Are you considering a Home Equity Line of Credit (HELOC) but unsure about the pros and cons? You’re not alone.

At HELOC360, we’ve seen many homeowners grapple with this decision. HELOCs can be a powerful financial tool, but they also come with risks.

In this post, we’ll break down the HELOC pros and cons to help you make an informed choice about whether it’s the right option for your financial needs.

What Is a HELOC and How Does It Work?

Definition and Basic Concept

A Home Equity Line of Credit (HELOC) is a line of credit secured by your home that gives you a revolving credit line to use for large expenses. This financial tool provides flexible access to funds for various purposes, from home improvements to debt consolidation.

HELOC Operation

Unlike traditional loans that provide a lump sum, a HELOC functions more like a credit card. You receive approval for a maximum credit limit based on your home’s equity. During the draw period, which is usually 10 years, you can withdraw funds up to your limit. You usually pay interest only on the amount you borrow during this time.

The Application Process

Applying for a HELOC involves several steps:

- Determine your home’s value and existing mortgage balance

- Calculate your available equity (up to 85% of your home’s value minus your mortgage balance)

- Gather necessary documents (proof of income, tax returns, property information)

- Compare rates and terms from different lenders

- Submit your application and await approval

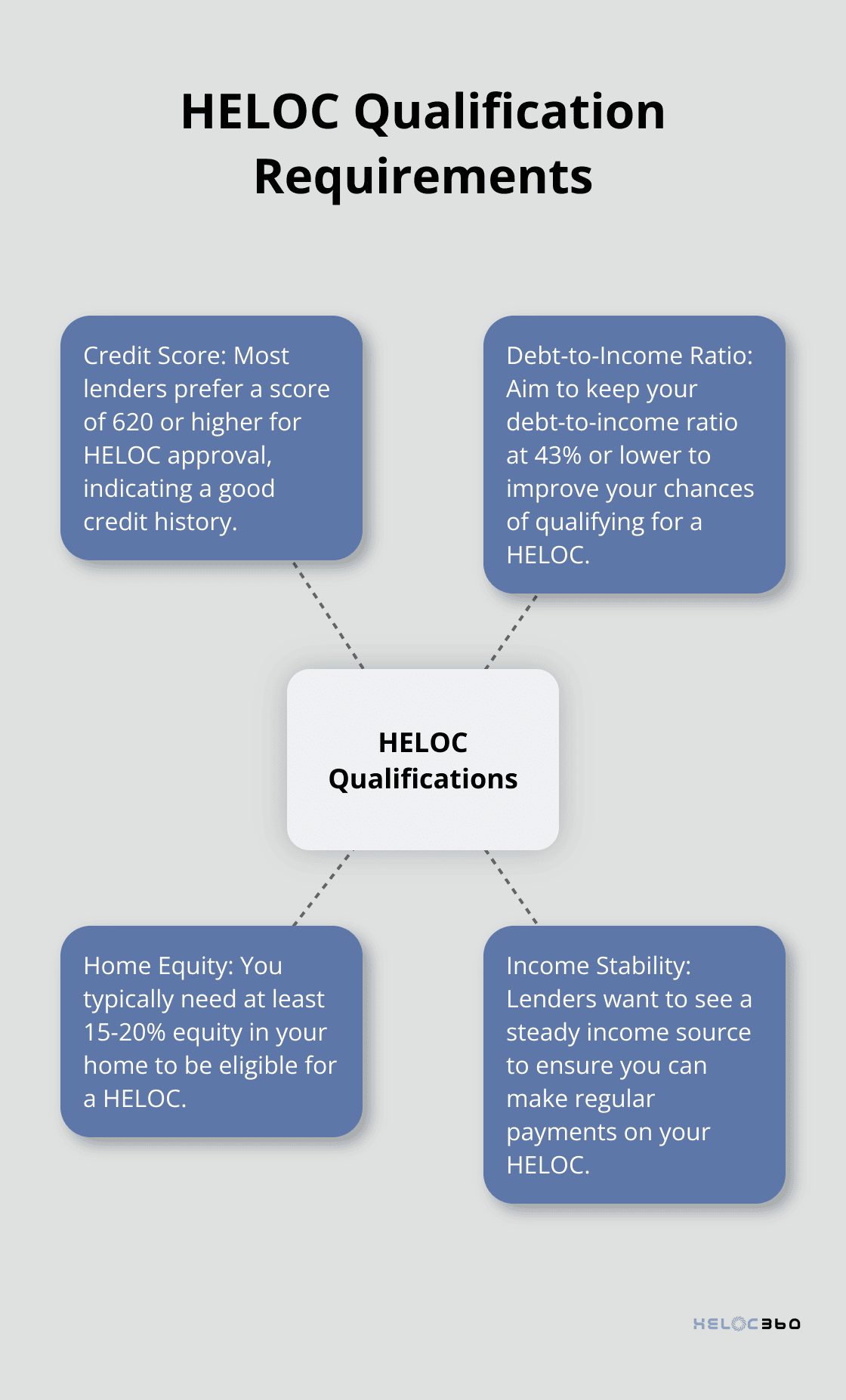

Qualification Requirements

Lenders typically assess the following factors:

