Navigating a HELOC disclosure statement can be daunting, but it’s a critical step in securing your financial future.

At HELOC360, we’ve seen how understanding these documents can make or break a homeowner’s borrowing experience.

This guide will break down the key components of a HELOC disclosure, helping you make informed decisions about your home equity line of credit.

What’s in a HELOC Disclosure Statement?

Key Components of a HELOC Disclosure

A HELOC disclosure statement is a document that lenders must provide to borrowers before they open a home equity line of credit. This statement outlines the terms, conditions, and potential risks associated with the HELOC.

The Federal Reserve Board requires lenders to include specific information in HELOC disclosures. These typically cover the annual percentage rate (APR), payment terms, and fees associated with the credit line.

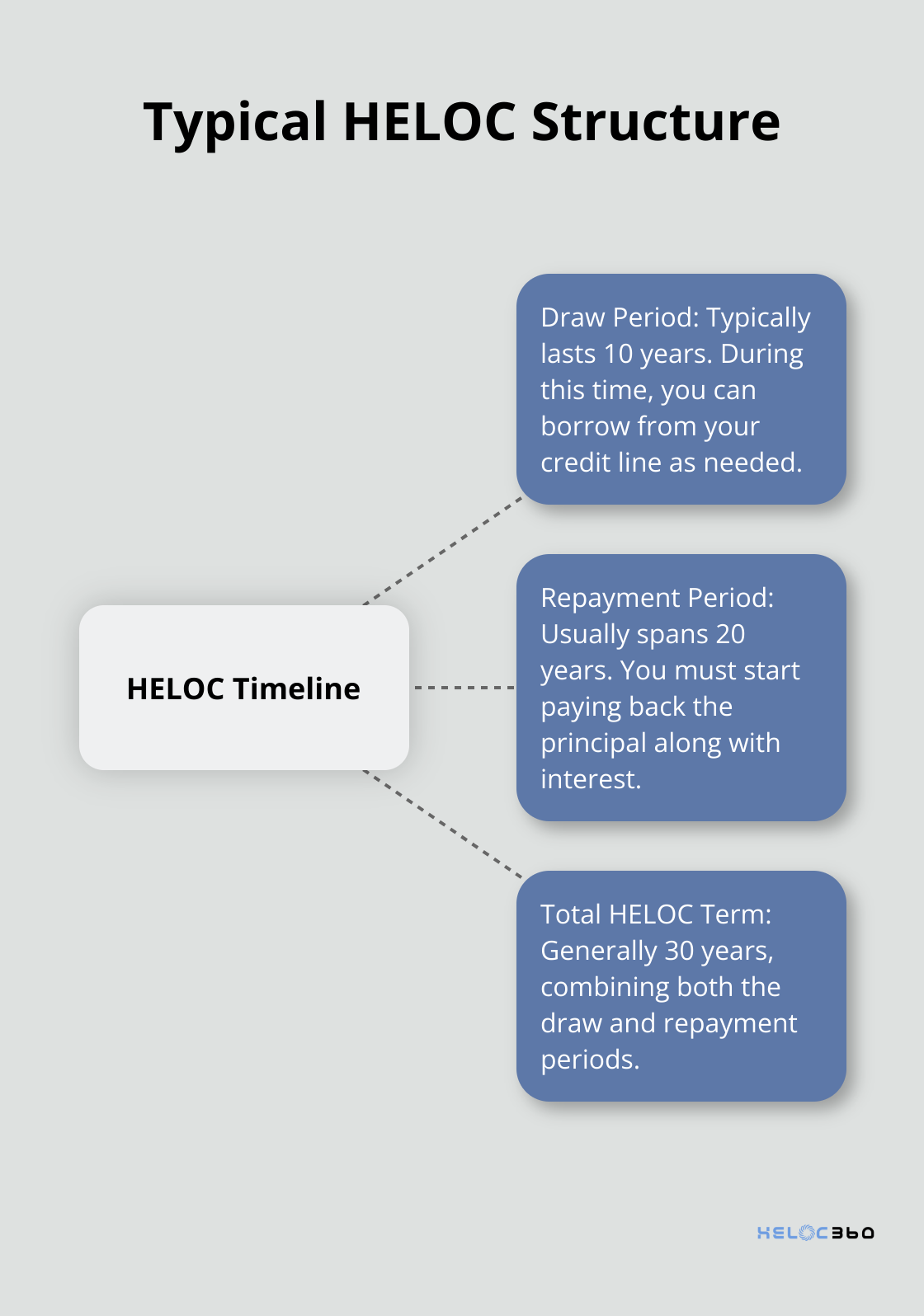

HELOC disclosures also detail the draw period and repayment terms. Most HELOCs have a 10-year draw period, followed by a 20-year repayment period. However, these terms can vary, so it’s important to review them carefully.

