- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Are you considering a Home Equity Line of Credit (HELOC)? Understanding the equity line of credit requirements is essential before you apply.

At HELOC360, we’ve seen many homeowners struggle with the application process due to a lack of preparation. This guide will walk you through the key requirements, helping you increase your chances of approval.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

What Credit Score Do You Need for a HELOC?

Minimum Credit Score Requirements

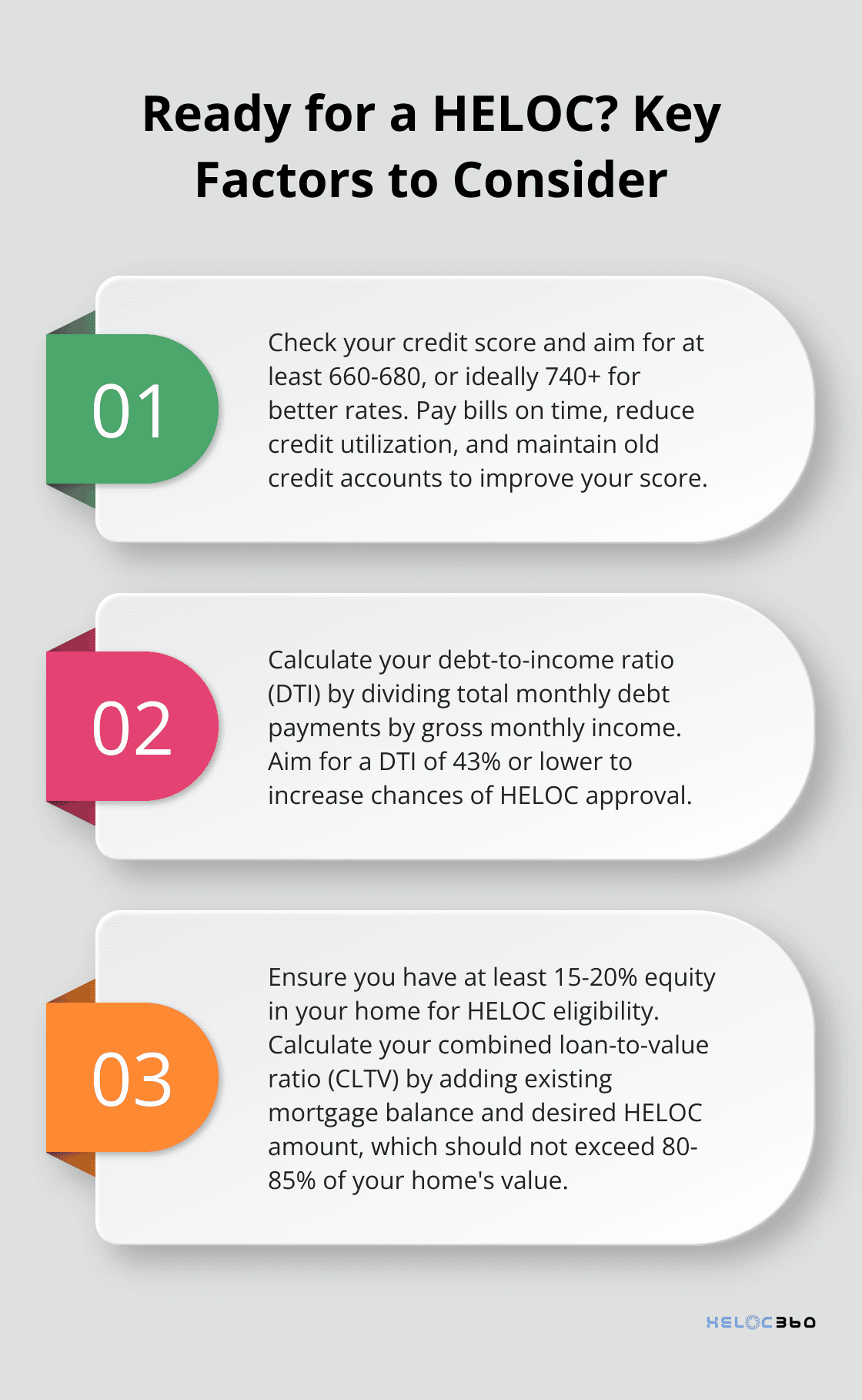

Your credit score significantly influences your ability to secure a Home Equity Line of Credit (HELOC). Generally, the minimum credit score needed to qualify for a home equity loan is around 660 to 680. However, to secure the most favorable rates and terms, you should try to achieve a score of 740 or higher.

The Role of Credit History

Your credit history holds equal importance to your credit score. Lenders will examine your payment history closely, searching for potential red flags (such as late payments, collections, or bankruptcies). A consistent record of timely payments over the past 12 to 24 months can substantially increase your chances of approval.

