HELOC suspensions can throw a wrench in your financial plans. These unexpected freezes on your home equity line of credit can leave you scrambling for alternatives.

At HELOC360, we understand the stress and uncertainty that come with such situations. This guide will help you navigate HELOC suspensions, understand their impact, and learn strategies to prevent them.

What Is a HELOC Suspension?

Definition and Impact

A HELOC suspension occurs when a lender temporarily freezes access to a home equity line of credit. This action prevents homeowners from drawing funds from their HELOC, even if they haven’t reached their credit limit. Such suspensions can disrupt financial plans, especially for those who rely on their HELOC for ongoing expenses or emergency funds.

Reasons for HELOC Suspensions

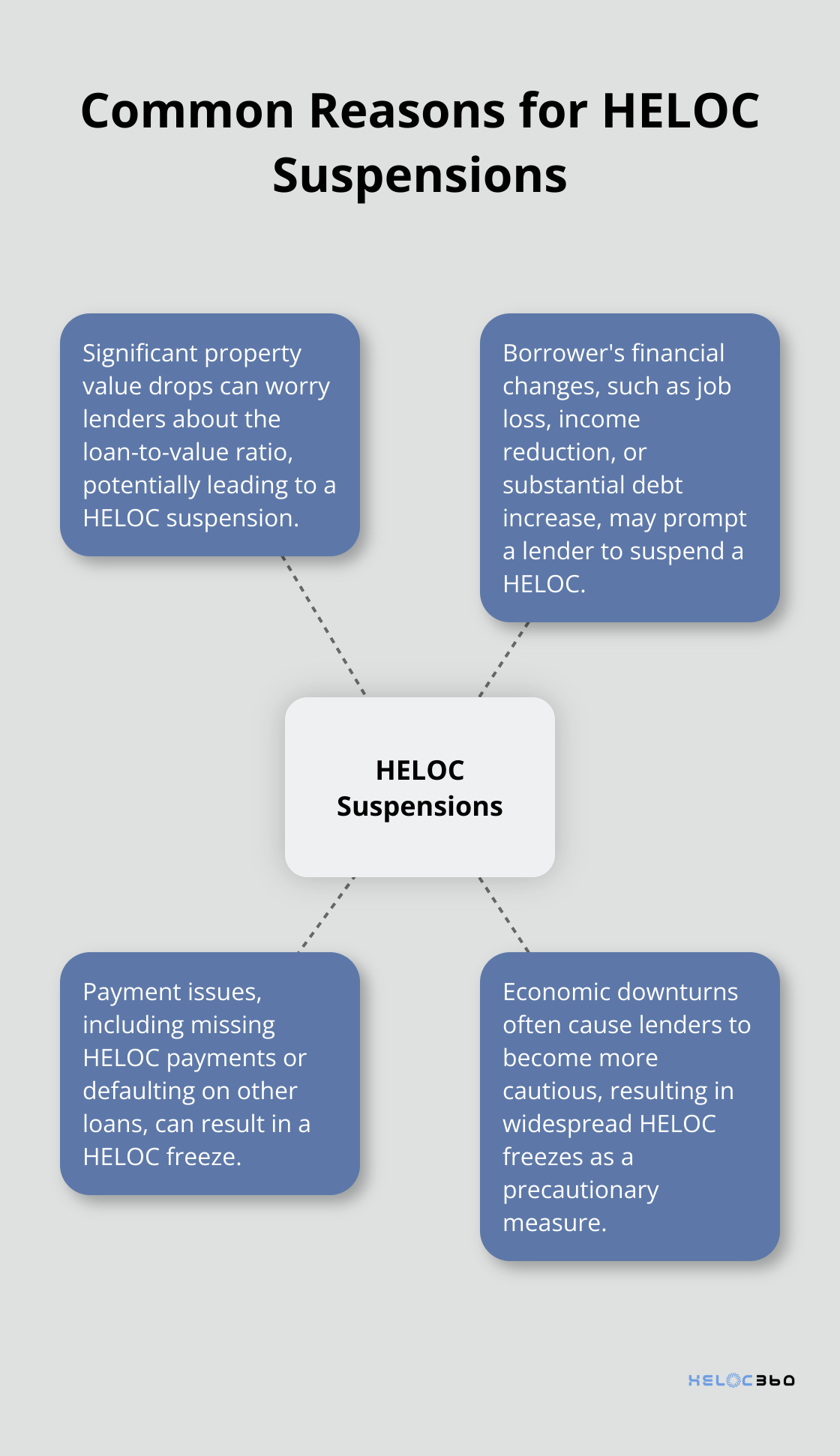

Lenders don’t suspend HELOCs arbitrarily. They typically take this action when they perceive increased risk. Common triggers include:

- Significant property value drops: A plummet in your home’s value might worry lenders about the loan-to-value ratio.