The Importance of Careful Review

A thorough examination of your HELOC disclosure is vital for several reasons. First, it helps you understand the true cost of borrowing.

Spotting Potential Risks

HELOC disclosures also highlight potential risks. For example, they’ll explain how variable interest rates work and how they might affect your payments.

Many borrowers overlook crucial details in their disclosures, which can lead to financial strain later. That’s why it’s always recommended to seek professional advice when reviewing these documents.

Understanding the Impact on Your Financial Future

Understanding your HELOC disclosure is the first step towards making informed decisions about your home equity. It’s not just about knowing the terms; it’s about comprehending how those terms will affect your financial future.

For instance, a disclosure will outline how changes in your home’s value can impact your credit line (this is particularly important in volatile housing markets). It will also explain scenarios where the lender might freeze or reduce your credit line, which could affect your long-term financial plans.

Navigating Complex Terms

HELOC disclosures often contain complex financial jargon. Try to familiarize yourself with terms like “margin” (the amount added to the index rate to determine your interest rate) and “cap” (the maximum interest rate you could be charged). Understanding these terms will give you a clearer picture of your potential financial obligations.

Now that we’ve covered the basics of a HELOC disclosure statement, let’s break down its key sections in more detail.

What’s Inside Your HELOC Disclosure?

Annual Percentage Rate (APR)

The Annual Percentage Rate (APR) stands as a cornerstone of your HELOC disclosure. It represents the yearly cost of borrowing, which includes interest and certain fees. As of May 21, 2025, the national average HELOC interest rate is 8.20%, according to Bankrate’s latest survey of the nation’s largest home equity lenders.

Most HELOCs feature a variable APR. Your rate can fluctuate based on changes in the prime rate. The disclosure will specify the frequency and magnitude of potential rate changes. Some lenders offer rate caps to limit APR increases. If your disclosure doesn’t mention a cap, ask your lender about it.

Fees and Charges

Your HELOC disclosure will list all fees associated with opening and maintaining your line of credit. These may include:

- Application fee

- Appraisal fee

- Annual maintenance fee

- Inactivity fee

Be cautious of lenders who claim “no fees.” Often, these costs are incorporated into your interest rate or loan amount. Ask for a detailed breakdown of all fees to avoid future surprises.

Draw Period and Repayment Terms

Your HELOC will have two distinct phases: the draw period and the repayment period. The typical length of a HELOC draw period is 10 years, although some draw periods can be as short as three or five years. During this time, you can borrow from your credit line.

After the draw period ends, you enter the repayment phase. This is when you must start paying back the principal along with interest. The repayment period often spans 20 years, but it can vary. Your disclosure should clearly state these terms.

Pay close attention to how your payments will change after the draw period ends. Many homeowners find themselves unprepared for the significant increase in their monthly payments.

Minimum Payment Requirements

Your disclosure will specify the minimum payment required during both the draw and repayment periods. During the draw period, you can take out money up to the limit as often as you’d like. However, some lenders may require you to pay a percentage of the principal as well.

In the repayment period, your minimum payment will include both principal and interest. Be aware that making only minimum payments during the draw period can lead to a substantial payment increase when repayment begins.

Understanding these key sections of your HELOC disclosure will help you make an informed decision. Take the time to review your disclosure carefully, and don’t hesitate to ask questions if anything remains unclear. Now, let’s explore some potential red flags and important considerations you should keep in mind when reviewing your HELOC disclosure.

What Are the Hidden Risks in Your HELOC?

