- ***PAID ADVERTISEMENT**

- ACHIEVE LOANS – HOME EQUITY EXPERTISE

- FLEXIBLE FINANCING SOLUTIONS

- PERSONALIZED SUPPORT

- RECOMMENDED FICO SCORE: 640+

- COMPETITIVE RATES STREAMLINED APPLICATION PROCESS

Refinancing your home equity line of credit can be a smart financial move. It’s a way to potentially lower your interest rate, change your payment terms, or access more equity in your home.

At HELOC360, we’ve seen many homeowners benefit from this strategy. This guide will walk you through the process of refinancing your HELOC, helping you make an informed decision about whether it’s the right choice for you.

- Approval in 5 minutes. Funding in as few as 5 days

- Borrow $20K-$400K

- Consolidate debt or finance home projects

- Fastest way to turn home equity into cash

- 100% online application

Why Refinance Your HELOC?

Understanding HELOC Refinancing

HELOC refinancing is a financial strategy that can significantly impact your home equity borrowing. It involves the replacement of your existing HELOC with a new one, often with different terms or a new lender. This process can transform the way homeowners optimize their borrowing strategy.

Adapting to a Changing Financial Landscape

The primary driver for HELOC refinancing is often a shift in the financial landscape. Interest rates fluctuate over time, and if rates have dropped since you opened your original HELOC, refinancing could lead to substantial savings. For example, if your current HELOC has a higher interest rate and you can refinance to a lower rate, you could save thousands of dollars over the life of the loan.

Modifying Your Borrowing Terms

Another compelling reason to refinance your HELOC is to adjust your borrowing terms. You might approach the end of your draw period and want to extend it to maintain access to funds. Or perhaps you prefer to switch from a variable rate to a fixed rate for more predictable payments. These adjustments can provide greater financial flexibility and peace of mind.

Accessing Additional Equity

If your home’s value has increased since you opened your original HELOC, refinancing can allow you to access this additional equity. This extra borrowing power can prove invaluable for funding major expenses like home renovations, education costs, or debt consolidation. According to CoreLogic, as of the third quarter of 2024, average equity gains were $5,700 between Q3 2023 and Q3 2024, highlighting the potential for increased borrowing capacity.

Aligning with Financial Goals

Refinancing your HELOC isn’t just about securing a better rate; it’s about aligning your borrowing strategy with your current financial goals and market conditions. You can make a decision that enhances your financial well-being for years to come by carefully considering your options and working with experienced professionals.

Now that you understand the reasons for refinancing your HELOC, let’s explore the steps you need to take to make it happen.

How to Refinance Your HELOC

Evaluate Your Current HELOC

Start with a thorough examination of your existing HELOC. Take note of the current interest rate, remaining balance, and the end date of your draw period. As of February 7, 2024, the average HELOC interest rate was 9.12%. If your rate exceeds this significantly, refinancing could result in substantial savings.

Next, conduct an assessment of your financial situation. Has your credit score improved since you initially obtained your HELOC? A higher score might qualify you for better rates.

Research New HELOC Options

It’s time to explore the market. Don’t limit yourself to your current lender – shop around. A study by Freddie Mac revealed that borrowers could save an average of $1,500 over the life of the loan by obtaining one additional rate quote, and $3,000 or more by comparing five quotes.

Search for lenders who offer competitive rates, flexible terms, and low fees. Pay close attention to the length of the draw period and repayment terms. Some lenders provide draw periods as long as 15 years, which could offer more financial flexibility.

Prepare Your Documentation

Lenders will need to verify your financial information. Typically, you’ll need to provide:

- Proof of income (W-2 forms, tax returns, pay stubs)

- Bank statements

- Proof of homeowners insurance

- Recent mortgage statements

Having these documents ready can accelerate the application process. The Mortgage Bankers Association reported that the average time to close a refinance was 48 days in 2024. Being prepared can help you beat this average.

Submit Your Application

After you’ve chosen a lender, it’s time to apply. Many lenders now offer online applications, making the process more convenient. Be prepared for a hard credit check (which can temporarily lower your credit score by a few points).

After you submit your application, the lender will order an appraisal of your home. Fourteen percent of the 226 tracked metro areas posted double-digit price gains in Q4 2024. If your home’s value has increased since you got your original HELOC, you might be able to access more equity.

As you move forward with your HELOC refinancing journey, it’s important to consider several key factors that can significantly impact your decision and the overall outcome. Let’s explore these crucial elements in the next section.

What Factors Matter Most When Refinancing?

Interest Rates and Payment Terms

Interest rates significantly impact HELOC refinancing. As of February 2025, current $50k HELOC rates are as low as 6.63%. If your current rate exceeds this, refinancing could lead to substantial savings. For example, on a $100,000 HELOC balance, a 1% rate reduction could save you $1,000 annually in interest payments.

Payment terms also deserve attention. Some lenders offer interest-only payments during the draw period, which can lower your monthly obligations. However, this approach may result in higher payments during the repayment period. Consider your long-term financial goals when you evaluate payment options.

The True Cost of Refinancing

Closing costs and fees can significantly affect the overall value of refinancing. These expenses typically range from 2% to 5% of the loan amount, but some lenders may reduce or waive them altogether. On a $200,000 HELOC, you might face $4,000 to $10,000 in closing costs. Calculate your break-even point – the time it takes for your interest savings to outweigh these upfront costs.

Some lenders offer no-closing-cost HELOCs, but these often come with higher interest rates. Always read the fine print and consider the long-term implications of such offers.

Your Financial Health and Home Value

Your credit score and available home equity are critical factors in HELOC refinancing. Most lenders require a minimum credit score of 620, but scores above 740 can secure the best rates. According to Experian, the average FICO score in the U.S. reached 716 in 2024, suggesting many homeowners are well-positioned for favorable refinancing terms.

