Navigating the world of Home Equity Lines of Credit (HELOCs) can be complex, especially when it comes to understanding HELOC escrow accounts.

At HELOC360, we often field questions about whether these accounts are necessary and how they impact borrowers.

This post will clarify when escrow accounts are required for HELOCs, their pros and cons, and how they might affect your financial planning.

What Are Escrow Accounts in HELOCs?

The Basics of Escrow Accounts

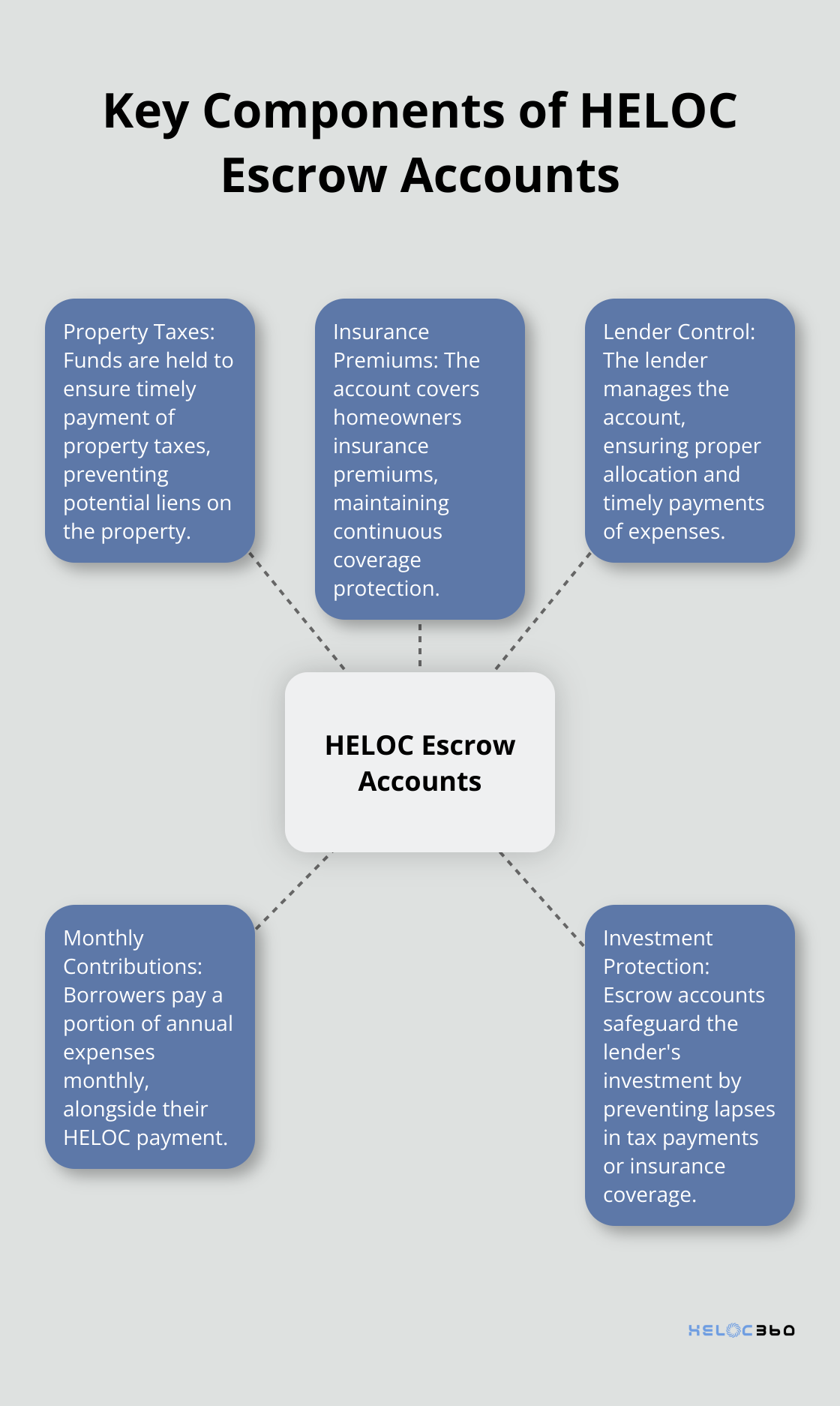

Escrow accounts serve as a cornerstone in the realm of Home Equity Lines of Credit (HELOCs). These financial instruments, set up by lenders, manage specific property-related expenses for borrowers. An escrow account functions as a separate savings account under the lender’s control. Its primary purpose is to hold funds for property taxes and homeowners insurance premiums. Rather than paying these substantial annual or semi-annual bills in one lump sum, borrowers contribute a portion of the cost monthly alongside their HELOC payment.

