Are you looking to optimize your HELOC? A HELOC recast might be the solution you’re seeking.

At HELOC360, we’ve seen how this financial strategy can transform homeowners’ financial situations. This blog post will guide you through the ins and outs of HELOC recasting, helping you make an informed decision about whether it’s right for you.

What Is HELOC Recasting?

Definition and Core Concept

HELOC recasting adjusts the terms of your HELOC without the need for a new loan. This process typically allows you to extend your repayment period or adjust your interest rate, which can lead to lower monthly payments.

Recasting vs. Refinancing

It’s essential to distinguish recasting from refinancing. Refinancing replaces your existing HELOC with a new loan, while recasting modifies your current HELOC terms. This difference matters because recasting often involves fewer fees and less paperwork than refinancing. The main advantage recasting has over refinancing is ease. To “recast” your loan, you don’t need to qualify in the same way you would for a new loan.

Ideal Scenarios for HELOC Recasting

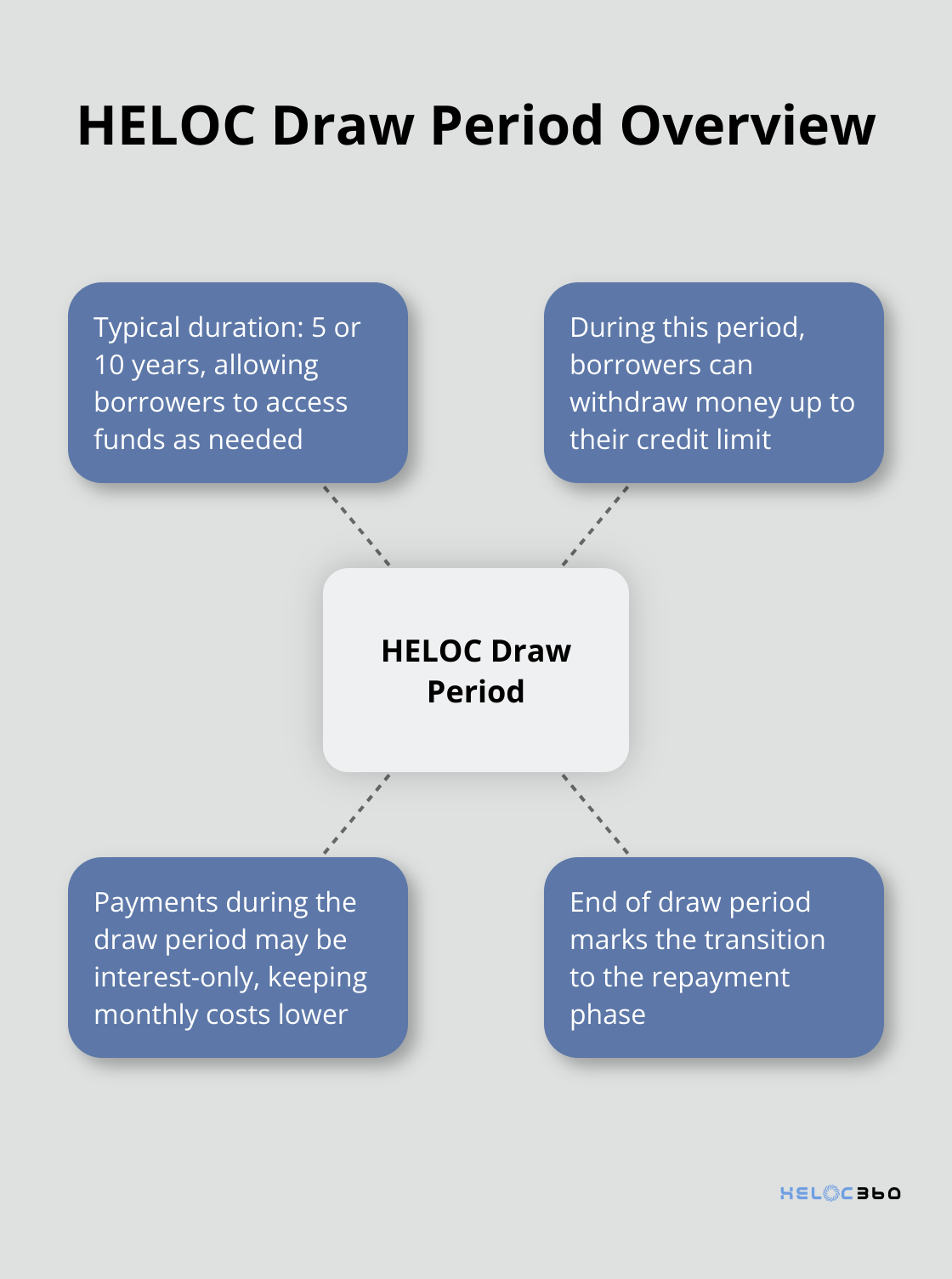

Recasting proves particularly beneficial in certain situations. For instance, if you approach the end of your HELOC’s draw period and want to extend it, recasting might offer the solution. The HELOC typically has a draw period of five or 10 years.