Strategies to Improve Your Credit Score

If your credit score falls short of your expectations, don’t lose hope. You can take several steps to improve it:

- Pay all bills on time: Set up automatic payments to avoid missing due dates.

- Reduce your credit utilization: Aim to use less than 30% of your available credit.

- Maintain old credit accounts: The length of your credit history matters, so keep those long-standing accounts open.

- Limit new credit applications: Each hard inquiry can temporarily lower your score.

- Review your credit report for errors: Contest any inaccuracies you find with the credit bureaus.

The Value of Comparing Lenders

Different lenders apply varying credit score requirements. While one lender might reject your application, another might approve it. This variation underscores the importance of comparing offers from multiple lenders.

If your credit was one of the deciding factors, you can improve your score by making on-time payments and paying down any outstanding debt. Such improvements can make the difference between rejection and approval, or between a high interest rate and a competitive one.

Beyond Credit Scores

While your credit score plays a vital role, it represents just one piece of the puzzle. Lenders also evaluate factors such as your debt-to-income ratio and the amount of equity in your home. In the next section, we’ll explore these additional requirements to provide you with a comprehensive understanding of what you need to qualify for a HELOC.

What’s Your Debt-to-Income Ratio?

Understanding DTI for HELOC Approval

Your debt-to-income ratio (DTI) plays a key role in your HELOC application. This percentage shows how much of your monthly income goes to debt payments. To calculate your DTI ratio, divide your total monthly debt payments by your total gross income. A lower DTI can boost your chances of getting approved for a HELOC.