The Purpose Behind Escrow Accounts

Lenders implement escrow accounts to protect their investment in your property. This practice ensures timely payment of property taxes and insurance premiums, which guards against potential liens on the property or lapses in insurance coverage. This protection extends to borrowers as well, helping them avoid late fees or potential legal issues related to unpaid property expenses.

Escrow Accounts in Traditional Mortgages

While escrow accounts are more commonly associated with traditional mortgages, they can also apply to HELOCs. In a typical mortgage scenario, the monthly payment includes principal, interest, and escrow contributions. The lender then uses the escrow funds to pay property taxes and insurance when they’re due.

Escrow Accounts in HELOCs

For HELOCs, the use of escrow accounts varies. Some lenders require them, especially if the HELOC holds first lien position (meaning it’s the primary loan on the property). Others offer them as an optional service to help borrowers manage their property-related expenses more effectively.

The Prevalence of Escrow Accounts

Escrow accounts are commonly used in property lending. They can prove particularly beneficial for first-time HELOC borrowers or those who prefer a more hands-off approach to managing their property expenses.

As we move forward, it’s important to understand when these escrow accounts become a requirement for HELOCs. Let’s explore the various scenarios and regulations that dictate the necessity of escrow accounts in the next section.

When Lenders Require HELOC Escrow Accounts

First Lien Position HELOCs

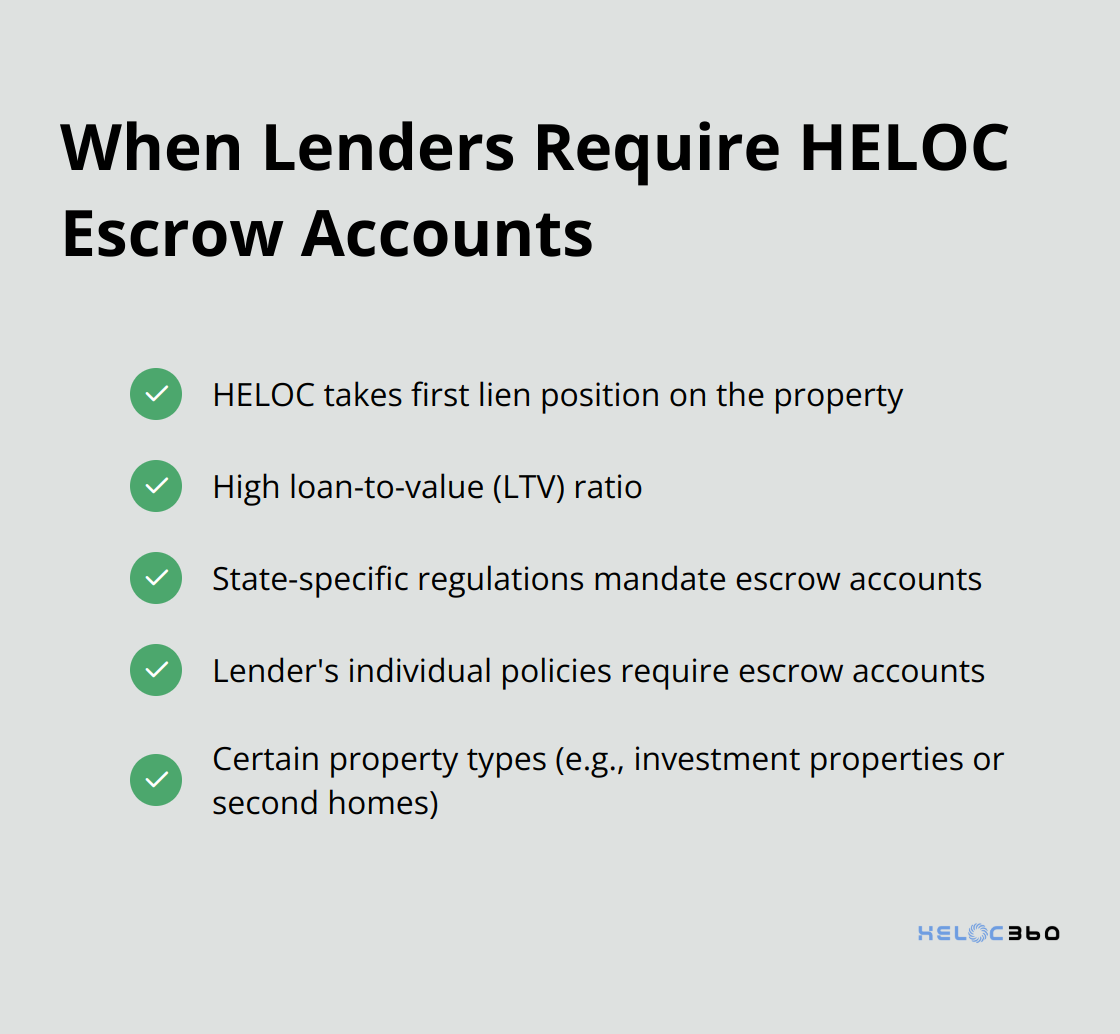

HELOCs don’t always come with mandatory escrow accounts, but certain circumstances can trigger this requirement. When a HELOC takes the first lien position on a property, lenders often require an escrow account. This scenario typically occurs when a HELOC refinances an existing mortgage. The HELOC becomes the primary loan on the property, which increases the lender’s risk. To mitigate this risk, many lenders mandate escrow accounts to ensure timely payment of property taxes and insurance premiums.

