At HELOC360, we often get questions about HELOC reporting on credit reports. Many homeowners are curious about how these flexible lines of credit impact their credit scores.

Understanding how HELOCs appear on your credit report is crucial for managing your financial health. In this post, we’ll explore the ins and outs of HELOC reporting and its effects on your credit profile.

What Exactly Is a HELOC on Your Credit Report?

The Basics of HELOC Reporting

A Home Equity Line of Credit (HELOC) appears on your credit report as a revolving account, similar to credit cards. However, HELOCs differ because they’re secured by your home’s equity. Your credit report will display your HELOC with specific details such as the credit limit, current balance, and payment history.

HELOCs vs. Traditional Loans

HELOCs offer a flexible borrowing structure, unlike installment loans (e.g., mortgages or personal loans). During the draw period (typically 10 years), you can borrow funds as needed up to your credit limit. Your credit report reflects this flexibility by showing the total credit line and the amount you’ve used, rather than a fixed loan amount.

Impact on Credit Mix

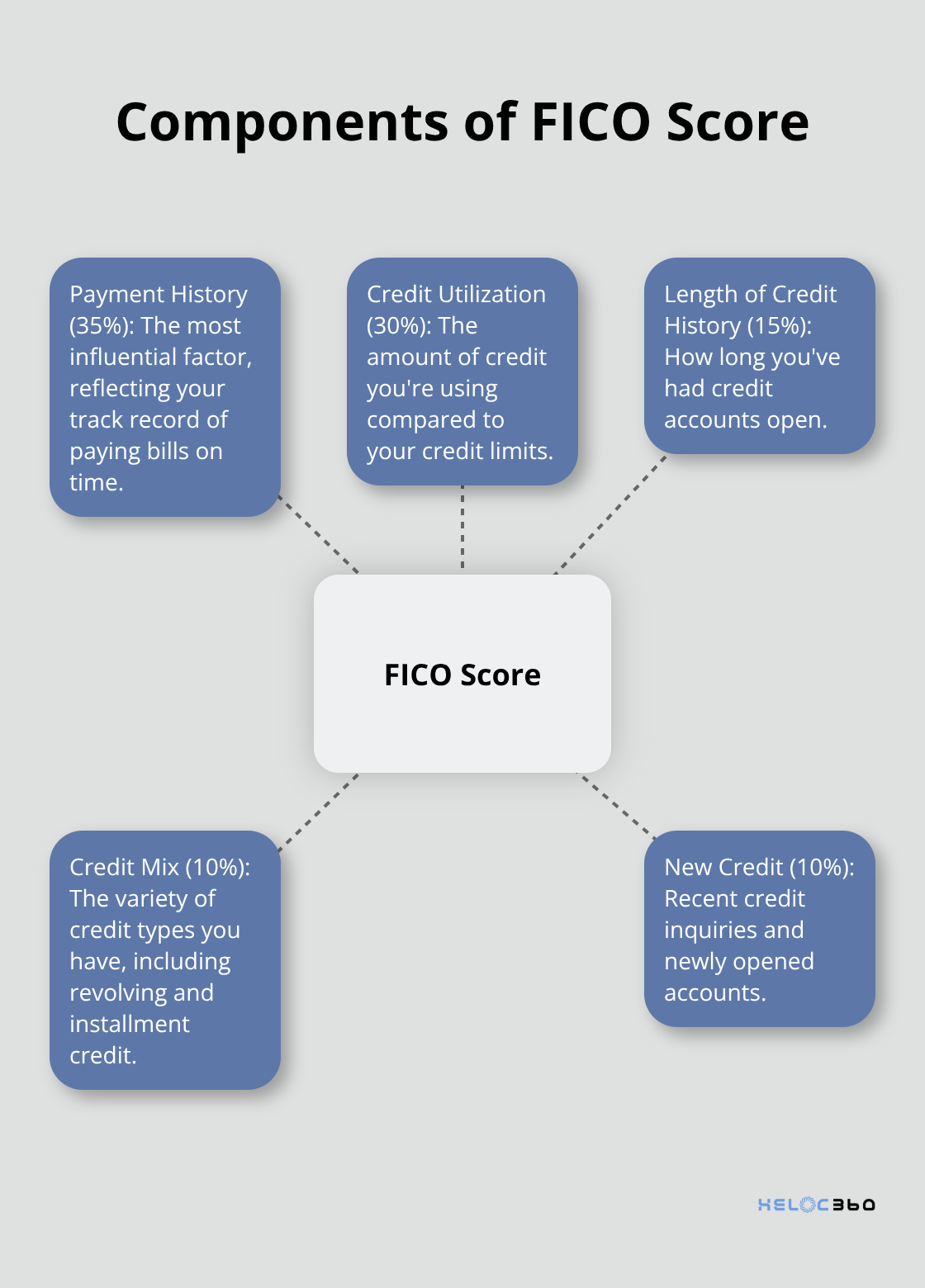

Credit bureaus value a diverse mix of credit types. A HELOC on your report can potentially improve your credit mix, which accounts for 10% of your FICO score. This demonstrates to lenders your ability to manage different types of credit responsibly.

Reporting Frequency and Updates

Lenders usually report HELOC activity to credit bureaus monthly. This regular reporting means your HELOC usage and payment behavior consistently influence your credit score. Timely payments and wise balance management are key to benefiting from this frequent reporting.

Credit Utilization Considerations

FICO Scores are designed to exclude HELOCs from credit utilization calculations. However, other scoring models might consider them, so it’s wise to keep your HELOC balance in check. Experian data shows that the average HELOC credit limit was $121,613 in 2024, providing borrowers with substantial borrowing power.