- Borrower’s financial changes: Job loss, income reduction, or substantial debt increase can prompt a suspension.

- Payment issues: Missing HELOC payments or defaulting on other loans can lead to a freeze.

- Economic downturns: Recessions often cause lenders to become more cautious, resulting in widespread HELOC freezes.

Legal Rights of Lenders

Lenders possess broad legal rights to suspend HELOCs. The Truth in Lending Act allows lenders to reduce or suspend a HELOC if:

- The property value declines significantly below the appraised value.

- They reasonably believe the borrower can’t fulfill repayment terms due to a material change in financial circumstances.

- The borrower defaults on a material obligation under the agreement.

- Government action prevents the lender from imposing the agreed-upon annual percentage rate.

Mitigating Suspension Risks

While you can’t completely prevent a HELOC suspension, you can reduce the risk:

- Maintain a low loan-to-value ratio: Try to keep your combined mortgage and HELOC balance below 80% of your home’s value. Some conventional loans typically require an LTV of 80% or less to avoid private mortgage insurance.

- Boost your credit score: A strong credit score (above 740) makes you a lower-risk borrower.

- Use your HELOC wisely: Avoid maxing out your credit line or using it for non-essential purchases.

- Monitor your property value: Regular appraisals can help you anticipate potential issues.

Understanding HELOC suspensions empowers homeowners to make informed decisions. However, knowing the impact of these suspensions on your financial situation is equally important. Let’s explore this in the next section.

What Happens When Your HELOC Is Suspended?

