Want to improve your HELOC approval odds? You’re in the right place.

At HELOC360, we’ve seen countless applications and know what lenders look for. This post will show you quick, effective ways to boost your chances of getting approved for a Home Equity Line of Credit.

From credit score improvements to home value increases, we’ll cover actionable steps you can take right away.

How to Boost Your Credit Score Fast

Your credit score plays a pivotal role in HELOC approval. Here’s how you can give your score a quick boost:

Spot and Fix Credit Report Errors

Start by obtaining your free credit reports from AnnualCreditReport.com. Scrutinize them for any mistakes such as incorrect balances or unrecognized accounts. The Federal Trade Commission reports that one in five consumers has an error on their credit report. If you discover any discrepancies, file a dispute immediately with the credit bureaus. This action can lead to a rapid increase in your score.

Slash Your Credit Card Balances

Your credit utilization ratio (the amount of credit you’re using compared to your limits) significantly impacts your score. Credit utilization is calculated by dividing the balance by credit limit for each card and for all cards together. Try to use less than 30% of your available credit. Quick payment of your balances might result in a score jump within a month.

Piggyback on Good Credit

Consider becoming an authorized user on a credit card owned by someone with excellent credit (if they’re willing). Being added as an authorized user can allow you to benefit from their payment history and available credit. Opt for a long-standing account with a high limit and low balance for maximum benefit.

Preserve Old Accounts

The length of your credit history matters. Older accounts can bolster your score, even if they’re inactive. They increase your average account age and total available credit. Credit Karma found that people with excellent credit scores (800+) have an average account age of 11 years or more.

Leverage Rapid Rescoring

Some lenders offer rapid rescoring services. A rapid rescore aims to accelerate the updating process, usually in the hopes that some newly considered information will increase your credit scores. While it may come with a fee, the potential boost to your approval chances could make it worthwhile.

Your credit score is just one piece of the HELOC approval puzzle. Let’s move on to explore how you can quickly enhance your home’s value to further strengthen your application.

Boost Your Home’s Value Fast

Focus on High-Impact Improvements

Start with quick fixes that pack a punch. A fresh coat of paint can work wonders. A Zillow survey from 2021 discovered that certain front door colors can affect the likelihood of a potential offer as well as the price of a home. Neutral tones like light gray or beige are safe bets. Don’t forget the exterior – a well-maintained facade can increase your home’s value by up to 5%.

Update your kitchen and bathrooms next. These rooms often yield the highest return on investment. Replace old faucets, update cabinet hardware, or install new light fixtures. These small changes can make a big impression without breaking the bank.