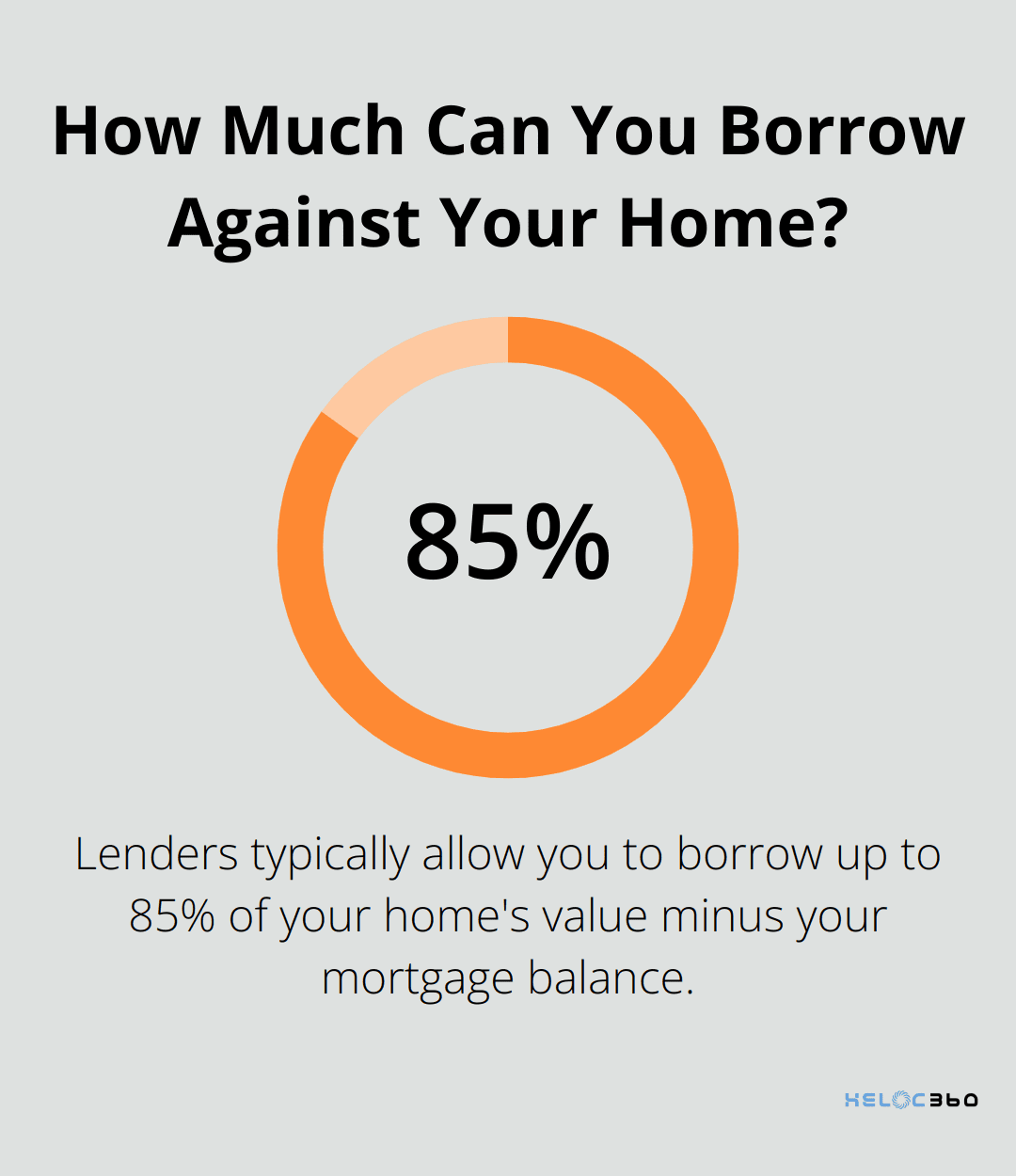

Home equity is equally important. Lenders typically allow you to borrow up to 85% of your home’s value (minus your mortgage balance). If your home’s value has increased since your original HELOC, you might qualify for a larger line of credit. Existing-home sales rose to a seasonally adjusted rate of 4.15 million in December 2024, the strongest pace since February, potentially boosting your available equity.

Tax Implications of HELOC Refinancing

The tax implications of HELOC refinancing can be complex. As of 2025, HELOC interest is only tax-deductible if you use the funds for home improvements. This rule applies to both new and refinanced HELOCs. If you refinance to consolidate debt or fund other expenses, you’ll lose this tax benefit.

Additionally, if you increase your HELOC amount through refinancing, be aware that interest on amounts over $750,000 (when combined with your mortgage) is not tax-deductible. Always consult with a tax professional to understand how refinancing will impact your specific tax situation.

Final Thoughts

Refinancing your home equity line of credit can lead to significant savings and increased financial flexibility. You must weigh factors such as interest rates, payment terms, closing costs, and your financial health when you consider this option. Your credit score and available home equity will play pivotal roles in securing favorable terms for your refinanced HELOC.

Tax implications should not be overlooked when you refinance your home equity line. HELOC interest is only tax-deductible if used for home improvements, and there are limits on the deductible amount. You should consult with a tax professional to understand how refinancing will impact your specific situation.

HELOC360 specializes in helping homeowners navigate the complex process of refinancing a home equity line. Our platform simplifies your refinancing journey, providing you with the knowledge and connections you need to make informed decisions. You can leverage your home’s value effectively, turning it into a gateway for new financial opportunities.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.