Another scenario where recasting excels is when interest rates have dropped since you opened your HELOC. Recasting allows you to secure a lower rate without the hassle of refinancing.

Financial Impact of Recasting

Recasting can have a substantial impact on your monthly budget. Consider this example: if you have a $100,000 HELOC balance with 10 years left on your repayment term, extending it to 20 years through recasting could potentially cut your monthly payments in half. However, it’s important to note that while this lowers your monthly payments, it may increase the total interest paid over the life of the loan.

Tools for Informed Decision-Making

Various online platforms provide tools to calculate the long-term impact of recasting on your specific financial situation. These tools can help you analyze your recasting options and potentially save on your monthly HELOC payments.

While recasting can offer financial benefits, it’s not the right choice for everyone. Your individual financial goals, current interest rates, and the terms of your existing HELOC all play a role in determining whether recasting is the best move for you. As we move forward, let’s explore the specific steps involved in the HELOC recasting process.

How to Recast Your HELOC

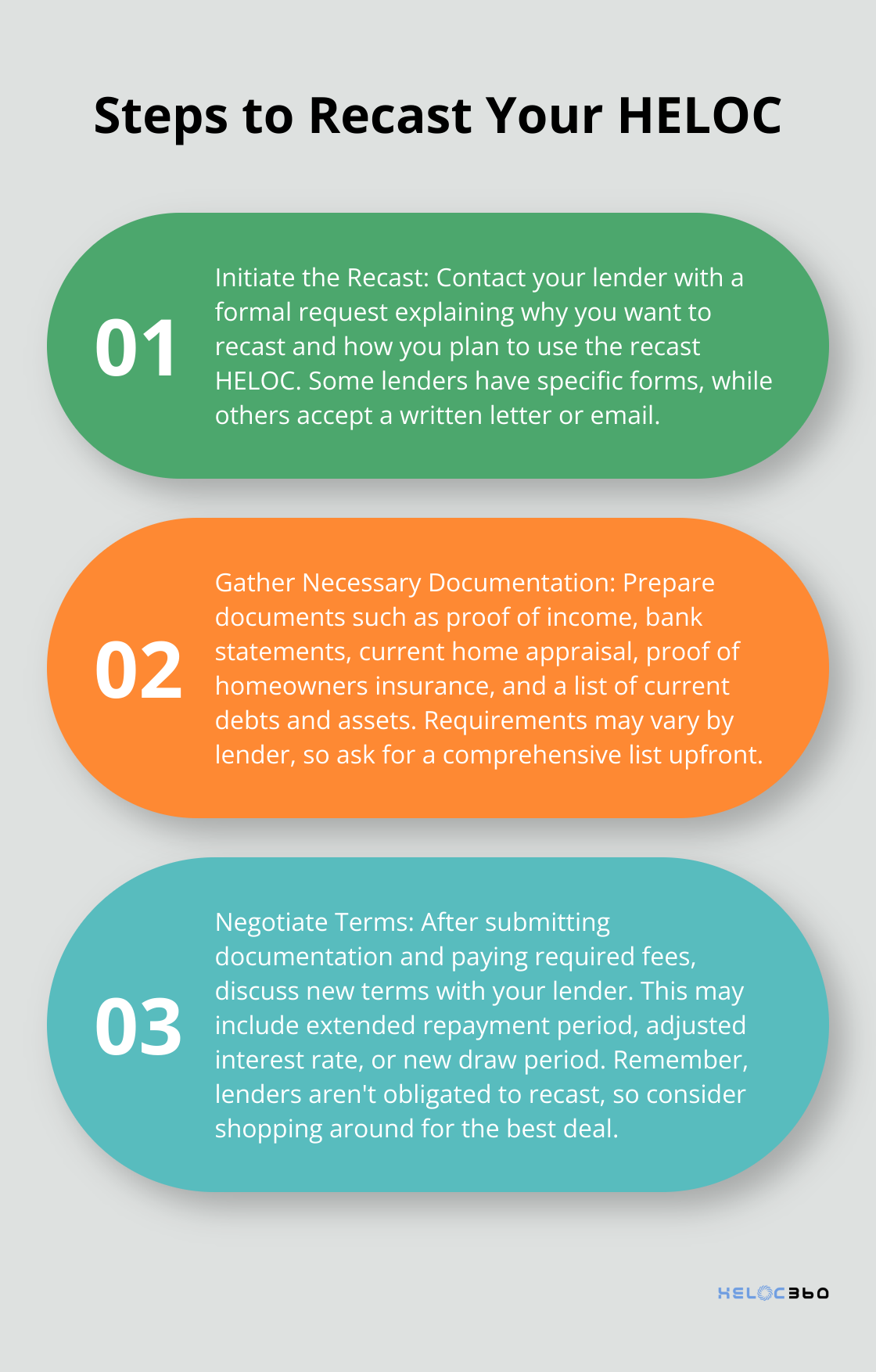

Initiate the Recast

The first step to recast your HELOC is to contact your lender. Most lenders require a formal request to start the process. This request typically includes an explanation of why you want to recast and how you plan to use the recast HELOC. Some lenders have specific forms for this purpose, while others accept a written letter or email.