- Credit score: Most prefer a score of 620 or higher

- Debt-to-income ratio: Try to keep it at 43% or lower

- Home equity: You need at least 15-20% equity in your home

- Income stability: Lenders want to see a steady income source

HELOC vs. Traditional Loans

HELOCs differ from traditional loans in several key ways:

- Flexibility: Draw funds as needed (instead of receiving a lump sum)

- Interest payments: Pay interest only on what you borrow (not the entire credit line)

- Variable rates: HELOCs usually have variable interest rates (which can fluctuate over time)

- Revolving credit: As you repay the principal, your available credit replenishes

HELOCs can benefit homeowners who need ongoing access to funds or are unsure of the total amount they’ll need to borrow. However, it’s important to understand the terms and potential risks before proceeding with a HELOC application.

Now that we’ve covered the basics of HELOCs, let’s explore their advantages in more detail.

Why HELOCs Are a Smart Financial Move

Unmatched Flexibility in Borrowing

HELOCs offer homeowners a powerful financial tool when used wisely. This flexibility proves particularly useful for ongoing projects or unexpected expenses. For example, during a home renovation, homeowners can draw funds as each phase of the project requires, rather than taking out a large loan upfront and paying interest on unused money.

Cost-Effective Borrowing Option

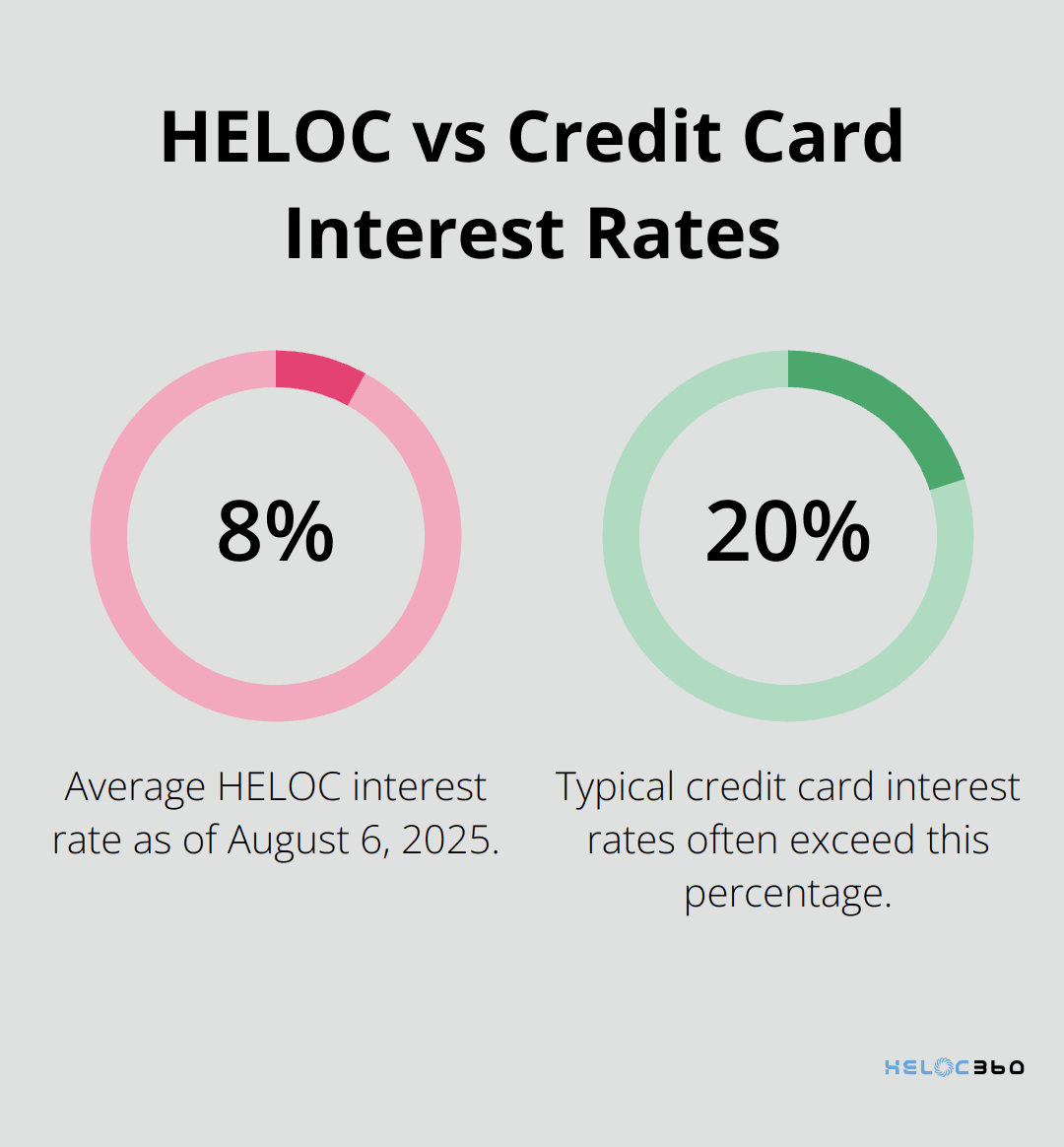

HELOCs typically offer lower interest rates compared to credit cards and personal loans. As of August 6, 2025, the national average home equity loan interest rate is 8.25%, while credit card rates often exceed 20%. This difference can result in substantial savings over time, especially for large expenses or long-term projects. On a $50,000 balance, homeowners could save over $6,000 in interest annually by choosing a HELOC over a high-interest credit card.

Potential Tax Benefits

The interest paid on a HELOC may be tax-deductible if the funds are used for home improvements (subject to current tax laws). The Tax Cuts and Jobs Act of 2017 allows homeowners to deduct some interest on loans greater than $750,000 when used to buy, build, or substantially improve the home that secures the loan. This potential tax benefit can further reduce the effective cost of borrowing, making HELOCs an attractive option for home renovation projects.

Versatility in Fund Usage

HELOCs are a go-to for home upgrades, debt consolidation, emergency expenses, and even big-ticket items like college tuition. This flexibility allows them to address multiple financial needs with a single financial tool, simplifying overall financial management.

Real-World Applications

Homeowners have used HELOCs creatively to achieve their financial goals. From funding rental property purchases to covering unexpected medical expenses, the applications are diverse. However, it’s important to have a clear plan for using and repaying the funds to maximize the benefits of a HELOC.

While HELOCs offer numerous advantages, they also come with potential risks. The next section will explore some drawbacks to consider before deciding if a HELOC aligns with your financial strategy.

What Are the Hidden Risks of HELOCs?

HELOCs can be powerful financial tools, but they come with potential pitfalls that every homeowner should understand. Let’s explore some of the less-discussed risks associated with these credit lines.

