Are you considering HELOC investing? Home Equity Lines of Credit (HELOCs) can be powerful tools for funding investment opportunities.

At HELOC360, we’ve seen many homeowners use their home equity to potentially grow their wealth. However, it’s crucial to understand both the benefits and risks involved.

This post will explore whether using a HELOC for investments is the right move for you.

What Is a HELOC and How Can It Fund Investments?

Understanding HELOCs

A Home Equity Line of Credit (HELOC) is a line of credit secured by your home that gives you a revolving credit line to use for large expenses. At its core, a HELOC functions like a credit card, providing a revolving line of credit that you can draw from as needed.

HELOCs as Investment Vehicles

When you use a HELOC for investments, you leverage your home’s value to fund potential growth opportunities. The process typically involves:

- Applying for a HELOC based on your home’s current value and your outstanding mortgage balance.

- Drawing funds up to your credit limit once approved.

- Using these funds to make investments of your choice.

- Repaying the borrowed amount (often with interest-only payments during the draw period).

It’s worth noting that HELOC rates are now at just 8.03% on average, according to Bankrate. This rate is generally lower than many other forms of credit, which makes HELOCs an attractive option for funding investments.

Popular Investment Opportunities with HELOC Funds

HELOC funds can fuel various investment strategies. Here are some popular options:

- Real Estate Investments: Many investors use HELOCs to purchase rental properties. The 1% rule suggests buying properties that can generate monthly rents equal to 1% of the purchase price for profitability.

- Stock Market Investments: Some homeowners use HELOC funds to invest in stocks or mutual funds. However, this strategy carries significant risk due to market volatility.

- Business Ventures: Entrepreneurs often tap into home equity to fund startups or expand existing businesses.

- Home Improvements: While not a traditional investment, strategic home upgrades can increase your property’s value. A recent report looks at the reasons for remodeling and the increased happiness found in the home once a project is completed.

Key Considerations Before Investing with a HELOC

Before you use a HELOC for investments, it’s important to:

- Evaluate your risk tolerance: You put your home on the line with this strategy.

- Analyze potential returns: Try to ensure the expected returns outweigh the HELOC’s interest costs.

- Have a solid repayment plan: A Fidelity Investments report emphasizes the importance of a clear strategy for repaying the borrowed funds.

While HELOCs can be powerful investment tools, they come with significant risks. It’s advisable to consult with financial professionals and thoroughly research your investment options before you proceed.

As we move forward, let’s explore the pros of using a HELOC for investment, including the potential benefits and opportunities that this financial strategy can offer.

Why HELOCs Can Be Smart Investment Tools

Lower Interest Rates

HELOCs offer a competitive edge with their attractive interest rates. As of June 25, 2025, the national average HELOC interest rate is 8.27% according to Bankrate’s latest survey of the nation’s largest home equity lenders. This rate undercuts most credit cards and personal loans, making HELOCs a cost-effective choice for investment funding.

Borrowing and Repayment Flexibility

HELOCs stand out for their adaptable nature. You only pay interest on the amount you borrow, not the entire credit line. This feature benefits real estate investors who need periodic access to funds for property purchases or renovations.

Many HELOCs allow interest-only payments during the draw period. This structure can free up cash flow for other investments or expenses. However, a solid repayment plan is essential for when the repayment period begins.

Potential Tax Benefits

While tax laws can change, as of 2025, interest paid on HELOCs used for home improvements may qualify for tax deductions. This potential benefit could lower your effective borrowing cost, enhancing the appeal of HELOC investments. (Always consult a tax professional for advice on your specific situation.)