Gather Necessary Documentation

After you initiate the recast request, your lender will ask for various documents. These often include:

- Proof of income (recent pay stubs, tax returns)

- Bank statements

- A current home appraisal

- Proof of homeowners insurance

- A list of your current debts and assets

The exact requirements vary by lender, so ask for a comprehensive list upfront. Having these documents ready can speed up the process significantly.

Understand the Costs

Recasting isn’t free, but it’s generally less expensive than refinancing. It’s important to note that HELOC recasting has specific requirements. For example, you can’t have a government-backed loan, you must meet minimum principal reduction standards, and you must satisfy equity requirements.

Negotiate Terms

After you submit your documentation and pay any required fees, you’ll enter the negotiation phase. This is where you discuss new terms with your lender, such as:

- Extended repayment period

- Adjusted interest rate

- New draw period (if applicable)

Lenders aren’t obligated to recast your HELOC. If your current lender doesn’t offer favorable terms, don’t hesitate to shop around. Multiple lender options increase your chances of finding the best deal.

Monitor the Process

The entire recasting process typically takes 45 to 60 days to complete, though this can vary depending on your lender and the complexity of your situation. Stay proactive during this time, and respond promptly to any requests for additional information or clarification.

Now that you understand the steps involved in recasting your HELOC, let’s explore the potential benefits and drawbacks of this financial strategy.

Is HELOC Recasting Right for You?

Financial Flexibility: The Primary Advantage

HELOC recasting can transform many homeowners’ financial situations. The most significant benefit is the potential for lower monthly payments. When you extend your repayment period, you spread your balance over a longer term, which reduces your monthly obligation. This can provide relief if you face temporary financial constraints or want to allocate cash to other investments.

Consider this scenario: A $100,000 HELOC balance with 5 years left on the term, when recast to a 15-year term, could potentially reduce your monthly payments by two-thirds. Such a dramatic reduction can create much-needed space in your budget.

Interest Savings: A Careful Consideration

Lower monthly payments are attractive, but you must consider the long-term impact on interest. In some instances, recasting leads to interest savings, especially if you secure a lower rate. However, an extended repayment term often results in more interest paid over the loan’s life.

Let’s examine some numbers. If you recast a $100,000 HELOC from a 5-year term at 6% to a 15-year term at 5%, you’ll save on monthly payments. However, you’ll end up paying about $30,000 more in total interest. This trade-off requires careful evaluation of your long-term financial goals.

Credit Score Impact

HELOC recasting typically has a neutral to positive effect on your credit score. Unlike refinancing (which involves opening a new credit line), recasting modifies your existing account. You avoid the temporary dip in your credit score that often accompanies new credit inquiries.

Furthermore, if recasting helps you manage your payments more effectively, it can improve your payment history – the most significant factor in your credit score calculation. Payment history makes up 35% of your score and is a major factor in its calculation.

Limitations and Restrictions to Consider

Before you decide to recast, you must understand the potential limitations. Not all lenders offer recasting options, and those that do often have specific requirements. These may include:

- Minimum equity thresholds (typically 20-25% of your home’s value)

- Restrictions on the number of times you can recast

- Fees for recasting (usually lower than refinancing costs, but still a consideration)

Some lenders may require a lump sum payment towards your principal before they agree to recast. This requirement can present a significant hurdle if you’re recasting to improve cash flow.

Final Thoughts

HELOC recasting provides homeowners with a powerful tool for financial flexibility. This strategy allows you to adjust your existing HELOC terms, potentially lowering monthly payments or securing a more favorable interest rate. It proves particularly valuable when you approach the end of your draw period or when market conditions have shifted since opening your HELOC.

The decision to recast a HELOC isn’t universal. You must weigh short-term benefits against long-term implications, considering your financial goals, current interest rates, and existing HELOC terms. Different lenders offer varying recast options and terms, so it’s wise to explore multiple options.

At HELOC360, we simplify the process and provide expert guidance through our comprehensive HELOC solutions. Our platform connects you with lenders that fit your unique needs, empowering you to leverage your home’s value effectively. We aim to help you make informed decisions about your home equity, including whether a HELOC recast aligns with your financial aspirations.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.