High Loan-to-Value Ratios

Lenders may require escrow accounts for HELOCs with high loan-to-value (LTV) ratios. If your HELOC pushes your total mortgage debt above a certain threshold, your lender might insist on an escrow account. This requirement helps protect the lender’s investment by ensuring responsible management of property-related expenses.

State-Specific Regulations

Some states have laws that impact HELOC escrow requirements. For example, HELOC lenders in California must comply with federal disclosure requirements and state-specific laws. In Texas, voters approved amendments to expand the state’s home equity lending laws in September 2003. It’s important to familiarize yourself with your state’s specific laws (or consult with a local real estate attorney) to understand how these regulations might affect your HELOC terms.

Lender Policies

Each lender has its own policies regarding HELOC escrow accounts. Some lenders always require escrow accounts for HELOCs, while others make it optional. These policies often depend on factors such as the lender’s risk assessment, the borrower’s credit history, and the overall loan amount. It’s advisable to discuss escrow options with potential lenders before committing to a HELOC.

Property Type Considerations

The type of property securing the HELOC can also influence escrow requirements. For instance, lenders might be more likely to require escrow accounts for HELOCs on investment properties or second homes. This is because these properties often carry higher risk for lenders compared to primary residences.

While escrow accounts aren’t always mandatory for HELOCs, they can provide benefits to both lenders and borrowers. Understanding these requirements will help you navigate the HELOC application process more effectively. In the next section, we’ll explore the pros and cons of having an escrow account for your HELOC, helping you make an informed decision about your home equity borrowing.

Are Escrow Accounts Beneficial for Your HELOC?