Immediate Financial Impact

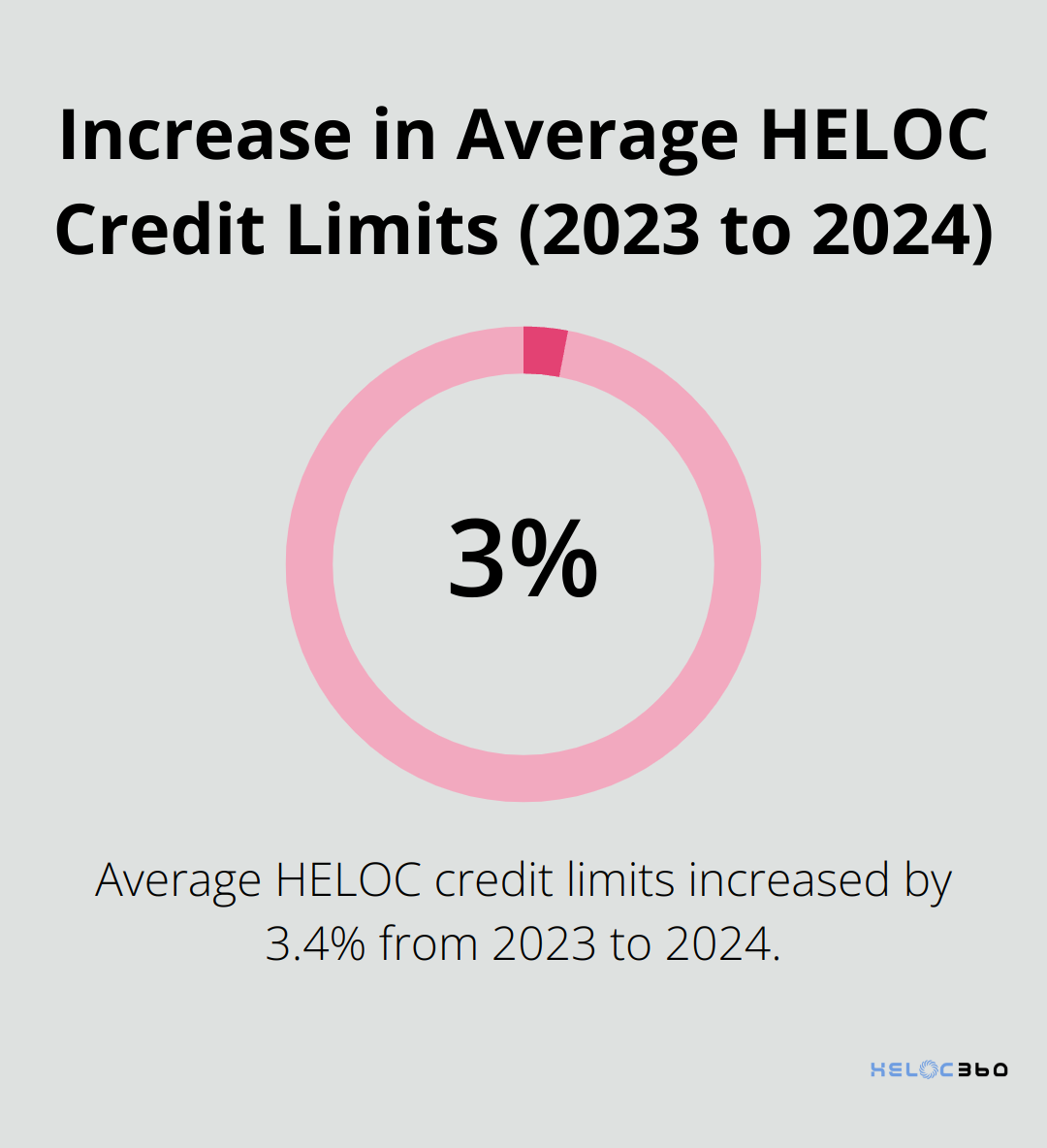

A HELOC freeze or reduction can disrupt your financial plans significantly. When a lender curbs a borrower’s ability to tap into their line of credit, it can leave you searching for alternatives. The loss of access to funds you may have counted on creates immediate challenges, especially if you planned to use your HELOC for home improvements, debt consolidation, or as an emergency fund. The average credit limit for HELOCs in 2024 was $121,613, which is 3.4% more than 2023’s average of $117,598.

Credit Score Implications

While a HELOC suspension doesn’t directly impact your credit score, it can lead to indirect effects. If you’re forced to rely more heavily on credit cards due to the suspension, your credit utilization may increase. The Consumer Financial Protection Bureau states that credit utilization accounts for about 30% of your FICO score, so this shift can noticeably affect your creditworthiness.

Alternative Funding Sources

When your HELOC is suspended, you need to explore other options:

- Personal loans: These can be a viable alternative, although they typically come with higher interest rates.

- Cash-out refinance: This option allows you to tap into your home equity by refinancing your mortgage for more than you owe and taking the difference in cash. It’s a one-time disbursement that replaces your existing mortgage with a new, larger mortgage.

- 0% APR credit cards: For smaller amounts, these cards can provide temporary relief. They typically offer 12-18 months of interest-free borrowing, but be cautious of high rates once the promotional period ends.

Steps to Take After a Suspension

If your lender suspends your HELOC, don’t panic. Take these steps:

- Contact your lender: Understand the reason for the suspension. Sometimes, it may be due to an error or misunderstanding that can be quickly resolved.

- Review your financial situation: If the suspension results from a change in your circumstances, address those issues. This might involve improving your credit score, reducing your debt-to-income ratio, or increasing your income.

- Request a reinstatement: The Federal Trade Commission requires lenders to reinstate your credit privileges when the conditions that led to the suspension no longer exist. Prepare documentation proving that your financial situation has improved or that your home’s value has increased.

- Build an emergency fund: Financial advisors often recommend saving 3-6 months of living expenses. This can provide a buffer against future financial shocks and reduce your reliance on credit lines like HELOCs.

HELOC suspensions can present significant challenges, but understanding your options and taking proactive steps can help you navigate this financial hurdle. In the next section, we’ll explore strategies to prevent HELOC suspensions and maintain financial stability.

How to Safeguard Your HELOC

Boost Your Credit Score

Your credit score plays a vital role in keeping your HELOC active. Applying for, opening and using a HELOC can help or hurt your credit scores depending on your overall credit profile and how you manage the account. Set up automatic payments for all your debts to avoid missed due dates. Keep your credit utilization below 30% across all accounts to positively impact your score.

Check your credit report regularly. Dispute any inaccuracies quickly to maintain a healthy score.

Communicate with Your Lender

Open communication with your lender is essential. Don’t wait for them to reach out. Contact them proactively, especially if you anticipate financial difficulties. Many lenders appreciate honesty and may be more willing to work with you if you clearly explain your situation.

Schedule quarterly check-ins with your lender to discuss your HELOC status. This regular contact allows you to address potential issues before they escalate and shows your commitment to responsible borrowing.

Diversify Your Financial Resources

Don’t rely solely on your HELOC for financial flexibility. Build a robust emergency fund that covers 3-6 months of expenses. This buffer can prevent you from overusing your HELOC and risking suspension.