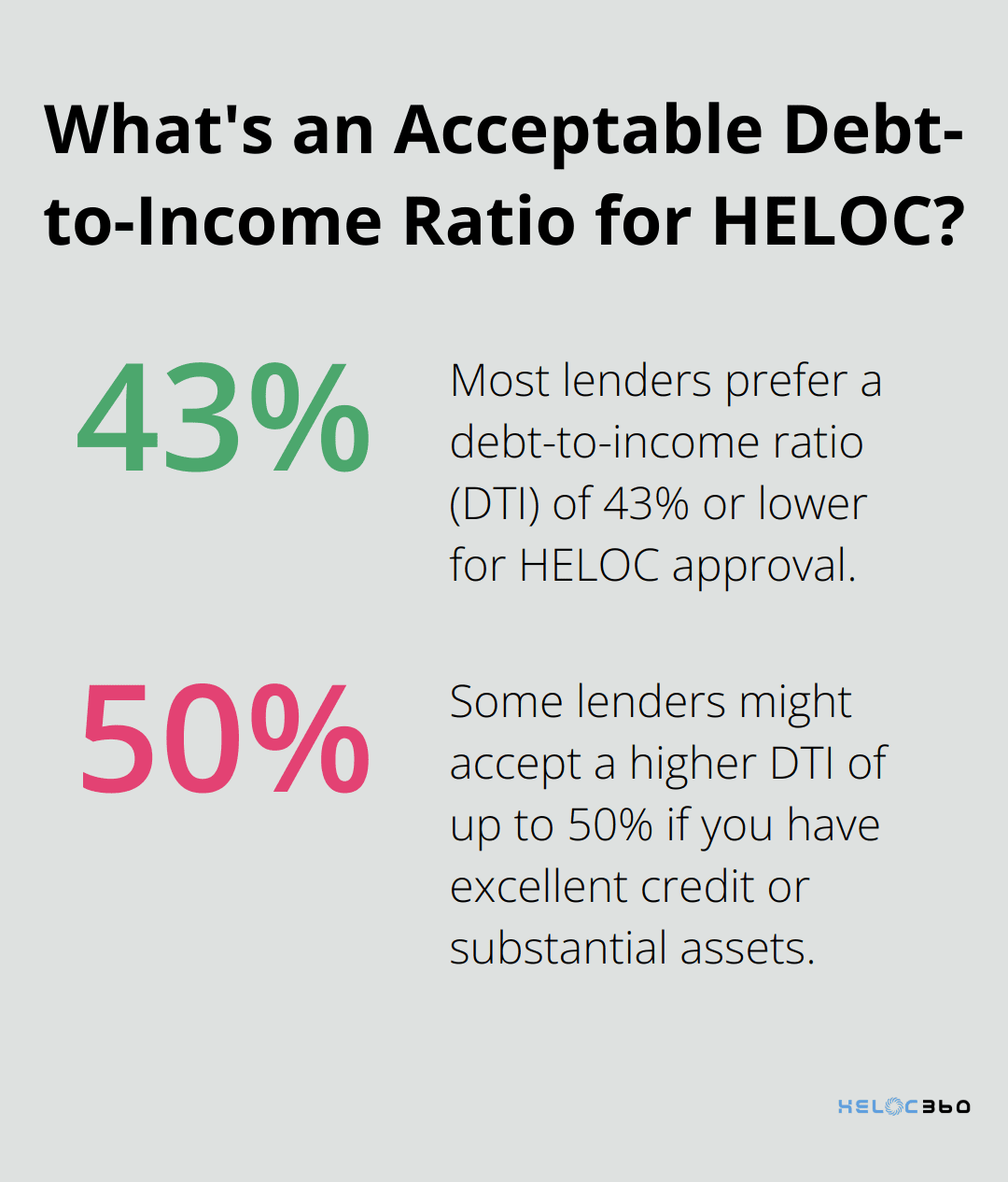

The Ideal DTI: 43% or Lower

Most lenders prefer a DTI of 43% or lower for HELOC approval. This means your total monthly debt payments (including your potential HELOC payment) should not exceed 43% of your gross monthly income. Some lenders might accept a higher DTI (up to 50%) if you have excellent credit or substantial assets.

To calculate your DTI, add all your monthly debt payments and divide by your gross monthly income. For example, if your monthly debts total $2,000 and your gross monthly income is $6,000, your DTI is 33.3% ($2,000 / $6,000 = 0.333).

Income Sources Lenders Consider

Lenders evaluate various income sources when reviewing your HELOC application:

- Salary or wages from employment

- Self-employment income

- Rental income

- Investment income

- Social Security benefits

- Pension or retirement income

- Alimony or child support (if consistent and likely to continue)

Lenders often favor stable, predictable income sources. Self-employed applicants or those with variable income might need to provide additional documentation to prove income stability.

Required Documentation for Income Verification

To verify your income, lenders typically request:

- W-2 forms for the past two years

- Pay stubs for the last 30 days

- Tax returns for the past two years (especially important for self-employed applicants)

- Bank statements for the past 2-3 months

- Investment account statements

- Proof of other income sources (e.g., rental agreements, Social Security award letters)

Self-employed individuals or those with irregular income might need to provide additional documents, such as profit and loss statements or business tax returns.

Gathering these documents in advance can speed up the application process. A complete financial picture demonstrates your preparedness and can positively influence the lender’s decision.

Now that you understand the importance of your debt-to-income ratio and income verification, let’s explore another critical factor in HELOC approval: your home equity and property value.

How Much Equity Do You Need for a HELOC?

Home equity significantly influences your eligibility for a Home Equity Line of Credit (HELOC). Lenders typically require a minimum amount of equity in your home before they consider your application. This chapter explores the specifics of equity requirements, property valuation, and how different property types affect your HELOC approval.