Simplified Financial Management

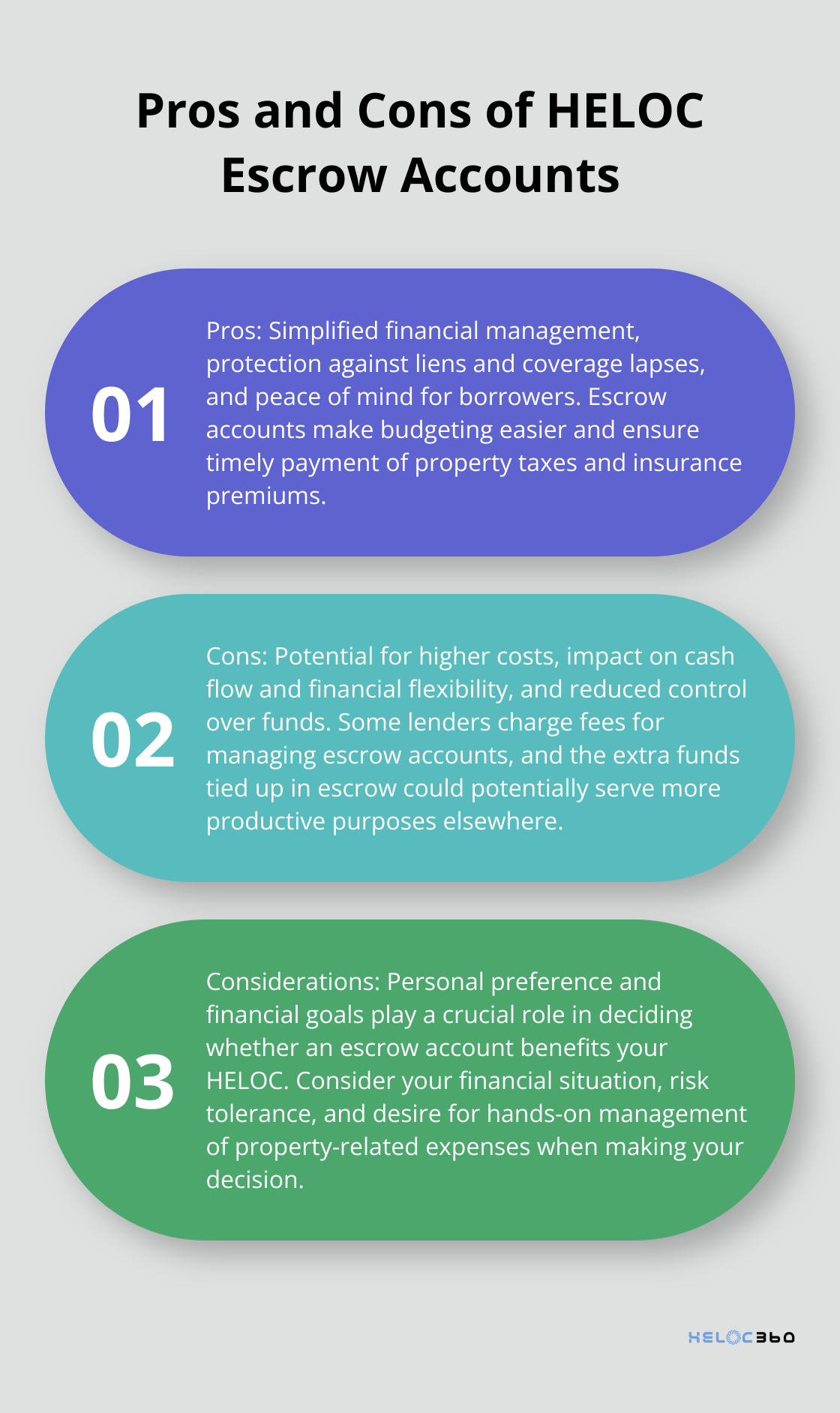

Escrow accounts can be an easy, hassle-free way to make payments for your mortgage, homeowners insurance, and property taxes. This approach makes budgeting easier and prevents the shock of substantial annual or semi-annual bills.

An escrow account is a third-party service that helps manage the flow of money and documents, ensuring both parties fulfill their obligations before the sale. This peace of mind proves particularly valuable for first-time HELOC borrowers or those on fixed incomes.

Protection Against Liens and Coverage Lapses

Escrow accounts provide a layer of protection for you and your lender. These accounts ensure timely payment of property taxes and insurance premiums, which helps you avoid the risk of tax liens or insurance coverage lapses. This protection matters because a tax lien could potentially take precedence over your HELOC, putting your home at risk.

Potential for Higher Costs

While escrow accounts offer convenience and protection, they can increase your overall expenses. Some lenders charge fees for managing escrow accounts. Additionally, lenders often require a cushion in the escrow account (typically equal to two months of payments). This requirement means you’ll need to put more money into the account upfront.

The Real Estate Settlement Procedures Act (RESPA) sets out the requirements for an escrow account that a lender establishes in connection with a federally related mortgage loan. However, even within these limits, the extra funds tied up in escrow could potentially serve more productive purposes elsewhere.

Impact on Cash Flow and Financial Flexibility

Escrow accounts affect your cash flow and financial flexibility. These accounts spread out large expenses over time, but they also increase your monthly payments. This higher monthly obligation could impact your ability to qualify for other loans or credit.

If you prefer to manage your own finances and potentially earn interest on the money set aside for taxes and insurance, an escrow account might not suit you. Some homeowners find they can earn better returns by keeping these funds in high-yield savings accounts or other investment vehicles until the bills come due.

Personal Preference and Financial Goals

Your financial situation, preferences, and goals determine whether an escrow account benefits your HELOC. These accounts offer convenience and protection, but they also come with potential costs and reduced flexibility. As you weigh your options, consider seeking personalized guidance to help you make the best decision for your unique circumstances.

Final Thoughts

Escrow accounts serve a vital function in the realm of HELOCs, offering both benefits and potential drawbacks for borrowers. These accounts can simplify financial management and provide peace of mind, but they may not suit everyone’s needs. Your decision to use a HELOC escrow account should stem from your unique financial situation, preferences, and objectives.

Lender policies and state regulations significantly influence HELOC escrow requirements. Some lenders mandate escrow accounts for HELOCs in first lien positions or those with high loan-to-value ratios. Local laws can also impact these requirements, so it’s important to understand the specific regulations in your area.

HELOC360 helps homeowners make informed decisions about their home equity. Our platform offers comprehensive guidance and connects you with lenders that match your specific needs. We strive to empower you to leverage your home’s value effectively and open doors to new financial opportunities.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.