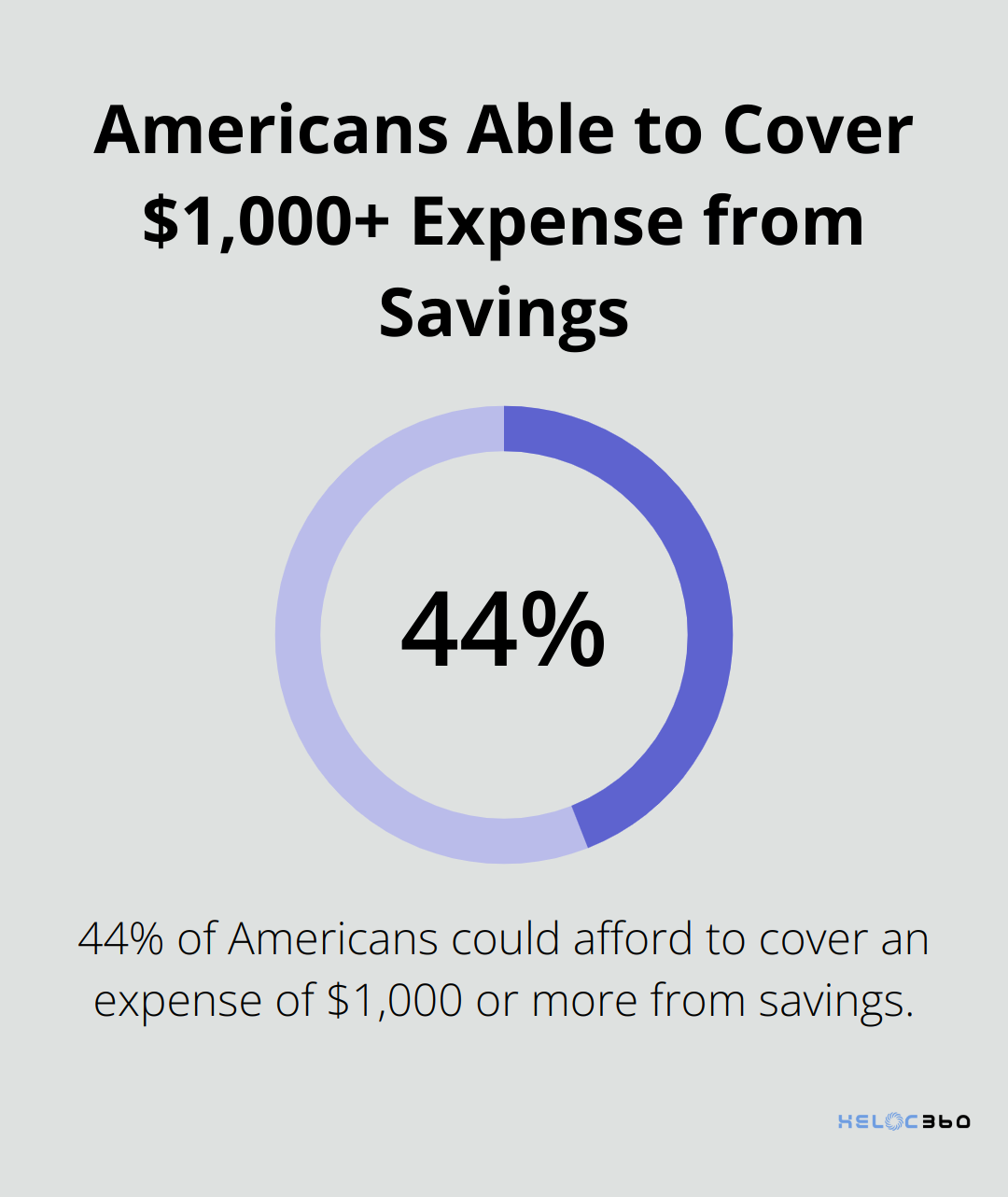

Explore other credit options as backups. According to Bankrate’s 2024 Annual Emergency Savings Report, only 44 percent of Americans could afford to cover an expense of $1,000 or more from savings.

Consider alternatives like a low-interest credit card or a personal line of credit for additional security.

Look into investment diversification too. A mix of stocks, bonds, and other assets can provide liquidity without tapping into your home equity.

Monitor Your Property Value

Keep track of your home’s value. Significant drops can trigger HELOC suspensions. Try to maintain a low loan-to-value ratio (keep your combined mortgage and HELOC balance below 80% of your home’s value). Regular appraisals can help you anticipate potential issues and protect your HELOC from depreciation.

Use Your HELOC Wisely

Avoid maxing out your credit line or using it for non-essential purchases. Responsible use demonstrates to lenders that you’re a low-risk borrower. This approach can help prevent acceleration and maintain your financial flexibility.

Final Thoughts

HELOC suspensions require a proactive approach and solid understanding of the financial landscape. Homeowners must stay informed about suspension reasons, potential impacts, and prevention strategies to protect their financial interests. Regular lender communication, a strong credit profile, and diverse financial resources help safeguard your HELOC.

Financial planning plays a vital role in navigating home equity borrowing complexities. You should understand lender rights, suspension implications on credit scores, and steps to take if your HELOC is suspended. This knowledge empowers you to make informed decisions about your financial future.

HELOC360 offers comprehensive solutions tailored to individual needs for those seeking guidance in managing their home equity. Our platform simplifies the process of understanding and utilizing HELOCs (connecting homeowners with expert advice and lender options that align with their financial goals). We provide the tools and knowledge to help you make the most of your home’s value.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.