HELOC utilization is a critical factor in your financial health, affecting everything from your credit score to your borrowing power.

At HELOC360, we’ve seen how proper management of HELOC utilization can make or break a homeowner’s financial strategy.

This post will explore the ins and outs of HELOC utilization, its impact on your credit, and practical strategies to keep it in check.

What Is HELOC Utilization?

Definition and Importance

HELOC utilization refers to the percentage of your available credit line that you’ve used. It’s a key metric that lenders and credit bureaus use to assess your financial health. Understanding and managing this number can significantly impact a homeowner’s financial strategy.

Calculating Your HELOC Utilization

To calculate your HELOC utilization, divide the amount you’ve borrowed by your total credit limit and multiply by 100. For example, if you have a $100,000 HELOC and you’ve used $30,000, your utilization is 30%. This simple calculation provides valuable insights into your borrowing habits and financial position.

The 30% Guideline

Financial experts often recommend keeping your HELOC utilization below 30%. This guideline isn’t arbitrary – it’s based on how credit scoring models view borrowing behavior. Staying under this threshold can help maintain a healthy credit score and demonstrate responsible credit management to lenders.

Reasons to Monitor Your Utilization

Keeping a close eye on your HELOC utilization is important for several reasons:

- Credit Score Impact: Applying for, opening and using a HELOC can help or hurt your credit scores depending on your overall credit profile and how you manage the account.

- Financial Overextension: It’s easy to lose track of how much you’ve borrowed when you have a large credit line available. Regular checks can prevent surprises and help you stay within your budget.

- Smart Financial Decisions: Understanding your utilization can guide wise financial choices. If you’re approaching the 30% mark, it might be time to consider paying down some of your balance or exploring other financing options for upcoming expenses.

Tools for Tracking Utilization

Many financial institutions offer online tools or mobile apps to help you track your HELOC utilization. These tools often provide real-time updates and alerts when you’re nearing certain thresholds. Some even offer personalized advice based on your utilization trends.

As we move forward, let’s explore how HELOC utilization directly impacts your credit scores and what that means for your overall financial health.

How HELOC Utilization Impacts Your Credit Score

The Significance of HELOC Utilization

HELOC applications require a hard credit pull, which temporarily lowers your credit score. Closing a HELOC and carrying a big debt balance can also affect your credit score. Understanding this relationship is essential for maintaining financial health.

The 30% Rule: A Credit Score Guideline

The 30% utilization rule applies to HELOCs as well as credit cards. Maintaining your HELOC utilization below 30% is generally considered optimal for a good credit score. FICO specifically excludes HELOCs when calculating credit utilization ratios.