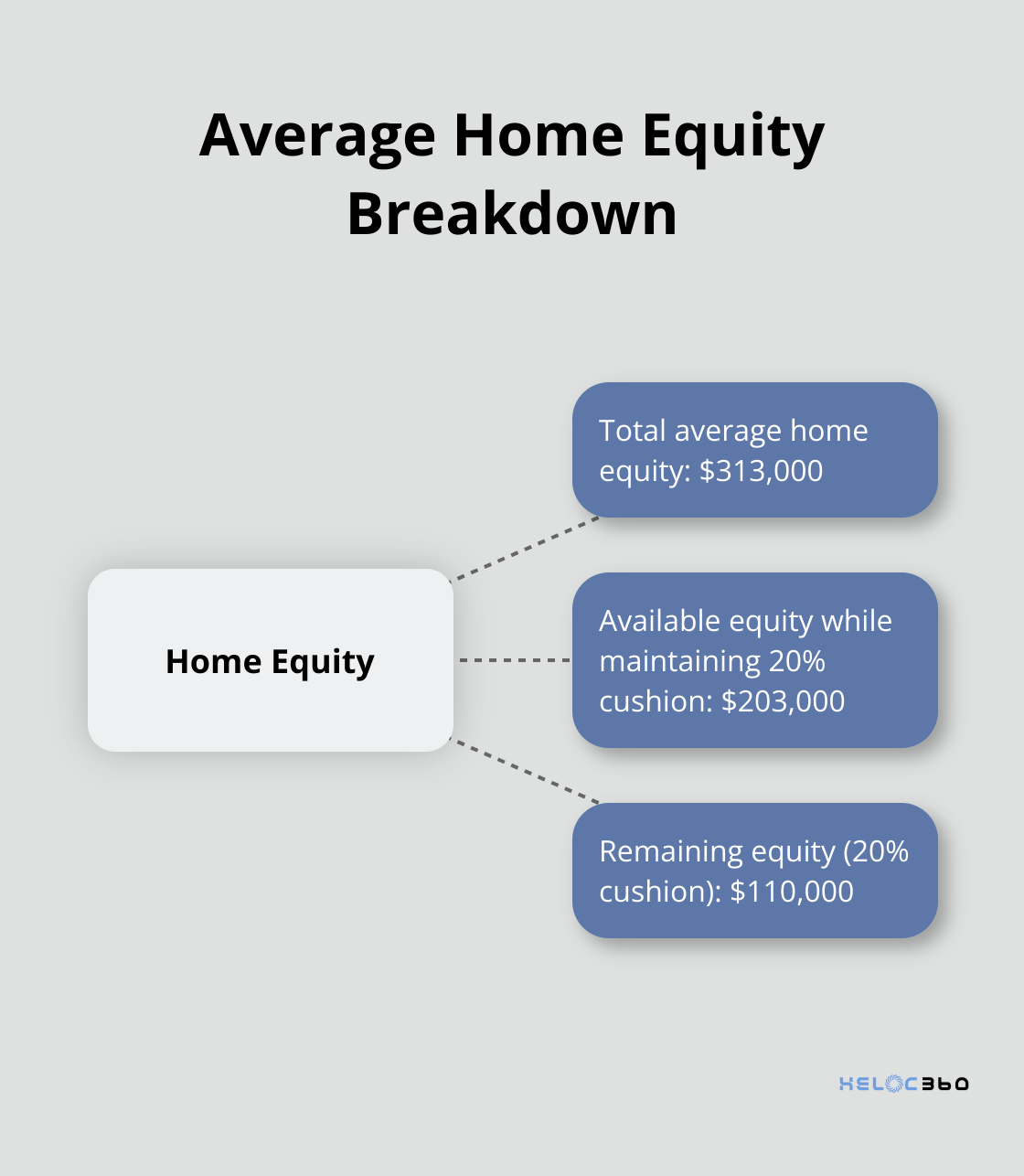

Leverage Your Home Equity

The power of HELOCs lies in their ability to tap into your existing home equity. The ICE March 2025 Mortgage Monitor Report reveals that the average mortgage-holder has about $313,000 in equity, with $203,000 available while maintaining a 20% equity cushion.

This accessibility to capital doesn’t require selling your home or taking on high-interest debt. For example, you could use your HELOC to invest in rental properties, potentially generating passive income that exceeds your HELOC payments (creating a positive cash flow scenario).

Investment Opportunities

HELOCs open doors to various investment strategies:

- Real Estate: Purchase rental properties or fund fix-and-flip projects.

- Stock Market: Invest in stocks or mutual funds (though this carries market volatility risks).

- Business Ventures: Fund startups or expand existing businesses.

- Home Improvements: Strategic upgrades can increase your property’s value.

While HELOCs offer compelling advantages for investments, they also come with risks. The next section will explore the potential drawbacks and challenges of using HELOCs for investment purposes, helping you make an informed decision about this financial strategy.

The Hidden Dangers of HELOC Investments

Your Home Is at Risk

The most severe risk of using a HELOC for investments is the potential loss of your home. With home equity “investment” contracts (HEIs), homeowners get cash up front in exchange for a repayment later. But HEIs can be risky, potentially leading to foreclosure if you can’t repay the HELOC.

Interest Rate Volatility

HELOCs typically come with variable interest rates. As of April 14, 2025, average HELOC rates increased slightly to 8.0%. This uncertainty complicates long-term cost predictions and could erode your investment returns.

Credit Score Implications

Opening a HELOC can initially lower your credit score. More importantly, if you max out your HELOC for investments, it could significantly increase your credit utilization ratio, potentially causing further damage to your score. A lower credit score can impact your ability to secure future loans or credit cards (and may even affect your insurance rates).

Market Unpredictability

Investments, especially in the stock market or real estate, can be volatile. The S&P 500 gained 23% in 2024, but historical data shows that such gains aren’t guaranteed. Market downturns can occur swiftly and severely. Stock market crashes have posed a threat to both U.S. financial markets and citizens throughout history.

The Debt Spiral

Using a HELOC for investments can lead to a dangerous cycle of debt. If your investments don’t perform as expected, you might borrow more to cover your losses or make payments. This can quickly escalate into a situation where you’re constantly borrowing to stay afloat.

Final Thoughts

HELOC investing offers a unique opportunity to leverage your home’s equity for potential financial growth. However, this decision requires careful consideration due to significant risks, including the possibility of losing your home and exposure to market volatility. A thorough assessment of your financial situation, risk tolerance, and long-term goals will help you determine if HELOC investing aligns with your objectives.

Market conditions play a vital role in the success of HELOC investments. While recent years have seen strong performance in equities and real estate, past performance doesn’t guarantee future results. It’s essential to stay informed about market trends and economic indicators that could impact your investments (such as interest rate fluctuations).

Expert guidance can make all the difference for those considering HELOC investing. At HELOC360, we specialize in helping homeowners navigate the complexities of home equity lines of credit. Our platform provides comprehensive solutions tailored to your specific needs, which can empower you to make informed decisions about leveraging your home’s value for investment opportunities.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.