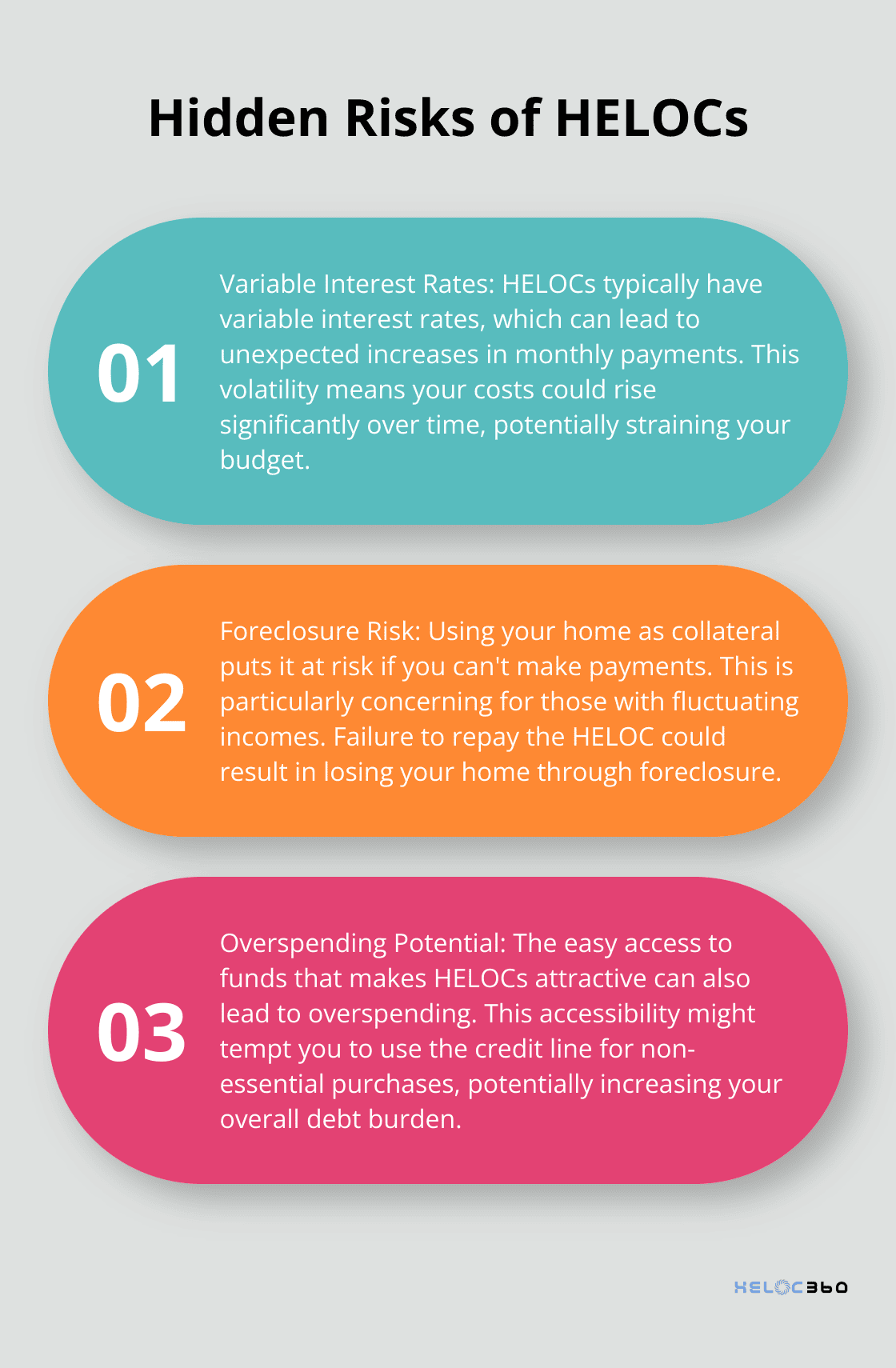

The Interest Rate Rollercoaster

While HELOCs often start with attractive rates, their variable interest can lead to unexpected increases. This volatility means your monthly payments could potentially increase along with rates.

To mitigate this risk, set aside extra funds each month to cushion against potential rate hikes. Some lenders offer rate caps, which limit how high your rate can go. Always ask about these options when shopping for a HELOC.

The Foreclosure Factor

Using your home as collateral puts it at risk if you can’t make payments. This risk is particularly acute for self-employed individuals with fluctuating incomes.

To protect yourself, maintain an emergency fund covering at least six months of HELOC payments. Additionally, some lenders offer payment protection plans, which can temporarily pause or reduce payments during financial hardships.

The Overspending Trap

The easy access to funds that makes HELOCs attractive can also lead to overspending. This can lead to increased overall debt.

To avoid this, create a detailed spending plan before opening a HELOC. Use budgeting apps to track your withdrawals and set up alerts when you’re nearing predetermined limits. Every dollar borrowed is a dollar (plus interest) that you must repay.

The Equity Erosion Effect

If property values decline, you could end up owing more than your home is worth.

To safeguard against this, avoid borrowing more than 80% of your home’s value. Keep an eye on local real estate trends and consider making extra payments to build equity faster when property values are stagnant or declining.

The Importance of Informed Decision-Making

Understanding these risks is crucial for making informed decisions about HELOCs. Always consult with a financial advisor to determine if a HELOC aligns with your long-term financial goals and risk tolerance. A HELOC can offer significant benefits when used wisely, but it requires careful consideration and planning.

Final Thoughts

HELOCs offer a unique mix of benefits and risks for homeowners. The flexibility to access funds as needed and potentially lower interest rates make HELOCs attractive, but variable rates and foreclosure risks require careful consideration. Your financial situation, long-term goals, and risk tolerance should guide your decision on whether a HELOC fits your needs.

Professional advice can help you navigate the HELOC pros and cons. A financial advisor or HELOC expert will provide personalized guidance based on your specific circumstances. They can help you understand the fine print and determine if this financial tool aligns with your objectives.

We at HELOC360 want to help homeowners make informed decisions about their home equity. Our platform offers comprehensive resources and connects you with lenders that match your needs (whether for home improvements, debt consolidation, or other financial goals). A HELOC can support your financial well-being when used wisely.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.