Understanding how your HELOC appears on your credit report empowers you to use it strategically. This knowledge can help you enhance your credit profile while accessing the funds you need for your financial goals. As we move forward, let’s explore how HELOCs can impact your credit scores in more detail.

How Does a HELOC Affect Your Credit Score?

Credit Utilization and HELOCs

Credit utilization plays a significant role in your credit score, typically accounting for about 30% of your FICO score. HELOCs, however, receive different treatment compared to other revolving credit accounts. FICO scores exclude HELOCs from credit utilization calculations, which can benefit borrowers. This exclusion allows you to use your HELOC without directly impacting this aspect of your credit score.

It’s important to note that some other credit scoring models might include HELOC balances in utilization ratios. While FICO remains the most widely used model, it’s prudent to maintain a low HELOC balance as a precautionary measure.

Payment History: A Potential Credit Score Booster

Your payment history constitutes about 35% of your FICO score, making it the most influential factor. Each timely HELOC payment can positively impact your credit score. A recent Federal Reserve study revealed that mortgage and HELOC transition rates edged up slightly.

The opposite also holds true. A single late payment can significantly decrease your score. The Consumer Financial Protection Bureau reports that a 30-day late payment can lower a good credit score by 80 points or more.

The Impact of Credit Inquiries

When you apply for a HELOC, lenders perform a hard inquiry on your credit report. This inquiry typically lowers your score by about 5-10 points. Don’t let this deter you if a HELOC aligns with your financial goals. The impact usually lasts for a short period, and your score can recover within a few months if you manage your credit responsibly.

Pro tip: Conduct your HELOC shopping within a 14-day window. Credit scoring models often treat multiple inquiries within this timeframe as a single inquiry (minimizing the impact on your score).

Long-Term Effects on Credit Mix

HELOCs can contribute positively to your credit mix, which accounts for about 10% of your FICO score. Lenders view a diverse credit portfolio favorably, as it demonstrates your ability to manage various types of credit. Adding a HELOC to your credit mix (alongside credit cards, personal loans, or mortgages) can potentially enhance your overall creditworthiness.

Strategies for HELOC Management

To maximize the positive impact of your HELOC on your credit score, consider these strategies:

- Make timely payments: Set up automatic payments to ensure you never miss a due date.

- Keep balances low: Try to maintain a low balance-to-credit-limit ratio, even though FICO doesn’t include HELOCs in utilization calculations.

- Use your HELOC strategically: Leverage it for value-adding investments or debt consolidation rather than unnecessary expenses.

Understanding these nuances empowers you to use HELOCs as effective financial tools while maintaining a robust credit profile. In the next section, we’ll explore advanced techniques for optimizing your HELOC usage to enhance your overall financial health.

How to Maximize Your HELOC’s Credit Benefits

Use Your HELOC for Debt Consolidation

A well-managed HELOC can significantly boost your financial health. One of the most effective ways to use your HELOC is for debt consolidation. Pay off high-interest credit card balances with your lower-interest HELOC to potentially improve your credit utilization ratio. This strategy can lead to a quick boost in your credit score. Experian reports that reducing credit card balances is one of the fastest ways to see an improvement in your credit score.

However, you must avoid the temptation of running up new balances on the paid-off credit cards. Discipline is key here – use your HELOC as a tool for financial improvement, not as an excuse for additional spending.

Create a Strategic Payment Plan

Applying for, opening and using a HELOC can help or hurt your credit scores depending on your overall credit profile and how you manage the account. To stay on the safe side, try to keep your HELOC balance below 30% of your credit limit. This approach helps maintain a healthy credit profile across various scoring models.

Set up automatic payments to ensure you never miss a due date. Late payments reported to credit bureaus will cause your credit score to drop and will stay on your credit report for seven years from the date you missed the payment.

Keep Tabs on Your Credit Report

Regular checks of your credit report are essential when you have a HELOC. Look for any errors in reporting, especially regarding your credit limit and payment history. The Federal Trade Commission reports that one in five consumers has an error on at least one of their credit reports.

If you spot any inaccuracies, dispute them promptly with the credit bureaus. Quick action can prevent potential negative impacts on your credit score.

Leverage Your HELOC for Credit Mix Improvement

HELOCs can contribute positively to your credit mix, depending on your overall credit profile and how you manage the account. Lenders view a diverse credit portfolio favorably, as it demonstrates your ability to manage various types of credit. Add a HELOC to your credit mix (alongside credit cards, personal loans, or mortgages) to potentially enhance your overall creditworthiness.

Implement Smart HELOC Usage Strategies

To maximize the positive impact of your HELOC on your credit score, consider these strategies:

- Make timely payments: Set up automatic payments to ensure you never miss a due date.

- Keep balances low: Maintain a low balance-to-credit-limit ratio.

- Use your HELOC strategically: Leverage it for value-adding investments or debt consolidation rather than unnecessary expenses.

Final Thoughts

HELOCs significantly impact credit reports and overall financial health. HELOC reporting on credit reports offers unique opportunities and potential pitfalls for homeowners. HELOCs appear as revolving credit lines on reports, secured by home equity, with FICO scores typically excluding them from credit utilization calculations.

Strategic HELOC use for debt consolidation or value-adding investments can improve financial standing. Homeowners should approach HELOC usage with a clear plan and discipline. Regular credit report monitoring is essential to maintain an accurate credit profile and prevent negative impacts on credit scores.

We at HELOC360 simplify the HELOC process and provide expert guidance. Our platform connects homeowners with lenders that match their unique needs (based on the information provided). Understanding HELOC reporting and managing these accounts responsibly can unlock new financial opportunities for a stronger future.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.