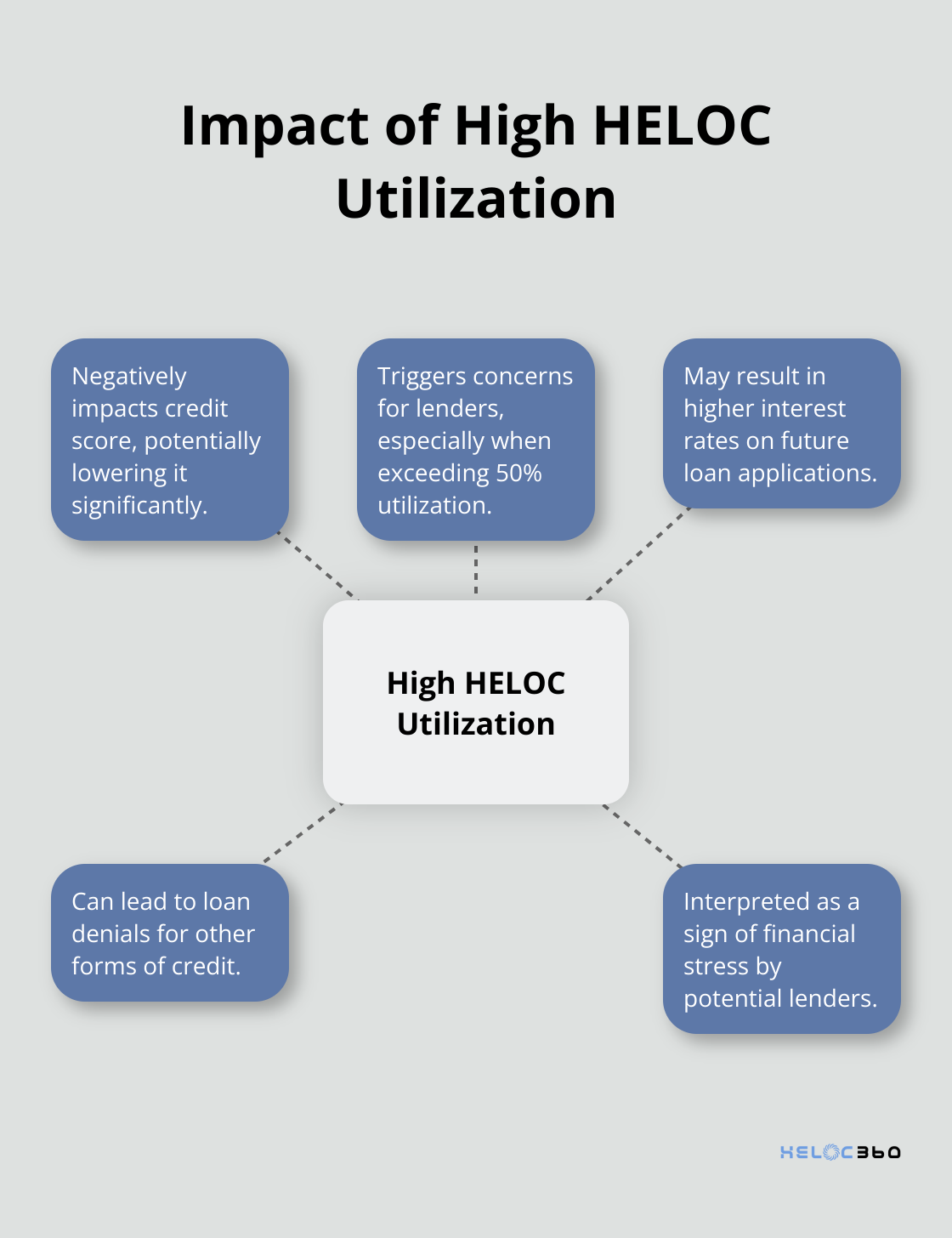

High Utilization: Lender Concerns

When HELOC utilization exceeds 50%, it can trigger concerns for lenders and negatively impact your credit score.

The Ripple Effect on Credit Applications

High HELOC utilization doesn’t just affect your credit score; it can also hinder your ability to secure other forms of credit. Lenders may interpret high utilization as a sign of financial stress, potentially resulting in higher interest rates or loan denials.

Striking a Balance: Smart HELOC Usage

While it’s important to keep utilization low, complete inactivity on your HELOC isn’t necessarily beneficial. Some account activity demonstrates responsible usage. Try to maintain a utilization rate between 10% and 20% to show active management without overextension.

As we move forward, let’s explore practical strategies for managing your HELOC utilization effectively and maintaining a healthy credit profile.

How Can You Manage Your HELOC Utilization?