The Double-Edged Sword of Variable Rates

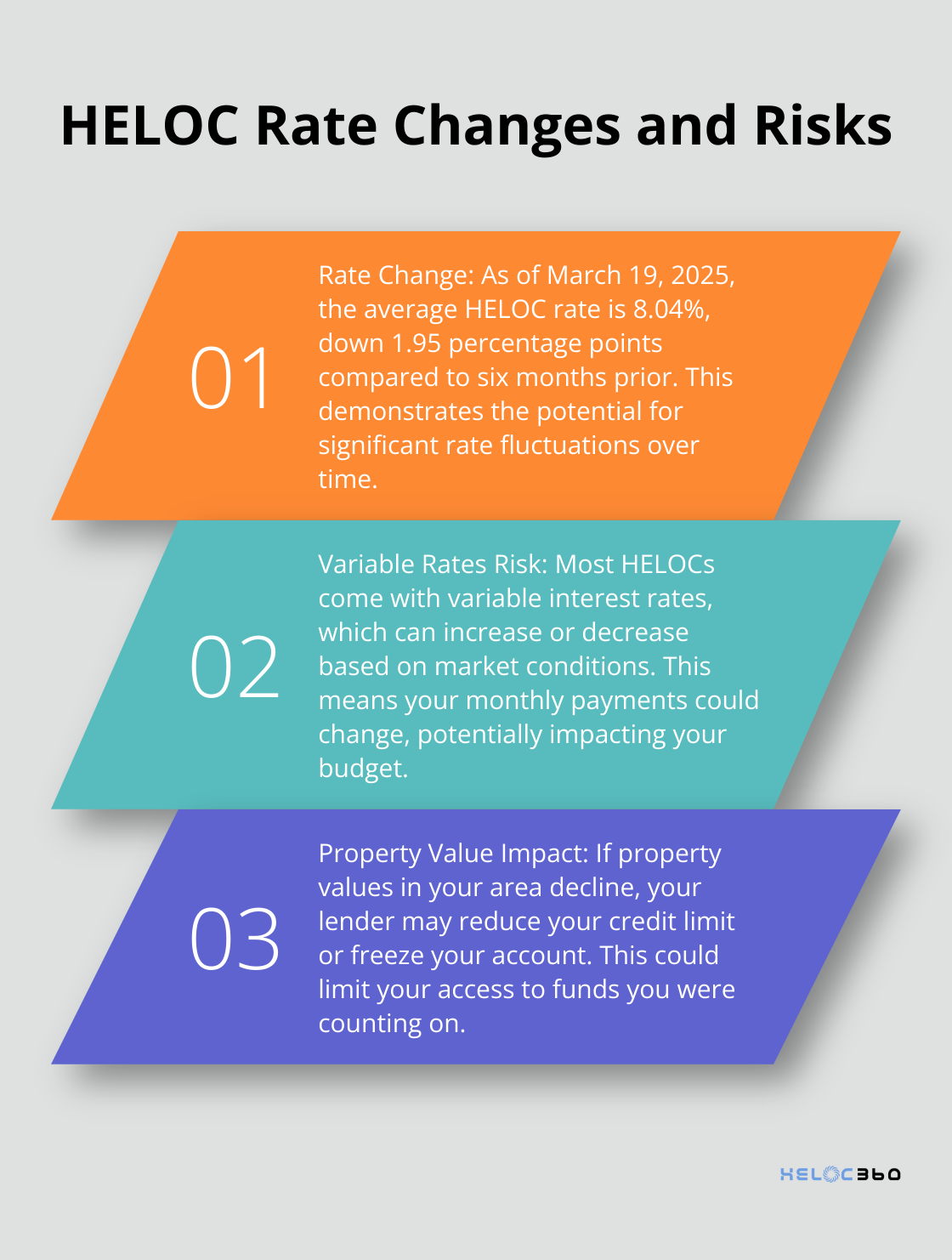

Most HELOCs come with variable interest rates, which can benefit or harm borrowers. These rates often start lower than fixed rates but can increase significantly over time. As of March 19, 2025, the average HELOC rate is 8.04%, down 1.95 percentage points compared to six months prior. This fluctuation means your monthly payments could potentially change based on market conditions.

To protect yourself, ask your lender about rate caps. Some HELOCs offer annual caps that limit how much your rate can increase in a given year, helping to protect borrowers from rapid rises in market interest rates.

The Trap of Negative Amortization

Negative amortization in HELOCs is a risk that borrowers should be aware of. Despite their advantages, home equity loans come with risks: You could lose your home if you miss payments or owe more than your home’s worth.

To avoid this trap, make principal payments during your draw period, even if they’re not required. This strategy can help you build equity faster and reduce the shock when your repayment period begins.

Sneaky Fees and Penalties

While your HELOC disclosure should list all fees, some can escape notice. For instance, inactivity fees can charge you for not using your credit line, while early termination fees can penalize you for paying off your HELOC too soon.

One often-overlooked cost is the appraisal fee. To minimize these costs, ask your lender for a comprehensive fee schedule and negotiate to have some fees waived. Many lenders will compete for your business, especially if you have a strong credit profile.

The Impact of Property Value Fluctuations

Your home’s value plays a key role in your HELOC. If property values in your area decline, your lender may reduce your credit limit or even freeze your account. This happened to many homeowners during the 2008 housing crisis, leaving them without access to funds they counted on.

To protect yourself, monitor your local real estate market closely. If you notice property values declining, consider drawing funds from your HELOC and storing them in a high-yield savings account. This way, you’ll have access to the money even if your lender reduces your credit limit.

Final Thoughts

Your HELOC disclosure outlines the terms, conditions, and potential risks of your home equity line of credit. You should review this document carefully to avoid unexpected costs and prepare for payment changes. Don’t hesitate to ask lenders for better terms, such as lower interest rates or reduced fees.

We at HELOC360 understand the challenges of navigating HELOC disclosures. Our platform simplifies this process and helps you unlock the full potential of your home equity. We provide expert guidance and connect you with lenders that match your unique needs.

HELOC360 empowers you with knowledge to make confident decisions about your home equity. Your home is more than just a place to live – it’s a powerful financial tool (when used wisely). It can open doors to new opportunities and help you build a stronger financial future.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.