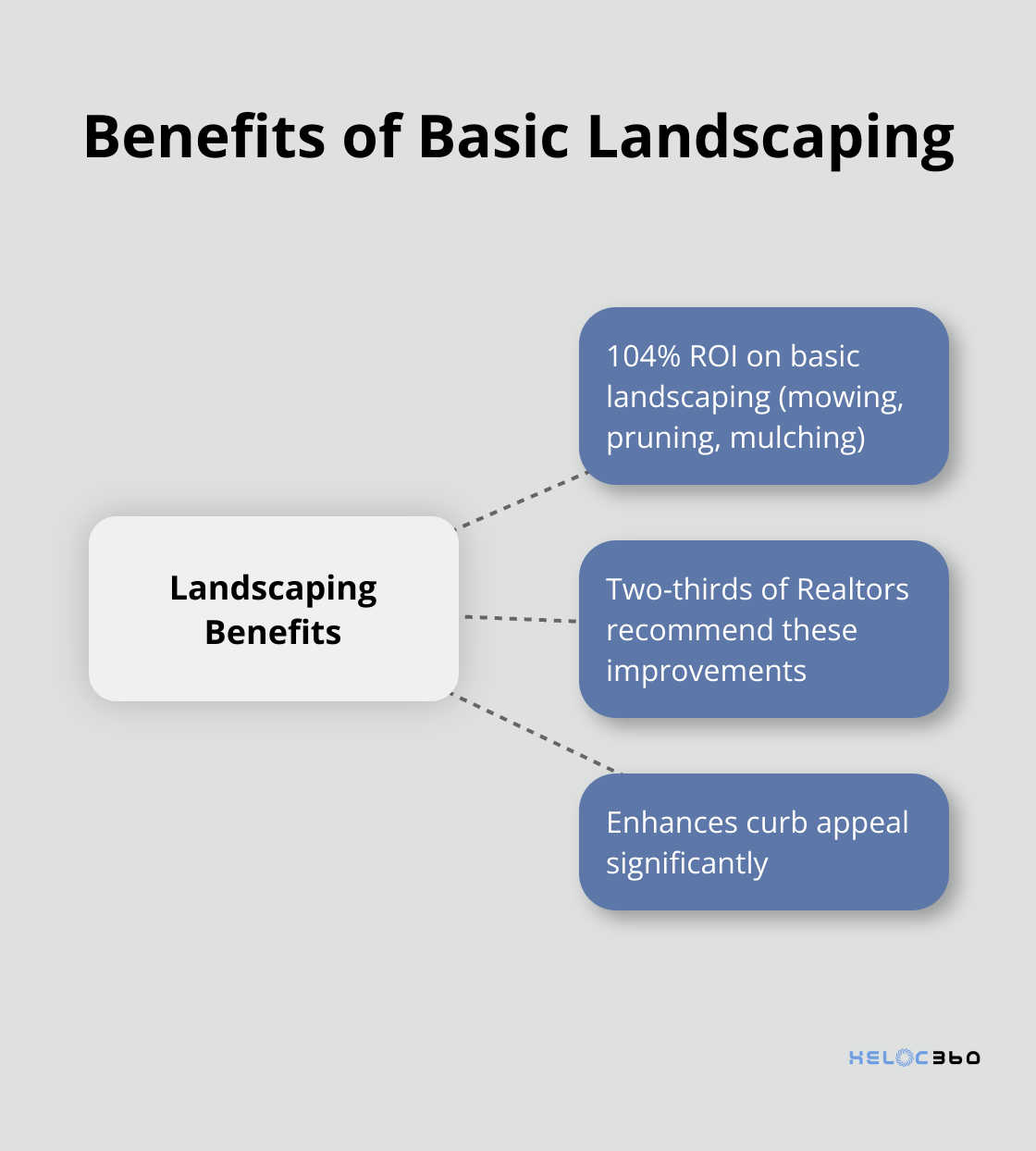

Landscaping is another area where a little effort goes a long way. A well-manicured lawn and some strategic planting can boost curb appeal significantly. According to NAR, mowing, pruning and an annual mulch application offers a whopping 104 percent ROI, and almost two-thirds of Realtors recommend these improvements.

Get a Professional Appraisal

A professional appraisal might seem like an unnecessary expense before applying for a HELOC, but it can be a smart move. HELOC appraisals are typically much less expensive and involved than a traditional, full appraisal used when purchasing a home.

If your appraisal comes in higher than expected, you can use this information to negotiate better terms with lenders. Some lenders might even accept a recent appraisal (saving you money in the long run).

Know Your Local Market

Understanding recent sales in your area can give you an advantage when applying for a HELOC. Use online real estate platforms to research comparable homes that have sold recently. Pay attention to features that seem to command higher prices.

This knowledge allows you to highlight your home’s best features when applying for a HELOC. It also helps you identify areas where your home might fall short, guiding your improvement efforts.

Lenders want to see that your property is a good investment. Showing you understand your local market demonstrates that you’re a savvy homeowner – a quality that can work in your favor during the approval process.

Document All Upgrades

Keep detailed records of all improvements you make to your home. This includes receipts, before-and-after photos, and any professional assessments. These documents provide concrete evidence of your home’s increased value, which can strengthen your HELOC application.

Now that you’ve boosted your home’s value, it’s time to tackle another critical factor in HELOC approval: your debt-to-income ratio. Let’s explore how you can improve this important financial metric quickly.

How to Slash Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio plays a key role in HELOC application evaluations. This percentage represents how much of your monthly income goes towards debt payments. A lower DTI ratio indicates to lenders that you’re a less risky borrower, potentially increasing your HELOC approval chances. Lenders typically prefer a debt-to-income (DTI) ratio below 43%.

Pay Off Small Debts First

Start with the elimination of smaller debts. This approach, often called the debt snowball method, can quickly reduce your number of monthly payments. Research shows that consumers will get out of debt quicker by paying down accounts one at a time starting with the smallest.

For instance, if you have a $500 credit card balance with a $50 minimum payment, paying off this debt could immediately lower your DTI ratio. As a bonus, you’ll have one less monthly payment to manage.

Increase Your Income

Raising your income effectively lowers your DTI ratio. Consider working overtime or starting a side job. The gig economy has seen significant growth, with the Pew Research Center reporting that 16% of Americans have earned money through online gig platforms.

Even a modest income boost can make a substantial difference. An extra $500 per month could lower your DTI ratio by several percentage points (depending on your current income and debt levels).

Refinance High-Interest Debts

Refinancing high-interest debt can lower your monthly payments and improve your DTI ratio. As of January 3, 2025, refinancing your HELOC can make your monthly payments more affordable, either by reducing your interest rate or the payment size (or possibly both).

Avoid New Credit Applications

In the weeks before your HELOC application, don’t take on any new debt. Each new credit application can result in a hard inquiry on your credit report, potentially lowering your credit score. Moreover, new debt increases your DTI ratio, making you appear riskier to lenders.

Lenders will scrutinize your recent credit activity. A sudden debt increase right before applying for a HELOC could raise red flags and potentially harm your approval chances. A lower DTI ratio can lead to better terms on future loans and increased financial flexibility.

Final Thoughts

Your HELOC approval odds depend on several key factors. You can improve your credit score quickly by addressing report errors, paying down balances, and maintaining older accounts. Enhancing your home’s value through strategic improvements and understanding your local market will strengthen your application. Lowering your debt-to-income ratio by paying off small debts and increasing income can present a stronger financial profile to lenders.

HELOC360 understands the complexities of the HELOC application process. Our platform streamlines your HELOC journey, providing expert guidance and connecting you with suitable lenders. We help you unlock the full potential of your home equity and achieve your financial goals.

Take action today to position yourself for success in your HELOC application. You could soon access the funds you need for your next big project or financial milestone. HELOC360 stands ready to assist you every step of the way.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.