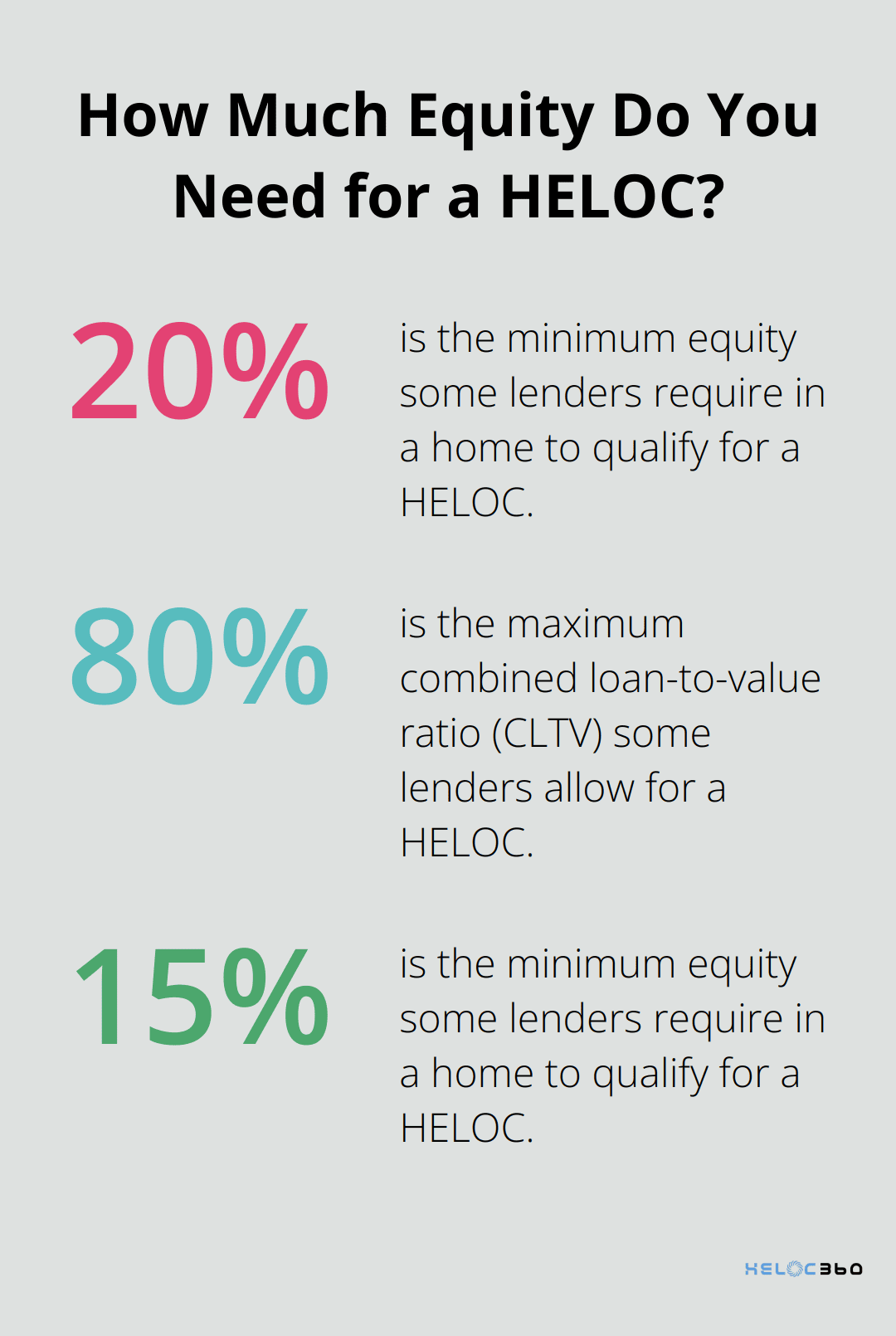

Minimum Equity Requirements

Most lenders require you to have at least 15% to 20% equity in your home to qualify for a HELOC. The combined loan-to-value ratio (CLTV) – which includes your existing mortgage balance and the HELOC amount – should not exceed 80% to 85% of your home’s value.

For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity. This represents about 33% equity, which would likely meet most lenders’ requirements.

However, more equity can improve your chances of approval and potentially secure better terms. Some lenders may offer more favorable rates or higher credit limits to borrowers with 30% or more equity in their homes.

How Lenders Determine Your Home’s Value

Lenders use various methods to assess your home’s value:

- Automated Valuation Model (AVM): This computer-generated estimate uses public records and recent sales data to determine your home’s value. It’s quick and cost-effective but may not be as accurate as other methods.

- Drive-by Appraisal: An appraiser visually inspects the exterior of your home and compares it to similar properties in the area. This method is more accurate than an AVM but less comprehensive than a full appraisal.

- Full Appraisal: This is the most thorough and accurate method. A licensed appraiser inspects both the interior and exterior of your home, considering factors like recent renovations, property condition, and local market trends.

The method chosen often depends on the lender’s policies and the loan amount you’re requesting. For larger HELOC amounts, a full appraisal is more likely to be required.

Impact of Property Type on HELOC Approval

The type of property you own can influence your HELOC approval and terms:

- Primary Residences: These are typically the easiest properties to secure a HELOC for, as lenders consider them lower risk.

- Second Homes: You may still qualify for a HELOC on a second home, but expect stricter requirements. Lenders might require a lower CLTV ratio or charge higher interest rates.

- Investment Properties: HELOCs for investment properties are less common and often come with more stringent requirements. You might need a higher credit score, more equity, or face higher interest rates.

- Condos and Townhouses: These property types may be subject to additional scrutiny. Lenders might review the financial health of the homeowners’ association and occupancy rates of the complex.

- Manufactured Homes: It can be more challenging to get a HELOC on a manufactured home. Some lenders may require the home to be permanently affixed to a foundation and titled as real property.

Understanding these factors can help you better prepare for the HELOC application process. If you’re unsure about your home’s value or equity position, try getting a professional appraisal or consult with a real estate agent before applying (this proactive approach can save you time and potentially improve your chances of approval).

Final Thoughts

Understanding equity line of credit requirements will improve your HELOC approval chances. Try to achieve a credit score of at least 660, maintain a debt-to-income ratio below 43%, and ensure you have 15-20% home equity. Prepare all necessary income documentation and consider a professional appraisal to determine your home’s value accurately.

Different property types have varying requirements, with primary residences typically being the easiest for HELOC approval. Second homes and investment properties often face stricter criteria and potentially higher interest rates. You should prepare accordingly if you own these types of properties.

We at HELOC360 understand that every homeowner’s situation is unique. Our platform simplifies the HELOC process and provides expert guidance. We connect you with lenders that match your specific needs to help you unlock your home equity’s full potential.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.