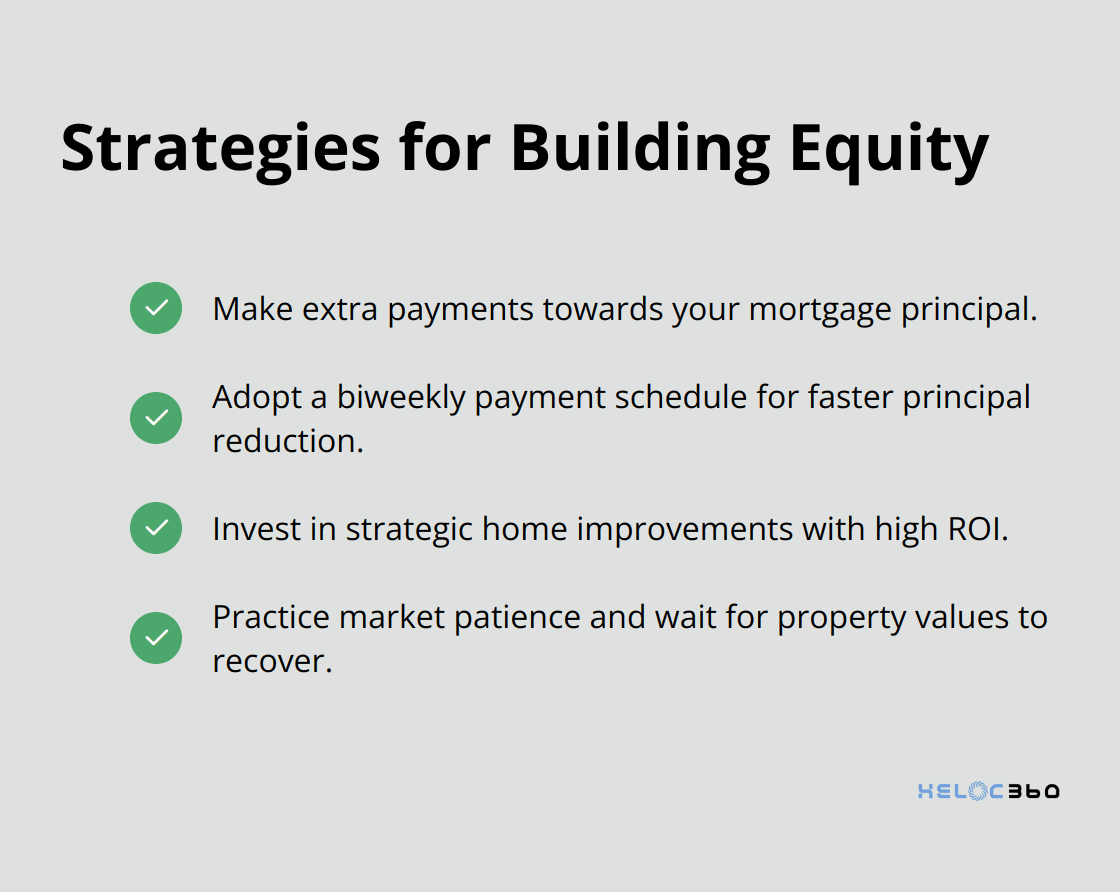

While refinancing provides immediate relief, building equity offers a long-term solution. Consider these strategies:

Seeking Professional Guidance

Navigating underwater mortgages presents unique challenges. While traditional HELOCs may not be an option, exploring these alternatives can provide a path forward. Every situation differs, and what works for one homeowner may not suit another. (A financial advisor can help determine the best strategy for your specific circumstances.)

Final Thoughts

Homeowners with underwater mortgages face challenges in obtaining HELOCs, but alternatives exist. Government-backed refinancing programs and FHA Streamline Refinance offer potential solutions for those with negative equity. These options can provide relief, lower interest rates, or more favorable terms, even when a home’s value falls below the mortgage balance.

Exploring all available options and understanding their long-term implications is essential. The path from an underwater HELOC situation to financial stability requires strategic planning and often professional guidance. Patience plays a key role in this process, as real estate markets tend to recover over time.

We at HELOC360 understand the complexities of navigating home equity in challenging situations. Our platform helps homeowners unlock their home equity potential, providing tailored solutions and expert guidance. While a HELOC on an underwater home may not be feasible, we can help you explore alternative options and connect you with suitable lenders (always seek professional financial advice for your specific circumstances).

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.