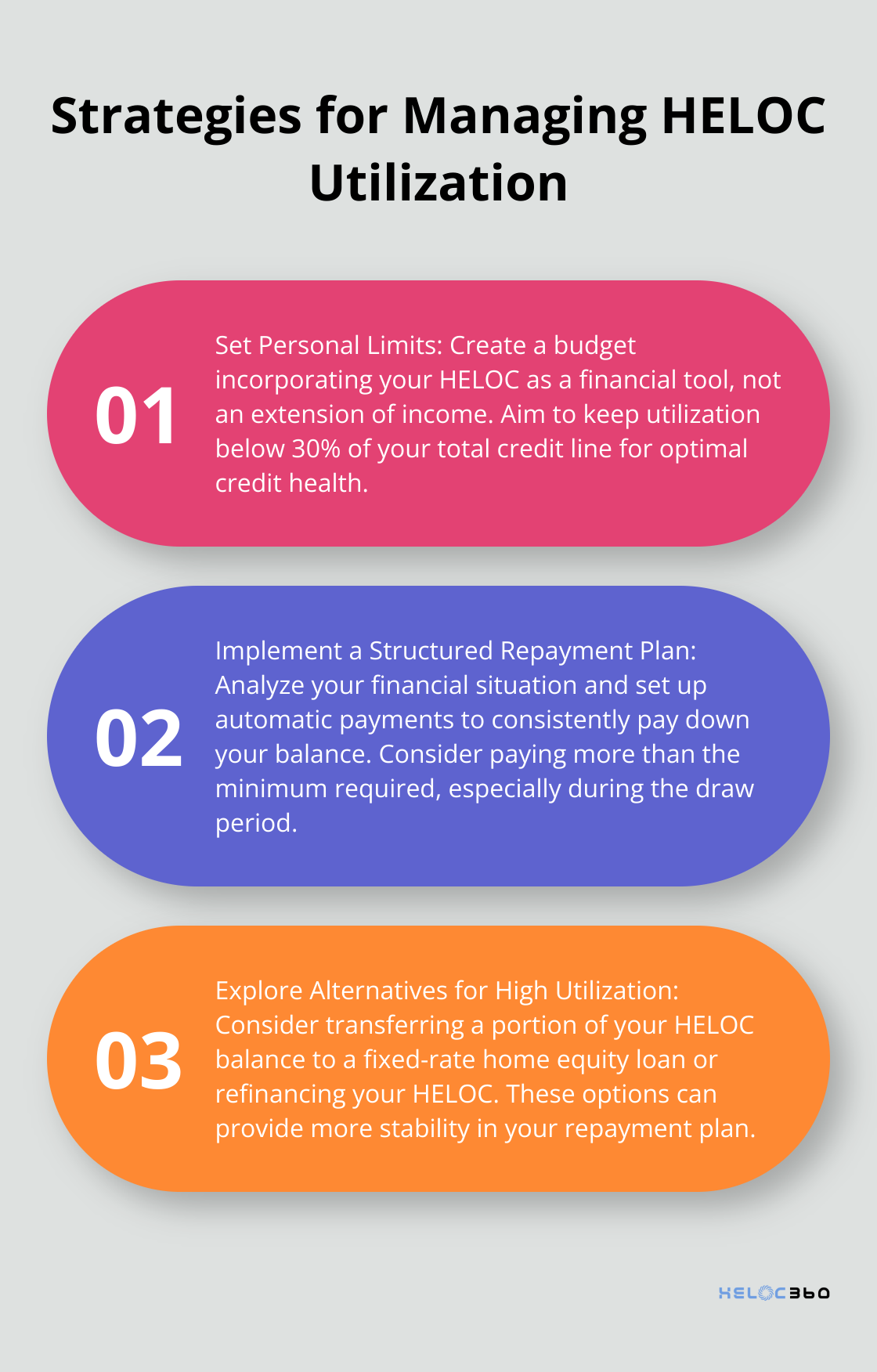

Set Personal Limits

One of the most effective strategies is to set personal limits on your HELOC usage. While your lender may approve you for a certain amount, it doesn’t mean you should use it all. Financial experts often recommend keeping your utilization below 30% of your total credit line.

To make this strategy work, create a budget that incorporates your HELOC as a financial tool, not an extension of your income. Treat it as you would any other credit line, be mindful of your spending and always have a clear purpose for the funds you draw.

Implement a Structured Repayment Plan

Creating and sticking to a repayment plan is vital for managing your HELOC utilization. Start by analyzing your current financial situation and determine how much you can comfortably allocate towards HELOC repayment each month.

Consider setting up automatic payments to ensure you consistently pay down your balance. If possible, pay more than the minimum required, especially during the draw period when you might only need to pay interest. Paying principal as well will reduce your utilization faster and save on interest in the long run.

Explore Alternatives for High Utilization

If you find your HELOC utilization increasing, it’s time to explore alternatives. One option is to transfer a portion of your HELOC balance to a fixed-rate home equity loan. This can provide more predictable payments and potentially lower interest rates (depending on market conditions).

Another strategy is to look into refinancing your HELOC, especially if you’re nearing the end of your draw period. Some lenders offer HELOC refinancing options that can extend your draw period or convert your variable rate to a fixed rate, providing more stability in your repayment plan.

For those with high-interest credit card debt, using a HELOC for debt consolidation can be a smart move, but only if you have a solid plan to avoid accumulating new credit card debt. The Federal Reserve Bank of New York reported that balances on home equity lines of credit (HELOC) rose by $6 billion, marking the twelfth consecutive quarterly increase. There is now $402 billion in outstanding HELOC balances.

Stay Proactive and Informed

The key to successful HELOC management is to stay proactive and informed. Regularly review your utilization, adjust your strategy as needed, and don’t hesitate to seek expert advice. Platforms like HELOC360 can provide valuable insights and connect you with lenders who offer terms that align with your financial goals.

Final Thoughts

HELOC utilization impacts your credit score, borrowing power, and financial stability. You should keep your utilization below 30% to maintain a healthy credit profile and demonstrate responsible borrowing habits to lenders. Responsible HELOC management involves setting personal limits, creating repayment plans, and exploring alternatives when utilization increases too much.

HELOC360 offers valuable support for homeowners who want to optimize their HELOC utilization. This platform provides expert guidance, simplifies the HELOC process, and connects you with suitable lenders. You can make informed decisions about your home equity and use it as a strategic tool for achieving your financial goals.

A HELOC is a powerful financial instrument (when used wisely). You can enhance your financial flexibility, fund important projects, and work towards a more secure financial future with effective HELOC utilization management. Your home’s equity is a valuable asset – use it wisely to build the financial future you envision.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.